SaaS Statistics By Importance, Growth, Market Projection, Region And Future Trends

Updated · Aug 29, 2024

WHAT WE HAVE ON THIS PAGE

- Introduction

- Editor’s Choice

- What is SaaS?

- Importance of SaaS Adoption

- SaaS Market Growth

- Number of SaaS Unicorns

- Effect Of The COVID-19 Pandemic On The SaaS Industry

- Adoption Of SaaS

- Average Number of SaaS Applications Per Company In 2024

- Top SaaS Applications By Category

- SaaS Market Projection 2026 to 2030

- SaaS Companies Across The World Statistics

- Pricing Model Differences and Trends

- SaaS and Product Development Statistics

- SaaS Security, Risk, and Compliance Statistics

- Regional SaaS Statistics

- Future Trends in 2024

- Conclusion

Introduction

SaaS Statistics: The software industry is on the brink of a big change because of the fast growth of cloud-based Software as a Service (SaaS) solutions. With SaaS, users can access full-featured software applications over the Internet instead of having them installed on their computers. This new way of delivering Software makes it easier to access, keeps it up-to-date automatically, is more flexible, and saves money, leading to a rapid increase in its use by businesses of all sizes.

Let’s look at the SaaS Statistics and trends driving the growth of SaaS and how this shift is changing business operations, affecting everything from productivity to profitability.

Editor’s Choice

- The Human Capital Management (HCM) SaaS market is projected to reach $38.17 billion by 2027.

- The Project and Portfolio Management (PPM) SaaS market is forecasted to reach $9.96 billion by 2026.

- The global SaaS market was worth $257.47 billion in 2022. It is expected to grow at an annual rate of 19.7% and reach $1.3 trillion by 2030.

- SaaS generated $167 billion in revenue in 2022, which was about two-thirds of all revenue from public cloud services.

- The US SaaS market is predicted to grow from $108 billion now to $225 billion by 2025.

- The SaaS market in the Asia Pacific region is expected to grow at a rate of 16.1%, with China and India leading this growth.

- SaaS Statistics stated that public SaaS companies had a median growth rate of 22% in 2023, while private SaaS companies grew at a rate of 35%.

- Spending on public cloud services is expected to exceed 45% of total IT spending by 2026, compared to 17% in 2021.

- The SaaS market for manufacturing is forecast to go beyond $19 billion by 2026.

- The medical SaaS industry was valued at $12.5 billion in 2021 and is projected to grow at an annual rate of 19.5% through 2027.

- The CRM SaaS industry is expected to grow at a rate of 13.43% per year from 2022 to 2027, reaching $59.4 billion.

- The EdTech SaaS market is expected to grow at a rate of 19.1% per year from 2021 to 2028.

- The average spending on SaaS per employee is projected to be $9,600 by the end of 2023.

- On average, each employee uses 36 cloud-based apps in their daily work.

- Customer Relationship Management (CRM) is the biggest and fastest-growing area in SaaS.

- The global CRM market is expected to reach $157.6 billion by 2030, as per SaaS Statistics.

- The Enterprise Resource Planning (ERP) SaaS market is predicted to hit $97.15 billion by 2026.

What is SaaS?

Software as a Service (SaaS) lets users access and use apps through the Internet. Common examples include email, calendar, and office tools like Microsoft Office 365.

With SaaS, you buy a complete software solution from a cloud service provider on a pay-as-you-go basis. You rent the Software for your organization, and your users can access it online, usually via a web browser. The service provider takes care of everything: the hardware, Software, and data are all stored in their data center. They handle the maintenance, security, and availability of the app and your data. SaaS allows your organization to start using an app quickly with minimal upfront costs.

Importance of SaaS Adoption

Aside from the obvious ease of use of SaaS solutions, businesses adopting SaaS products and services gain extra benefits that drive digital change.

- Boosted Productivity

SaaS combines different productivity tools onto single cloud platforms that can be accessed from any device, anywhere. This speeds up communication, information sharing, and teamwork between colleagues, teams, and departments. Real-time syncing also reduces repetitive tasks. Employees save time that was previously wasted on manual data transfers and other routine tasks.

- Better Flexibility

SaaS’s pay-as-you-go pricing, along with quick setup and easy scaling, helps businesses take advantage of new opportunities quickly. Leaders can start new projects after a short procurement process or large upfront costs for hardware or Software. Faster deployments mean businesses can get new solutions to customers more quickly.

- Advanced Security

Top SaaS providers invest in the latest security tools and protocols, which are often more advanced than older on-premises systems. Features like multi-factor authentication, data encryption, and regular updates help protect data and systems across the entire SaaS platform.

- Increased Efficiency

SaaS automation, backups, and third-party integrations streamline business processes by connecting previously separate systems and data sources. Information moves smoothly between departments without manual transfers, and machine learning helps improve decision-making with valuable insights.

- Long-Term Competitive Advantage

SaaS’s flexible design allows businesses to stay ahead with quick feature updates. Advanced features like predictive analytics and custom reporting enhance organizational capabilities and keep businesses ahead of competitors with outdated systems. New features are added smoothly without lengthy planning.

Overall, the many benefits of SaaS solutions make them crucial for businesses looking to advance. Companies that adopt SaaS early will likely maintain a leadership position in the market for a long time.

SaaS Market Growth

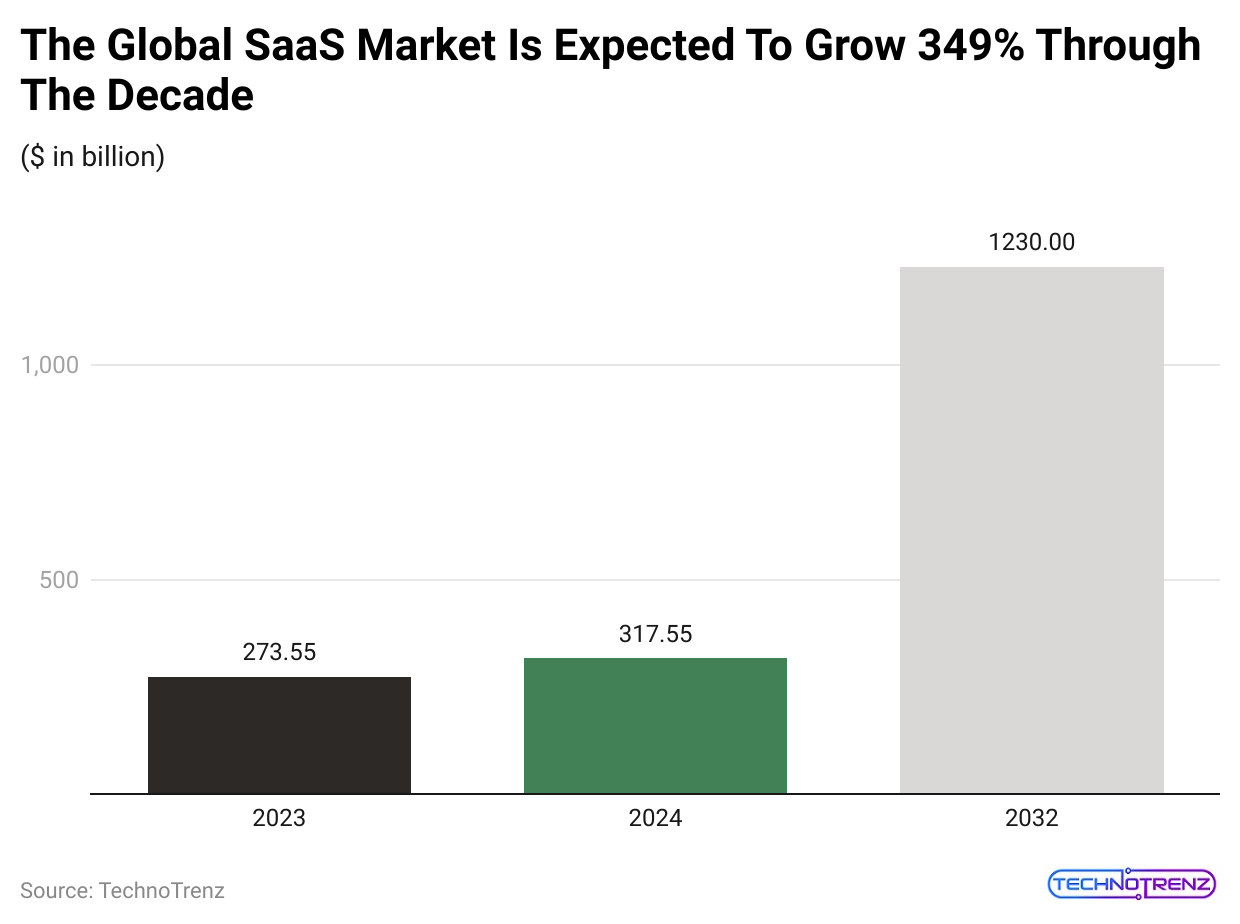

- The global SaaS market is expected to grow by 349% over the next decade.

