Financial Services Industry Statistics By Size, Employment, Demographic And Region

Updated · Aug 27, 2024

WHAT WE HAVE ON THIS PAGE

- Introduction

- Editor’s Choice

- What is Financial Services?

- Importance Of Financial Services

- Financial Services Industry Size Statistics

- Financial Services Consumers Converting By Calling

- Financial Services Industry Statistics By Employment

- Financial Services Industry Professionals Demographics

- Regional Financial Service Industry Statistics

- Conclusion

Introduction

Financial Services Industry Statistics: Financial services are services and products provided by financial institutions. These institutions facilitate different financial transactions and other financial activities, such as credit cards, investment opportunities, money management, loans, and insurance. The essential types of financial services are payment and lending, insurance brokerage, reinsurance, investment, and foreign exchange services.

The payment and lending industry refers to the lenders making funds and making them available to an individual. The services are offered to medium- and small-sized businesses and even large businesses. Corporations, governments, investment institutions, and individuals use the services. In this article, we shall shed more light on the statistics of the financial services industry.

Editor’s Choice

- The financial sector includes businesses involved in banking, lending, insurance, investment, and managing money and wealth.

- Most finance professionals are White (71.9%), followed by Hispanic or Latino (9.5%), Asian (8.4%), and Black or African American (5.7%).

- According to Financial Services Industry Statistics, around 6.68 million Americans work in the finance and insurance industry as of February 2023.

- Sustainable finance assets under management are forecasted to hit $40.5 trillion by 2025.

- Since complete data on the global finance sector isn’t available, its size is usually estimated. Financial services are essential for many industries that depend on loans and credit to operate.

- To estimate the size of the finance sector, people look at different factors like assets under management, market value, or total market size.

- Although estimates can vary, most suggest that the financial services sector makes up about 20% to 25% of the global economy.

- Financial Services Industry Statistics stated that Finance professionals are 59% more likely to work for private companies than for public companies.

- The decentralized finance (DeFi) market is projected to grow to $501.91 billion by 2026.

What is Financial Services?

Financial services are the money-related services provided by the finance industry. This includes a wide range of businesses that handle money, such as credit unions, banks, credit card companies, insurance firms, accounting firms, consumer finance companies, stock brokers, investment funds, personal financial advisors, and some government-supported organizations. These financial services companies are found in all developed regions and often gather in major financial centers like London, New York City, and Tokyo.

Importance Of Financial Services

Financial services are essential for improving a country’s economy. They help increase production in various sectors, which drives economic growth. As the economy grows, people experience a higher standard of living. Financial services also allow individuals to buy goods through methods like hire purchase, and financial institutions earn profits from these transactions. These services encourage investment, savings, and production.

- Promoting Investment

Financial services increase product demand, which producers often need to meet by investing more. Financial services, like merchant banking, help investors raise capital through new market issues. The stock market attracts investment from both domestic and international sources. Factoring and leasing companies help producers sell products and acquire modern machinery.

- Promoting Savings

Financial services, such as mutual funds, offer various saving options. They provide investment opportunities for people, including retirees, to earn returns with minimal risk. Regulations ensure that these services protect savers’ interests.

Financial Services Provided by Institutions

- Factoring

- Leasing

- Forfaiting

- Hire Purchase Finance

- Credit Cards

- Merchant Banking

- Book Building

- Asset Liability Management

- Housing Finance

- Portfolio Finance

- Underwriting

- Credit Rating

- Interest & Credit Swap

- Mutual Funds

Minimizing Risks

Insurance companies reduce financial risks for both businesses and individuals. They cover various risks, including those from natural disasters, and provide savings options. The government has established the Insurance Regulatory and Development Authority (IRDA) to oversee these companies.

- Maximizing Returns

Financial services help businesses achieve higher returns by providing credit at reasonable rates. Producers can get credit for buying assets or leasing expensive equipment. Factoring companies help sellers and producers increase their sales and profits, even in competitive markets.

- Ensuring Greater Yield

Yield, which refers to the profit earned from investments, attracts more producers to the market. Financial services help producers earn more profits and build wealth. They also offer opportunities for higher yields through the stock market and other financial markets.

- Economic Growth

Financial services support balanced development across all economic sectors: primary, secondary, and tertiary. This balanced growth improves employment opportunities and overall economic health. In developed countries, the service sector is particularly important and contributes significantly to the economy.

- Economic Development

Financial services help consumers buy products and services that improve their quality of life. Through hire purchase, leasing, and housing finance, consumers can acquire cars, homes, and other items while saving money.

