Online Banking Usage Statistics By Region, Demographic, Online vs Mobile Banking, Fraud And Growth

Updated · Aug 29, 2024

WHAT WE HAVE ON THIS PAGE

- Introduction

- Editor’s Choice

- What is Online Banking?

- What Can One Do Through Online Banking?

- General Online Banking Statistics

- Regional Online Banking Statistics

- Traditional vs. Online Banking Statistics

- Leading Online Banking Platform

- Online Banking Demographics Statistics

- Customer Preferences For Banking Channels

- Digital Banking Adoption Rate

- Online vs Mobile Banking Statistics

- Online Banking Fraud Statistics

- Generational Attitudes on Mobile Banking

- Digital Banking Market Growth Projection

- Banking Sector in India

- Conclusion

Introduction

Online Banking Usage Statistics: The Internet has made our lives easier in many ways by reducing the need for face-to-face interactions and adding convenience to transactions. One industry that has greatly benefited from going online is banking. With online banking, customers can now manage their money from anywhere without having to visit a bank branch. Banks have found it simpler to keep track of money and offer many more services to customers, which has helped them grow their user base and increase profits. Managing transactions between different banks and within the same bank has also become easier.

In this article, Online Banking Usage Statistics, we will explore some key moments and interesting statistics related to online banking, helping you understand both the advantages and challenges of going digital.

Editor’s Choice

- 39% of people globally use banking apps as their main way to manage their money.

- Millennials are the most enthusiastic about online banking, with 79.3% interested in it.

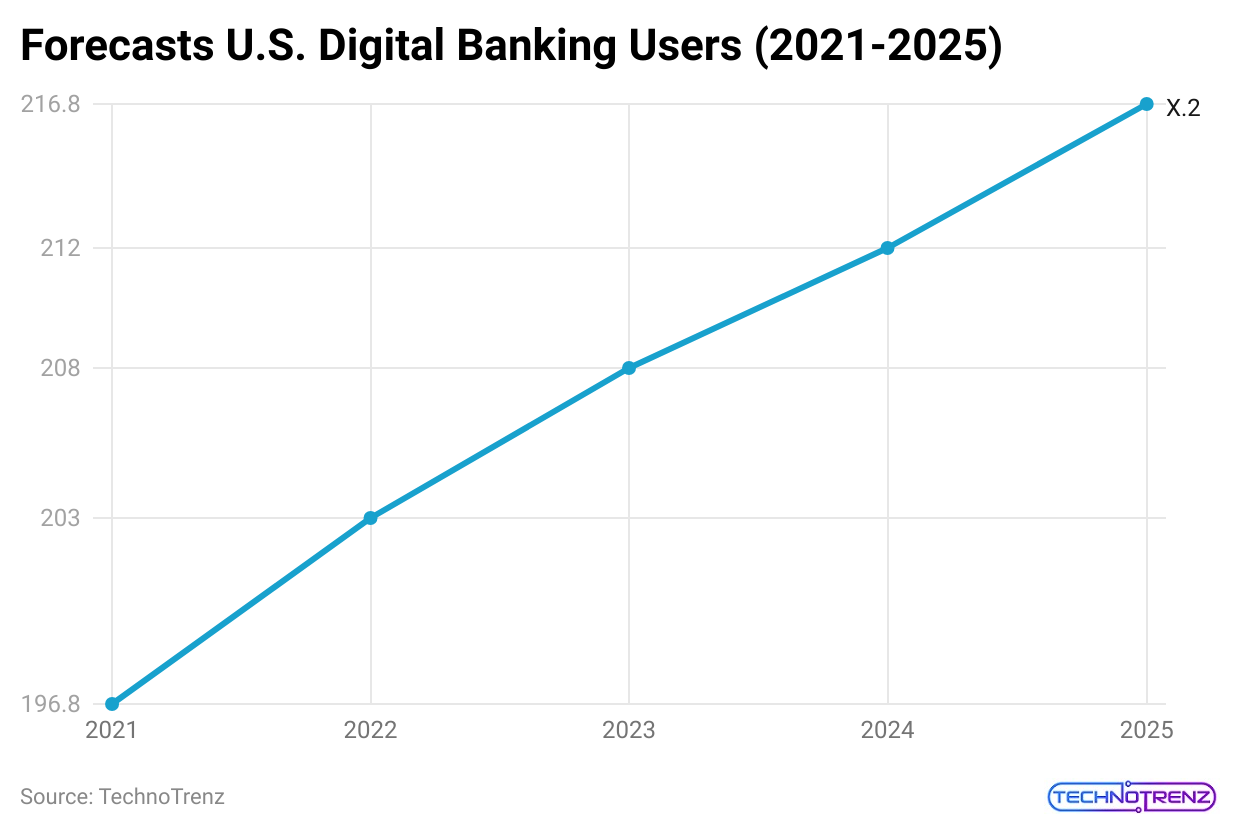

- By 2025, there are expected to be about 216.8 million digital banking users in the US.

- It’s predicted that 3.6 billion people will use online banking worldwide by 2024.

- With the growth of digital and Internet technologies, 91% of Americans feel that access to financial services is now good, very good, or excellent.

- Banks are focusing on two main goals for their future technology plans: 81% aim to improve the customer experience, and 39% want to enhance online and mobile services.

- In 2023, total assets for public-sector banks were $1,686.70 billion, while private-sector banks had $1,016.39 billion in assets.

- Digital banking is very popular in India, with around 295.5 million users, according to Online Banking Usage Statistics.

- In 2021, the US made up 28.78% of the global digital banking market.

- The online banking market in Europe is projected to reach $5.2 billion by 2026.

- Chatbots are expected to save online banks about $7.3 billion.

- By 2026, China’s mobile banking market is forecasted to be worth $4.6 billion.

- The Asia-Pacific mobile banking market is predicted to exceed $615.6 million by 2026.

- Experts predict that mobile payments will grow at a rate of 29% per year from 2020 to 2027, reaching $8.94 trillion.

- The digital banking market in Japan is forecast to grow at an annual rate of 4.5% from 2020 to 2025.

- Online Banking Usage Statistics stated that fraudsters are increasingly taking over accounts, and these takeovers account for 89% of losses from digital fraud.

- India’s digital lending market has grown at an annual rate of 39.5% over the past decade. By 2030, it is expected to exceed $720 billion, making up about 55% of the country’s total $1.3 trillion digital lending market.

- Online Banking Usage Statistics stated that private banks accounted for 22.8% of the fraud amount reported in FY24.

What is Online Banking?

In simple terms, online banking means handling your money using the Internet. Instead of going to a bank branch to do things like deposit money, transfer funds, or pay bills, you can do all these tasks through a secure website or app provided by your bank.

With online banking, you can manage your accounts anytime—whether it’s day or night, even on weekends and holidays. However, depending on what you’re doing and your bank’s operating hours, some transactions, like depositing checks, might take a little time to process.

What Can One Do Through Online Banking?

