Blockchain Statistics By Market, Revenue, Demographics, Regions And Benefits

Updated · Aug 21, 2024

WHAT WE HAVE ON THIS PAGE

- Introduction

- Editor’s Choice

- Why is Blockchain Important?

- Types of Blockchain

- General Blockchain Statistics 2024

- Blockchain Market and Revenue Statistics

- Blockchain Demographics Statistics

- Blockchain Regional Statistics

- Adoption of Blockchain Technology Overall

- Cryptocurrency Statistics

- NFT Statistics 2024

- Blockchain in Industry-Specific Market Sizes Statistics

- Blockchain Savings and Investment Estimation

- Benefits of Blockchain Technology

- Conclusion

Introduction

Blockchain Statistics: A blockchain is like a digital record book that is shared across many computers and managed by a network of users. When a cryptocurrency transaction happens, it gets added to this record book, which other users can see. This setup helps ensure the security and openness of transactions, which is why many people find cryptocurrency so attractive. The Blockchain’s digital record is secure because once a transaction is recorded, it can’t be changed or erased. This helps prevent fraud and keeps things accurate. Because the Blockchain is distributed across many computers, there’s no single point that can be controlled or manipulated.

This makes it harder for anyone to alter the records. Trust is built because the system is managed by the entire network, not just one central authority. We shall shed more light on Blockchain Statistics through this article.

Editor’s Choice

- Global spending on Blockchain was expected to reach $11.7 billion in 2022, and the market for blockchain technology is projected to grow to $20 billion by 2024.

- By 2029, the blockchain industry is forecasted to grow at a compound annual growth rate (CAGR) of 56.3%, reaching a value of over $163.83 billion.

- In 2021, the payments sector made up more than 44% of the blockchain market. IBM is anticipated to be the leading company in the blockchain market through 2030.

- Blockchain-based payments and financial tools could increase global GDP by $433 billion by 2030. The top use for Blockchain in the next ten years is expected to be tracking the origin of products.

- As of April 2023, there were over 82 million blockchain wallet users worldwide. The blockchain market grew as a result of the Covid-19 pandemic.

- Implementing blockchain technology in the finance sector could save companies at least $12 billion each year. Blockchain can also cut bank infrastructure costs by 30%.

- The blockchain technology market is projected to grow at a rate of 67.3% from 2021 to 2028.

- By 2023, it is estimated that 10% of global economic infrastructure will use blockchain technology.

- The blockchain market in the supply chain sector is expected to grow at a rate of 50.2% per year from 2021 to 2027.

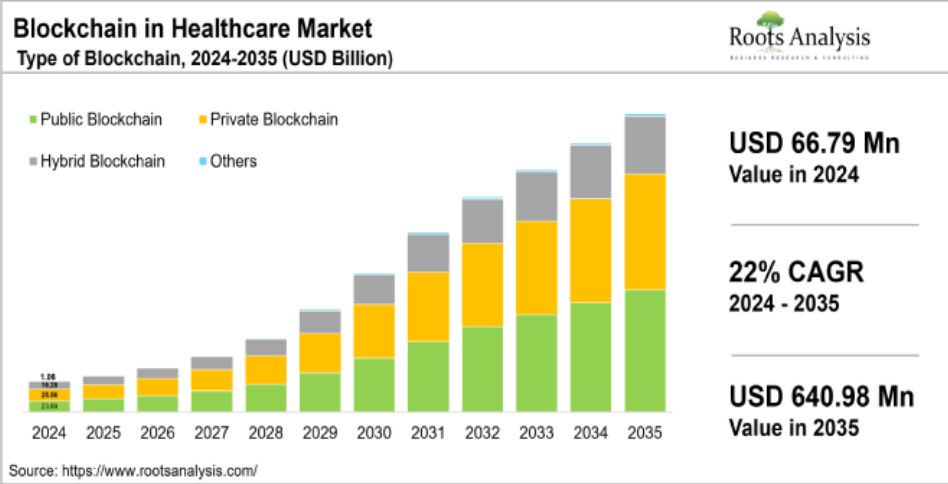

- Spending on Blockchain in healthcare is expected to rise to $5.61 billion by 2025.

- Blockchain Statistics stated that the FBI holds 1.5% of the total global Bitcoin supply.

- By 2025, 55% of healthcare apps are predicted to use blockchain technology.

- The blockchain market is expected to be worth over $1 trillion by 2030. In 2021, spending on blockchain solutions was estimated to exceed $6.6 billion.

- Blockchain startup activity is moving from the US to China. By 2025, Asia is predicted to have 745 million cross-border B2B blockchain transactions.

Why is Blockchain Important?

Businesses depend on information. The faster and more precise the information, the better. Blockchain is great for this because it offers immediate, shared, and visible data stored in an unchangeable record that only approved network members can access. A blockchain network can keep track of orders, payments, accounts, production, and more.

Additionally, the Blockchain’s openness allows users to check and verify transactions themselves. Although users are often anonymous, the transactions are public and can be reviewed by anyone, which adds to the system’s reliability.

These features—security, transparency, and decentralization—are why many people find cryptocurrency and Blockchain technology so appealing.

Types of Blockchain

As blockchain technology develops, several types have appeared to meet different needs. Here’s a simple look at four main types:

-

Public Blockchain

Public blockchains are open networks that anyone can join without needing permission. They are completely decentralized, meaning no single organization or person controls the network. Users can stay anonymous, and as long as they can prove their work, they can participate in the network.

-

Private Blockchain

Private blockchains are controlled networks. One organization manages who can access the network and what they can do, whether it’s viewing, verifying, or adding data. These blockchains are used by organizations that need to keep information private, like big companies or government agencies.

-

Consortium Blockchain

Consortium blockchains, also called federated blockchains, are managed by a group of organizations. Multiple members have the authority to set rules and change or cancel transactions. This shared control can lead to better efficiency and privacy.

-

Hybrid Blockchain

Hybrid blockchains combine the features of public and private blockchains. They offer selective transparency, meaning that some parts of the Blockchain are visible to everyone while others are restricted to certain users. This setup lets organizations share data securely without needing a third party.

General Blockchain Statistics 2024

- Blockchain technology is growing rapidly, with significant increases each year. In 2017, its growth rate was 35.2%.

- By 2018, it jumped to 41.8%, and it is projected to reach nearly 70% by 2025.

- Blockchain-Based Cryptos Could Bring in $1 Billion for Banks.

- The number of blockchain wallets has grown significantly. It was about 10.98 million in late 2016 but has surged to 83.4 million by July 2022, showing the increasing popularity of blockchain technology.

- The healthcare sector is expected to invest $5.61 billion in blockchain technology by 2025.

- This is a significant increase in the US, given that the country spends 20% of its GDP on healthcare, according to Blockchain Statistics.

- Recent data shows that banks around the world are quickly adopting blockchain technology.

- The financial sector is the biggest investor in Blockchain, holding 46% of the market share.

- Adding blockchain technology can improve data security between these devices and IoT systems.

- Blockchain’s network of nodes also helps with automatic data backups if a breach occurs.

- Blockchain transaction rates vary. The lowest recorded was 1.13 transactions per second in January 2018, and the highest was 7.56 transactions per second in May 2019.

(Reference: quytech.com)

