AI Oven Market Size

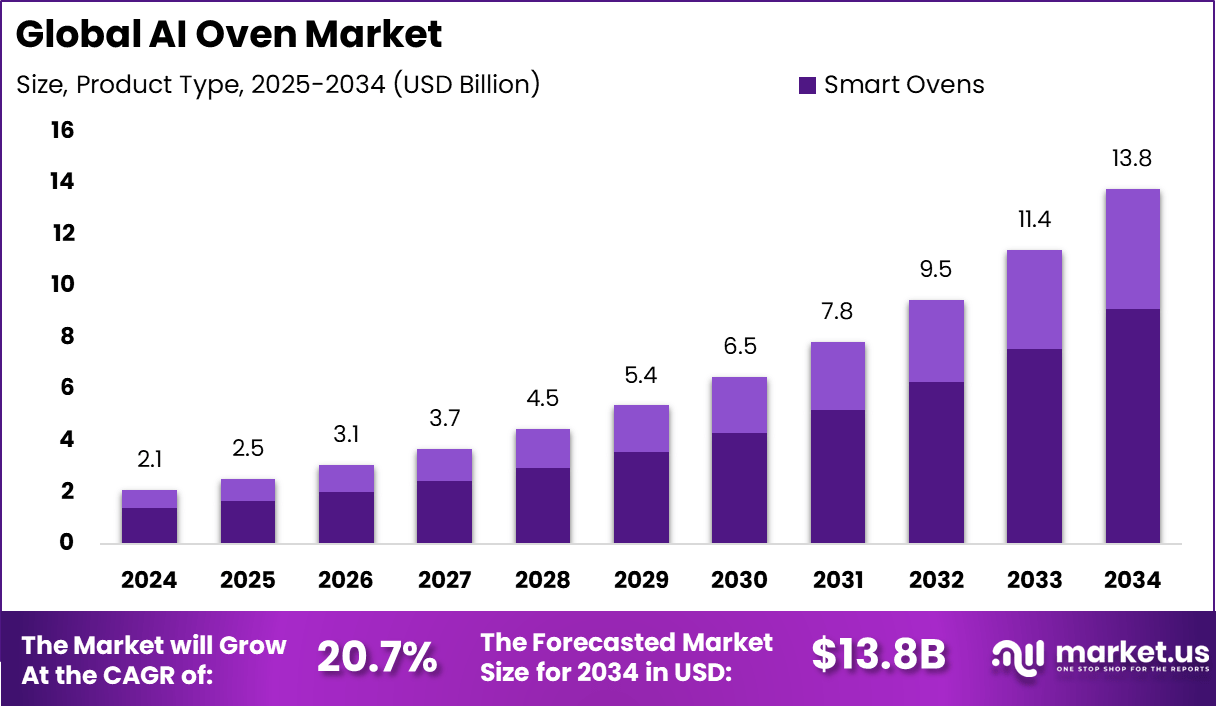

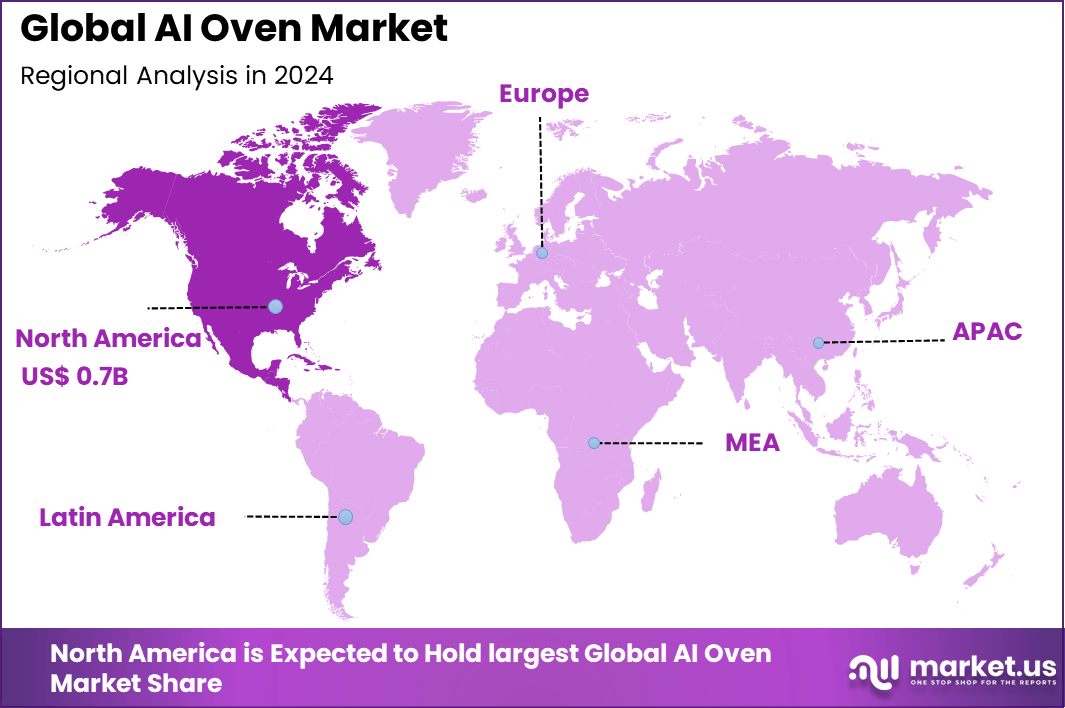

The Global AI Oven Market generated USD 2.1 billion in 2024 and is projected to expand significantly, reaching USD 2.5 billion in 2025 and approximately USD 13.8 billion by 2034. This reflects a strong compound annual growth rate (CAGR) of 20.7% over the forecast period. In 2024, North America emerged as the leading regional market, accounting for 36.2% of the global share and generating revenue of USD 0.7 billion. This dominance highlights the region’s early adoption of smart home technologies, advanced consumer preferences, and higher spending capacity on AI-driven kitchen appliances.

The AI oven market refers to connected cooking appliances that use computer vision, embedded neural networks, sensors, and cloud or local inference to automate and optimize cooking. Typical capabilities include on-device food recognition using an internal HD camera, automated program selection, doneness prediction, guided recipes, voice control, and integration with smart home platforms. These functions are being enabled by on-device models that recognize ingredients and portions and then configure heat, time, and fan settings without manual tuning.

Top driving factors include rising smart home adoption, the need for consistent cooking outcomes, and a push for interoperability across brands. Smart devices are present in a large share of households, which creates a natural addressable base for connected appliances. In the United States, 45% of internet households report owning at least one smart home device and 18% report six or more, indicating a deepening device stack that increases receptivity to smart cooking.