Online banking services can vary from bank to bank, but generally, you can do nearly everything online that you would do at a physical bank branch. Here are some common tasks you can handle through your bank’s secure website:

- Pay Bills:

With online bill pay, you can manage all (or most) of your bills from one place rather than dealing with separate invoices or statements each month. After you sign up and set up your account, you can add payees, schedule payments, make one-time or recurring payments, and set reminders for due dates. Keep in mind that it might take a few days for your bank to process these transactions.

- Make a Deposit:

If you’ve ever kept a check in your wallet for weeks because you didn’t have time to visit the bank, you’ll appreciate that many banks and credit unions offer online deposit features. To deposit a check online, you generally need to:

- Open your banking app on your phone.

- Sign the back of the check.

- Take photos of the front and back of the check with your phone.

- Choose the account for the deposit and tap submit.

Remember, some banks may take time to verify the check, so your funds might be available later.

- Manage Your Accounts:

Online banking allows you to see up-to-date information about your accounts. You can check your balance, view recent transactions, and track money coming in or going out. This helps you spot any unusual activity and quickly address potential errors or fraud.

- Make Account-to-Account Transfers:

If you have multiple accounts like a checking account, savings account, or a line of credit, you can transfer money between them easily. This is useful if you need to move funds to cover shortfalls or manage your money better, especially if you keep a minimum balance in a low-interest checking account and use a high-interest savings account for larger transfers.

- Check Statements and Account Balances:

With online banking, you can receive electronic statements and check your account balances anytime. You can also see which bills have been paid and whether deposits have been processed. Be aware of the difference between your current balance and your available balance. For example, if you’ve paid $350 in bills and deposited $100 that has yet to be processed, your available balance might show $250 less than your current balance. Always use the available balance to avoid overspending.

- Order Checks:

Many banks and credit unions allow you to order checks and deposit slips online. You can usually see costs and choose from different designs. If there’s a fee, it might be deducted from your checking account when your order is processed.

- Other Services:

Other online services your bank might offer include:

- Ordering a stop payment on a check

- Setting up alerts for fraud or low balances

- Transferring money between banks

- Sending money to others

- Finding an in-network ATM

- Updating your contact details

- Ordering a new debit card

General Online Banking Statistics

- In 2020, nearly 800 million people in the Far East and China used digital banking. By 2024, around 1 billion people in these regions are expected to use digital banking.

- According to 2021 data, India had the highest number of real-time online transactions in the world, with about 48 billion transactions. China, the US, Canada, the UK, France, and Germany followed.

- Using chatbots in customer service can save financial institutions about $7.3 billion in support costs.

(Source: enterpriseappstoday.com)

- In 2001, Bank of America was the first US bank to have over 3 million digital banking users, even though digital banking customers made up only 20% of its total customer base at that time.

- Security First Network Bank, launched in 1995, was the first bank in the US to be fully digital, meaning it had no physical branches. Fully digital banks can offer higher interest rates and lower service costs.

- Even though customer satisfaction with AI-based service could improve, chatbots offer significant savings for digital banking, according to Online Banking Usage Statistics.

- Around 82% of customers say they haven’t switched banks because of their digital banking services. This shows that good digital banking platforms can help banks keep their customers and attract new ones.

- Digital banks typically offer 1% to 2% higher annual percentage yields (APY) compared to traditional banks because they have lower operating costs.

(Reference: enterpriseappstoday.com)

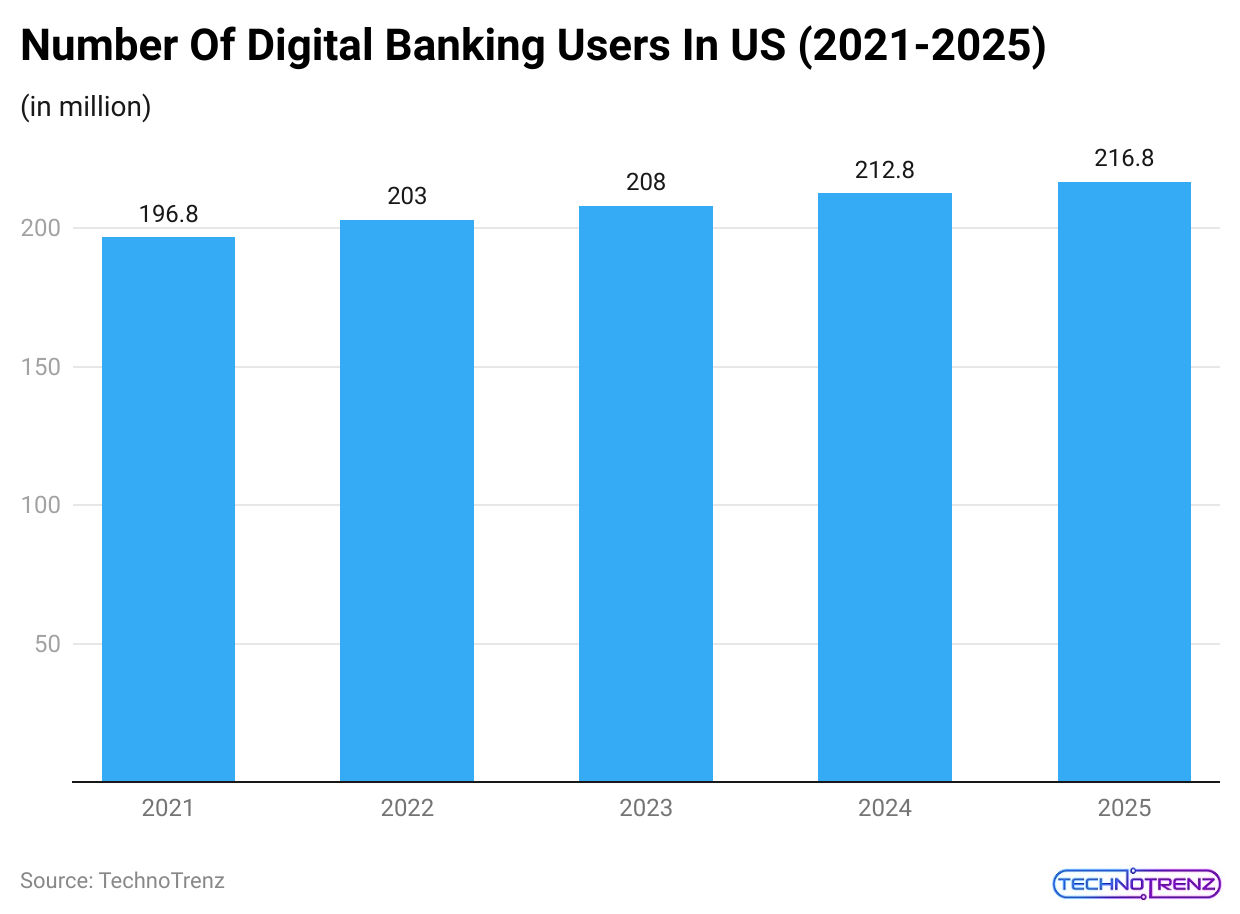

- By 2025, there will be approximately 216.8 million digital banking users in the United States, a steady increase in the number of people adopting digital banking.