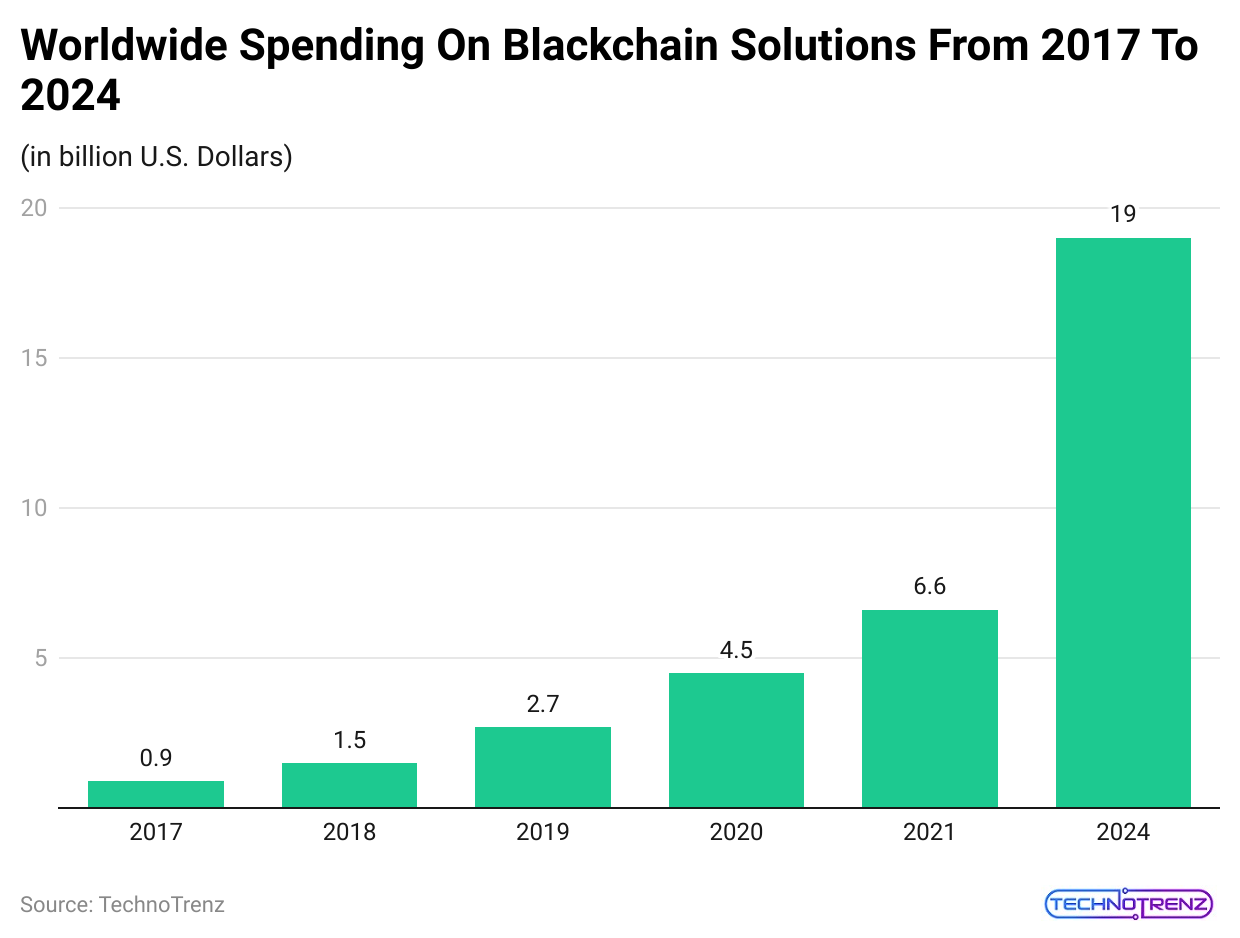

- In the above chart, we can see the global spending on Blockchain solutions between 2017 to 2024.

- Countries like Japan, the United States, Belarus, and Switzerland are already using cryptocurrencies in their banking operations, and more are expected to follow soon.

- Blockchain IoT Market Expected to Grow 40% Annually by 2026.

- The Internet of Things (IoT) industry is already very profitable, with billions of connected devices globally.

- It’s no surprise that 62% of blockchain storage options are mobile wallets. Although other types of wallets exist, most users prefer mobile ones.

- Global Blockchain Market to Grow at Over 69% Annually From 2019 to 2025.

- Blockchain Statistics stated that the financial sector leads in blockchain investment, owning 46% of the market.

- Other sectors like energy and manufacturing each hold 12%, healthcare has 11%, government spends 8%, retail has 4%, and media and entertainment make up 1%. Globally, about 77% of financial firms are expected to use blockchain technology.

- Out of 4.57 billion internet users globally, 3.5 billion use mobile phones.

- As of January 2022, the rate was 2.87 transactions per second.

Blockchain Market and Revenue Statistics

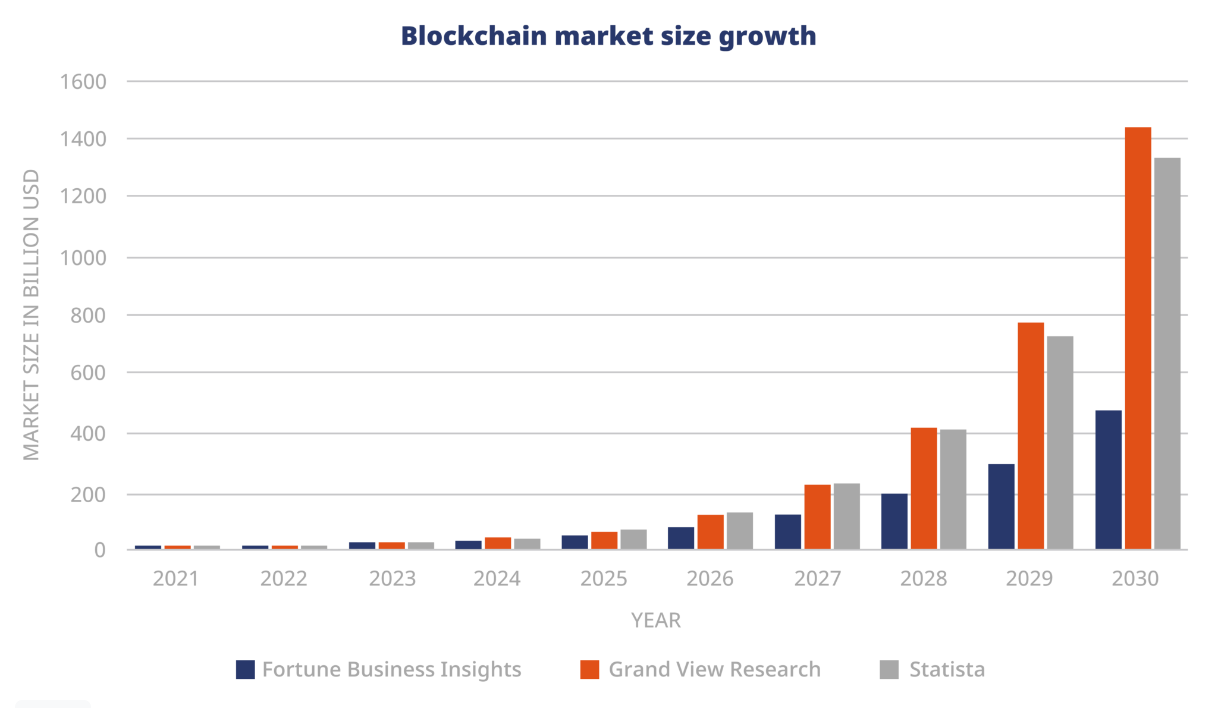

- Blockchain Statistics expects the market to expand from $17.57 billion in 2023 to $469.49 billion by 2030, with a compound annual growth rate (CAGR) of 59.9%.

- It also predicts an even bigger increase, with a CAGR of 87.7% from 2023 to 2030. They estimate the market will grow from $17.46 billion to $1,431.54 billion.

(Source: kruschecompany.com)

- Different Blockchain Statistics forecast strong growth, with a CAGR of 82.8% from 2021 to 2030, projecting the market will reach $1,235.71 billion by 2030.

- Blockchain technology might save banks between $8 billion and $12 billion annually by improving transaction security and cutting data transfer and storage costs.

- The global blockchain market is expected to grow to $20 billion by 2024, up from just over $315 million in 2015, showing a big increase in its use and revenue.

- The United States is the top spender on Blockchain, with expected investments of $2.6 billion. Western Europe will spend $1.6 billion, and China will invest $777 million.

- Over the next five years, Central and Eastern Europe will see a 50% growth rate, while China’s growth rate will be 54.6%.

(Source: researchgate.com)

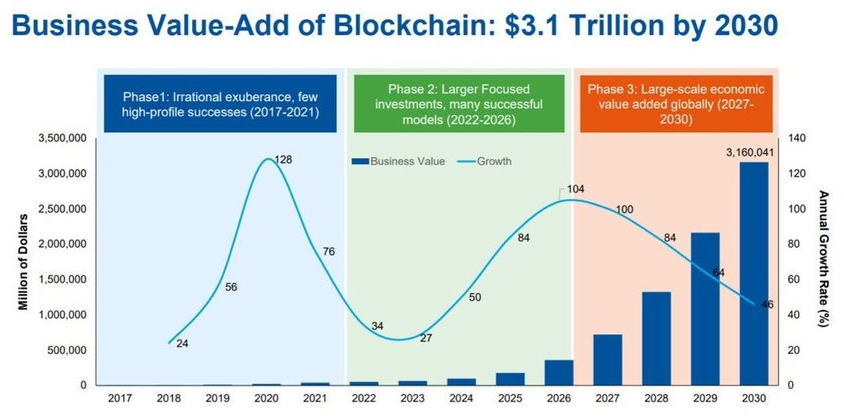

- The business value of blockchain technology is predicted to reach over $360 billion by 2026 and $3.1 trillion by 2030 as more industries adopt it.

- Blockchain could reduce banks’ infrastructure costs by up to 30%, saving them around $12 billion, by replacing outdated and expensive data storage methods with more secure and efficient blockchain solutions.

- Most business leaders, or 71%, who use Blockchain believe it is essential for advancing technology, particularly in logistics and shipping.

- Almost 90% of government organizations plan to invest in blockchain technology this year to improve transparency and regulatory compliance.

- 74% of Consumer Goods & Manufacturing Companies Are Testing or Using Blockchain.

- According to Blockchain Statistics, over half of the companies (53%) are working on using Blockchain to improve their supply chains.

- 36% of people in the European payments industry believe Blockchain will affect their sector by 2025.

- 70% of executives in the Asia-Pacific region believe blockchain technology will give them a competitive advantage.