- Benefit to Government

Financial services allow the government to raise short-term and long-term funds for various needs. Short-term funds come from Treasury Bills purchased by banks, while long-term funds are raised through government securities. Financial services also help meet foreign exchange needs without requiring collateral.

- Expanding Financial Institutions’ Activities

Financial services enable institutions to raise and allocate funds efficiently. Services like mutual funds, factoring, and credit cards help institutions expand and diversify their activities, promoting economic dynamism.

- Capital Market

A healthy capital market indicates a strong economy. Financial services ensure companies can access the funds they need to grow and increase profits. Without these services, there would be no capital market, leading to negative market growth.

- Promotion of Domestic and Foreign Trade

Financial services boost both local and international trade. Factoring and forfaiting companies help increase sales and exports, while banking and insurance services support these activities.

- Balanced Regional Development

The government supports economically backward regions with tax breaks and cheaper credit to encourage investment. This promotes production, creates jobs, and raises income and demand, helping these regions develop and catch up with more advanced areas.

Financial Services Industry Size Statistics

- The global financial services industry is worth about $22.7 trillion.

- The wealth management market is expected to reach $118 trillion by 2025.

- Financial Services Industry Statistics stated that the global insurance market is valued at over $5 trillion.

- E-commerce transactions made up 16% of global payment volume in 2020.

- The global life insurance market is estimated to hit $4.3 trillion by 2026.

- Peer-to-peer lending is projected to reach $589 billion by 2025.

- Financial Services Industry Statistics stated that the global credit card market is worth more than $4 trillion.

- The digital asset management market is expected to grow to $5.1 billion by 2025.

- Global assets under management (AUM) are predicted to reach $145.4 trillion by 2025.

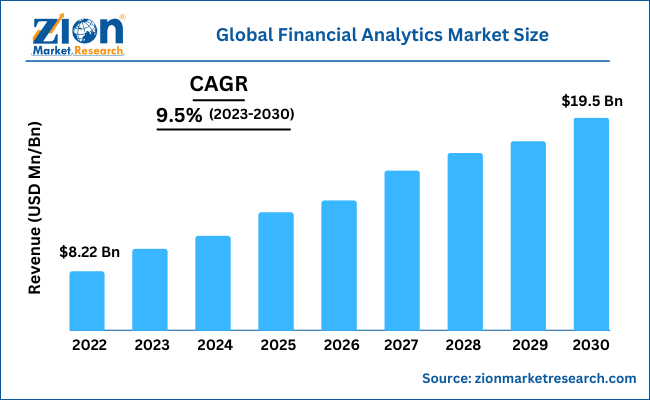

(Source: zionmarketresearch.com)

- In 2020, there were over 240 billion non-cash transactions worldwide.

- The hedge fund industry manages about $4 trillion in assets.

- Global pension fund assets are estimated to be around $52 trillion, as per Financial Services Industry Statistics.

- The microfinance market is expected to reach $313.02 billion by 2027.

- Approximately 2 billion people globally do not have bank accounts, according to the World Bank.

- The global trade finance market is valued at over $61 trillion.

- Financial institutions spend over $270 billion annually on regulatory compliance, as stated in Financial Services Industry Statistics.

- Smartphone wallet transactions are estimated to exceed $3.5 trillion worldwide by 2023.

- ESG (environmental, social, and governance) assets under management are expected to double to $53 trillion by 2025.

- Global remittance flows are projected to reach $930 billion in 2023.

- The cryptocurrency market capitalization exceeded $2 trillion in April 2023.

- Sustainable finance assets under management are forecasted to hit $40.5 trillion by 2025.

- The global credit union industry serves more than 274 million members.

- Financial Services Industry Statistics stated that online brokerage accounts account for 63% of all retail trading volume.

- The crowdfunding market is predicted to grow to $29.8 billion by 2027.

- Financial Services Industry Statistics stated that the global trade finance gap is estimated at $1.5 trillion.

- The number of open banking users worldwide is expected to surpass 79 million by 2023.

(Reference: mordorintelligence.com)

- Real-time payments are expected to make up 21% of global payment revenues by 2024.

- The neo-banking market is projected to reach $394.6 billion by 2026.

- According to the World Bank’s Financial Services Industry Statistics, over 2 billion adults globally remain unbanked.

- Digital lending is expected to account for 30% of all personal loans by 2023.

- The global gig economy is projected to reach $455.2 billion by 2023, as per Financial Services Industry Statistics.