- Online Banking Usage Statistics stated that financial institutions started experimenting with digital banking in the 1980s.

- Stanford Federal Credit Union began offering online banking services to its members in 1994.

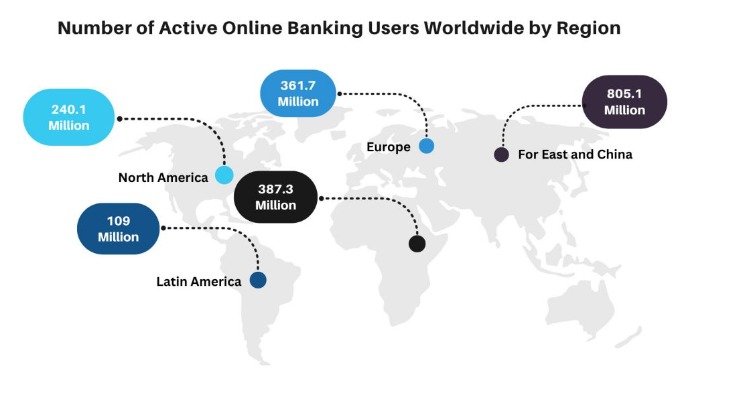

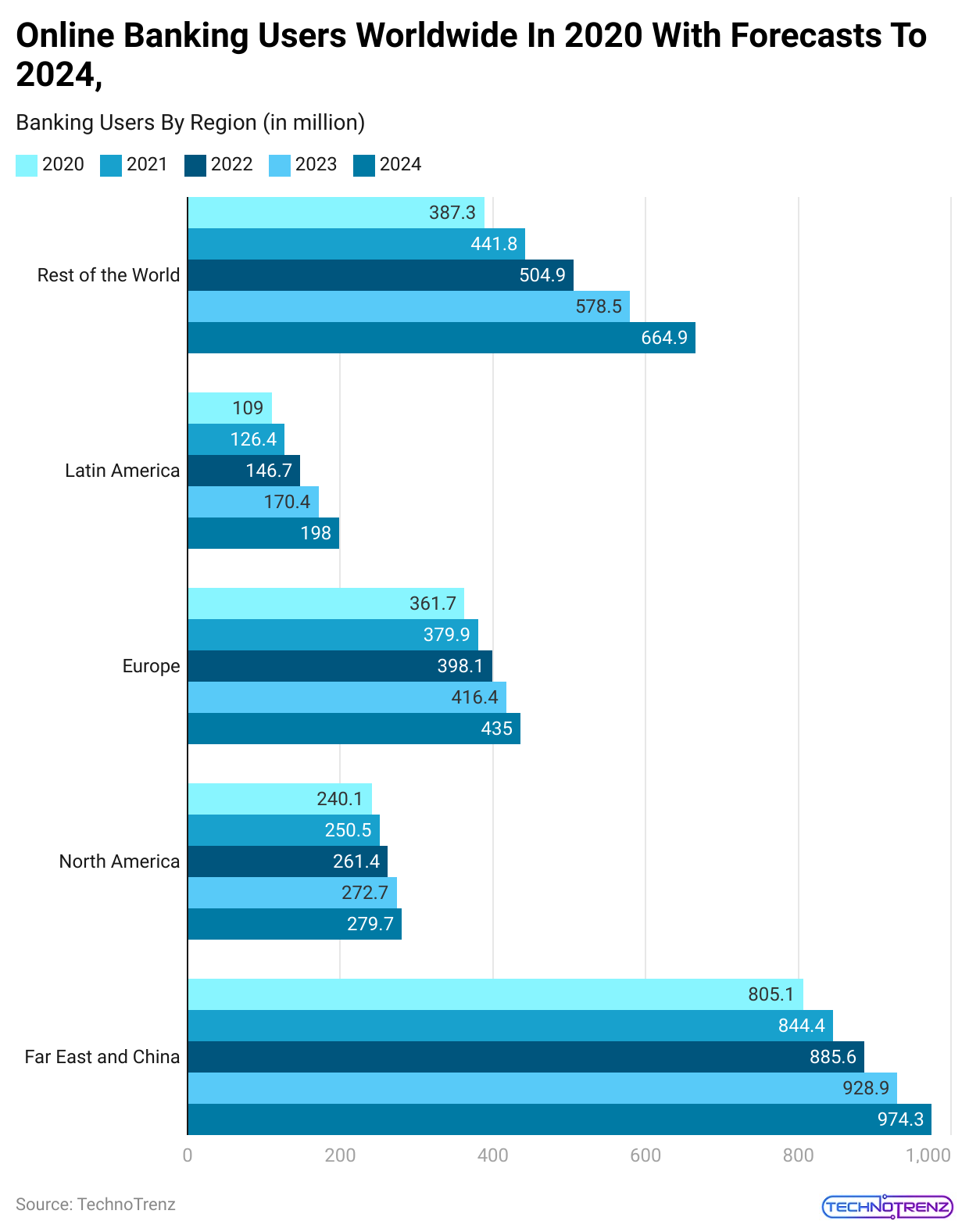

Regional Online Banking Statistics

(Reference: scoop.market.us)

| 2020 (in million) | 2021(in million) | 2022(in million) | 2023(in million) | 2024(in million) | |

| Rest of the World | 387.3 | 441.8 | 504.9 | 578.5 | 664.9 |

| Latin America | 109 | 126.4 | 146.7 | 170.4 | 198 |

| Europe | 361.7 | 379.9 | 398.1 | 416.4 | 435 |

| North America | 240.1 | 250.5 | 261.4 | 272.7 | 279.7 |

| Far East and China | 805.1 | 844.4 | 885.6 | 928.9 | 974.3 |

United Nations

(Reference: scoop.market.us)

- In 2023, about 82% of adults in the US used online banking services.

- In 2020, around 64% of adults in the US used mobile banking services.

- In 2023, 73% of people who used online banking in the US also used online bill payment services.

- The use of peer-to-peer (P2P) payment services among US online banking users rose to 52% in 2020.

- A study by JD Power found that overall satisfaction with online banking in the US increased by 9 points to 869 out of 1,000 in 2023.

- In 2023, there were about 203 million digital banking users in the US, and this number is expected to grow to 216.8 million by 2025, as predicted in Online Banking Usage Statistics.

United Kingdom

- According to a report by the UK’s Office for National Statistics, 91% of adults in the UK had used the Internet in the past three months in 2023, and 85% of adults regularly used online banking.

- A UK Finance study of Online Banking Usage Statistics found that 78% of adults used mobile banking apps, with mobile banking logins occurring more than 7.4 million times each day.

- The 2023 UK Payment Markets report by UK Finance revealed there were over 2.8 billion Faster Payments transactions in the UK, totaling £2.4 trillion.

- UK Finance reported that contactless payments made up 39% of all card transactions in 2024, according to Online Banking Usage Statistics.