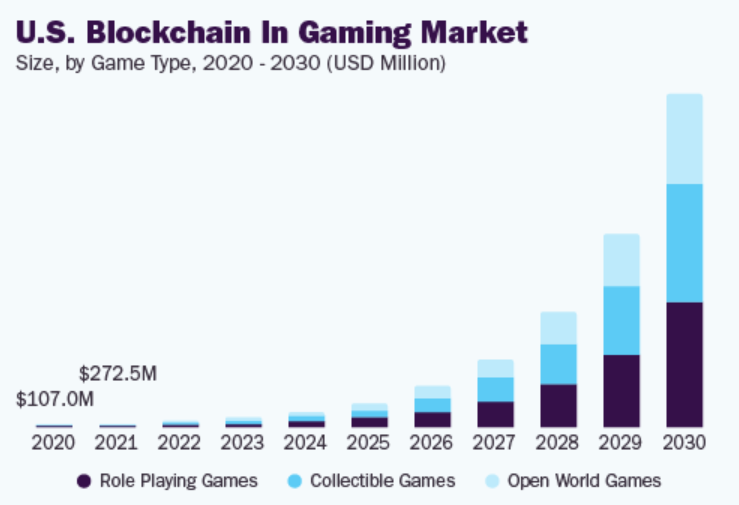

- 44% of gamers have purchased or traded game items using Blockchain, with Bitcoin being the most popular payment method.

- In China, 109 companies are using Blockchain for real-world applications, helping banks and other institutions operate more efficiently.

- Till 2025, 55% of healthcare applications are expected to use blockchain technology for better data security and efficiency.

- Nearly 45% of financial institutions experience fraud and cybercrime every year, driving their interest in Blockchain for better security.

- The US currently has 36,659 Bitcoin ATMs, making it easier for people to buy cryptocurrencies.

- There are over 36,000 Bitcoin ATMs in the US, making it easier to buy and sell cryptocurrencies.

- KuCoin invested $3 million in Bitcoin Australia to expand cryptocurrency trading in the region.

- Bittrex, a major trading platform, has seen over $86 million in trading volume in just 24 hours.

- The blockchain market for financial services

- is projected to grow to $22.46 billion by 2026.

- The blockchain market in manufacturing is expected to grow to $778.05 million by 2026.

(Reference: precedenceresearch.com)

- The global blockchain market size is expected to reach $7.59 billion by 2024.

- The global blockchain market is projected to exceed $60 billion by 2024.

- Spending on blockchain technology is expected to grow to $19 billion by 2024.

- 13% of senior IT leaders have clear plans to incorporate blockchain technology into their companies.

- Over the next five years, around 70% of blockchain spending is expected to come from IT and business services.

- IBM employs 1,000 people in Germany to work on blockchain and IoT projects.

- The US has 36,659 Bitcoin ATMs, making cryptocurrency more accessible to consumers.

- Blockchain Statistics stated that charities and nonprofits are increasingly accepting cryptocurrency donations, with over $69 million donated last year.

- 99% of Russian financial companies aimed to integrate Blockchain into their systems.

- Nearly 45% of financial institutions are affected by fraud and cybercrime each year.

Blockchain Demographics Statistics

- Men have shown more interest in blockchain and cryptocurrency markets compared to women.

- Women often see these markets as very risky, which makes them less likely to use or invest in them. The same applies to many Asians, who also tend to avoid investing in crypto.

- Blockchain Statistics states that men are more than twice as likely to have used cryptocurrencies. About 22% of men reported using them, while only 10% of women did.

- As per CNBC and Acorn survey, 16% of men and 7% of women invest in blockchain technology.

| Investment Type | Share of Males Investing | Shares of Females Investing |

| Bonds | 14% | 11% |

| Real Estate | 36% | 30% |

| Mutual Funds | 30% | 20% |

| Individual Stocks | 40% | 24% |

| exchange-traded funds | 14% | 7% |

| Blockchain Technology | 16% | 7% |

- Since 69% of people in the United States are White, it’s expected that White people also have the highest percentage of cryptocurrency ownership in the US.

| Ethnicity/Race | % of Crypto ownership |

| Asian |

6% |

|

Black of African-American |

8% |

| Hispanic |

24% |

|

White |

62% |

- The likelihood of owning cryptocurrency across different races in the US is fairly even: 11% of White people, 11% of Black people, 10% of Hispanics, 14% of Asians, and 13% of people from other racial groups own cryptocurrency.

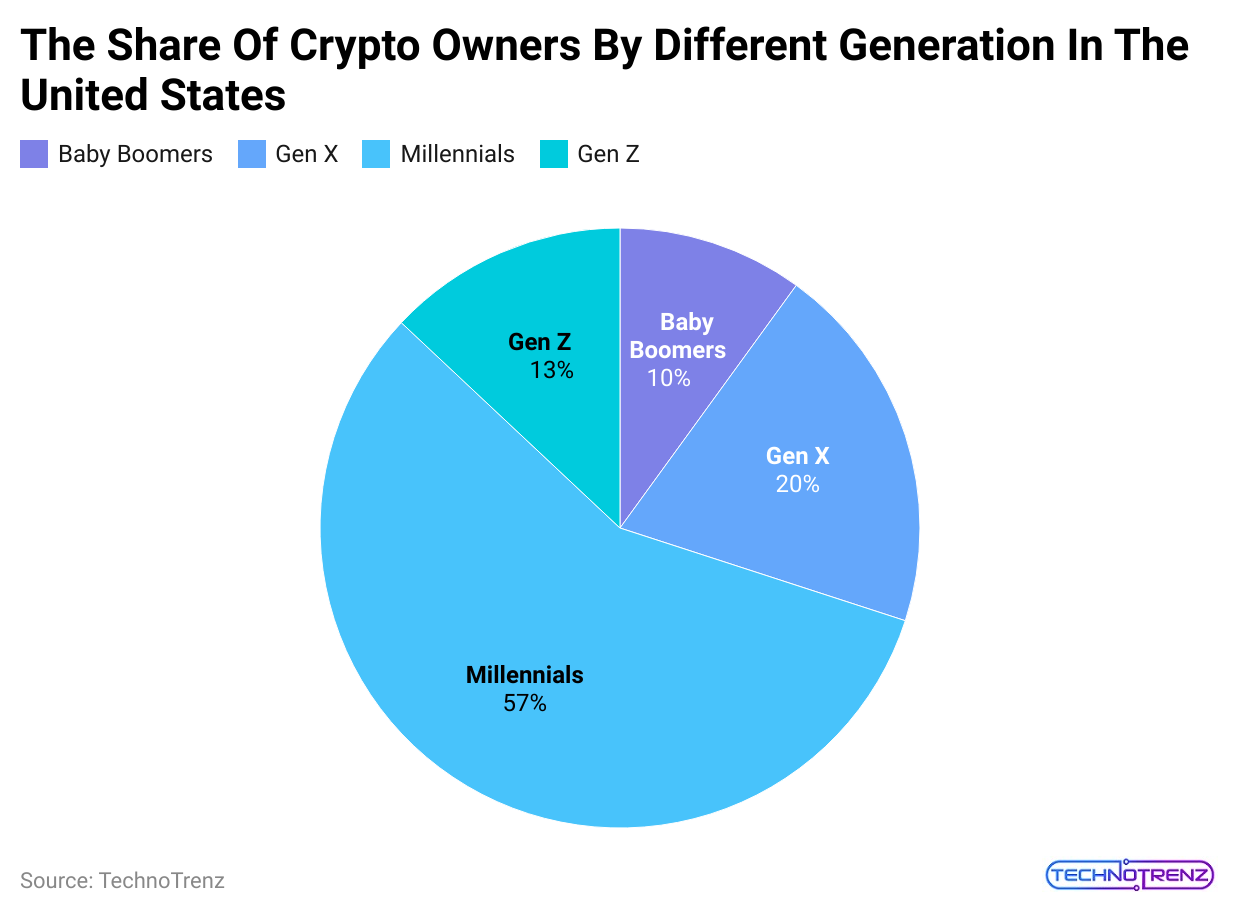

- 57% of all cryptocurrency owners in the United States are Millennials. According to Blockchain Statistics, most of these crypto owners are working professionals who have a good understanding of finance and investments.

- Following Millennials, the next largest group of crypto owners is from Generation X (Gen X).

- Young people in the US are more likely to own cryptocurrency: 15% of those aged 18 to 34 own it, compared to 11% of those aged 35 to 64 and only 4% of those aged 65 and older.

(Reference: demandsage.com)

(Reference: demandsage.com)

| Generation | % of Crypto Owners |

| Baby Boomers |

10% |

|

Gen X |

20% |

| Millennials |

57% |

|

Gen Z |

13% |

Blockchain Regional Statistics

- The number of cryptocurrency users, and thus crypto wallet users, differs greatly by continent.

- Asia leads with 160 million users, while Oceania has the fewest, with only 1 million users.

| Continent | No. of Cryptocurrency users |

| Oceania |

1 million |

|

South America |

24 million |

| North America |

28 million |

|

Africa |

32 million |

| Europe |

38 million |

|

Asia |

160 million |

- In terms of the total value of cryptocurrencies held by users, North America is in the lead, making up 35% of the total value.

- Africa has the smallest share, with just 3%, according to Blockchain Statistics.