According to Forbes Advisor, artificial intelligence is expected to deliver a 21% net increase to the United States GDP by 2030. This outlook highlights AI’s rising role in strengthening national economic expansion. A parallel in-house survey reflects a similar 21% boost, indicating broad confidence in AI’s potential to drive growth and reshape economic dynamics across industries.

The momentum of adoption can be seen in the early success of ChatGPT, which reached 1 million users in just five days after its launch. A Forbes Advisor survey further shows that 64% of businesses believe AI will improve their productivity, underlining how enterprises view AI as a transformative tool for operational efficiency and competitive advantage.

Industry forecasts suggest even stronger outcomes in the near term. Research indicates the AI sector could grow more than 13x in six years, employing up to 97 million people by 2025. Growth expectations remain steep, with annual expansion estimated at 120%, while 83% of companies now consider AI integral to their strategic planning and long-term decision-making.

Market Key Takeaways

- By product type, smart ovens dominate with 66.3%, reflecting consumer demand for connected and intelligent cooking appliances.

- By technology, voice-activated ovens account for 37.6%, supported by integration with virtual assistants and smart home ecosystems.

- By application, the residential segment leads with 74.7%, driven by household adoption of AI-enabled kitchen solutions.

- By sales channel, offline retail holds 60.0%, as consumers continue to prefer in-store purchases for high-value appliances.

- North America contributes 36.2%, supported by early adoption of smart home technologies and premium kitchen appliances.