- The Open Banking Implementation Entity reported that by 2023, over 440 regulated providers were involved in Open Banking, offering a variety of new financial services.

Europe

- In Europe, about 60% of people used online banking in 2023, according to the European Central Bank’s report on retail payments. (Source: European Central Bank)

- Till 2025, around 46% of Europeans used mobile banking services, based on a study by ING.

- McKinsey estimates that by 2025, digital payments will make up 66% of point-of-sale transactions in Europe.

- Online Banking Usage Statistics stated that the Nordic countries (Sweden, Norway, Denmark, Finland) have high rates of online banking use, with Sweden’s adoption rate of over 80%.

- According to a McKinsey survey, about 70% of Germans use online banking services.

Canada

- According to a 2021 survey by the Canadian Bankers Association, 78% of Canadians use online banking as their main way to manage their finances.

- By 2023, 68% of Canadians regularly used mobile banking.

- The same survey found that 86% of Canadians use online banking to check their account balances, 80% use it to transfer money, and 77% use it to pay bills.

- According to a survey by the Canadian Bankers Association, 92% of Canadians feel their online banking is secure.

- Online banking use varies by age in Canada. According to Online Banking Usage Statistics, as of 2021, 96% of Canadians aged 18-34 use it, while 62% of those aged 65 and older do.

Australia

- According to the Australian Communications and Media Authority (ACMA), as of December 2024, 83% of Australians aged 15 and older used the Internet for banking.

- A survey by Online Banking Usage Statistics found that in 2020, the most frequent online banking activities among Australians were checking account balances (89%), transferring money between accounts (73%), and paying bills (72%).

- According to Online Banking Usage Statistics, the Australian Cyber Security Centre (ACSC) stated a 45% growth in phishing attacks that target mobile and online banking users in Australia in 2023.

- According to the Roy Morgan Digital Payments Report, 72.4% of Australians aged 14 and older used online banking at least once in four weeks as of March 2023.

Traditional vs. Online Banking Statistics

- In 2023, 56% of adults in the UK preferred using digital banking methods over visiting physical branches.

- According to a survey, 86% of people who use online banking said convenience is the main reason they use digital services.

- Mobile banking apps have become very popular, with 63% of smartphone users using them in recent years, according to Online Banking Usage Statistics.

(Reference: scoop.market.us)

- The use of biometric features like fingerprint or facial recognition for online banking has grown, improving security.

- Mobile banking users typically make 8.2 transactions per month, while people who use bank branches make 3.9 transactions per month.

- In 2023, 46% of Americans used mobile banking apps to deposit checks, 44% to pay bills, and 41% to transfer money between accounts.

| Traditional Banking | Digital Banking | |

| Share of consumers’ primary accounts | 65% | 27% |

|

Common savings account interest rates |

0.01% – 0.02% APY | 4.00% – 5.10% APY |

| Services | Primarily branch banking, though some may also offer online accounts |

Primarily online and mobile banking |

|

Advantages |

|

|

| Disadvantages |

|

|

- Online Banking Usage Statistics stated that online banking customers report higher satisfaction than traditional banking customers, with 80% of digital users saying they are happy with their experience.

- As of 2022, about 70% of adults in the US used online banking, while 59% still went to bank branches for their banking needs.

- By 2024, the number of people using digital banking worldwide is expected to reach 3.6 billion.

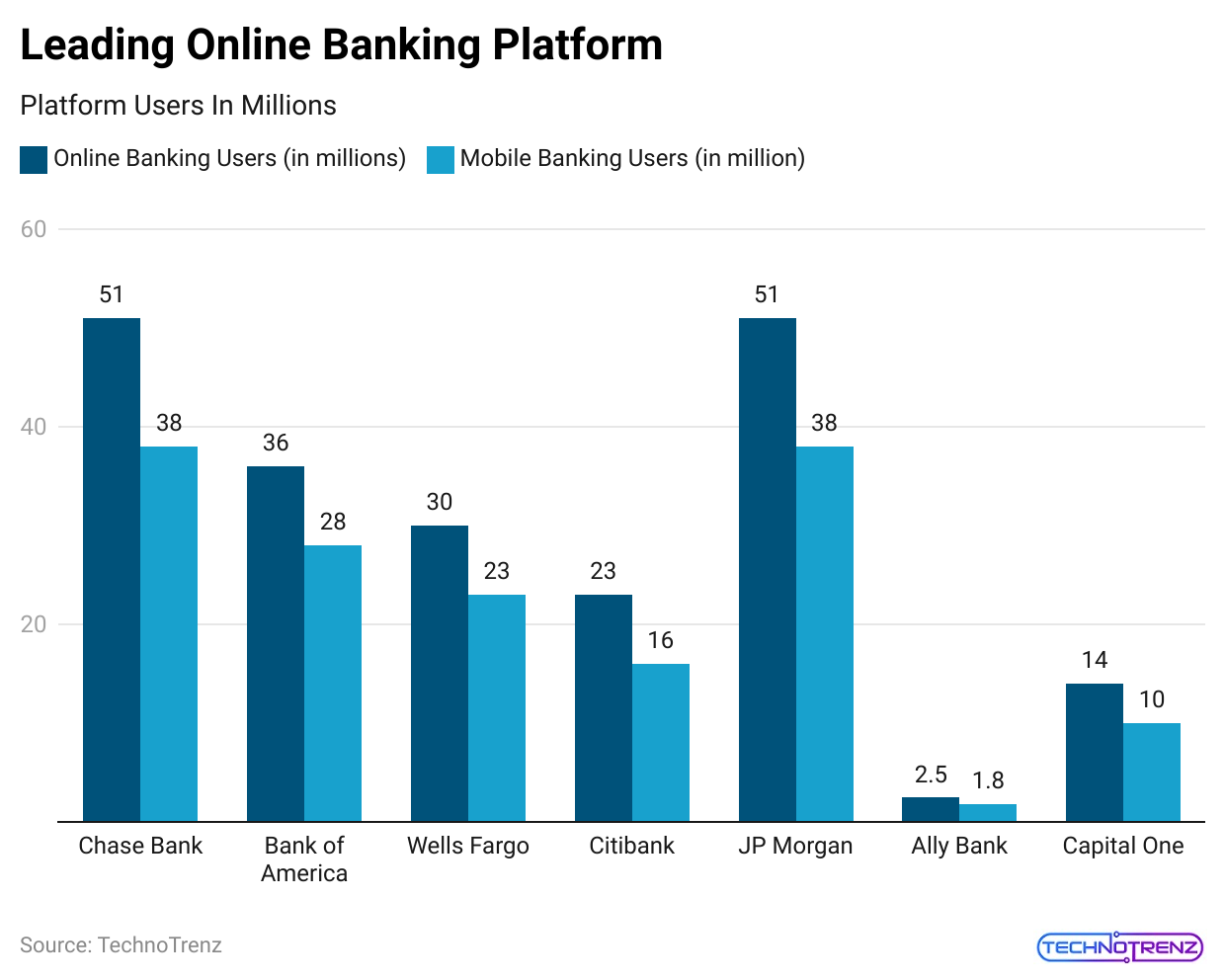

Leading Online Banking Platform

(Reference: scoop.market.us)

| Banks | Online Banking Users (in millions) | Mobile Banking Users (in million) |

| Chase Bank | 51 | 38 |

|

Bank of America |

36 | 28 |

| Wells Fargo | 30 |

23 |

|

Citibank |

23 | 16 |

| JP Morgan | 51 |

38 |

|

Ally Bank |

2.5 | 1.8 |

| Capital One | 14 |

10 |

Online Banking Demographics Statistics

(Reference: scoop.market.us)