- CNBC reports that men in the US are more than twice as likely to invest in cryptocurrency compared to women (16% of men vs. 7% of women). Overall, 11% of the US population owns cryptocurrency.

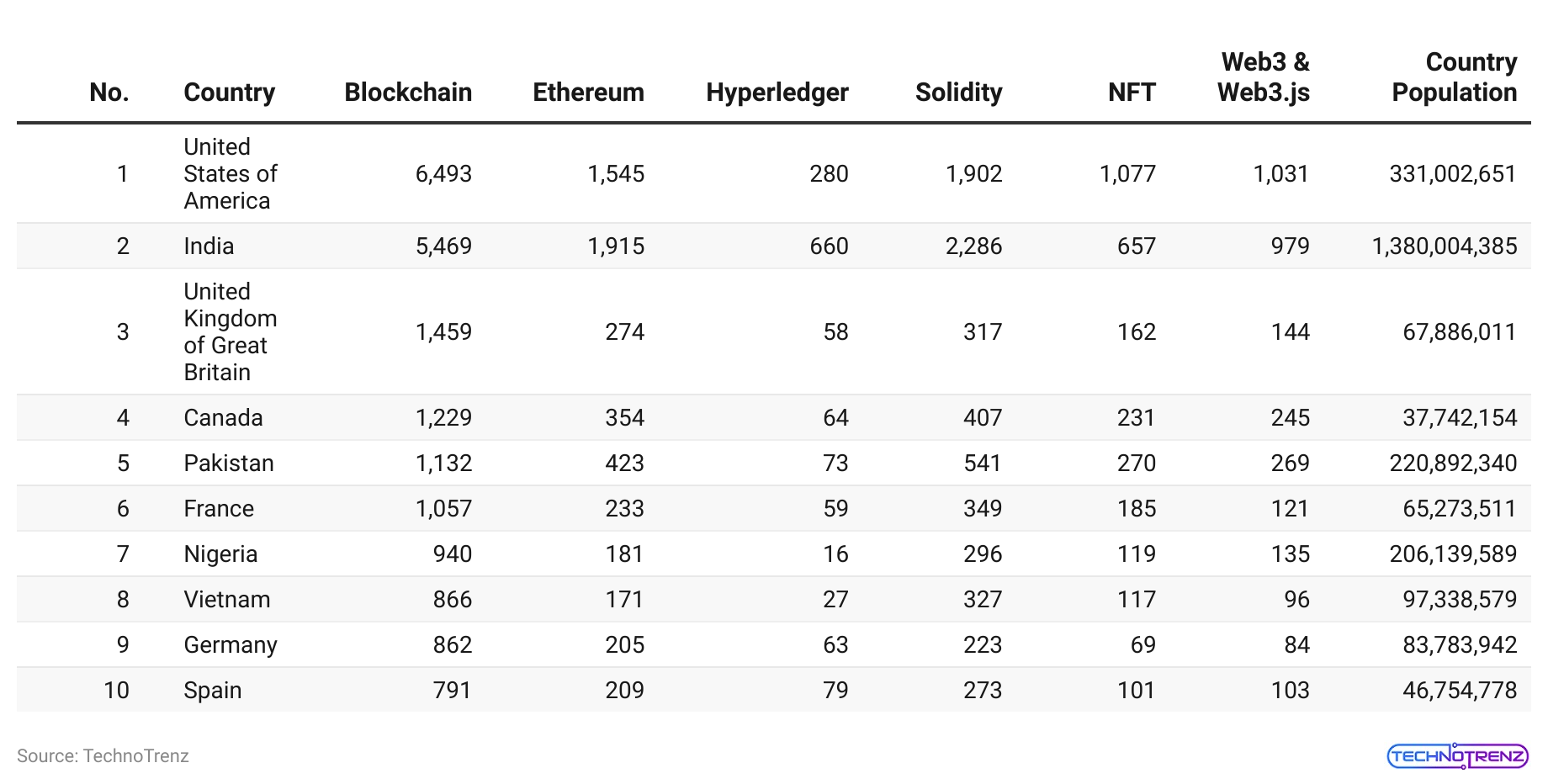

- The US leads in terms of the number of blockchain developers, with about 6,500, while India follows with around 5,500. Other countries have fewer developers in this field, as shown in the figure.

The following table shows us the Blockchain Developers Globally By Nation:

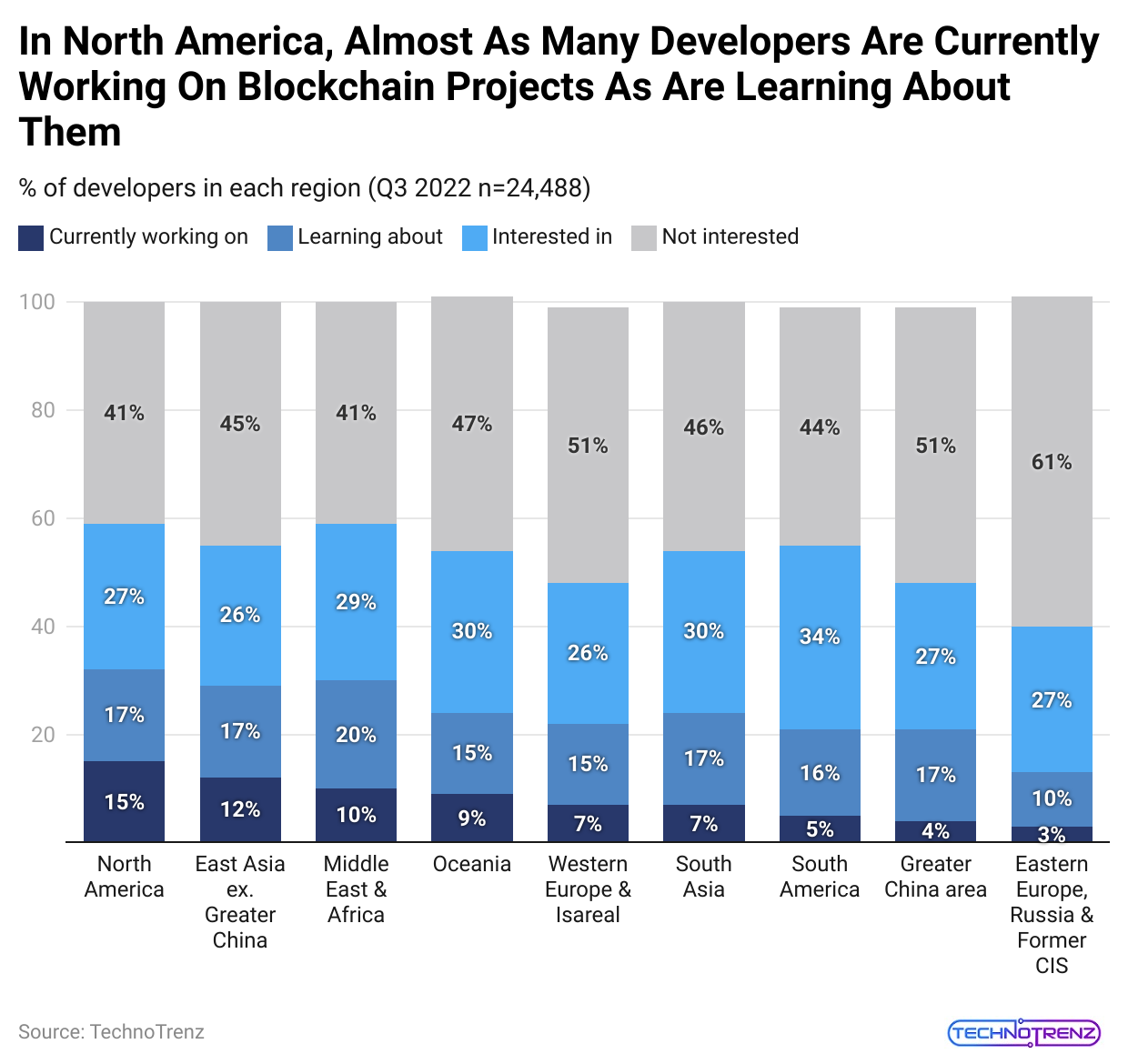

- In terms of blockchain development activity, North America (NA) and East Asia (EA), not including Greater China, lead the way.

- In these regions, 15% of developers in North America and 12% in East Asia have experience with blockchain projects or are currently learning about the technology.

- Africa and the Middle East are third globally, with 10% of developers having direct blockchain project experience, according to Blockchain Statistics.

- However, this region has the highest percentage of developers currently learning about Blockchain, at 20%.

(Reference: kruschecompany.com)

| Countries | Currently working on | Learning about | Interested in | Not interested |

| North America | 15% | 17% | 27% |

41% |

|

East Asia ex. Greater China |

12% | 17% | 26% | 45% |

| Middle East & Africa | 10% | 20% | 29% |

41% |

|

Oceania |

9% | 15% | 30% | 47% |

| Western Europe & Isareal | 7% | 15% | 26% |

51% |

|

South Asia |

7% | 17% | 30% | 46% |

| South America | 5% | 16% | 34% |

44% |

|

Greater China area |

4% | 17% | 27% | 51% |

| Eastern Europe, Russia & Former CIS | 3% | 10% | 27% |

61% |

- This suggests that Africa and the Middle East might become important markets for blockchain technology in the future, given their quick adoption of new technologies like mobile banking and their development hubs.