- In 2023, North America held 48% of the global SaaS market share, worth $131.18 billion.

- SaaS Statistics stated that Software makes up over 84% of the SaaS market compared to services.

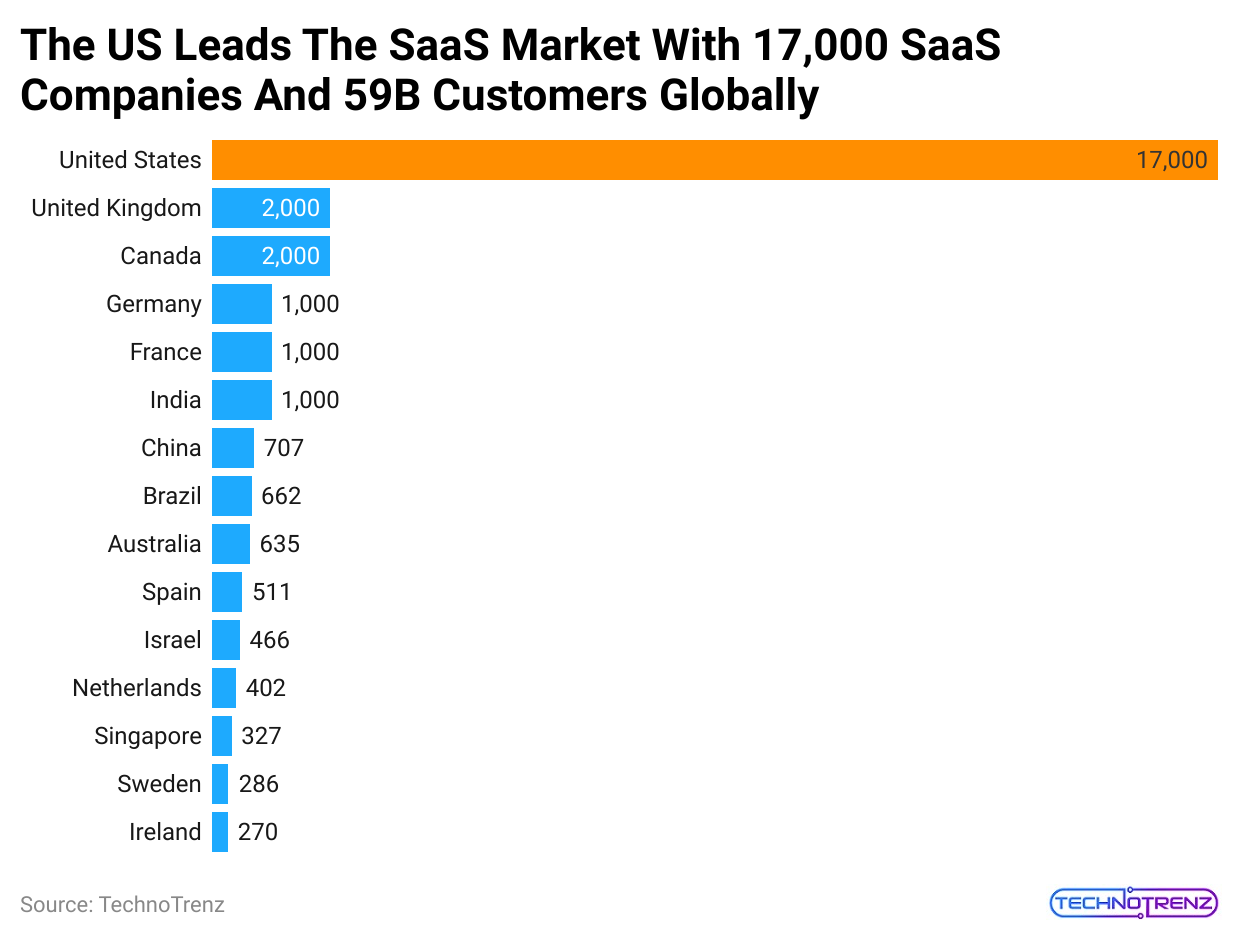

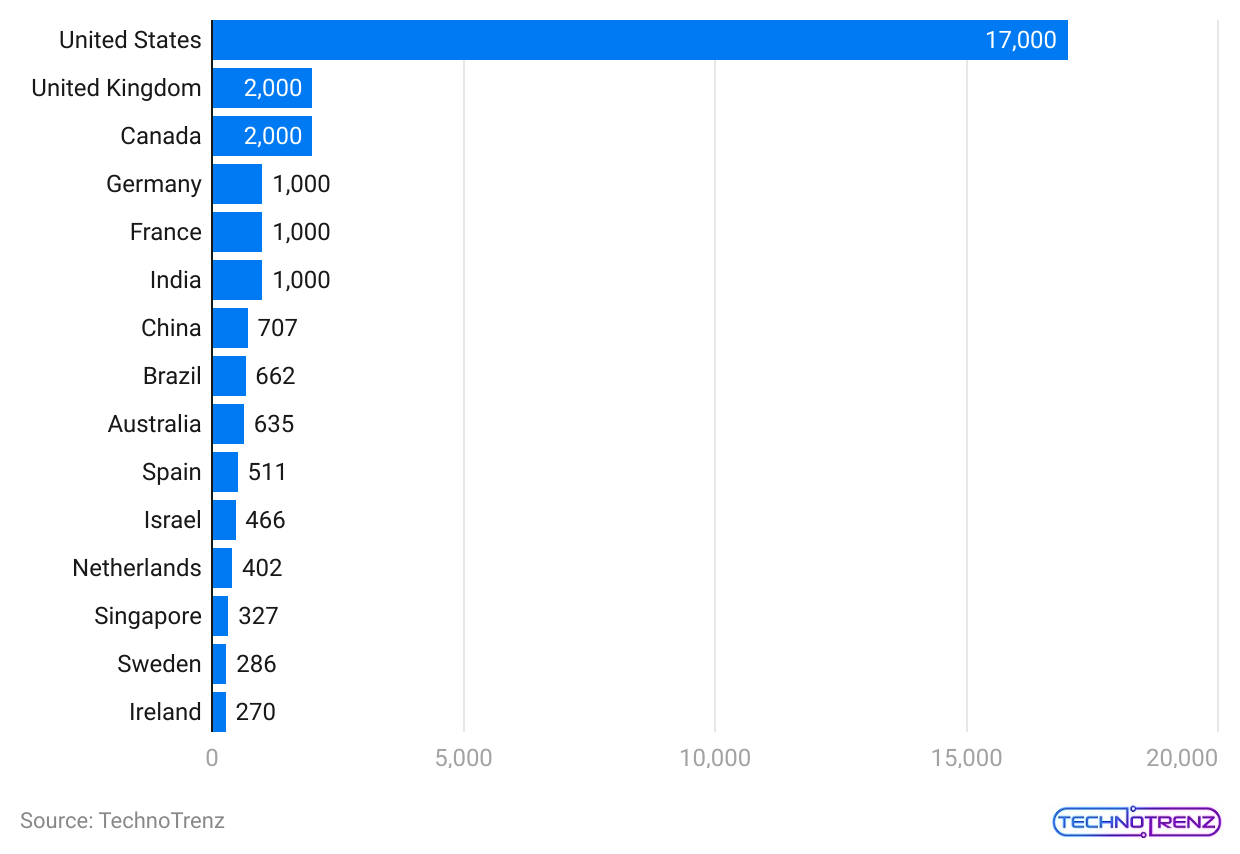

- The US leads the world in SaaS market share, with more than 17,000 companies.

- Microsoft is one of the biggest SaaS companies globally, with a market value of $2.3 trillion as of 2023.

- The global SaaS market is expected to grow at an annual rate of 18.4% from 2024 to 2032.

- The Asia Pacific region is predicted to be the fastest-growing for SaaS, with an annual growth rate of 22%.

(Reference: venasolutions.com)

- By 2028, it is expected that over 50% of enterprise businesses will use industry cloud platforms.

- A 2024 survey found that 60% of businesses plan to spend more on Software this year.

- As of October 2023, the average growth rate for public SaaS companies is 35%.