(Reference: scoop.market.us)

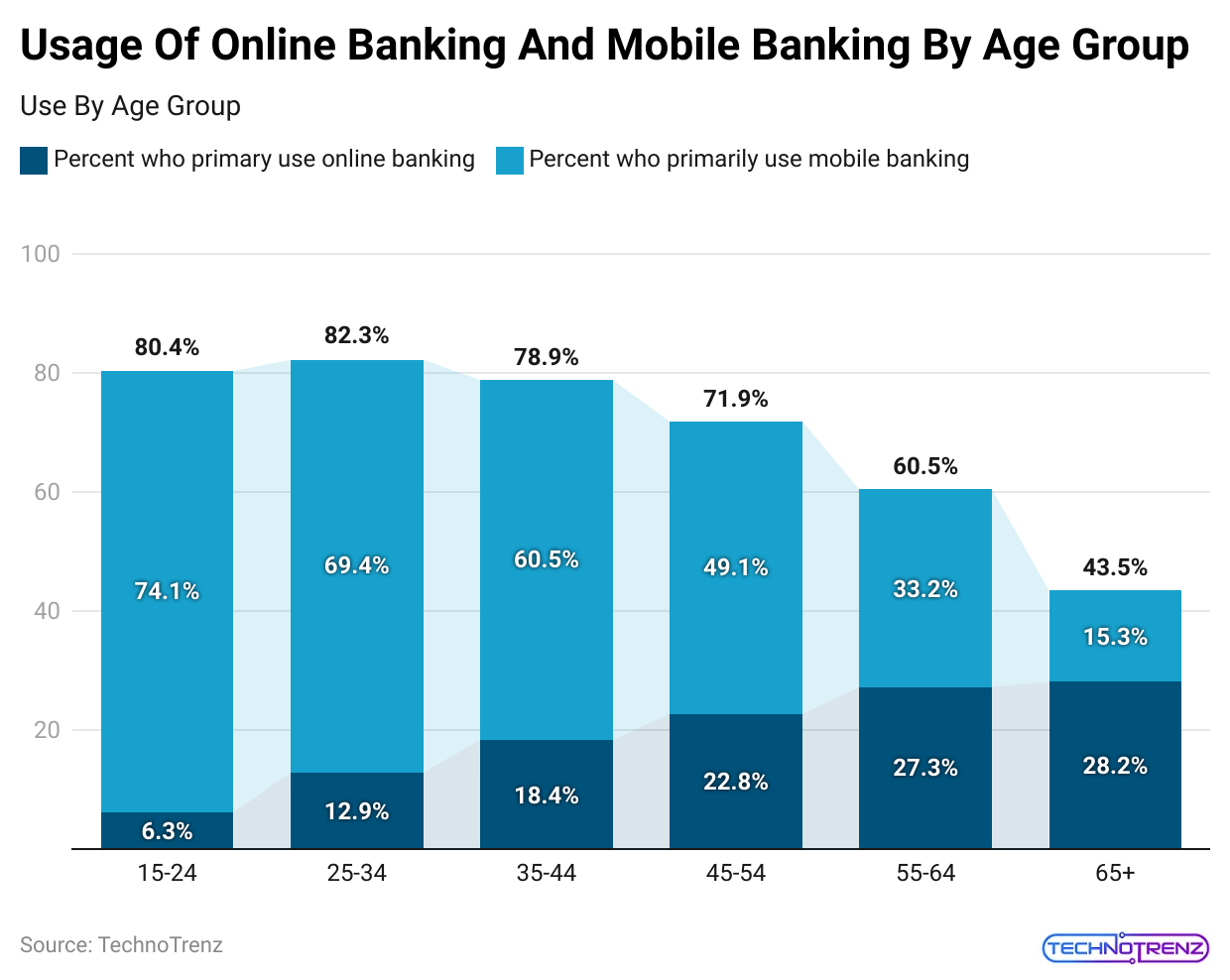

- Ages 15-24: Only 6.3% of people in this age group mainly use online banking, while a large majority, 74.1%, use mobile banking.

- Ages 25-34: About 12.9% of people in this group primarily use online banking, while 69.4% rely mostly on mobile banking.

- Ages 35-44: In this age group, 18.4% mainly use online banking, and 60.5% use mobile banking as their main method.

- Ages 45-54: Here, 22.8% of people primarily use online banking, while 49.1% mostly use mobile banking.

- Ages 55-64: Among these individuals, 27.3% primarily use online banking, and 33.2% use mobile banking as their main choice.

- Ages 65 and older: In this age group, 28.2% primarily use online banking, while 15.3% rely mainly on mobile banking.