- Eastern Europe and the former CIS have the lowest percentages of developers working on blockchain projects or learning about the technology, at 3% and 10%, respectively.

Adoption of Blockchain Technology Overall

- 40% of organizations plan to invest $5 million or more in blockchain technology over the next year.

- China is expected to benefit the most from blockchain adoption, potentially adding $440.4 billion to its GDP by 2030, or a 1.7% increase.

- The US is projected to gain $407.2 billion, Germany $95.3 billion, and the UK $72.2 billion.

- Blockchain Statistics stated that the experts predict that within a decade, 10% to 15% of global infrastructure will use blockchain technology.

- Additionally, Blockchain could enhance 40 million jobs worldwide by 2030.

(Reference: financesonline.com)

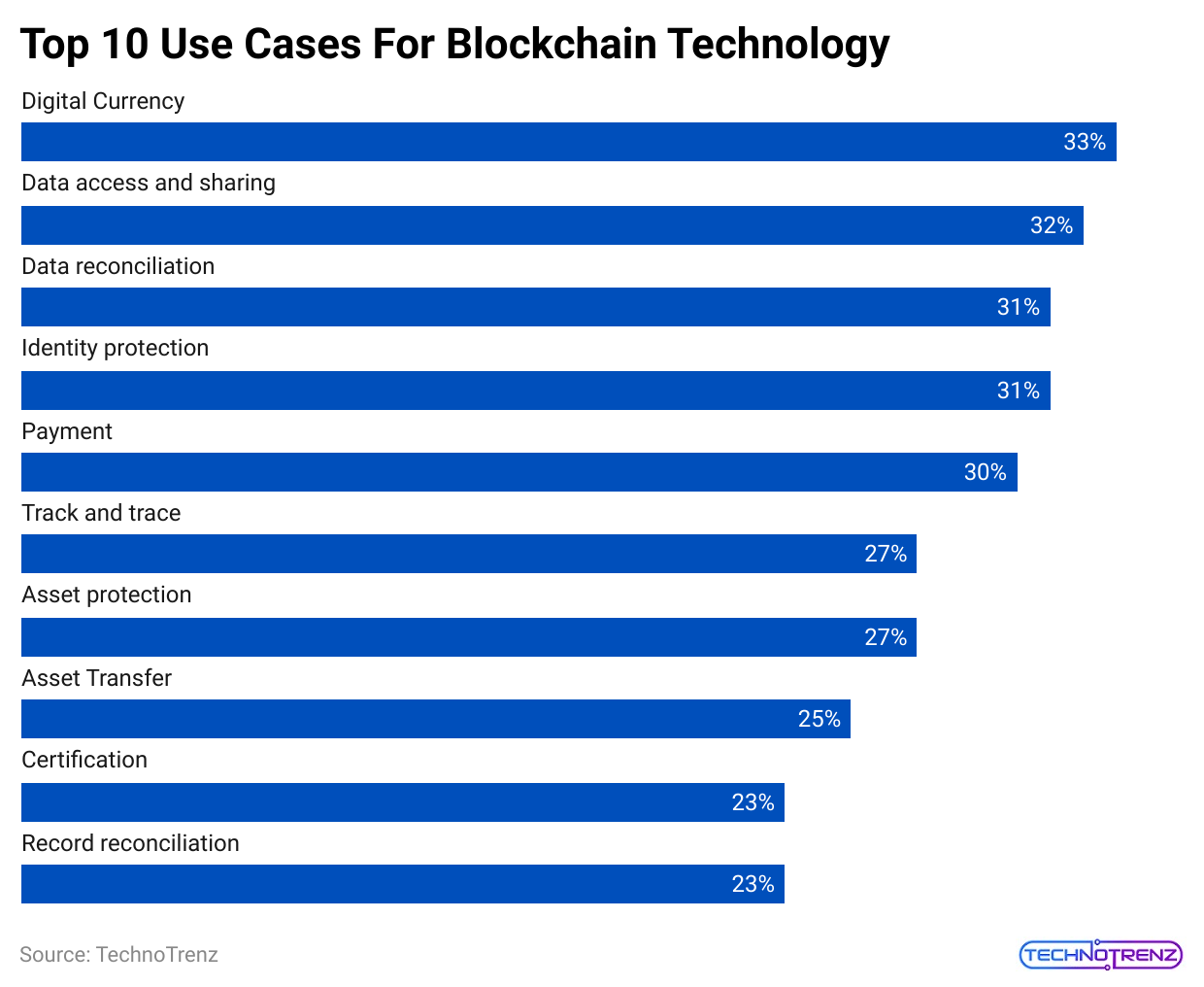

| Digital Currency | 33% |

| Data access and sharing |

32% |

|

Data reconciliation |

31% |

| Identity protection |

31% |

|

Payment |

30% |

| Track and trace |

27% |

|

Asset protection |

27% |

| Asset Transfer |

25% |

|

Certification |

23% |

| Record reconciliation |

23% |

- In China, 70% of executives consider Blockchain one of their top five priorities, making it the strongest region for blockchain focus. In contrast, only 42% of organizations in Germany view it as a priority.

- Globally, the top uses for blockchain technology are digital currency (33%), data access and sharing (32%), and data reconciliation (31%). Other common uses include identity protection (31%), payments (30%), and tracking and tracing (27%).

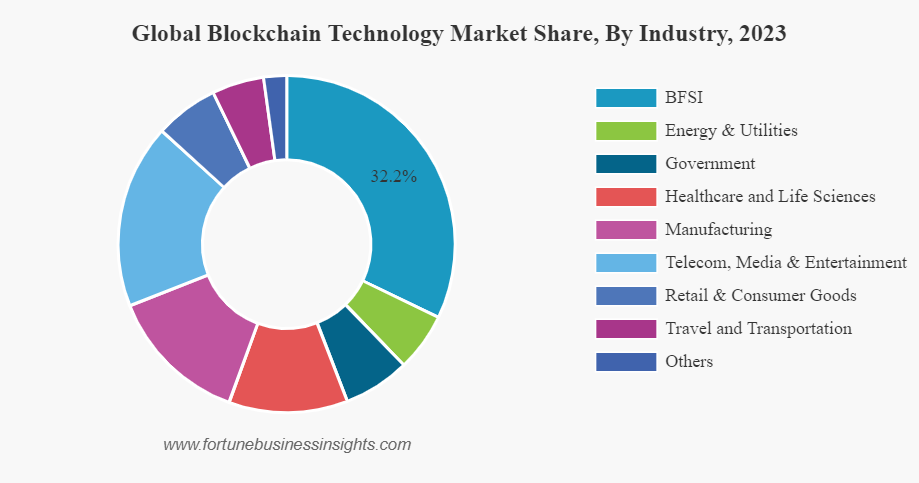

(Source: fortunebusinessinsights.com)

(Source: fortunebusinessinsights.com)