- Equity-backed SaaS companies have a median growth rate of 35% as of October 2023, while bootstrapped companies report a 32% median growth rate.

- B2B private SaaS companies with annual recurring revenue (ARR) under $1 million have the highest median growth rate at 50% as of October 2023.

- As of October 2023, the biggest B2B private SaaS organizations with ARRs of almost $20 million had the lowest growth rate, at 27%.

- Private SaaS funding in Europe is growing 3.2 times faster each year, as per SaaS Statistics.

- In 2024, there were about 9,100 SaaS companies in the US, serving around 15 billion customers worldwide.

(Reference: statista.com)

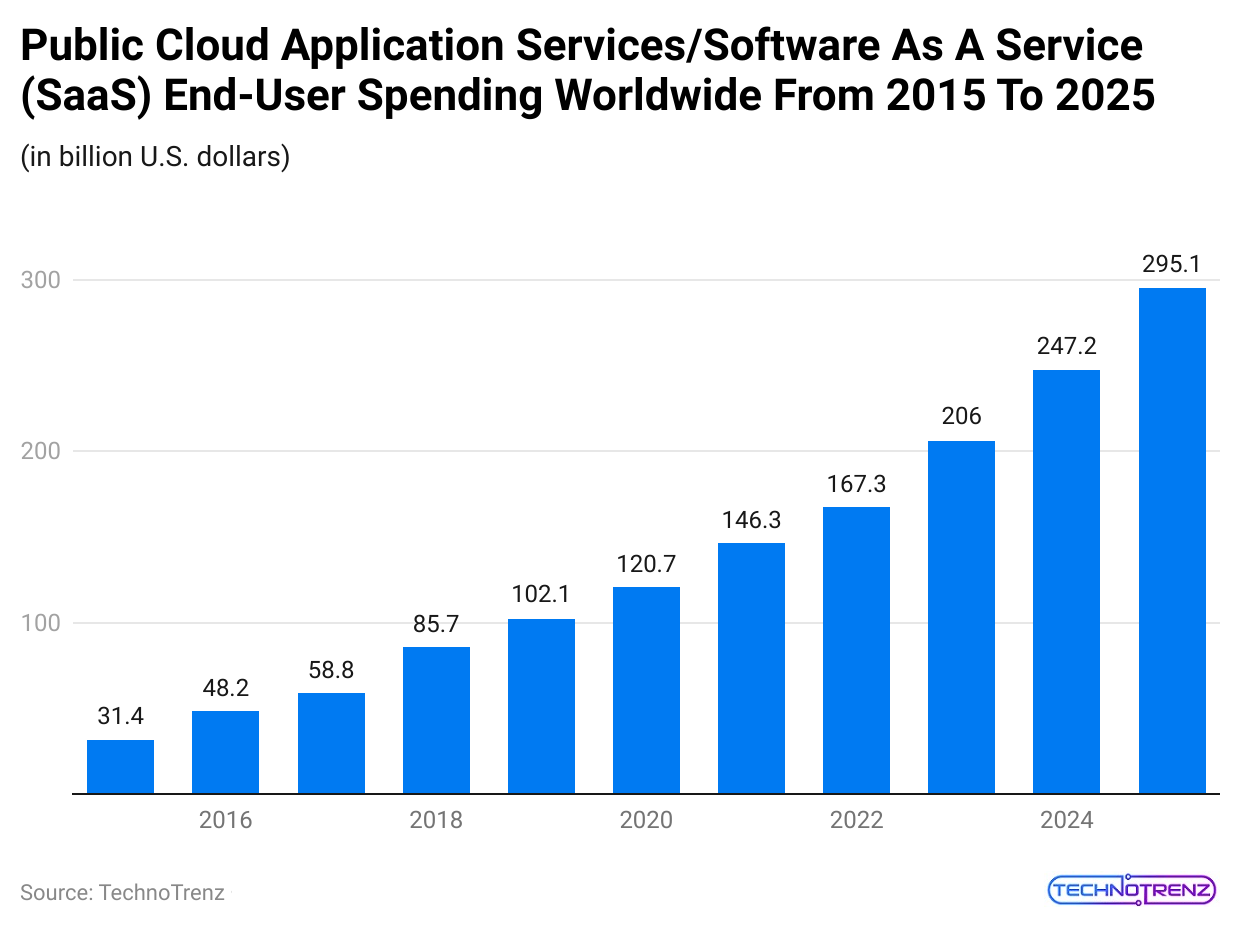

- The Software as a Service (SaaS) market is estimated to be worth about USD 197 billion in 2023 and is expected to grow to USD 247 billion by 2024.

- SaaS apps run in the cloud and are usually accessible via desktops, mobile apps, and web browsers.

- The top four countries with the most SaaS companies are the United Kingdom (1,500), Canada (992), Germany (840), and India (711).

- The SaaS markets in China, India, and Brazil are expected to grow more than twice their current size from 2020 to 2025.

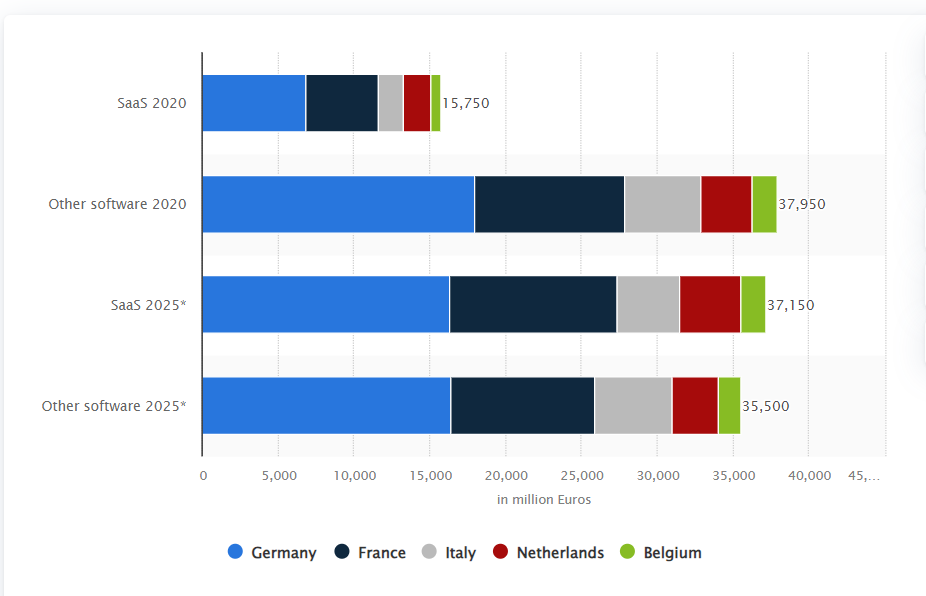

- SaaS Statistics stated that Germany’s SaaS market is predicted to grow the most, from €6.85 billion to €16.3 billion by 2025.

- In 2021, the US had over 337 SaaS unicorns (companies valued at $1 billion or more) and 15 decacorns (companies worth over USD 10 billion).

- On G2’s “Best Software Products 2023” list, the top three SaaS apps are Zendesk, Freshping by Freshworks, and HubSpot Marketing Hub.

- For every $1 million spent on customer acquisition costs (CAC), an additional $100,000 in monthly recurring revenue (MRR) is generated, showing a good return on MRR for sales and marketing spending.

- A report from SaaS Statistics, based on over 750 responses, shows that:

- 96% of SaaS-powered workplaces use apps that are entirely SaaS-based.

- SaaS Statistics stated that almost 49% of transitional workplaces use mostly SaaS apps.

- 13% of traditional workplaces use SaaS apps.

- SaaS companies with annual revenues over $1 million saw a slight boost in growth during the first quarter of this year.

Number of SaaS Unicorns

- The Software as a Service (SaaS) industry has recently seen a big rise in the number of unicorns—companies valued at $1 billion or more.

- Currently, more than 150 B2B SaaS companies have reached unicorn status, and this number is expected to grow as more businesses start using SaaS solutions.

- As of 2024, the global B2B SaaS industry has over 337 unicorn companies.