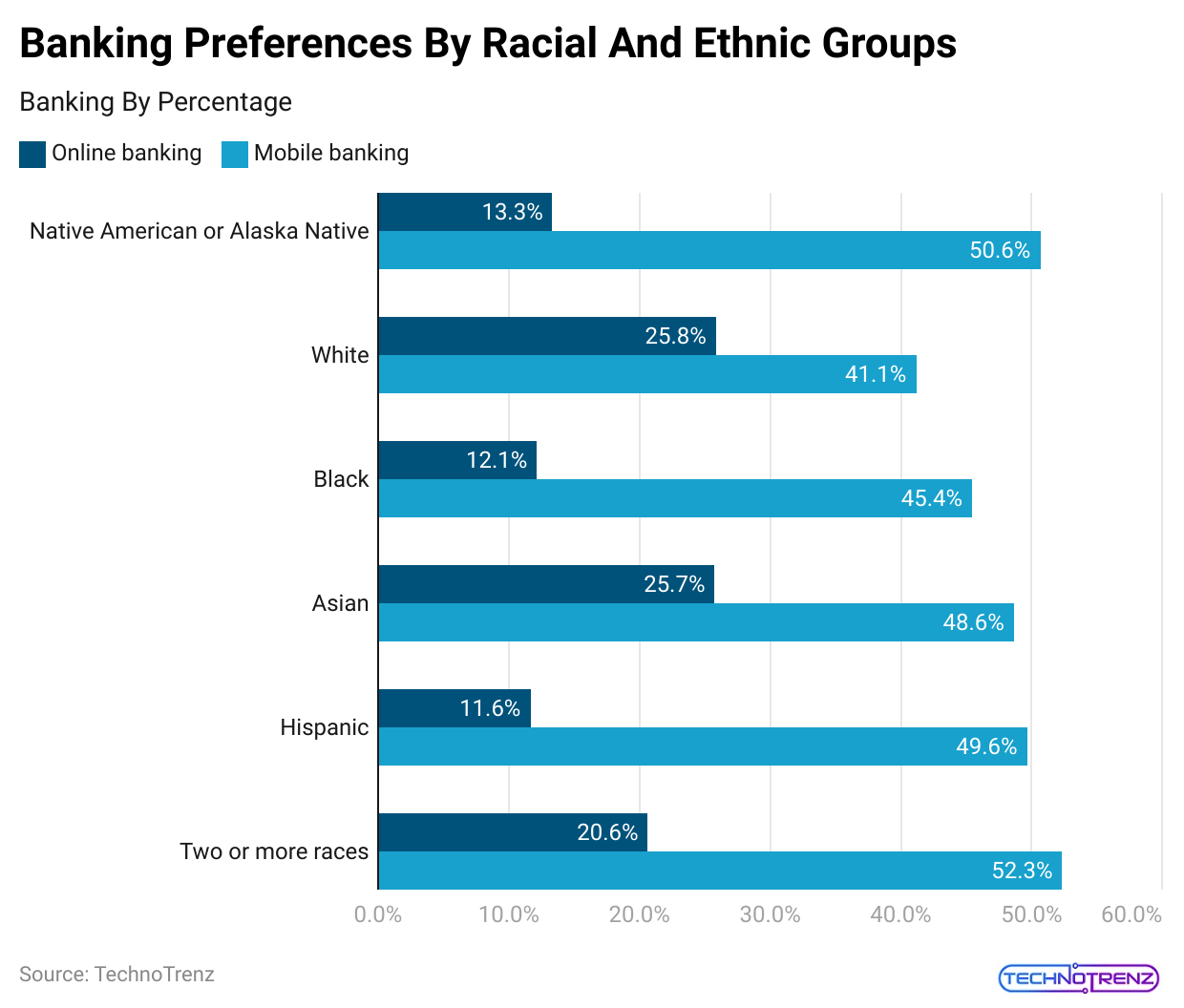

(Reference: scoop.market.us)

- Two or More Races: Among people who identify as belonging to two or more races, 20.6% mainly use online banking, while 52.3% primarily use mobile banking.

- Hispanic: For those identifying as Hispanic, 11.6% primarily use online banking, and 49.6% use mobile banking the most.

- Asian: Among Asians, 25.7% primarily use online banking, while 48.6% mainly use mobile banking.

- Black: In the Black community, 12.1% primarily use online banking, and 45.4% primarily use mobile banking.

- White: According to Online Banking Usage Statistics, 25.8% of White individuals primarily use online banking, while 41.1% mainly use mobile banking.

- Native American or Alaska Native: Among Native American or Alaska Native individuals, 13.3% primarily use online banking, and 50.6% use mobile banking the most.

Customer Preferences For Banking Channels

- 67% of Millennials prefer using online and mobile banking instead of traditional banking.

- 23% of online banking users use online chat for customer support.

- 32% of online banking users check their account balances every day.

- Almost 75% of consumers prefer using digital channels for account questions and resolving issues.

- Roughly 36% of online banking users consider mobile check deposits the most important feature.

- Online Banking Usage Statistics stated that almost 33% of consumers have left a bank or credit union because of a bad digital experience.

(Source: businessinsider.com)

(Source: businessinsider.com)

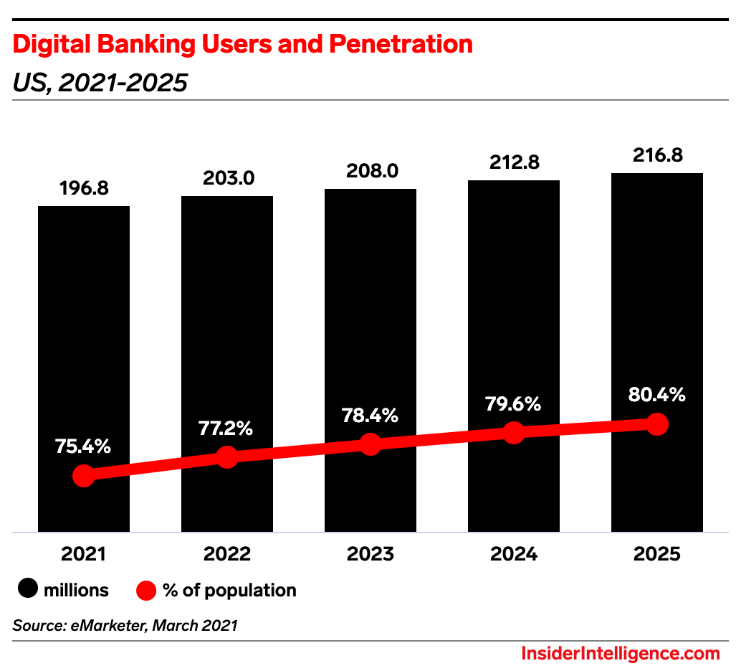

| Year | millions | % of population |

| 2021 | 196.8 |

75.4% |

|

2022 |

203.0 | 77.2% |

| 2023 | 208.0 |

78.4% |

|

2024 |

212.8 | 79.6% |

| 2025 | 216.8 |

80.4% |

- 69% of consumers use online or mobile banking to pay bills.

- Online and mobile banking users are 20-30% more likely to stay with their bank.

- Around 87% of banking customers think they should be able to complete any banking task on a mobile device.

- 55% of Latin Americans using digital banking have yet to make plans to return to traditional banking.

- Nearly 70% of small business owners prefer online banking for its convenience.

- Online Banking Usage Statistics stated that around 72% of online banking users like the ability to pay friends and family digitally.

- 39% of consumers believe the pandemic has increased their use of online banking tools.

- Almost 53% of consumers use online banking to budget and track their spending.

- Online banking use is highest among people aged 25-34, at 67%.

- Nearly 28% of bank customers are open to using biometric authentication for online banking.

- Around 74% of consumers expect a consistent experience across all banking channels—online, mobile, and in-person.

- 49% of online banking users say mobile alerts are their most valued feature.

- Roughly 66% of consumers have used video chat services offered by their bank for support.

- 60% of global consumers prefer to pay using mobile wallets linked to their bank accounts.

Digital Banking Adoption Rate

- In 2023, 72% of adults in the US used online banking.

- Online Banking Usage Statistics stated that almost 54% of Millennials prefer online banking over traditional banking.

- Roughly 70% of internet users in the UK use online banking

- Nearly 18% of US consumers used online-only banks in the past year.

- 64% of US adults used online or mobile banking to check their account balances in the past year.

- Almost 34% of US adults have never used online or mobile banking services.

- 63% of Australians use online banking at least once a month.

- Online Banking Usage Statistics stated that almost 41% of US adults use online banking to pay bills.

- 28% of UK consumers increased their use of digital banking during the COVID-19 pandemic.

- 70% of adults in India accessed online banking in 2023.

- 37% of US consumers used online banking more often in 2023 compared to the previous year.