- The commercial insurance market is estimated to be around $1.2 trillion.

- Financial Services Industry Statistics stated that the value of mobile wallet transactions is forecasted to reach $14 trillion by 2025.

- The gig economy is expected to make up 43% of the total workforce by 2025.

- The virtual event market is estimated to reach $404 billion by 2027.

- The decentralized finance (DeFi) market is projected to grow to $501.91 billion by 2026.

Financial Services Consumers Converting By Calling

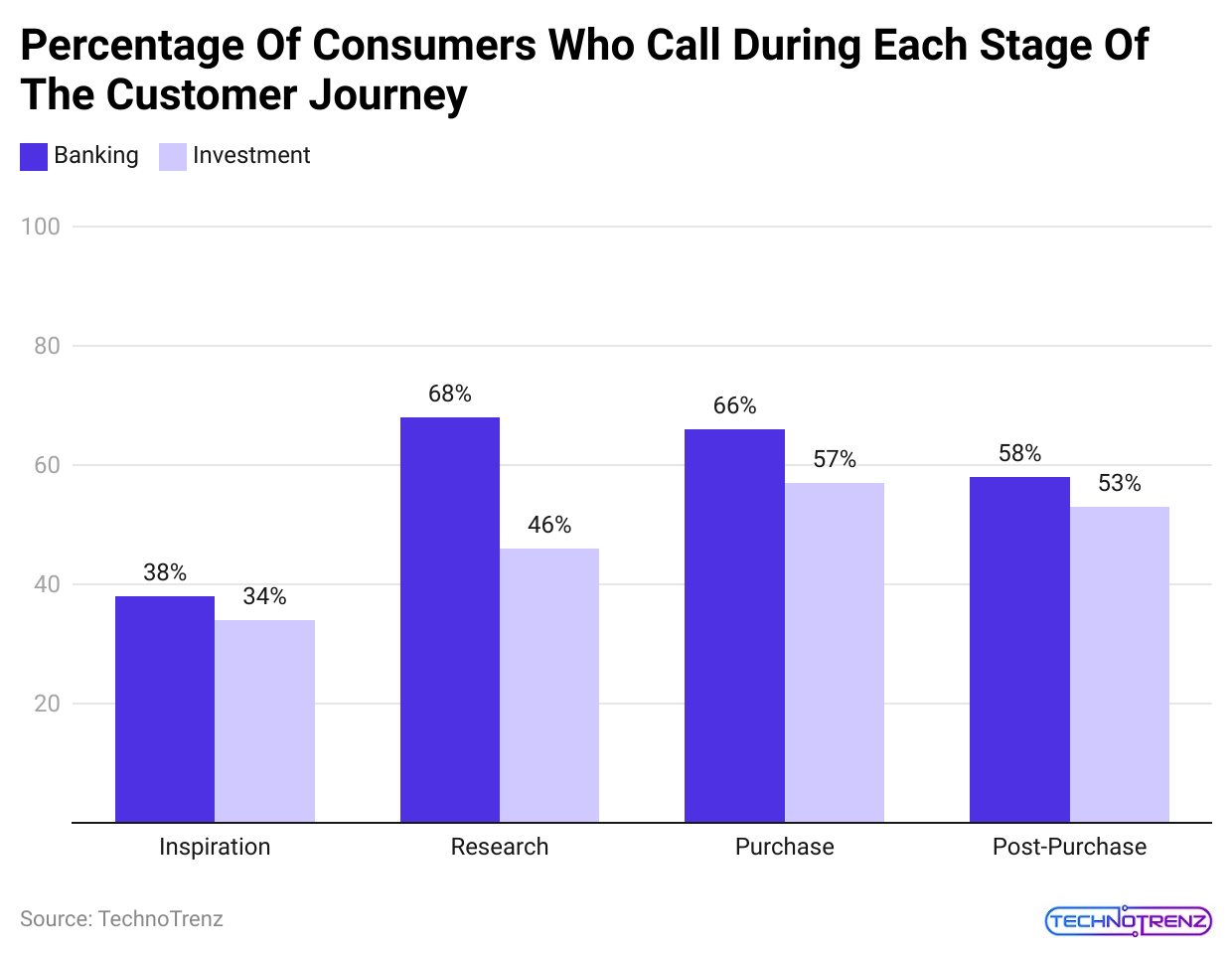

- Financial Services Industry Statistics stated that almost 66% of banking customers and 57% of investment customers prefer to call a live agent when making a purchase.