- The industry includes several well-known companies, and below are some quick facts about a few of them.

| Company | Locations | Employees | Valuation |

| Robinhood | Menlo Park, California | Over 1,000 |

$11.2 billion |

|

UiPath |

New York City, New York | Over 2,500 | $10 billion |

| Stripe | San Francisco, California | Over 2,800 |

$95 billion |

|

Zoom |

San Jose, California | Over 3,500 | $35 billion |

| Slack | San Francisco, California | Over 2,800 |

$15 billion |

|

DocuSign |

San Francisco, California | Over 3,000 | $6 billion |

| PagerDuty | San Francisco, California | Over 800 |

$2 billion |

|

Datadog |

New York City, New York | Over 2,000 | $15 billion |

| HubSpot | Cambridge, Massachusetts | Over 3,000 |

$5 billion |

|

CrowdStrike |

Sunnyvale, California | Over 2,500 | $7 billion |

| Okta | San Francisco, California | Over 1,500 |

$14 billion |

|

AppFolio |

Santa Barbara, California | Over 1,200 | $3 billion |

| Twilio | San Francisco, California | Over 3,000 |

$40 billion |

Effect Of The COVID-19 Pandemic On The SaaS Industry

- Because of pandemic restrictions, many companies had to start working from home quickly. For both experienced and new remote workers, SaaS apps became crucial for keeping businesses running.

- These apps included video conferencing tools like Zoom, messaging apps like Slack, and collaboration platforms such as Google Workspace and Microsoft Teams.

- The global market for web and video conferencing SaaS was estimated at USD 3.5 billion in 2020. It’s expected to grow to USD 7 billion by 2026.

(Reference: logicworks.com)

- Zoom’s revenue jumped from USD 540 million in 2019 to $1.96 billion in 2020 and reached USD 4.49 billion in 2023.

- Due to COVID-19, 30% of businesses reported spending more on cloud services than planned.

- The number of collaboration apps installed on company devices increased by 176% in May 2020 alone.

- The global market for online collaboration is predicted to grow from USD 12.4 billion in 2019 to USD 13.5 billion by 2024. As of 2022, it was valued at $16.1 billion.

- In 2020, 66% of US employees worked remotely due to COVID-19.

- The pandemic also led to the Great Resignation, where over 40 million Americans quit their jobs in 2021.

- SaaS companies were affected but less so than industries like service, retail, and hospitality.

- SaaS companies with medium growth (10-50% annual revenue increase) experienced about 11% employee turnover in 2021.

- As per SaaS Statistics, companies with less than 10% growth had nearly 15% of their workforce leave voluntarily.

- The fastest-growing SaaS companies (with over 50% annual growth) had only about 7.5% voluntary turnover, half the rate of the slowest-growing companies.

Adoption Of SaaS

- Most companies plan to start using cloud SaaS in 2024 and will use multiple applications.

- For 40.43% of SaaS companies, getting new customers set up takes less than a day, speeding up the time to benefit from the service.

- On average, a SaaS company has about 36,000 customers. However, public SaaS companies that serve mostly small and medium-sized businesses (SMBs) have over 85,000 users.

- 73% of organizations think SaaS is essential for reaching their business goals, as stated by SaaS Statistics.

- Organizations use an average of 371 SaaS applications, which is a 32% increase since 2023.

(Reference: enterpriseappstoday.com)

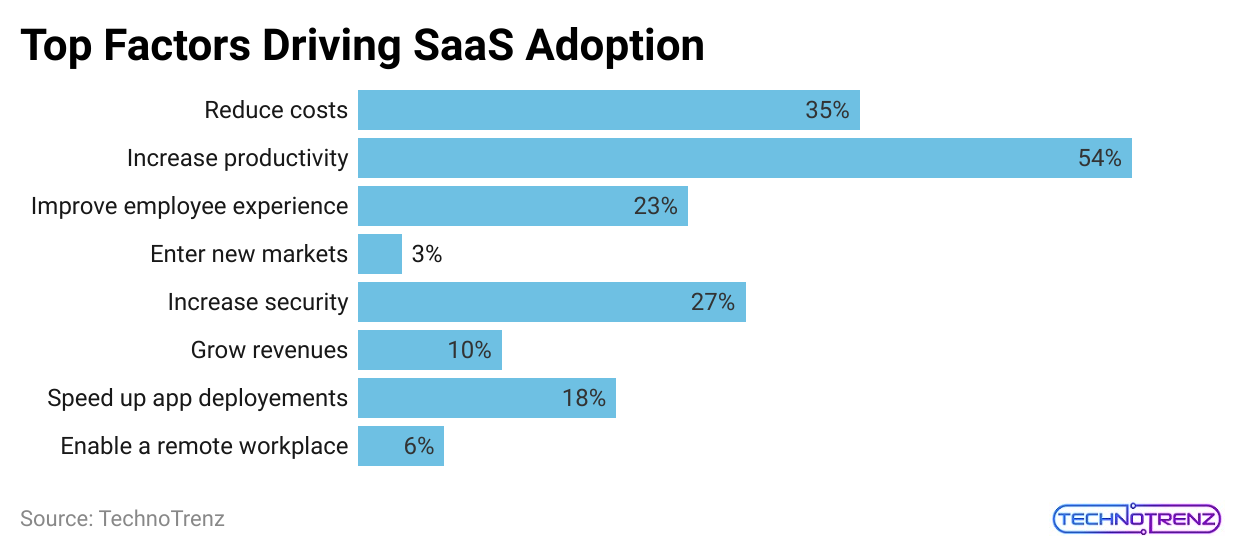

- People mainly use SaaS applications to boost productivity, with 54% of users citing this as their top benefit.

Other reasons include:

- 35% of companies use SaaS to cut costs.

- 27% use it for better security.

- 23% find it improves the employee experience.

- 18% appreciate the faster deployment of apps.

- 10% see growth in revenues.

- 6% use SaaS to support remote work.

- Each department in an organization typically uses around 87 SaaS applications.

- The average spending on SaaS per employee is $9,643, with SMBs spending more than larger companies.

- Government agencies are also adopting cloud SaaS. Over 50% of US government organizations are now using cloud services.

- In 2023, 51% of government IT leaders had a cloud migration plan. Recent surveys show that 53% have now implemented cloud applications and services.

- SaaS Statistics stated that Government cloud spending has increased over the years. In 2022, NASA spent $257 million, the Social Security Administration (SSA) spent $191 million, and the Treasury spent $398 million on cloud services.

- 50% of respondents in a 2023 study planned to increase the number of cloud providers they use in the next two years.

- 68% of enterprise companies consider themselves to be at an “intermediate” or “advanced” level with cloud technology.

- 16% of enterprise companies are at the beginner stage with cloud technology.

- 12% of companies are watching the cloud industry but have yet to start using or learning about it.

- The 2020 Data Attack Surface Report forecasts that 50% of all digital data worldwide will be stored in the cloud by 2025.

- Companies and CIOs are drawn to cloud-based SaaS for its features.

- SaaS Statistics stated that almost 93% of CIOs have adopted or plan to adopt SaaS.

- 70% of CIOs are attracted to SaaS for its agility and scalability. Many also expect that most applications will soon be cloud-based.

- 38% of companies use cloud-based systems to improve disaster recovery.

- 37% of companies choose cloud-based systems for their flexibility, as per SaaS Statistics.

SaaS is a significant part of company budgets for specific reasons:

- SaaS spending is less than 15% of total enterprise spending.

- 12% of a business’s SaaS budget is for operating systems.

- 10% of a business’s SaaS budget is for security software.

- 10% of a business’s SaaS budget is for productivity tools.