- 26% of Japanese adults perform online banking activities every day, as stated in Online Banking Usage Statistics.

- 65% of adults in Singapore use digital banking services at least once a week.

- Nearly 38% of Mexican consumers use online banking to manage their budgets.

- Roughly 76% of Swedish adults use online banking for transfers and payments.

- 31% of Dutch consumers have made international money transfers through online banking.

- Online Banking Usage Statistics stated that around 49% of Russian adults use online banking for investments and savings.

Online vs Mobile Banking Statistics

- Globally, 73% of people use online banking channels at least once a month, while 59% use mobile banking apps as often.

- About 70% of customers want consistent online and mobile banking services when choosing a bank.

- According to Online Banking Usage Statistics, 94% of people who use mobile banking also access online banking through a PC at least once a month.

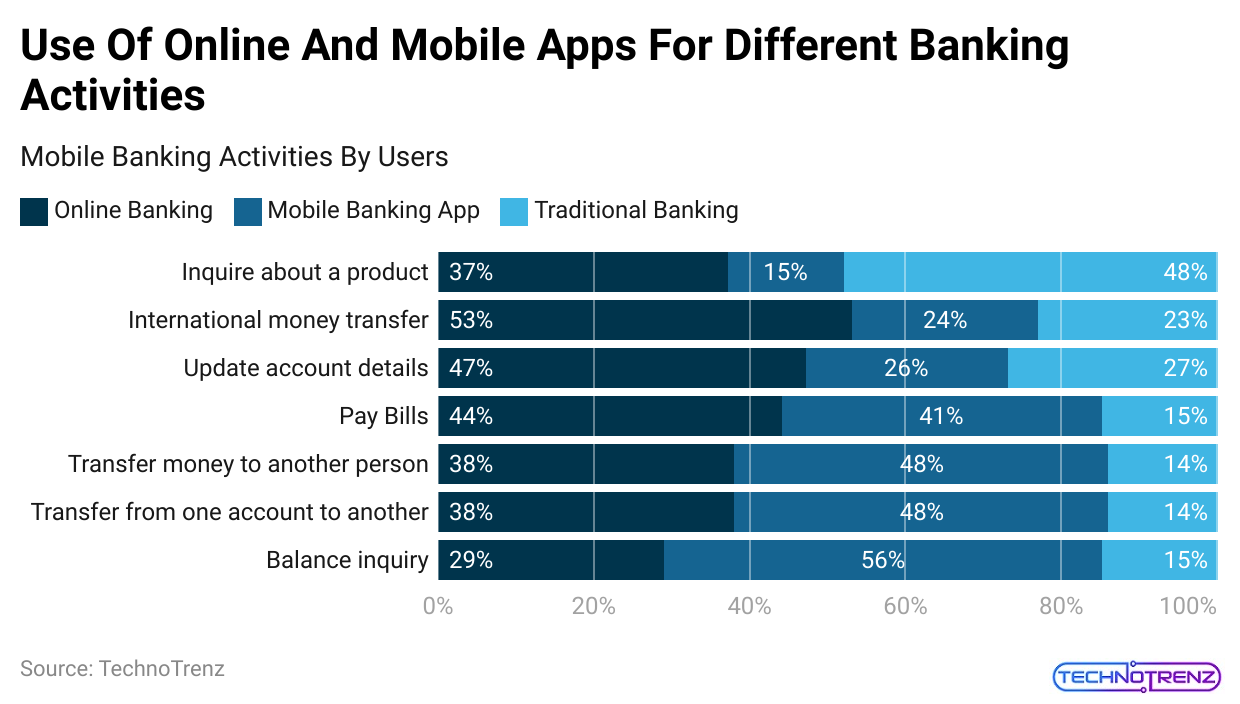

- Most people check their account balances using either mobile (56%) or desktop (29%) banking platforms.

- 48% of account holders use mobile banking to transfer funds between their accounts or to others, while 38% prefer using desktop online banking. Only 14% use other methods, like in-branch banking.

- 24% of account holders prefer to make international transfers using a smartphone, while 53% choose to use a laptop or desktop computer.

- 26% of users update their account details via smartphone banking apps, while 47% prefer doing this on a desktop computer.

- Online Banking Usage Statistics stated that almost 41% of account holders use mobile apps to pay their bills and 44% use online banking for bill payments.

- Only 15% of users inquire about banking products (like loans or credit cards) through mobile banking apps. 37% use online banking for these questions, but many still prefer to visit a bank branch for this information.

- Digital banking statistics forecast that by 2024, there will be over 3.6 billion users of online and mobile banking.

- Additionally, a recent study on consumer banking trends suggests that using chatbots will help banks save $7.3 billion a year on customer service costs by 2023.

Online Banking Fraud Statistics

- In the financial year 2023-24 (FY24), the number of fraud cases in the banking sector surged by nearly 300%, reaching 36,075 cases.

- However, the total amount involved in these fraud cases dropped significantly to ₹13,930 crore ($1.7 billion) in FY24, down from ₹45,358 crore ($5.5 billion) in FY22.

- According to the Reserve Bank of India’s annual report, 67% of the fraud cases reported in FY24 came from private sector banks, while public sector banks reported 75% of the total fraud amount.

- Online Banking Usage Statistics stated that private banks accounted for 22.8% of the fraud amount reported in FY24.

- The annual report shows a big increase in online fraud cases over the past two years.

- According to the report, online fraud cases surged by 708%, reaching 29,082 incidents. This rise in fraud cases matches an increase in the amount of money lost through Internet banking and card fraud.

- Over these two years, the amount of money stolen online jumped by 145% to ₹1,457 crore.

- This growing problem emphasizes the need for the central bank to improve regulations in this area as per Online Banking Usage Statistics.

- While many fraud cases were reported involving the Internet and cards, the largest amounts of money lost were related to loans.

- Public-sector banks reported more fraud in loan portfolios than private banks. Of the total fraud amount of ₹13,930 crore reported in FY24, 84% came from loans.

Generational Attitudes on Mobile Banking

Millennials:

- 58% use finance-related mobile apps at least once a day.

- This increases to 85% if you look at those who use them at least once a week. 63% have three or more finance-related apps on their phones, and 15% have six or more.

Baby Boomers:

- 23% never use mobile apps for financial tasks, compared to 9% of people overall.

- One-third do not have any finance-related apps on their phones.

Gen X:

- 43% use finance-related mobile apps at least once a day. Almost half (49%) have three or more finance-related apps on their phones.

Gen Z:

- 48% use mobile apps for financial tasks at least once a day, which is slightly less than 58% of Millennials.

- Most Gen Z respondents (47%) have 1-2 finance-related apps on their phones, while 39% have 3-5 apps, and 10% have six or more.

Top Features Desired in Financial Apps:

Gen Z:

- 31% want to connect external financial accounts to view all their data in one place.

- 25% prefer integration with digital wallets like Apple Pay or Google Pay.

- 22% want to order a personalized card.

- 20% would like instantly issued virtual cards.