- For financial services, people often want to speak to someone directly.

- 72% of people shopping for loans make at least two phone calls to the financial institution during the loan process.

- Complex financial services usually need more than one call with a live agent to complete a purchase.

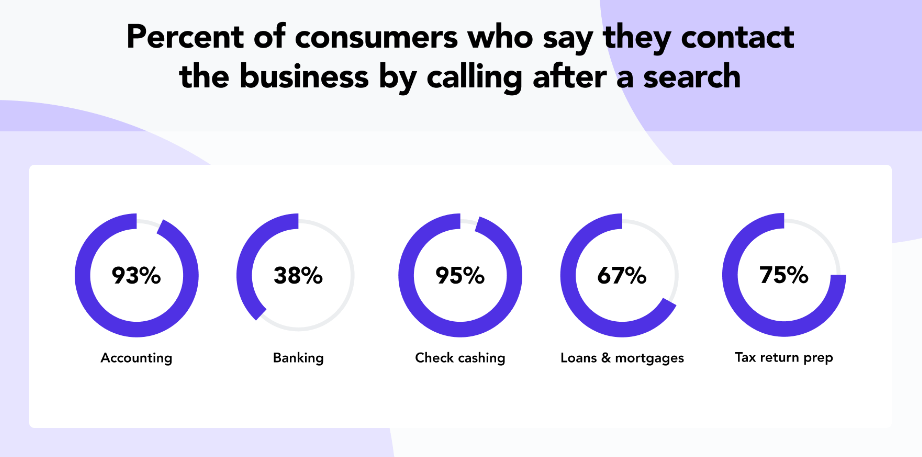

- 95% of people use check cashing services, 93% of people use accounting services, and 75% of people who prepare tax returns call the business after searching online. Since these services involve sensitive financial information, customers often prefer speaking with a live agent.

(Reference: invoca.com)

- Financial services customers are most likely to call when the purchase price is around $416. The more expensive the service, the more likely customers are to call to complete the purchase.

- 64% of calls to financial services providers come from organic search, while 36% come from paid search. A strong SEO strategy is crucial for driving calls.

- According to Financial Services Industry Statistics, 49% of financial services phone leads from organic searches come from mobile devices.

- To increase

- e phone leads from organic search, test and improve the placement of call buttons and calls to action (CTAs) on your website.

- 52% of financial services phone leads from paid searches come from mobile devices, as per Financial Services Industry Statistics.

- Mobile is a key channel for phone leads from paid search — use call extensions to increase phone leads from mobile devices, as per Financial Services Industry Statistics.

(Source: invoca.com)

- Financial Services Industry Statistics stated that January is the month with the highest call volume for financial services providers.

- To maximize revenue, make sure you offer a smooth call experience even during busy times.

- Financial services providers receive the most calls at noon, according to Financial Services Industry Statistics. Make sure your call center is well-staffed during this peak time.

Financial Services Industry Statistics By Employment

- As of February 2023, around 6.68 million Americans work in the finance and insurance industry.

- The largest group of workers is 414,680 tellers. Next are 412,970 sales agents for securities, commodities, and financial services.

- Other top jobs in this sector include loan officers, insurance sales agents, accountants, and auditors.

- According to Financial Services Industry Statistics, the average yearly salary for professionals in finance and insurance is about $72,400.

- Of the five main job roles in this sector, sales agents for securities, commodities, and financial services have the highest average annual salary at $96,000.

- Here’s a breakdown of the median and average annual salaries for the five main occupations in the finance and insurance sector:

| Occupation | Median Annual Salary | Mean Annual Salary |

| Tellers | $32,600 |

$32,930 |

|

Securities, commodities, and financial services sales agents |

$63,820 | $96,000 |

| Loan Officers | $63,130 |

$76,230 |

|

Insurance Sales Agents |

$52,210 | $69,200 |

| Accountants and auditors | $78,600 |

$87,660 |

- As of February 2023, there are about 374,000 job openings in the finance and insurance industry, a decrease from the 439,000 openings in January 2022.

- The unemployment rate in the finance and insurance industry is 2% as of February 2023.

- This is higher than the 1.8% unemployment rate in January 2022 but lower than the national unemployment rate of 3.8% in February 2022.

Financial Services Industry Professionals Demographics

- Over 135,252 finance professionals are working in the United States.