Average Number of SaaS Applications Per Company In 2024

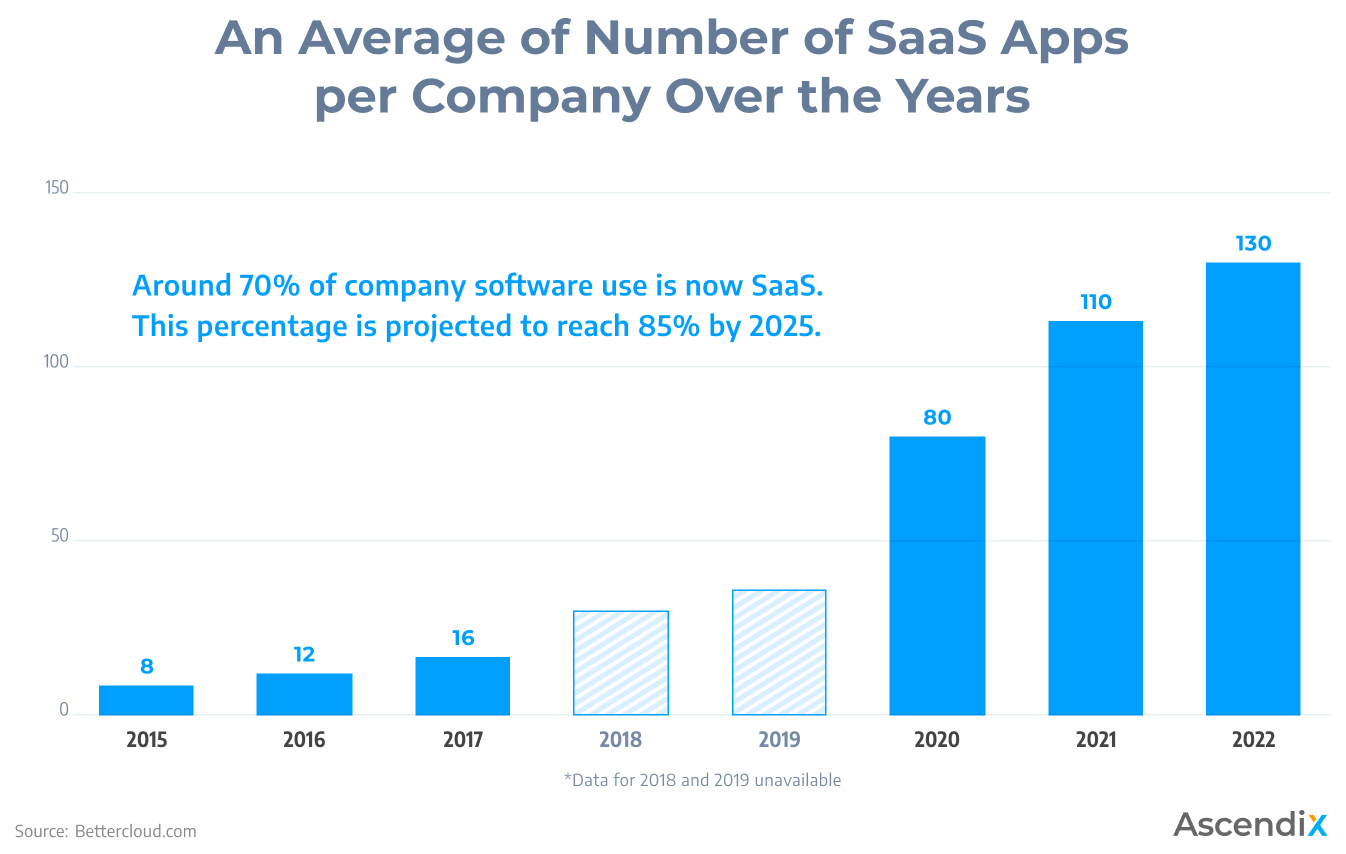

- Right now, SaaS makes up around 80% of the software companies use. This is expected to increase to 85% by 2025.

- However, the growth in SaaS adoption has slowed down because many companies are trying to reduce the number of redundant apps they use.

- Even though the number of SaaS apps grew by 18% from last year, 40% of IT professionals reported that they have combined similar apps, which has led to higher turnover rates.

- Many companies use various SaaS apps for project management, like Asana, Monday, and Trello, among thousands of other options.

- This year, IT teams have been streamlining and reducing duplicate SaaS apps, which has slowed down the growth rate.

- According to SaaS Statistics, the average number of SaaS applications per company increased from 110 in 2023 to 130 in 2024.

- This marks a fivefold increase over the past three years and a tenfold increase since 2015. However, the number of SaaS apps used can vary depending on the size of the organization.

(Source: ascendixtech.com)

- Companies with fewer than 50 employees use about 21 SaaS applications on average.

- In contrast, companies with 50 to 99 employees use around 32 SaaS applications, which is a 52% increase.

- Organizations with 100 to 499 employees use nearly twice as many SaaS applications as those with 50 to 99 employees (61 vs. 32).

- SaaS Statistics stated that larger companies with over 1,000 employees use an average of 200 SaaS applications.

- The most commonly used SaaS applications are for collaboration and communication, followed by human resources management and project management software.

- Overall, larger organizations tend to use more SaaS applications than smaller ones.

Top SaaS Applications By Category

As of January 2024, Adobe is the largest SaaS company, with a value of $276 billion. It is followed by Salesforce, valued at $271.9 billion, and Intuit, valued at $174.2 billion.

-

Top Sales SaaS Application

| Company (Ticker) | Market Cap |

| Salesforce, Inc(CRM) |

$253.3B |

|

Guidewire Software, Inc (GWRE) |

$9.4B |

| The Descartes System Group Inc.(DSGX.) |

$7.4B |

|

SPS Commerce, Inc (SPSC) |

$6.8B |

| AppFolio, Inc. (APPF) |

$6.3B |

-

Top Marketing Saas Applications

| Company (Ticker) | Market Cap |

| Shopify.Inc (SHOP) |

$94.0B |

|

HubSpot, Inc. (HUBS) |

$28.1B |

| Wix.com Ltd (WIX) |

$7.3B |

|

Kiaviyo, Inc (KVYO) |

$6.5B |

-

Top Engineering SaaS Applications

| Company (Ticker) | Market Cap |

| Samsara Inc. (IOT) |

$37.0B |

|

MongoDB, Inc (MDB) |

$30.3B |

| Veeva Systems Inc. (VEEV) |

$29.1B |

|

Dynatrace, Inc (DT) |

$17.0B |

| Bentley Systems, Incorporated ( BSY) |

$14.9B |

|

Unity Software Inc. (U) |

$12.6B |

| Procore Technologies, Inc (PCOR) |

$9.9B |

-

Top Customer Support SaaS Applications

| Company (Ticker) | Market Cap |

| Okta, Inc. (OKTA) |

$13.4B |

|

Twilio Inc. (TWLO) |

$13.3B |

-

Top DevOps SaaS Applications

| Company (Ticker) | Market Cap |

| Atlassian Corporation (TEAM) |

$57.4B |

|

Autodesk, Inc. (ADSK) |

$51.8B |

| Palantir Technologies Inc (PLTR) |

$38.9B |

|

Splunk Inc. (SPLK) |

$25.7B |

| GitLab Inc. (GTLB) |

$10.6B |

-

Top Business Operations SaaS Applications

| Company (Ticker) | Market Cap |

| Adobe Inc. (ADBE) |

$284.0B |

|

Workday, Inc (WDAY) |

$73.8B |

| Zoom Video Communications, Inc. (ZM) |

$21.0B |

|

UlPath Inc. (PATH) |

$12.6B |

| ZoomInfo Technologies Inc. (ZI) |

$11.4B |

|

Paycom Software, Inc (PAYC) |

$11.2B |

| Dropbox, Inc (DBX) |

$10.9B |

|

Ceridian HCM Holding Inc. (CDAY) |

$10.3B |

| Monday.com.LTD (MNDY) |

$9.4B |

|

Paylocity Holding Corporation (PCTY) |

$8.6B |

| Smartsheet Inc (SMAR) |

$6.3B |

-

Top Finance SaaS Applications

| Company (Ticker) | Market Cap |

| Intuit Inc. (INTU) |

172.9B |

|

Block, Inc (SQ) |

$42.7B |

| BILL Holdings, Inc. (BILL) |

$7.7B |

-

Top IT and Security SaaS Applications

| Company (Ticker) | Market Cap |

|

ServiceNow, Inc. (NOW) |

$150.6B |

| CrowdStrike Holdings, Inc. (CRWD) |

$62.3B |

| Zscaler, Inc (ZS) |

$32.9B |

|

Cloudflare, Inc (NET) |

$27.1B |

| Akamal Technologies, Inc. (AKAM) |

$18.2B |

|

DocuSign, Inc. (DOCU) |

$12.9B |

| Elastic N.V(ESTC) |

$12.0B |

|

F5, Inc. (FFIV) |

$10.8B |

| SentinelOne, Inc. (S) |

$7.4B |

|

Confluent, Inc (CFLT) |

$6.8B |

SaaS Market Projection 2026 to 2030

- The global cloud computing market is expected to reach $947.3 billion by 2026.

- The video conferencing market is projected to reach $14.58 billion by 2029.

- SaaS Statistics stated that the healthcare SaaS market is expected to hit $50 billion by 2028.

- SaaS finance and accounting software is anticipated to hit $7.4 billion by the same year.

- The global e-learning market is forecasted to reach $11.9 billion.

- The market for Enterprise Resource Planning (ERP) software is expected to grow to $59.5 billion.

- By 2027, the global SaaS market for retail and e-commerce is projected to reach $138.9 billion.

- The cloud-based computing market is also forecasted to reach $947.3 billion by 2026.

- By 2027, the banking, insurance, and financial sector is expected to grow to $130.7 billion.

- The global market for SaaS customer relationship management (CRM) systems is expected to reach $44.6 billion by 2026.

