Cloud Computing Market Size

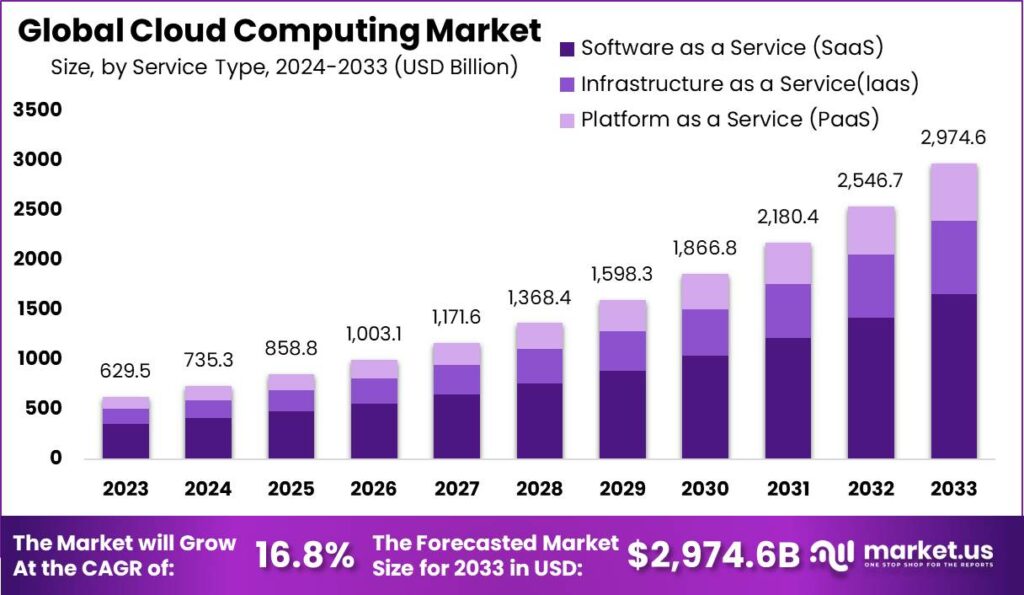

According to Market.us, The global cloud computing market is set for rapid expansion, projected to rise from USD 629.5 billion in 2023 to approximately USD 2,974.6 billion by 2033, growing at a compound annual growth rate of 16.8%. This growth is supported by the increasing reliance of enterprises on cloud platforms to enhance scalability, flexibility, and cost efficiency.

The Cloud Computing Market centers around the provision of on-demand computing services delivered via the internet. These services include storage, processing power, networking, and software applications that businesses and individuals can access without relying on local servers or personal computers. Cloud computing enables organizations to scale resources dynamically and supports a range of workloads from data storage and web hosting to complex artificial intelligence operations.

“The cloud computing market is redefining digital infrastructure by enabling scalable, on-demand access to computing power, data storage, and advanced services. Its growth reflects a broader shift toward flexibility, cost efficiency, and real-time innovation across industries.”

One of the main driving factors in this market is the rising demand for scalable and flexible digital infrastructure. Businesses are increasingly adopting cloud services to support digital transformation initiatives, enable remote work, and harness emerging technologies such as big data analytics, artificial intelligence (AI), and the Internet of Things (IoT). Additionally, enterprises are drawn to cloud solutions because they offer cost efficiencies through pay-as-you-go pricing models, reducing the need for large upfront investments in hardware and software.

According to a report by Radixweb, By 2025, it is expected that 85% of organizations will operate with a cloud-first strategy, while currently, 60% of corporate data is already stored in the cloud. The shift in IT investment priorities is also notable, with forecasts indicating that 51% of IT budgets will transition from traditional systems to cloud-based solutions by 2025. However, challenges around security and complexity remain significant.

Nearly 40% of IT decision-makers seek support from suppliers for cloud security, while 59% of executives are considering moving private customer data and 52% are contemplating the migration of financial data into cloud systems. This underlines both the opportunity and risk associated with cloud adoption.

Sectoral use is widespread, with Retail (96.9%), Media and Entertainment (94.9%), and Finance and Banking (92.8%) ranking highest in cloud utilization. Around 31% of organizations expect more than three-quarters of their workloads to be cloud-based, reflecting the depth of transformation underway. Market leadership remains concentrated, with Microsoft Azure and Amazon Web Services dominating cloud storage adoption, being utilized by more than 73% of surveyed enterprises.

Key Takeaways

- The global cloud computing market is projected to reach USD 2,974.6 Billion by 2033, up from USD 629.5 Billion in 2023, growing at a 16.8% CAGR.

- Software as a Service (SaaS) led with 55.8% share in 2023, driven by rising demand for subscription-based software and enterprise applications.