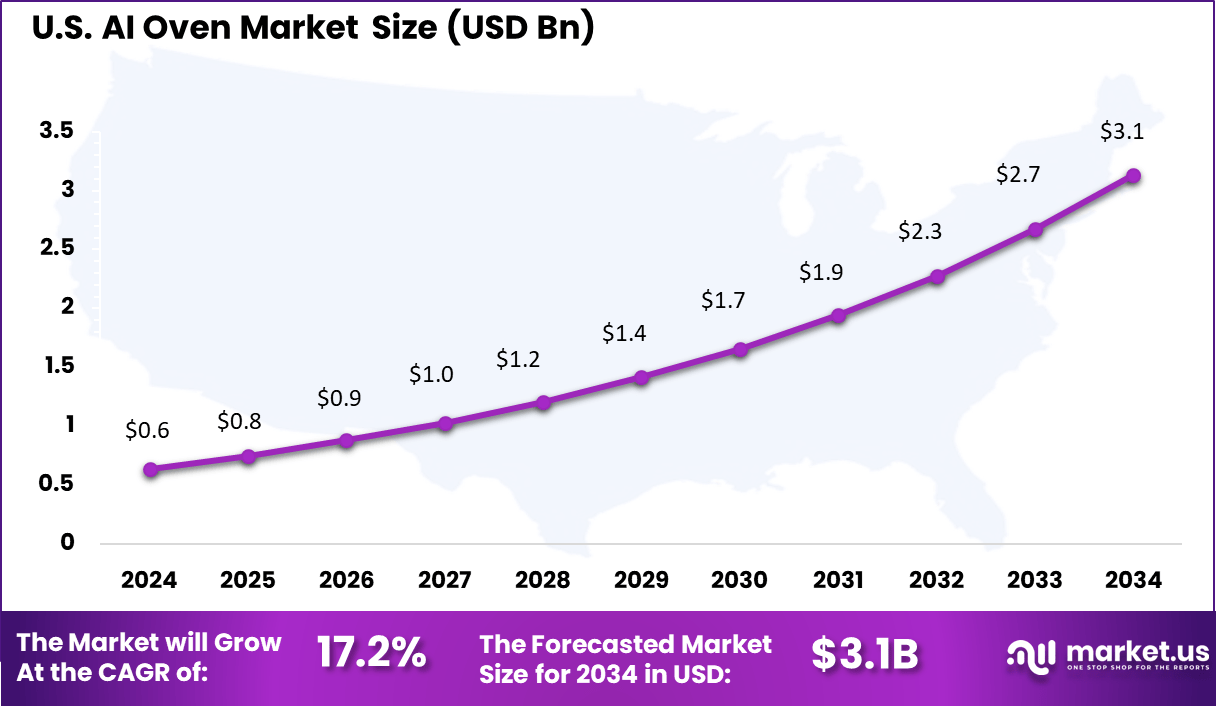

- The US market reached USD 0.64 billion and is expanding at a strong CAGR of 17.2%, highlighting rapid consumer adoption of AI-powered cooking solutions.