- The worldwide market for SaaS supply chain management (SCM) systems is projected to be $14.4 billion by 2026.

- According to SaaS Statistics, the global SaaS market is projected to reach $571.9 billion by 2027.

- Global Public Cloud Services End-Users Spending Forecast(Million of US Dollars)

| 2022 | 2023 | 2024 | |

| Cloud Applications Infrastructure Services (PaaS) | 111,976 | 138,962 |

170,355 |

|

Cloud Application Services (SaaS) |

167,342 | 197,288 | 232,296 |

| Cloud Business Process Services (BPaaS) | 59,861 | 65.240 |

71,063 |

|

Cloud Desktop-as-a-Service (DaaS) |

2,525 | 3,122 | 3,535 |

| Cloud management and Security Services | 34,487 | 42,401 |

51,871 |

|

Cloud System Infrastructure Services ( IaaS) |

114,786 | 150,310 | 195,446 |

| Total Market | 490.977 | 597,325 |

724,566 |

- According to Gartner, worldwide spending on cloud application services (SaaS) is expected to surpass $232 billion in 2024, up from $197 billion in 2023.

- For comparison, Gartner predicts that total public cloud spending, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Desktop as a Service (DaaS), Business Process as a Service (BPaaS), and cloud management and security services, will reach $725 billion in 2024. This means SaaS will make up about 30% of that total.

(Reference: cloudzero.com)

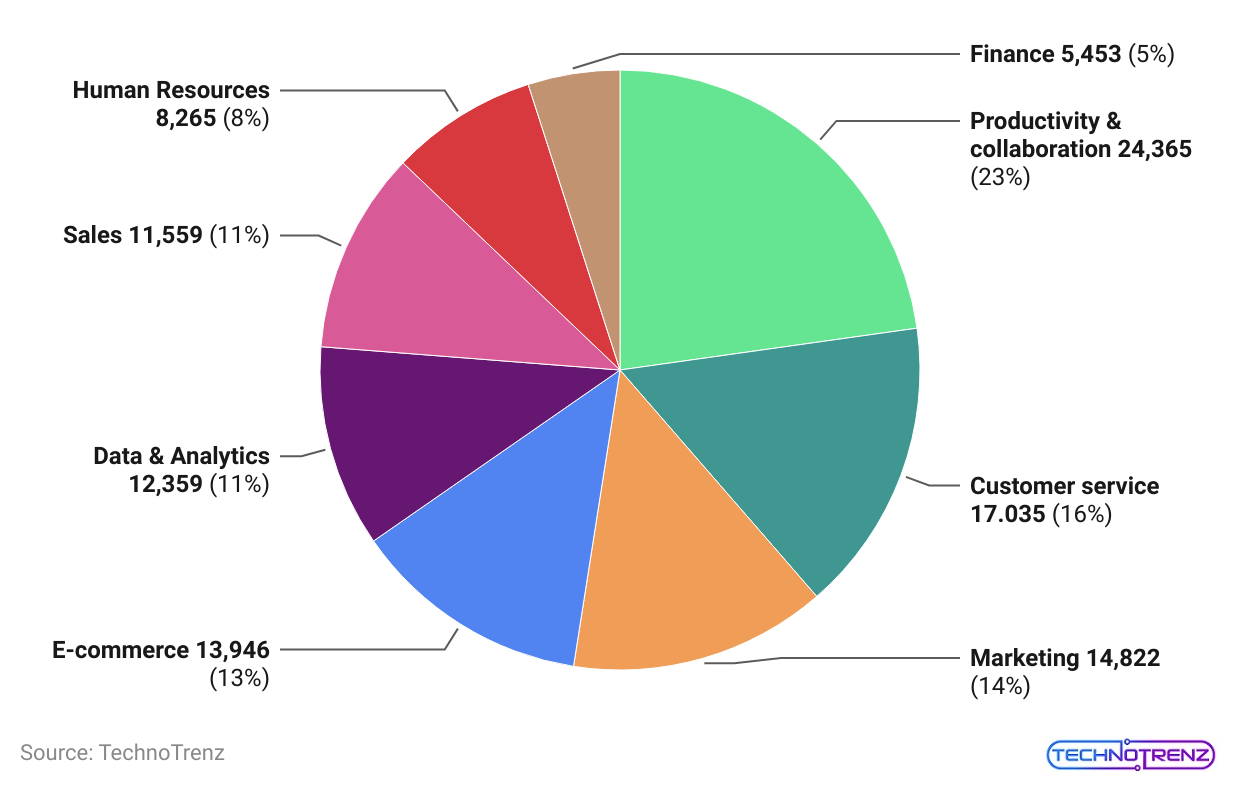

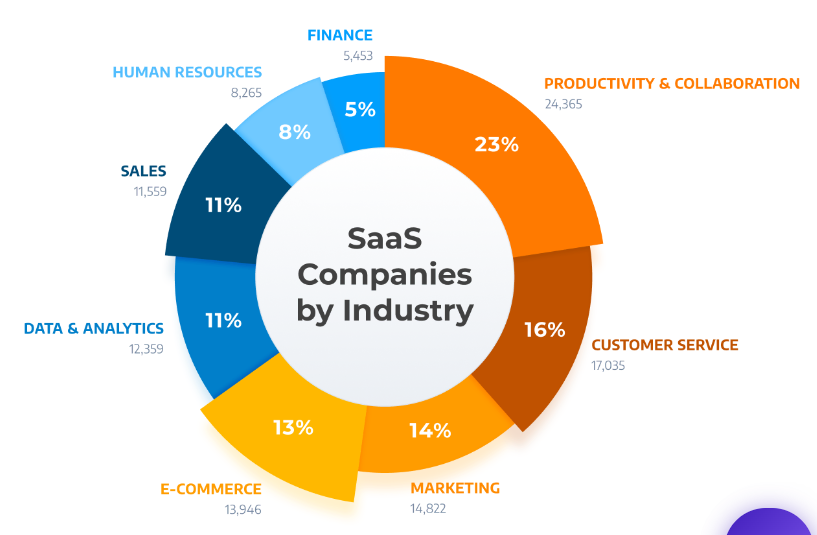

- SaaS Statistics estimated that there are more than 24,365 SaaS solutions available in 2023. The top categories are customer service (over 17,000), marketing (over 14,800), and e-commerce SaaS tools.

SaaS Companies Across The World Statistics

- The SaaS market is expected to grow to $700 billion by 2030, with an annual growth rate of 18.3% from 2022 to 2030.

- Salesforce is the biggest SaaS organization across the globe, with over $34 billion in revenue in 2024.

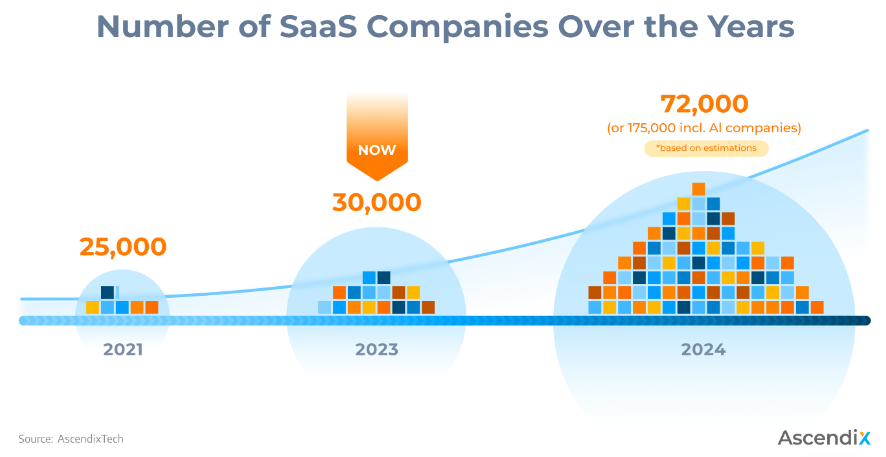

- In 2024, there are about 30,800 SaaS companies worldwide, according to a Statista report.

- SaaS currently makes up almost 70% of all Software used by companies. This is expected to increase to 85% by 2026.

- The US leads the global SaaS market, with almost 17,000 organizations.

- By 2025, about 72,000 SaaS organizations could be in operation. The SaaS industry is forecasted to rise at a value of $307 billion by 2026. However, if we include companies that focus on artificial intelligence, the number of SaaS companies could grow to 175,000.

- In 2024, there are more than 30,800 SaaS organizations that serve thousands of clients.

(Source: ascendixtech.com)

These SaaS companies work in different areas:

- Almost 24,000 focus on productivity tools and collaboration applications.