- The private cloud segment secured 43.1% share, reflecting strong adoption among businesses seeking security and regulatory compliance.

- Large enterprises accounted for 59.0% share, as they invested heavily in digital transformation and advanced infrastructure.

- The BFSI sector held 21.5% share, supported by demand for secure cloud platforms in banking, payments, and risk management.

- North America dominated with 39.3% share, supported by early adoption, strong cloud infrastructure, and high enterprise spending.

Emerging Trend

AI-Driven Cloud Services and Automation

An increasingly prominent trend in cloud computing is the seamless integration of artificial intelligence and machine learning capabilities directly into cloud services. Cloud providers are embedding AI tools that businesses can leverage without needing deep in-house expertise. This enables organizations to automate complex processes, derive actionable insights from large data sets, and enhance decision-making across operations.

This development marks a shift from cloud platforms being mere infrastructure providers to becoming intelligent platforms that actively enhance enterprise workflows. AI-enhanced cloud services facilitate faster application deployment, personalized customer experiences, and smart resource management. As AI itself demands scalable and flexible compute power, this interdependence further accelerates cloud adoption and innovation.

Driver

Rising Demand for Scalable, Cost-Effective IT Infrastructure

One of the strongest growth drivers in cloud computing is the rising enterprise demand for IT infrastructure that is both scalable and cost-effective. Organizations across industries are pursuing digital transformation strategies requiring agile, on-demand computing resources that traditional on-premises infrastructure cannot easily provide.

Cloud solutions offer flexible pay-as-you-go pricing models, enabling companies to scale capacity based on current workloads without large upfront investments. This financial flexibility is particularly attractive to small and medium-sized enterprises and startups, fostering broader cloud adoption. Additionally, cloud platforms support remote workplaces and collaboration through secure, accessible environments, increasingly critical in a post-pandemic world.

Restraint

Data Security, Privacy, and Compliance Concerns

Despite rapid adoption, investments in cloud computing face significant restraints rooted in concerns about data security, privacy, and regulatory compliance. Sensitive data hosted on third-party cloud platforms raises fears of unauthorized access, breaches, and misuse, affecting industries with stringent privacy mandates like healthcare and finance.

Regulations such as GDPR and HIPAA impose strict rules on data handling, storage, and transfer, complicating cloud usage. Organizations often struggle with the lack of transparency and control inherent in multi-tenant cloud environments. Consequently, these factors cause delays and cautious decision-making in cloud migration and expansion initiatives, slowing market growth.

Opportunity

Expansion of Hybrid and Multi-Cloud Architectures

The cloud market is witnessing a significant opportunity in the expansion of hybrid and multi-cloud strategies. Hybrid cloud combines private data centers with public cloud resources, while multi-cloud leverages multiple providers to optimize costs, performance, and redundancy. These approaches alleviate vendor lock-in and improve workload flexibility.

Organizations are increasingly adopting domain-specific or compliance-ready cloud platforms that meet industry regulations out of the box. This customization streamlines application deployment in regulated sectors and enhances operational resilience. As hybrid and multi-cloud environments mature, they open new avenues for cloud service providers and integrators focused on delivering flexible, tailored cloud ecosystems that meet diverse business needs.

Challenge

Managing Cloud Cost Optimization and Visibility

A critical challenge for cloud computing adoption is managing and optimizing costs amid complex, dynamic cloud usage. Many organizations find it difficult to gain true visibility into their cloud spend at a granular level. Unforeseen expenses related to idle resources, inefficient provisioning, or over-provisioning can quickly accumulate, eroding cloud investment returns.

Lack of internal expertise and insufficient cloud governance tools exacerbate this problem. Decision-makers often struggle to allocate IT budgets effectively or identify cost-saving opportunities without comprehensive reporting and automated controls. Addressing cloud cost management complexity is essential for businesses to sustain growth and ensure cloud usage aligns with financial objectives.

Key Market Segments

Service Type

- Software as a Service (SaaS)

- Infrastructure as a Service(laas)

- Platform as a Service (PaaS)

Deployment Mode

- Hybrid Cloud

- Private Cloud

- Public Cloud

Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

End-Use Industry

- IT & Telecommunications

- BFSI

- Retail & Consumer Goods

- Energy & Utilities

- Manufacturing

- Government & Public Sector

- Media & Entertainment

- Healthcare

- Other End-Use Industries

Top Key Players in the Cloud Computing Market

- Adobe Inc.

- Google LLC

- Alibaba Group Holding Limited

- IBM Corporation

- Oracle Corporation

- Salesforce, Inc.

- Microsoft Corporation

- Cisco Systems, Inc.

- VMware LLC

- SAP SE

- Other Key Players