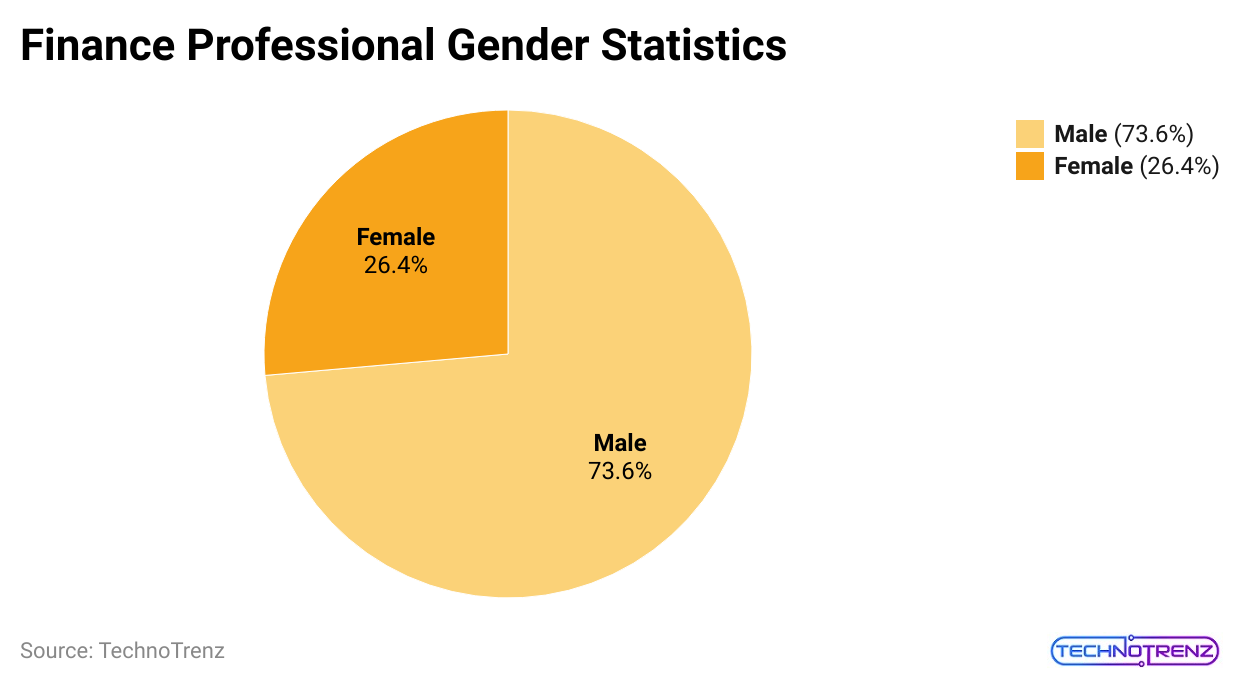

- Of these professionals, 26.4% are women, and 73.6% are men.

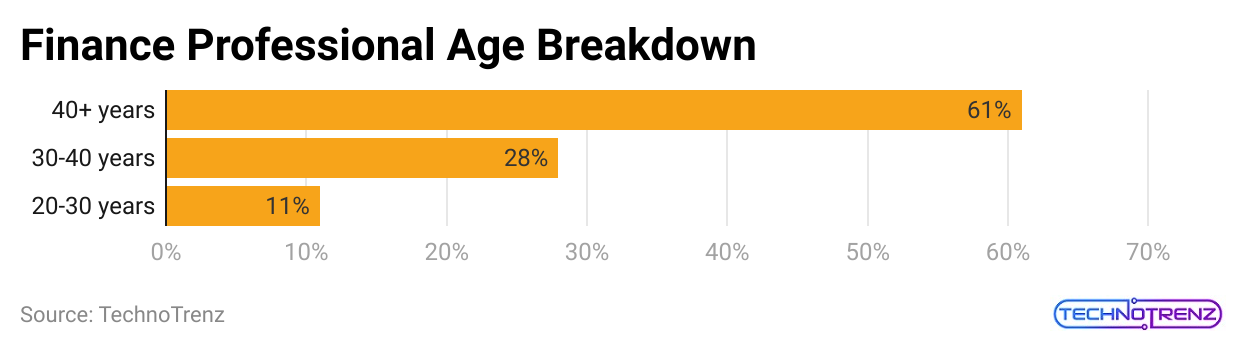

- The average age of finance professionals is 44 years old, as stated in Financial Services Industry Statistics.

(Reference: 10xhire.io)

- In the above chart, we can see the gender ratio of financial professionals.

- Most finance professionals are White (71.9%), followed by Hispanic or Latino (9.5%), Asian (8.4%), and Black or African American (5.7%).