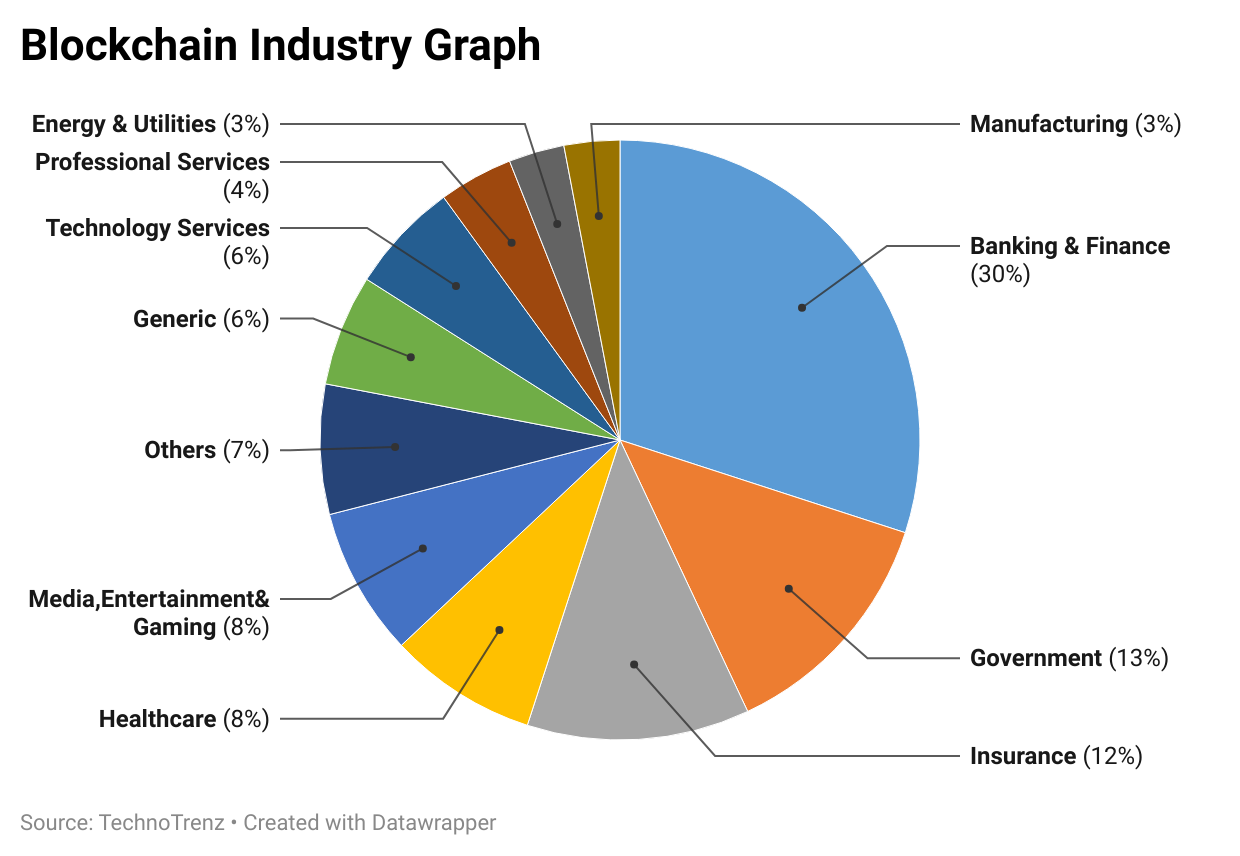

- In the pie chart above, we can see the Global Blockchain technology market share by industry in 2023.

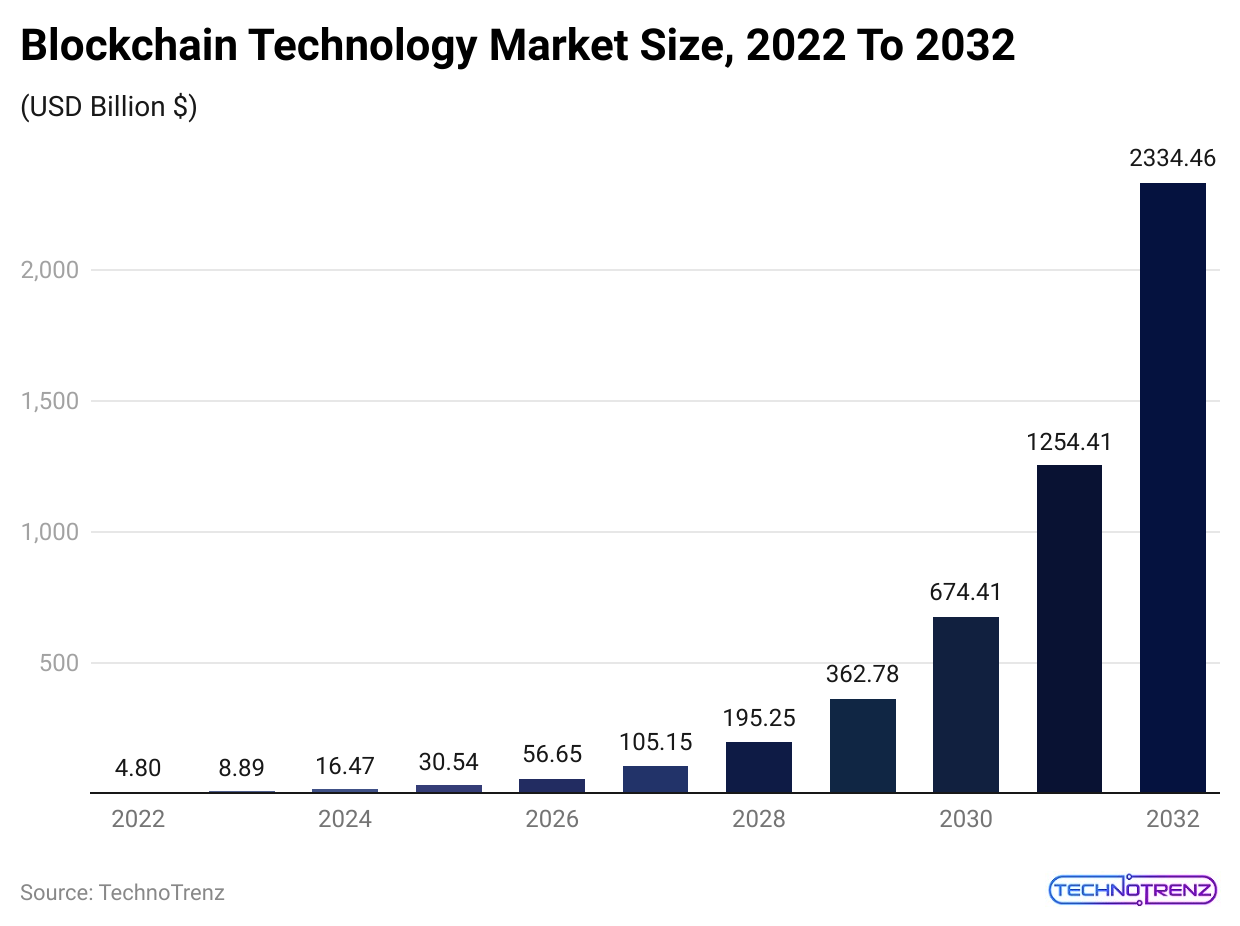

- Blockchain technology is expected to reach nearly $1,000 trillion by 2032, according to recent market research. This new forecast is lower than an earlier one.

- The forecast focuses on Blockchain used with cloud applications for specific business sectors and does not include decentralized apps like blockchain gaming.

- In June 2022, it was predicted that blockchain technology would reach $1,235 billion by 2030, growing at a compound annual growth rate (CAGR) of 82.8%.

- However, the latest forecast from December 2023 now estimates it will be worth $943 billion by 2032, with a CAGR of 56.1%. The reason for this change needs to be explained.

- One study showed that 36% of IT leaders are actively looking for blockchain security solutions, while 50% are not interested in adopting them.

- 88% of senior executives think that blockchain technology will eventually become widely used.

- As per Blockchain Statistics, 39% of senior executives worldwide have already implemented blockchain technology in their organizations.

- Among these companies, 41% had revenues over $100 million, and 46% had revenues over $1 billion.

Cryptocurrency Statistics

- As of 2023, North America is the top region for receiving cryptocurrency, holding 35% of the total value.

- The United States has the most cryptocurrency ATMs, with 14,112 (83%).

- Europe is second with 1,258 ATMs (7.4%), and Canada is third with 2,046 ATMs (2.3%).

- Since February 2021, there have been more than 1.193 million Ethereum transactions daily, as per Blockchain Statistics.

- According to the Global Crypto Adoption Index, the top five countries for crypto adoption are Ukraine, Russia, China, Kenya, and South Africa.

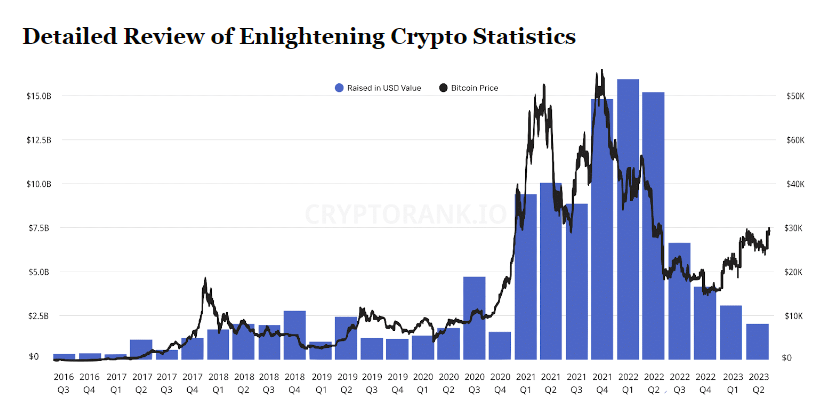

(Source: techreport.com)

- In the above chart, we can see the statistics of the rise in USD Value and the Bitcoin price from 2016 to 2023.

- Other regions follow with Europe at 22%, Central and Southern Asia at 13%, Eastern Asia at 11%, Latin America at 9%, the Middle East at 7%, and Africa at 3%.

- There are currently over 22,900 cryptocurrencies worldwide, with 8,832 of them being active, as per Blockchain Statistics.

(Reference: investingintheweb.com)

(Reference: investingintheweb.com)

- In June 2023, the Bitcoin blockchain was 464.83 gigabytes in size, and by the end of the year, around 90% of Bitcoins will have been mined.

- Blockchain Statistics stated that the price of Bitcoin was $25,658 as of June 10, 2023.

- Based on trading volume, the top cryptocurrency exchanges are Binance ($28.85 billion), HBTC ($14.44 billion), and Hydax Exchange ($12.19 billion).

- Other significant exchanges include Dsdaq ($11.97 billion), ZG.com ($11.5 billion), and Xheta Global ($12.07 billion).