- Around 17,000 specialize in consumer service solutions, like Salesforce.

- About 15,000 are in marketing software.

- Nearly 14,000 are involved in e-commerce.

- Around 12,000 work in data and analytics.

- There are about 11,500 organizations in sales, including those focused on artificial intelligence.

(Source: ascendixtech.com)

- According to SaaS Statistics, the United States has the most SaaS companies, about 17,000, which is roughly 60% of the total. These companies serve 59 million customers worldwide.

- According to SaaS Statistics, the United Kingdom has around 1,600 SaaS organizations, Canada has 992, Germany has 840, France has 684, and India has 711.

(Reference: ascendixtech.com)

- The US has almost eight times more SaaS organizations than any other nation, with around 9,100 in total.

- In Europe, the count of SaaS organizations is also growing quickly.

- The UK leads with about 2,000 SaaS organizations and 3 billion customers.

- The UK’s SaaS market was estimated to reach $18.06 billion in 2024 and is expected to grow at an annual rate of 20.88% from 2024 to 2029.

- According to SaaS Statistics, the UK market size is projected to reach $44.03 billion by 2029.

- Germany (840), Canada (992), and India (711) are also major players in the SaaS market, with a considerable number of companies and high consumer rates.

- The worldwide SaaS industry is expected to reach $242.9 billion by 2025, a 113.49% increase.

- The US SaaS market is anticipated to double in value, hitting $202.2 billion, even though it might lose some market share.

- The UK’s SaaS market is predicted to grow almost two times, growing to $15.4 billion.

- China’s SaaS industry is set to grow the most, rising from $4.2 billion in 2022 to $13.8 billion by 2025.

- By then, the SaaS market will make up 50.8% of the whole software industry.

(Source: ascendixtech.com)

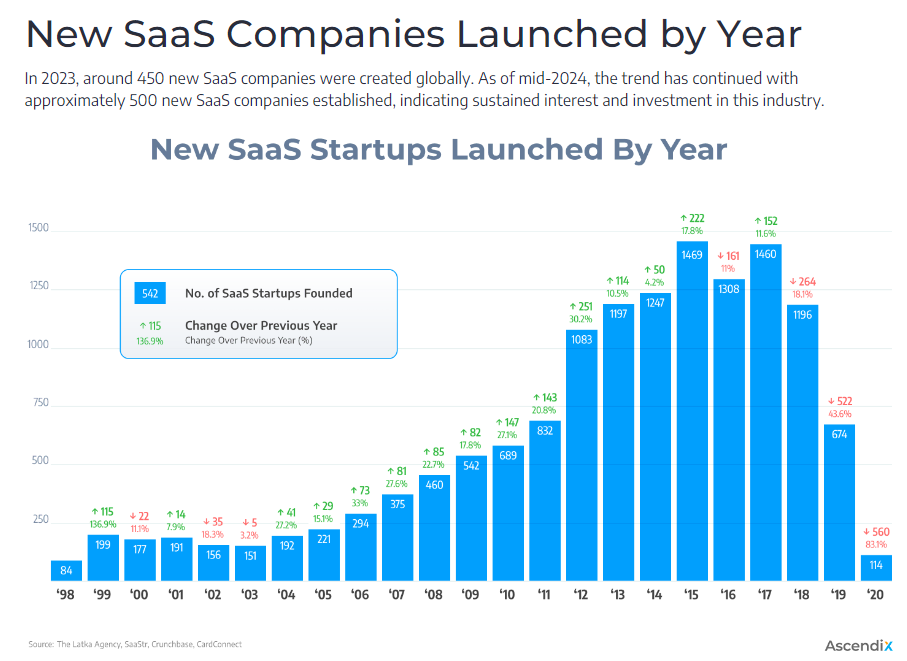

- In 2023, almost 450 new SaaS organizations were started around the world, as per SaaS Statistics.

- By mid-2024, about 500 more new SaaS organizations had been launched.

Pricing Model Differences and Trends

- Pricing is an important consideration for both businesses and individuals when deciding whether to use SaaS products.

- It affects how cost-effective and practical these software solutions are for their needs.

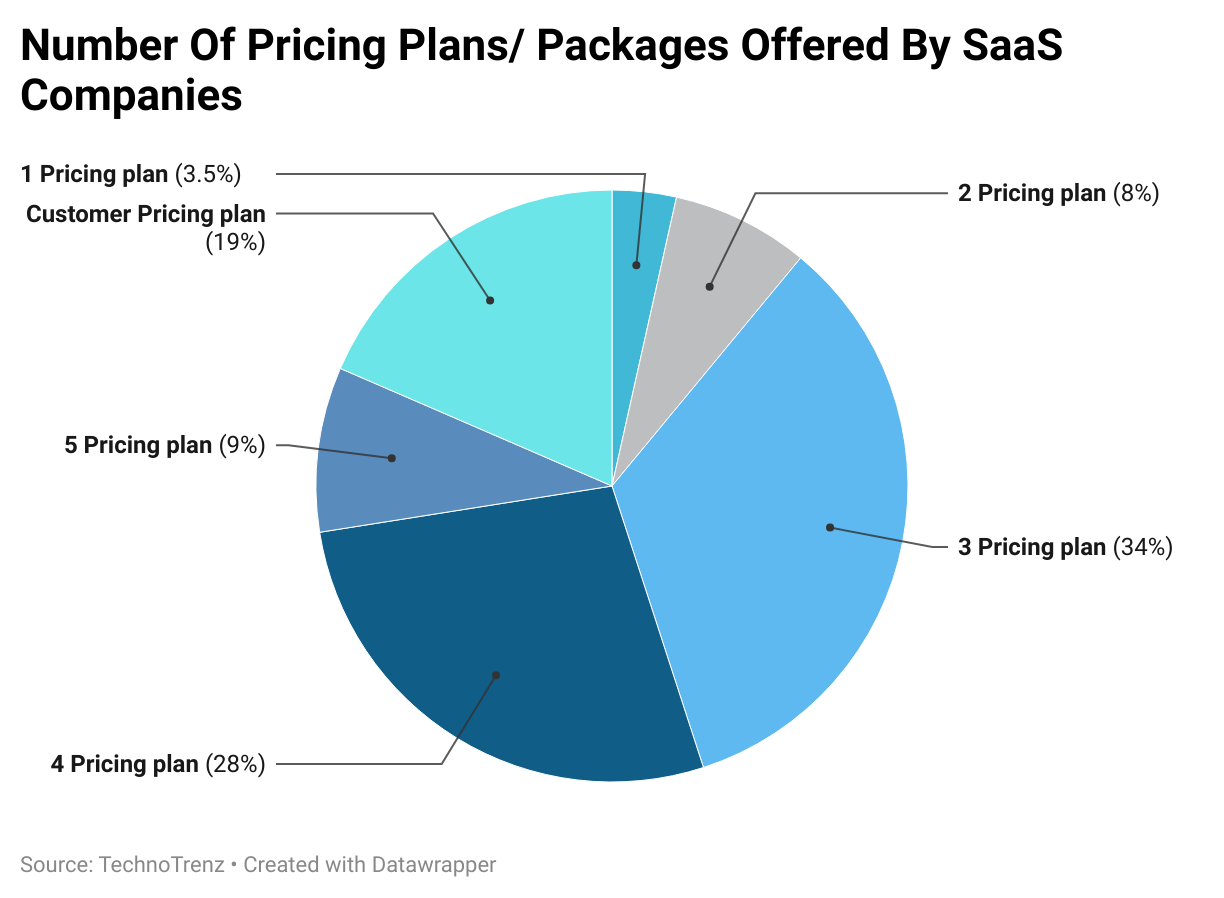

Looking at how SaaS companies set their prices gives insights into how well they understand and meet their customers’ needs. Here’s a look at the pricing trends among SaaS companies:

- Most SaaS products are sold with yearly plans, although the average contract length is about 1.3 years.

- In 2019, SaaS companies with month-to-month contracts had a 14% churn rate, while those with contracts of 1 to 1.5 years had a slightly higher churn rate of 15%.

- 56% of SaaS companies do not offer a free trial. On the other hand, 44% provide a free trial online, 41% offer a free 30-day trial, and 18% have a free two-week trial.

- About 39% of SaaS companies use a value-based pricing model, while 38% use a usage-based pricing model.

(Reference: redline.digital)

- On average, SaaS companies spend only 6 hours setting their pricing strategies.

- Around 79% of SaaS companies update their pricing each year, which is common for both established and newer companies.