- In 2022, women in the finance industry earned 85% of what men earned.

- 5% of finance professionals identify as LGBT, as stated in Financial Services Industry Statistics.

- Finance professionals are 59% more likely to work for private companies than for public companies, according to the Financial Services Industry Statistics.

(Reference: 10xhire.io)

(Reference: 10xhire.io)

- In the pie chart above, we can see the statistics on the gender of finance professionals.

| Male | 73.6% |

| Female | 26.4% |

- Among finance professionals, 26.4% are women, and 73.6% are men, as per Financial Services Industry Statistics.

- Most finance professionals, making up 61% of the field, are 40 years old or older, which matches the average age in this industry as stated in Financial Services Industry Statistics.

(Reference: 10xhire.io)

| Finance professional years> | % |

| 20-30 years |

11% |

|

30-40 years |

28% |

| 40+ years |

61% |

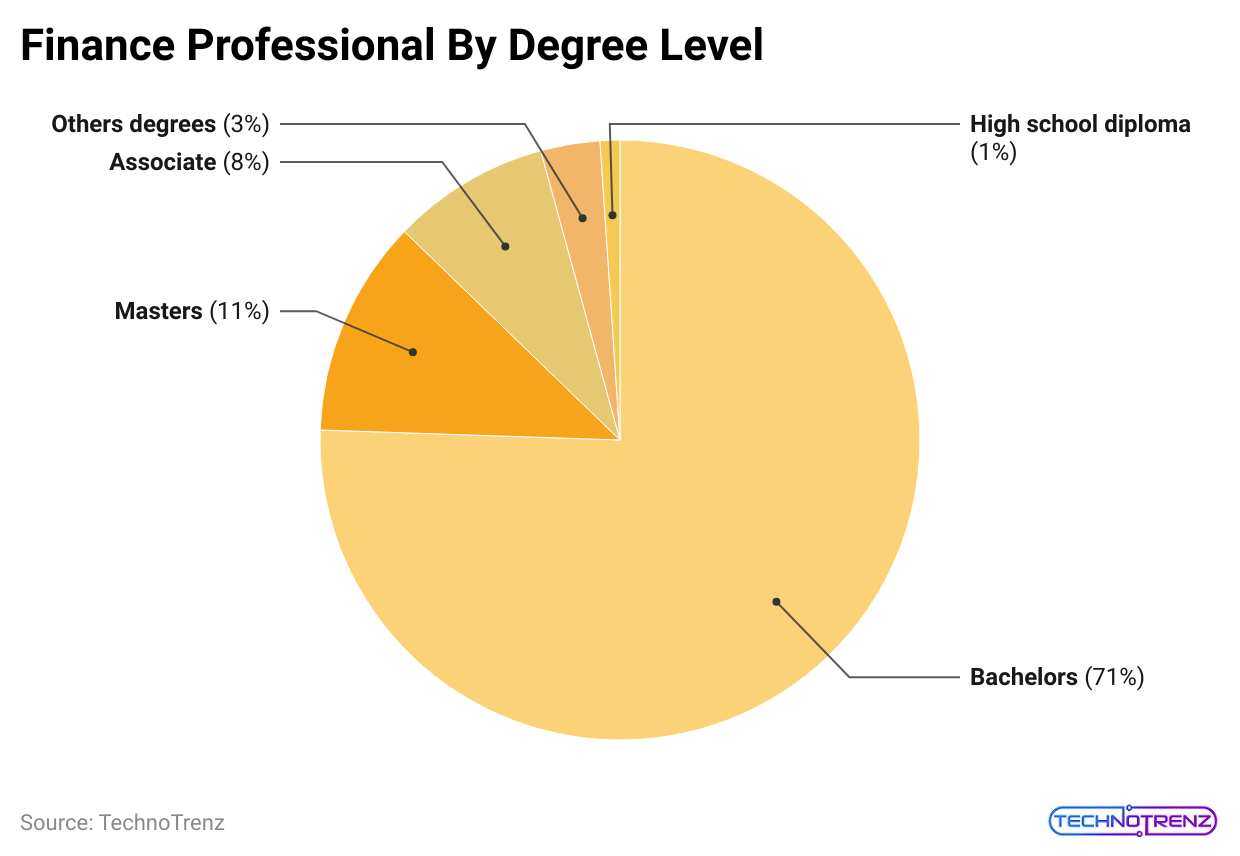

- Most finance professionals have a bachelor’s degree, with 77% having this qualification. The next most common degrees are master’s degrees, held by 11%, and doctorate degrees, held by 8%.