- 19% want to enroll in paperless account statements.

Millennials:

- 32% want to order a personalized card.

- 31% prefer integration with digital wallets like Apple Pay or Google Pay.

- 27% want to connect external financial accounts to view all their data in one place.

- 24% would like instantly issued virtual cards.

- 23% want to open new accounts online.

Gen X:

- 41% want to order a personalized card.

- 29% prefer opening new accounts online.

- 29% would like instantly issued virtual cards.

- 25% want integration with digital wallets like Apple Pay or Google Pay.

- 25% want to connect external financial accounts to see all their data in one place.

Baby Boomers:

- 45% want integration with digital wallets like Apple Pay or Google Pay.

- 45% prefer instantly issued virtual cards.

- 36% want to connect external financial accounts to see all their data in one place.

- 32% want to order a personalized card.

- 25% would like to open new accounts online.

Digital Banking Market Growth Projection

- Online Banking Usage Statistics stated that the digital banking market is expected to reach $22.3 trillion by 2026.

- By 2025, around 3.6 billion people worldwide are predicted to use digital banking.

- The digital banking software market is projected to hit $18.6 billion by 2027.

- By 2025, 68% of transactions in the US are expected to be done through digital banking platforms.

- The digital banking industry in the Middle East and Africa is forecast to grow at an annual rate of 9.5% from 2020 to 2026.

- By 2024, 34% of payments in the global banking sector are predicted to be made through real-time payment systems.

- The digital banking market in North America is expected to grow at an annual rate of 16.4% from 2020 to 2027.

- Digital banking use in the Middle East is projected to increase by 11% each year through 2025.

- The digital banking market in Japan is forecast to grow at an annual rate of 4.5% from 2020 to 2025.

- By 2024, 70% of people in Europe are expected to use digital banking platforms actively.

- The global digital banking market is expected to reach $22.8 trillion by 2028.

- The digital banking market in the Middle East is projected to grow at an annual rate of 20% from 2020 to 2025.

- Online Banking Usage Statistics stated that the digital banking platform market is expected to reach $19.7 billion by 2026.

- According to Online Banking Usage Statistics, there will be 1.2 billion digital banking users in the Asia-Pacific region by 2025.

- Digital banking transactions in Canada are expected to rise by 45% by 2023.

- The digital banking platform market in Europe is estimated to grow at an annual rate of 22.4% by 2024.

Banking Sector in India

- The Indian banking system includes 12 public-sector banks, 21 private-sector banks, 44 foreign banks, and 12 small finance banks.

- In the first four months of FY23, banks added 2,796 ATMs, compared to 1,486 in FY22 and 2,815 in FY21.

- Online Banking Usage Statistics stated that all new bank accounts in rural India are now opened digitally.

- BCG expects digital payments to make up 65% of transactions by 2026.

- In 2023, total assets for public-sector banks were $1,686.70 billion, while private-sector banks had $1,016.39 billion in assets.

(Source: niyogin.com)

- Public sector banks held 58.31% of the total banking assets, including those of public, private, and foreign banks, as stated in Online Banking Usage Statistics.

- In 2023, public-sector banks earned $102.4 billion in interest income, while private-sector banks earned $70 billion.

- India’s digital lending market has grown at an annual rate of 39.5% over the past decade. By 2030, it is expected to exceed $720 billion, making up about 55% of the country’s total $1.3 trillion digital lending market.

- Bank deposits in India have seen significant growth.

- According to the RBI, total deposits of all scheduled banks increased by ₹2.04 lakh crore ($2,452 billion) by FY24. As of May 3, 2024, bank deposits were ₹209.36 trillion ($2,507.62 billion).

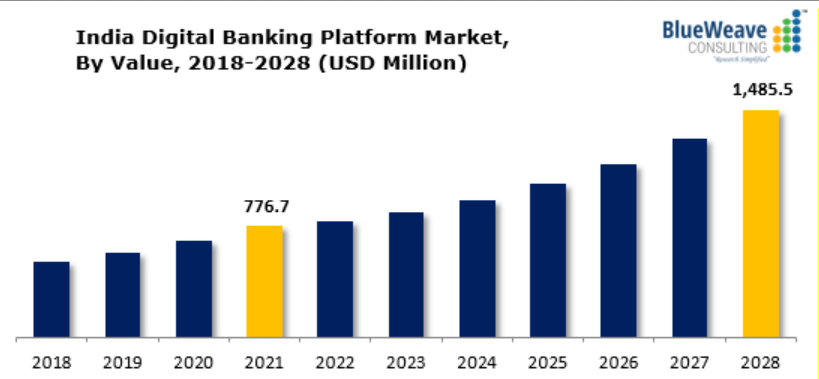

- Digital banking in India is expected to grow at a rate of 23.1% per year from 2022 to 2030.

- According to Online Banking Usage Statistics, Non-Banking Financial Companies (NBFCs) are also predicted to reach $5 trillion by 2024.

- Before COVID-19, e-banking was an extra service, but the pandemic changed the global view on internet banking.

- Indian banks have seen impressive growth by adopting digital technologies. They aim to build stronger relationships with customers to enhance their banking services.

Conclusion

Online banking is changing how we manage our money by offering great convenience and efficiency. With millions of users around the world, online banking applications are becoming essential for handling finances. The Online Banking Usage Statistics in this blog show how quickly mobile banking is growing and becoming popular. Applications like Chase Mobile and Alipay are leading the way, highlighting the shift towards entirely online banking.

As technology keeps improving, mobile banking will become even more embedded in our daily routines, making it easier than ever to manage our finances.

Sources

FAQ.

The number of people using online banking in the US grew significantly from 2019 to 2023. Statista reports that by 2023, more than 66% of Americans were using online banking. They expect this number to keep rising and reach over 79% by 2029.

Digital banking is more popular with younger generations, but all age groups favour it. According to the American Bankers Association (ABA), about 74% of millennials prefer digital banking, the highest percentage among any generation.

The number of people using online banking in the US increased a lot from 2019 to 2023. According to Statista, by 2023, more than 66% of Americans used online banking. Statista predicts this number will keep growing and could reach over 79% by 2029.

Online banking allows us to access our bank accounts electronically from any device at any time. Through online banking, you can quickly check your account balance, review transaction history, transfer money between accounts, pay bills, deposit checks, and more.

Online banking offers several benefits compared to traditional banking. It’s more convenient and saves time. It often provides better rates and features, and it has improved security. Additional features include automated payments, notifications, and tools for budgeting and saving.

Saisuman is a professional content writer specializing in health, law, and space-related articles. Her experience includes designing featured articles for websites and newsletters, as well as conducting detailed research for medical professionals and researchers. Passionate about languages since childhood, Saisuman can read, write, and speak in five different languages. Her love for languages and reading inspired her to pursue a career in writing. Saisuman holds a Master's in Business Administration with a focus on Human Resources and has worked in a Human Resources firm for a year. She was previously associated with a French international company. In addition to writing, Saisuman enjoys traveling and singing classical songs in her leisure time.