- Seat-based pricing, or per-user pricing, is more common than usage-based pricing, with about 38% of companies using this model.

- In seat-based pricing, costs are based on the number of users or “seats” accessing the product, while usage-based pricing charges are based on how much the product is used.

- Only 6% of SaaS companies research to understand what buyers need and what they are willing to pay. Meanwhile, 45% have done some basic market research, but 48% have not engaged in any form of pricing research, according to SaaS Statistics.

- Discounts are becoming less common. About 29% of companies have cut back on offering discounts, and 39% only provide occasional discounts.

SaaS and Product Development Statistics

- Using SaaS increases employee productivity by 20-25% on average.

- Nearly 75% of SaaS companies use chatbots for customer support.

- 80% of SaaS companies use freemium models to attract new users.

- SaaS companies that personalize their customer interactions see a 30% boost in conversion rates.

- 72% of SaaS companies find that subscription-based pricing helps them retain customers better.

- SaaS companies that provide self-service options see a 10% boost in customer satisfaction.

- Around 90% of SaaS companies believe that customer success has a direct effect on their profits.

- SaaS Statistics stated that SaaS companies using chatbots cut support costs by 27%.

- SaaS companies that offer a free trial have a 25% higher rate of converting leads into customers.

- 76% of SaaS businesses provide customers with the option to pay monthly.

- SaaS companies that use AI tools experience a 25% rise in productivity, as per SaaS Statistics.

- Roughly 75% of SaaS companies focus on user experience during product development.

- Offering 24/7 support leads to a 28% increase in customer satisfaction for SaaS companies.

- 65% of SaaS companies invest in customer training programs to improve retention.

- On average, SaaS companies see a 20% increase in customer retention after starting a referral program.

- SaaS companies that use gamification see a 25% rise in user engagement.

- By 2023, 50% of SaaS companies will be looking into using augmented reality to enhance user experience.

- SaaS companies that offer mobile app access see 20% higher user engagement as per SaaS Statistics.

SaaS Security, Risk, and Compliance Statistics

- 78% of organizations store sensitive data in SaaS applications.

- On average, organizations keep 61% of their sensitive data in SaaS apps, and many have faced at least one cybersecurity issue.

- Concerns about encryption are the top security worry related to SaaS.

- 43% of IT professionals have set up a SaaS app that stores sensitive information as per SaaS Statistics.

- 42% of IT professionals need help to secure user activities in SaaS apps.

- Insider threats, in which former employees still have access to SaaS apps, account for 22% of security issues.

- Cyber-attacks and a shortage of skilled workers could slow down market growth. For example, Cloud Security Alliance (CSA) reports that misconfigurations in SaaS caused 63% of security incidents.

- Almost 43% of organizations can link at least one security issue to a SaaS misconfiguration.

- SaaS Statistics stated that around 46% of organizations have the resources to check for SaaS misconfigurations only once a month or less often, and 5% never check.

- According to 35% of companies, the main problem with SaaS misconfigurations is having too many people with the authority to change security settings.

Regional SaaS Statistics

- SaaS companies are worldwide, and different regions show distinct patterns in how they create and use SaaS solutions.

- The USA leads by far, with 17,000 SaaS companies, which is more than eight times the number in any other country.

- The United Kingdom and Canada are next, each with 2,000 SaaS companies as per SaaS Statistics.

(Reference: notta.ai)

- SaaS Statistics stated that the US has 59 billion SaaS customers, more than all other countries combined.

- India leads in Asia with 994 SaaS companies and two billion customers.

- In 2020, China’s SaaS market revenue was about RMB 50 billion, showing steady growth over the past decade.

- Japan’s SaaS market has been growing each year since 2017 and is expected to exceed $1.5 billion in 2023.

- Africa and the Middle East are seeing a big rise in SaaS usage, with an expected annual growth rate of 22.4% from 2021 to 2026.

- North America held the largest share of the global SaaS market, about 55%, in 2020.

- Latin America is expected to grow at an annual rate of 21.9% from 2020 to 2025.

- The European SaaS market is projected to reach $60.36 billion by 2025, growing at an annual rate of 18.4%.

- The UK SaaS market was valued at $7.5 billion in 2020 and is expected to double by 2025. Similar growth is also occurring in the SaaS markets in China, India, and Brazil.

(Source: notta.ai)

- Germany is anticipated to see the largest growth in the SaaS market among major markets. Its market size is expected to increase from €6.85 billion in 2020 to €16.3 billion by 2025, nearly tripling in five years.

Future Trends in 2024

In 2024, SaaS trends are focusing on meeting the needs of various industries and users. Here are some of the key trends:

AI Integration and Analytics

- SaaS platforms are increasingly incorporating AI, especially for data analysis, to make operations more efficient and provide better insights.

- In 2023, AI, particularly Generative AI (GenAI), made significant strides and became a key feature in many online services.

- For example, after ChatGPT’s success, Canva introduced AI tools like Magic Media and Magic Eraser.

- Salesforce also launched “Einstein Copilot,” an AI assistant for customer support.

- LinkedIn and other platforms have also adopted AI features. AI is becoming essential in business and is expected to be worth over $1.8 trillion by 2030.

- Data Security

- As the B2B SaaS market grows, keeping data private and secure remains a top priority.

- Companies are using strong security measures like encryption and multi-factor authentication to protect sensitive information.

- They also adhere to regulations like GDPR to manage customer data responsibly.

- Ongoing improvements and readiness for new security challenges are crucial for protecting customer data.

- Personalized User Experiences (Vertical SaaS)

- Vertical SaaS companies are focusing on creating customized experiences by using data and AI to cater to individual preferences.

- These companies can adjust their features to meet the specific needs of their industry.

- This customization helps them offer more tailored services, find more sales opportunities, and reduce customer acquisition costs.

- Embedded Payment Systems

- Adding payment features directly into SaaS products simplifies transactions and creates new revenue streams for providers.

- This trend is becoming more common because it offers a smoother user experience and increases customer loyalty.

- While companies like Shopify and Mindbody have long benefited from payment services, many other SaaS businesses are just starting to explore this option.

- Usage-Based Pricing Models

- Many SaaS providers are shifting to pricing based on actual usage, which offers more flexibility and can reduce users’ costs.

- In 2024, software spending increased by 17.9%, partly due to higher prices and inflation.

- Another factor is “shrinkflation,” where providers charge the same but offer less functionality.

- Usage-based pricing models, where unused credits expire and additional features cost extra, are becoming more common.

- Mobile-First Solutions

- With the growing use of mobile devices, there is a rise in mobile-first SaaS solutions.

- These solutions are designed for smaller screens and touch controls, making Software easy to use on mobile devices.

- Examples of SaaS products with this approach include Loom, Calendly, Evernote, Notion, and Airtable.

- Improved Integration Capabilities

- SaaS providers are increasingly focusing on integrating their services with existing business systems.

- As more companies adopt SaaS, they want it to work well with their current technology.

- Initially, SaaS providers offered limited integration options, which frustrated users who had to rely on third-party APIs.

- Now, SaaS companies are improving integration to better fit into existing setups.

Conclusion

The SaaS Statistics above show that SaaS is a fast-growing industry with a promising future. The need for cloud-based solutions is rising every day, and SaaS companies are in a great position to benefit from this trend. However, as SaaS adoption grows, so does the competition. Companies in the SaaS market need to keep improving and innovating to stay ahead of their rivals.

Customer satisfaction is also crucial. SaaS companies should focus on making sure their products meet customer needs. Happy customers are more likely to stay and recommend the service to others. Overall, SaaS is an exciting and rapidly evolving field with a lot of potential for growth and innovation.

Sources

FAQ.

On average, a SaaS company can expect a profit margin of about 90%. Profit margin is the percentage of revenue that remains after all business expenses have been subtracted.

The Rule of 40 is a guideline that says a software company’s total revenue growth rate plus its profit margin should be 40% or higher. If a SaaS company meets or exceeds this 40% threshold, it is considered to be managing its profits and growth sustainably. Companies that fall below 40% might need help with cash flow or liquidity problems.

Saisuman is a professional content writer specializing in health, law, and space-related articles. Her experience includes designing featured articles for websites and newsletters, as well as conducting detailed research for medical professionals and researchers. Passionate about languages since childhood, Saisuman can read, write, and speak in five different languages. Her love for languages and reading inspired her to pursue a career in writing. Saisuman holds a Master's in Business Administration with a focus on Human Resources and has worked in a Human Resources firm for a year. She was previously associated with a French international company. In addition to writing, Saisuman enjoys traveling and singing classical songs in her leisure time.