- The table below shows the number of active cryptocurrencies recorded over the years.

| Year | Number of active cryptocurrencies |

| 2013 |

66 |

|

2014 |

506 |

| 2015 |

562 |

|

2016 |

644 |

| 2017 |

1,335 |

|

2018 |

1,658 |

| 2019 |

2,817 |

|

2021 |

7,557 |

| 2022 |

9,310 |

|

2023 |

8,866 |

- Bitcoin leads the market with a 66% market share. Ripple (3%) and Ether (8%) follow, while Litecoin has a 1% market cap and Monero has 0.5%. Other cryptocurrencies together make up 7% of the market.

- In 2020, Ukraine sent $8.2 billion and received $8.5 billion in cryptocurrency.

- Russia received $16.6 billion and sent over $16.8 billion.

- High cryptocurrency adoption in these countries is partly due to low public trust in government, businesses, and media. Bitcoin transactions total 272,006.

NFT Statistics 2024

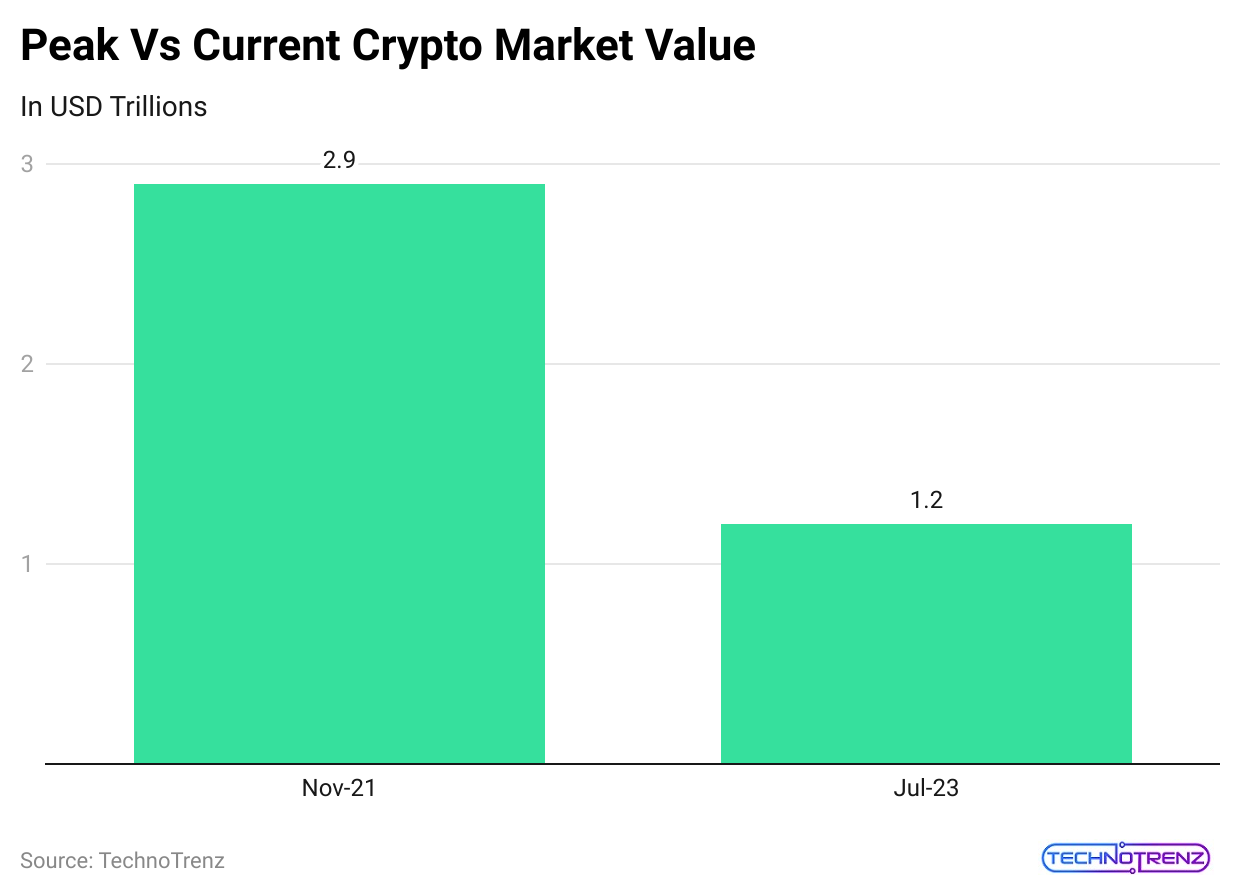

- The global NFT market earned $892 million in 2022 and is projected to reach $1.6 billion by the end of 2023.

- The NFT market is expected to exceed $3.1 billion by 2027, growing at an annual rate (CAGR 2023-2027) of 18.55%.

- A global research firm, VMR, forecasts even faster growth, predicting the NFT market will hit $231 billion by 2030.

- Blockchain Statistics stated that the average revenue per user (ARPU) in the NFT market is $114 in 2023.

- There are 14 million NFT users in 2023, and this number is expected to rise to 19 million by 2027.

- The NFT market is expected to have a user penetration rate of 0.2% by 2023, and it is forecasted to stay the same by 2027.

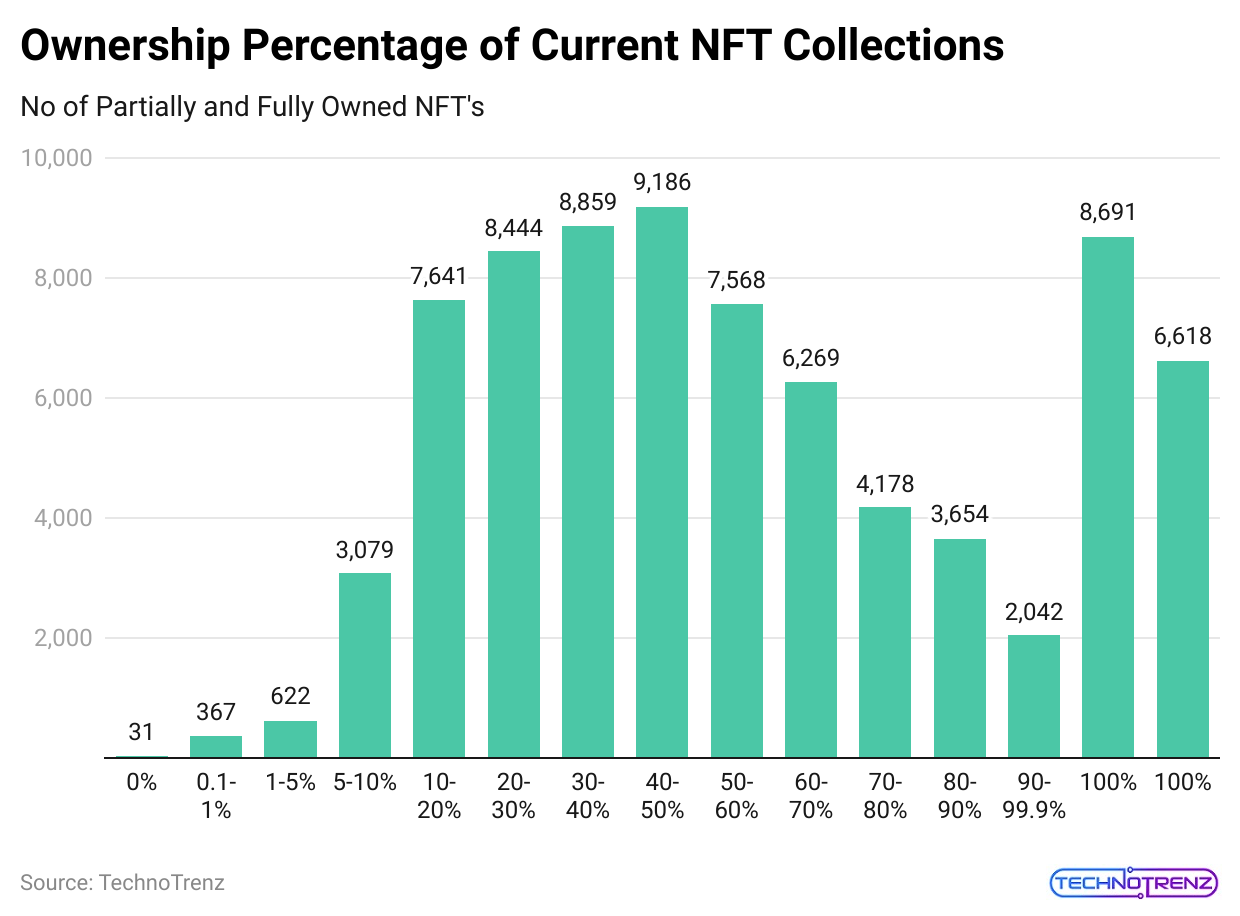

(Reference: cryptonews.net)

(Reference: cryptonews.net)

- Despite concerns that interest in NFTs might be declining, data shows that NFTs are still popular in 2023.

- Analysis of NFT-related tweets shows the highest interest in these countries: Montenegro, Bosnia and Herzegovina, Luxembourg, Cuba, Curacao, Taiwan, Colombia, France, Lebanon, and Vietnam.