(Reference: 10xhire.io)

(Reference: 10xhire.io)

| Financial Professional Degree | % |

| High school diploma |

1% |

|

Associate |

8% |

| Masters |

11% |

|

Bachelors |

71% |

| Others degrees |

3% |

- Finance professionals with a doctorate earn a median annual income of $68,340, which is higher than those without a degree.

- Those with a master’s degree earn a median annual income of $63,145, while those with a bachelor’s degree earn $57,968, as per Financial Services Industry Statistics.

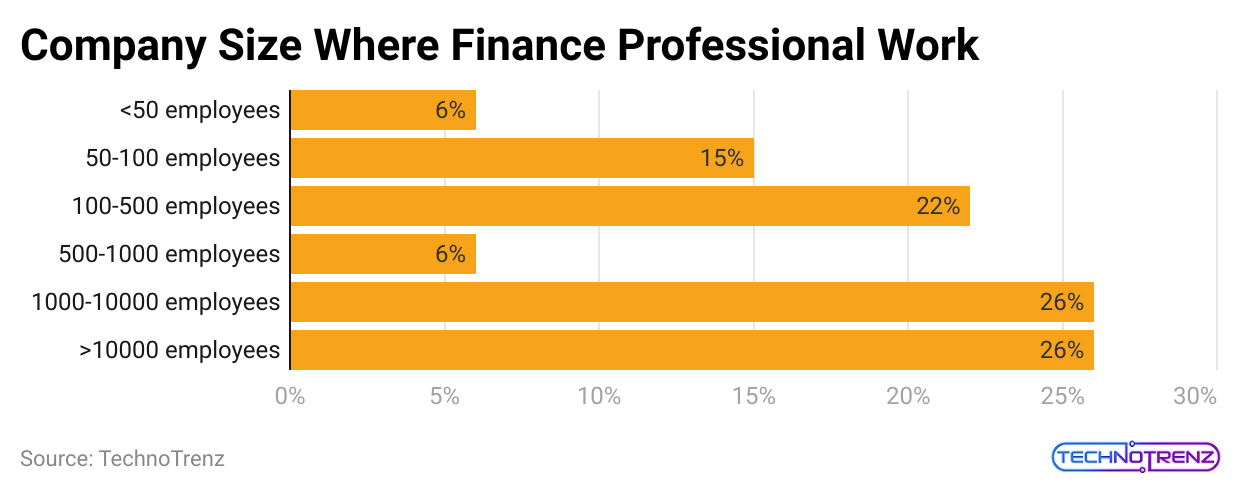

- The financial services sector employs over 7.6 million people and has more than 500,000 private businesses. Most finance professionals work for private companies in this industry.

(Reference: 10xhire.io)

(Reference: 10xhire.io)

| Company size | % |

| >10,000 employees |

26% |

|

1,000-10,000 employees |

26% |

| 500-1,000 employees |

6% |

|

100-500 employees |

22% |

| 50- 100 employees |

15% |

|

<50 |

6% |

Regional Financial Service Industry Statistics

(Reference: statista.com)

(Reference: statista.com)