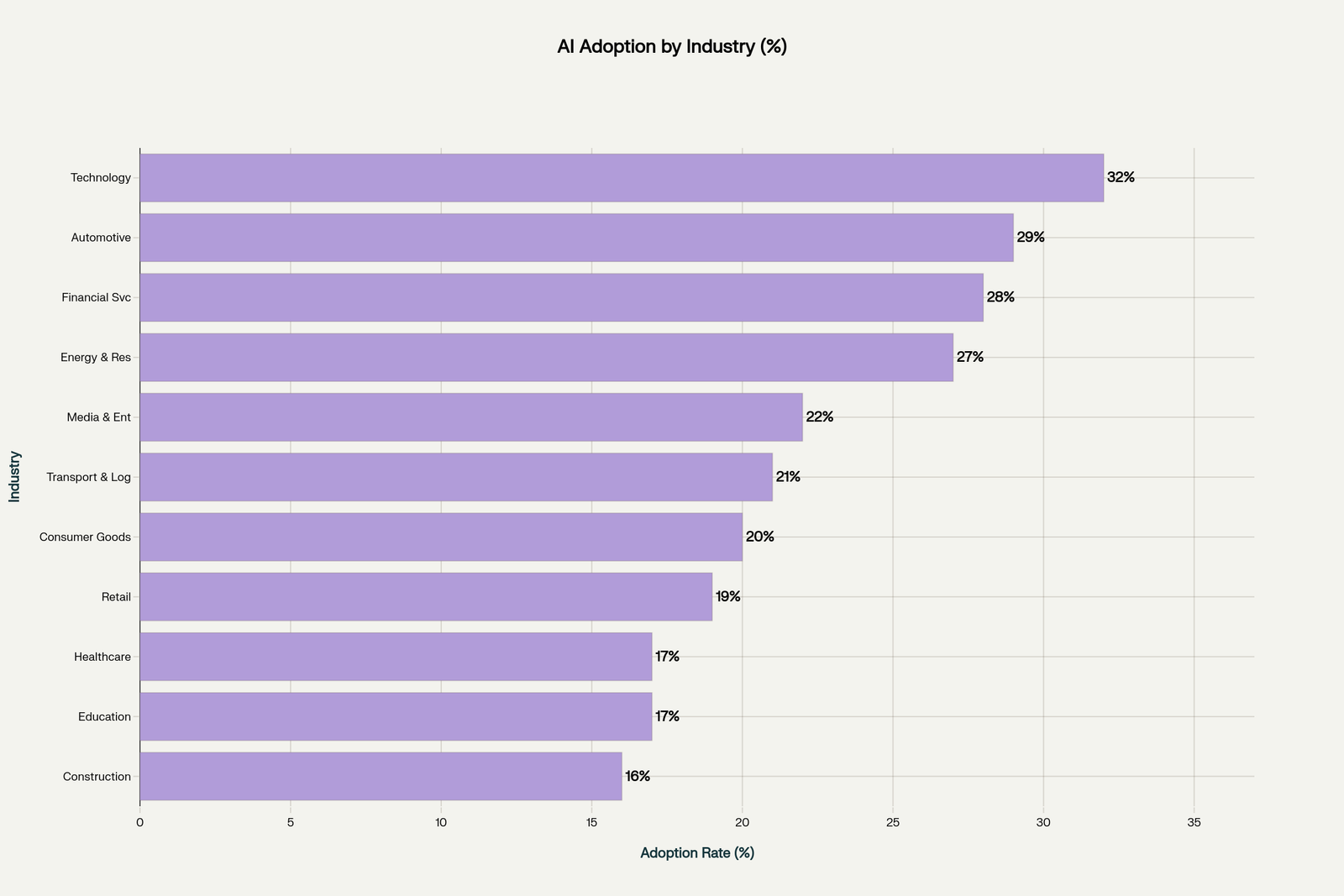

AI Adoption by Industry

Summary Table

| Industry | Adoption Rate (%) |

|---|---|

| Technology | 32% |

| Automotive | 29% |

| Financial Services | 28% |

| Energy & Resources | 27% |

| Media & Entertainment | 22% |

| Transport & Logistics | 21% |

| Consumer Goods | 20% |

| Retail | 19% |

| Healthcare | 17% |

| Education | 17% |

| Construction | 16% |

By Product Type

Smart ovens dominate the AI oven market with a strong 66.3% share.

These ovens are favored for their ability to offer automated cooking, precise temperature control, and remote operation through apps or voice commands. Their multifunctional capabilities, such as baking, roasting, and air frying, make them highly versatile and ideal for modern kitchens looking to streamline meal preparation.

Consumers are increasingly drawn to smart ovens for convenience and efficiency. About 65% of buyers highlight automated features and time-saving convenience as primary purchase motivators. This trend reflects a rising demand for connected appliances that integrate smoothly into smart home ecosystems, making meal preparation easier and more predictable.

By Technology

Voice-activated technology comprises 37.6% of the AI oven market share.

This technology allows users to control their ovens hands-free by integrating with popular smart assistants like Alexa and Google Assistant. It enhances kitchen safety and convenience by enabling tasks like preheating, setting timers, or adjusting cooking modes with simple voice commands.

The hands-free control is particularly valuable for multitasking in busy households. Around 44% of users report improved cooking outcomes due to real-time adjustments made possible by voice commands and AI monitoring. This feature also increases accessibility for elderly users or those with mobility challenges, expanding the market’s appeal.

By Application

The residential segment leads the AI oven market with 74.7% of the share.

Growing consumer interest in smart home technology and kitchen automation drives this dominance. AI ovens fit well into everyday household routines by offering recipe guidance, energy-efficient cooking, and customizable settings to meet diverse dietary needs. Home users appreciate the time savings and consistent results these ovens provide. Around 50% of smart kitchen appliance owners expect to integrate multiple connected devices by 2025, showing how AI ovens are becoming central to smart home ecosystems. The residential focus also encourages innovation toward simpler, user-friendly interfaces.

By Sales Channel

Offline sales channels account for 60.0% of AI oven purchases, showing that most consumers still prefer buying major kitchen appliances in physical stores.

Shoppers value being able to see, feel, and sometimes test products prior to purchase. Customer service, installation support, and in-person demonstrations further support this preference. Despite the growth of e-commerce, offline retail remains trusted for high-investment purchases like AI ovens. This trend highlights the importance of traditional retail networks and specialty electronics stores in providing the tactile experience and expert advice consumers seek when investing in smart home devices.

Regional Focus: North America

North America holds a significant 36.2% share of the global AI oven market, driven by high smart home adoption and tech-savvy consumers. Urban households here are early adopters who prioritize convenience, energy efficiency, and connected living, which aligns closely with AI oven capabilities. The region’s advanced infrastructure supports rapid integration of smart appliances into daily life.

The presence of extensive retail networks and strong after-sales service further strengthens market growth. Consumers in North America also show strong preferences for safety features, personalized cooking programs, and seamless smart home ecosystem integration, positioning the region as a key driver of innovation and adoption.