The most popular NFTs by all-time trading volume are:

- Bored Ape Yacht Club

- CryptoPunks

- Mutant Ape Yacht Club

- Otherdeed for the Otherside

- Art Blocks Curated

- Azuki

- Clone X – Takashi Murakami

- Moonbirds

- Doodles

- Bored Ape Kennel Club

- Data from Morning Consult reveals that millennials are the biggest group of NFT collectors, making up 23%.

- Around 250,000 people trade NFTs each month on OpenSea.

- The average price of an NFT is predicted to reach $0.03 as the market recovers.

- Blockchain Statistics stated that more than half of NFT sales are under $200.

- In comparison, only 8% of Gen X, 4% of Gen Z, and 2% of Baby Boomers collect NFTs.

(Reference: demandsage.com)

- In 2023, Blur, OpenSea, X2Y2, Magic Eden, and LooksRare will be the largest NFT marketplaces by market share.

- There are over 360,000 NFT owners in 2023.

- The majority of NFT users are from Thailand, Brazil, the United States, China, Vietnam, India, and Canada.

- About 19,000 NFTs are sold daily.

Blockchain in Industry-Specific Market Sizes Statistics

- More than 100 banks are now testing or using blockchain technology.

- The blockchain market in healthcare is expected to reach $5.6 billion by 2025.

- Over half of new business processes and systems are projected to use some form of blockchain technology by 2022.

- The blockchain market in the supply chain sector is forecasted to reach $424.24 million by 2023.

- Around 55% of large companies worldwide are either developing or considering blockchain projects.

- Blockchain could potentially cut banks’ infrastructure costs by $15-20 billion annually by 2022.

- 47% of top executives plan to integrate Blockchain into their systems within the next three years.

- Blockchain could save global businesses $550 billion each year by 2030 through reduced risk and fraud.

- Blockchain Statistics stated that almost 84% of businesses are exploring or using blockchain technology in some form.

- The retail blockchain market is expected to grow to $11.18 billion by 2027.

- By 2027, the blockchain market in insurance is projected to exceed $1.39 billion.

- 12% of commodities traders are currently using blockchain technology.

- The global blockchain market in agriculture is expected to reach $429.7 million by 2027.

- The blockchain technology market is expected to grow at a rate of 67.3% per year from 2020 to 2027.

- IBM holds the most blockchain patents worldwide, with over 108 patents.

- 44% of businesses surveyed believe Blockchain will disrupt their industry.

- In 2021, the total value locked in decentralized finance (DeFi) projects using blockchain technology exceeded $100 billion.

- Around 90% of major banks in North America and Europe are exploring blockchain opportunities.

(Reference: esds.co.in)

- By 2023, 30% of manufacturing companies are expected to use Blockchain to detect unauthorized changes in production systems.

- The global blockchain market in energy is projected to reach $1.11 billion by 2027.

- The blockchain market in media, advertising, and entertainment is expected to grow to $1.54 billion by 2024.

- The blockchain market in education is expected to grow at a rate of 61.4% per year from 2020 to 2028.

- Blockchain investments in the Asia-Pacific region are forecasted to exceed $2.4 billion by 2026.

- By 2027, blockchain technology is expected to facilitate over 9% of global GDP.

- The blockchain market in gaming is projected to reach $3.09 billion by 2025.

- 18% of chief procurement officers see Blockchain as a major disruptive force in procurement.

- The blockchain market in the food and agriculture sector is expected to reach $1.4 billion by 2028.

- Around 56% of blockchain projects focus on the financial services industry, according to Blockchain Statistics.

- The global blockchain market in automotive and aerospace is estimated to reach $20.62 billion by 2026.

- Blockchain technology is predicted to generate $176 billion in business value by 2030.

- Over 70% of major global banks are experimenting with blockchain technology.

- The retail blockchain market is expected to grow at a rate of over 50% per year between 2021 and 2026.

(Source: rootsanalysis.com)

- By 2023, the blockchain market in healthcare is expected to be worth $1.6 billion.

- Blockchain technology could save financial services companies $8-12 billion annually in Know Your Customer (KYC) and Anti-Money Laundering (AML) costs.

- About 87% of businesses are using or planning to use blockchain technology.

- The blockchain market in transportation and logistics is expected to grow at a rate of 81.9% per year from 2021 to 2026.

- 50% of global business networks are expected to use blockchain technology by 2021.

- 38% of technology executives consider Blockchain a top strategic priority for their organizations.

- The blockchain technology market is projected to grow at a rate of 67.3% from 2021 to 2028.

- By 2023, it is estimated that 10% of global economic infrastructure will use blockchain technology.

- The blockchain market in the supply chain sector is expected to grow at a rate of 50.2% per year from 2021 to 2027.

- The blockchain market in the pharmaceutical industry is forecasted to reach $949.53 million by 2028.

- Blockchain Statistics stated that around 72% of global ERP solutions are expected to include Blockchain by 2023.

(Source: grandviewresearch.com)

- The blockchain market in gaming is expected to grow at a rate of over 13% per year from 2021 to 2026.

- Blockchain Statistics stated that around 34% of large global companies are investing in blockchain technology.

- The blockchain market in education is projected to reach $1.3 billion by 2027.

- The blockchain market in insurance is expected to grow at a rate of 82.5% per year from 2020 to 2027.

Blockchain Savings and Investment Estimation

- Blockchain-based rewards could cut global electricity use for Bitcoin by six times.

- Blockchain technology might save the healthcare industry $100 to $150 billion each year by 2025.

- By 2030, Blockchain could add $3 trillion to the global GDP.

- Goldman Sachs put $50 million into a cryptocurrency startup called Circle in 2015.

- Projects using blockchain technology are expected to boost blockchain investments by 60% by 2023.

- Blockchain Statistics stated that investments in Blockchain could grow by 66% by 2026.

- By 2030, Blockchain might add $2.5 trillion in business value to supply chain and trade finance.

- Blockchain technology could help the global food and agriculture industry save $31 billion by 2025.

- Adopting blockchain technology could cut global healthcare costs by $450 billion by 2025.

Benefits of Blockchain Technology

#1. Enhanced Security

- Your data is important and sensitive, and Blockchain can change how you protect it.

- Blockchain creates a permanent record that can’t be changed and is fully encrypted. This helps prevent fraud and unauthorized access.

- Privacy issues can be managed by hiding personal data and setting permissions to control who can access information.

- Since blockchain stores data across many computers rather than one server, it’s much harder for hackers to access it.

Greater Transparency

- Without Blockchain, each organization maintains its separate database.

- Blockchain uses a shared ledger that records transactions and data in the same way across multiple locations.

- Everyone with permission to access the network sees the same information at the same time, offering complete transparency.

- All transactions are recorded permanently with timestamps.

- This allows everyone to see the full history of a transaction and greatly reduces the chances of fraud.

#2. Instant Traceability

- Blockchain creates a record of where an asset has been at each stage of its journey.

- This record provides proof in industries where customers care about environmental or human rights issues or where counterfeiting and fraud are concerns.

- With Blockchain, you can share information about the origin of a product directly with customers.

- It also helps identify any weak spots in the supply chain, such as delays in shipping.

#3. Increased Efficiency and Speed

- Traditional processes that rely on paperwork are slow, error-prone, and often need third-party involvement.

- Blockchain simplifies these processes, allowing transactions to be completed faster and more efficiently.

- Documents and transaction details can be stored on the Blockchain, removing the need for paper and speeding up reconciliation.

- This makes clearing and settlement much quicker.

#4. Automation

- “Smart contracts” can automate transactions, boosting efficiency and speed. Once the conditions set in the contract are met, the smart contract automatically executes the next step.

- Smart contracts cut down on the need for human intervention and third parties to confirm the contract’s terms.

- For example, in insurance, once all necessary documents are submitted for a claim, the system automatically processes and pays the claim.

Conclusion

Blockchain statistics indicate that businesses will increasingly use this technology to improve transparency and overcome fraud. The decentralized ledger system is secure and cannot be changed, which means that all information given into the Blockchain is permanent and be possibly checked by anyone. This makes it a useful tool for businesses that want to ensure their data is accurate. As more people learn about blockchain technology, they likely start trusting it more for transactions like buying products or services. We have shed enough light on Blockchain Statistics through this article.

Sources

FAQ.

According to Custom Market Insights (CMI), the blockchain technology market was valued at $4.8 billion in 2022. It is expected to reach about $69 billion by 2032, growing at an annual rate of 68% from 2023 to 2032.

Singapore is a major leader in blockchain technology. The government is investing heavily in blockchain research and development. With its friendly regulations, Singapore has become a key place for initial coin offerings (ICOs), drawing many blockchain companies to set up their businesses there.

As AI deals with sensitive personal data, Blockchain will keep it safe and unchanged using top-notch encryption techniques.

Ketaki Joshi is an expert writer on "Technology in Healthcare" with extensive experience in researching AI in healthcare, telemedicine, and tech gadgets as healthcare companions. She writes feature articles for newsletters and websites and research news stories for doctors and researchers. A lifelong reader, Ketaki left her job at a French multinational company to become a professional writer. Her dedication has led to the recent release of her first short story on Amazon, "The Envelope That Changed Our Lives."