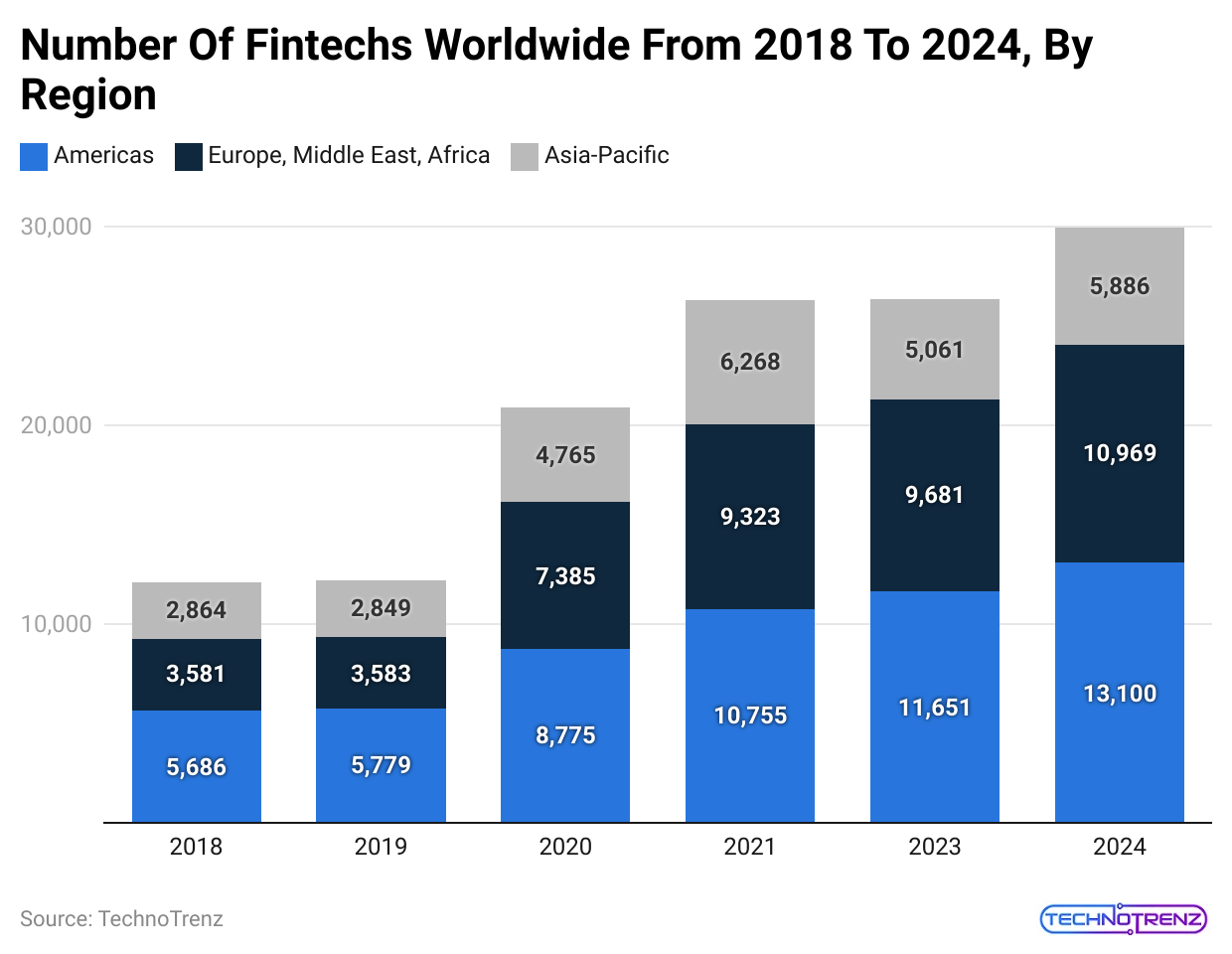

- In the above chart, we can see the number of fintech companies worldwide from 2018 to 2024 by region.

(Reference: statista.com)

- In the above chart, we can see the number of cashless transactions globally from 2013 to 2027 by region.

(Reference: statista.com)

- The above chart shows the credit card debt in the United States from Q4 2010 to Q4 2023 in billions of US dollars.

(Reference: statista.com)

- In the above chart, we can see the number of mergers and acquisitions in the global market from 1985 to May 2024.

Conclusion

Although exact numbers are hard to get, the financial services sector is a key part of the global economy. It includes banks, investment firms, and insurance companies, all of which are important for how the market operates. There are various ways to measure the size of this sector compared to the world economy. While estimates differ, most suggest that the financial services sector makes up about 25% of the global economy.

In the coming years, the Financial Service Sector Industry will reach heights, and people will be dependent on technology to make payments. We have shed enough light on the Financial Services Industry Statistics through this article.

Sources

FAQ.

Changes in customer preferences, new technologies, and government decisions will greatly shape financial industry trends in 2024. The financial services market is expected to grow from $25,848 billion in 2022 to $37,484 billion by 2027, with an annual growth rate of 7.5%.

This year, financial institutions are expected to focus more on sustainability and environmental, social, and governance (ESG) factors. Financial organisations will be encouraged to invest more in green projects than ever before.

The financial services market has been expanding rapidly in recent years. It is expected to grow from $31,138.82 billion in 2023 to $33,539.52 billion in 2024, with an annual growth rate of 7.7%.

Ketaki Joshi is an expert writer on "Technology in Healthcare" with extensive experience in researching AI in healthcare, telemedicine, and tech gadgets as healthcare companions. She writes feature articles for newsletters and websites and research news stories for doctors and researchers. A lifelong reader, Ketaki left her job at a French multinational company to become a professional writer. Her dedication has led to the recent release of her first short story on Amazon, "The Envelope That Changed Our Lives."