Country Snapshot: United States

The United States AI oven market is growing rapidly with a steady CAGR of 17.2%. The US is a leading market thanks to consumer focus on customized cooking experiences, sustainability, and convenience. Features like AI-powered predictive maintenance and voice-guided recipes are gaining popularity, resonating well with American families who value tech-enabled kitchen solutions.

Competitive Landscape

Bosch, Siemens, and LG are recognized for their strong presence in premium kitchen appliances, and their early investments in AI ovens highlight their focus on smart cooking solutions. Their products emphasize precision cooking, energy efficiency, and integration with home ecosystems. Haier and Midea also stand out, offering AI ovens with affordability and wide accessibility. Their growth is being supported by the rising consumer demand for connected appliances, particularly in urban households where convenience and smart controls are highly valued.

Welbilt and Unox Casa cater mainly to the commercial segment, with AI ovens designed for restaurants, bakeries, and professional kitchens. Their solutions focus on consistency, automation, and reducing operational errors. June Oven and Markov Corp, on the other hand, bring innovation at the consumer level by introducing AI features such as recipe learning, adaptive cooking modes, and sensor-based adjustments. These players are shaping the segment by bridging the gap between convenience and advanced food preparation technology.

VIOMI and other emerging players strengthen the market with competitive pricing, strong distribution, and AI-enabled designs tailored to regional preferences. Their role is especially important in increasing market penetration in developing economies. Collectively, these companies are investing in AI algorithms, voice-activated technologies, and IoT integration to enhance cooking experiences.

Top Key Players in the Market

- Bosch

- Welbilt

- Midea

- Haier

- VIOMI

- June Oven

- Markov Corp

- Unox Casa

- LG

- Siemens

- Other Major Players

Driver Analysis

Rising Smart Home Integration

The demand for AI ovens is strongly driven by the increasing integration of smart home technologies. Consumers, especially younger tech-savvy groups like millennials and Gen Z, seek kitchen appliances that work seamlessly with platforms such as Amazon Alexa and Google Assistant. This integration allows users to control ovens remotely, receive cooking alerts, and efficiently manage energy consumption in coordination with other smart devices, making cooking more convenient and connected. As smart homes grow globally, the AI oven naturally fits into this ecosystem, boosting its adoption.

Moreover, with projections estimating over 300 million smart homes worldwide by 2025, the infrastructure for adopting AI ovens is expanding rapidly. This reduces hesitation about adding new connected appliances and encourages consumers to invest in advanced cooking solutions. The trend toward automated and integrated kitchens highlights the AI oven as an essential device for modern households seeking ease and precision in cooking.

Restraint Analysis

High Initial Investment Costs

The high price point of AI ovens compared to traditional ovens is a major restraint limiting their adoption. Currently, AI ovens cost three to five times more than conventional models, making them less accessible to average consumers. This premium pricing mainly targets affluent buyers and early adopters who can afford advanced smart kitchen gadgets, but it restricts widespread market penetration among price-sensitive consumers.

The elevated cost reflects the complex technology used, including advanced sensors, AI processors, and connectivity features that require specialized manufacturing. The expenses involved in R&D, software development, and quality assurance add to the final product price. Additionally, limited production volumes prevent economies of scale, keeping prices high while slowing down mass adoption of AI ovens.

Opportunity Analysis

Expansion in Emerging Markets

Emerging markets offer significant growth opportunities for AI ovens due to rising disposable incomes, urbanization, and increasing awareness of smart home technologies. Regions like Asia-Pacific are witnessing rapid economic development coupled with a growing middle class interested in upgrading domestic appliances for convenience and modern lifestyles. Local manufacturers, such as Midea and Haier, are actively expanding their presence by offering products tailored to these markets.

This regional growth potential is bolstered by infrastructure improvements and wider internet accessibility, enabling support for smart connected appliances. Companies stand to benefit by adapting pricing and marketing strategies specific to these new consumer bases. As these markets mature, the shift from premium to mid-range models will help accelerate volume growth and adoption, unlocking sizeable untapped demand.

Challenge Analysis

Data Privacy and Security Concerns

Privacy and security issues pose a significant challenge to the adoption of AI ovens. Since these devices are connected to home networks and cloud platforms, consumers worry about data breaches and unauthorized access to personal information. Smart ovens collect data on usage patterns, cooking habits, and other personal details that could be vulnerable if not properly secured, undermining consumer trust.

Manufacturers must address these concerns by implementing robust cybersecurity measures and transparent data policies to build confidence. Furthermore, users may struggle with understanding complex privacy settings, which can deter less tech-savvy individuals from purchasing AI ovens. Resolving these challenges is critical for sustaining market growth and ensuring the safe integration of AI ovens within smart homes.