Introduction

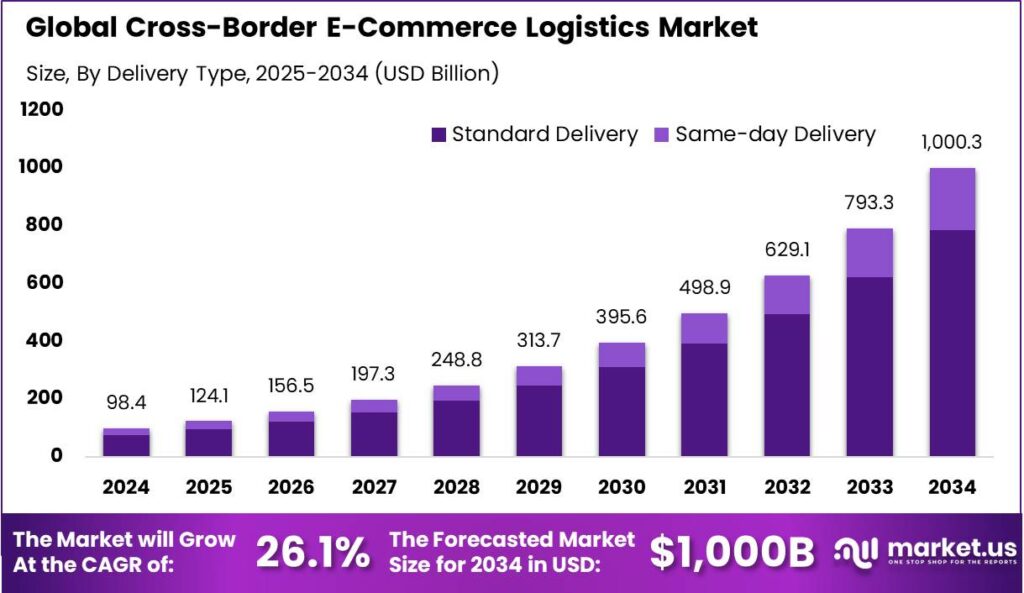

According to Market.us, The Global Cross-Border E-Commerce Logistics Market is expected to witness rapid expansion, rising from USD 98.4 billion in 2024 to nearly USD 1,000 billion by 2034, reflecting a CAGR of 26.1%. The surge is driven by the increasing volume of international online transactions, growing consumer demand for foreign goods, and advancements in logistics networks that support faster and more reliable cross-border deliveries.

The Cross-Border E-Commerce Logistics Market refers to the network of services, infrastructure, and technologies that enable the transportation, warehousing, customs clearance, and delivery of goods purchased through online platforms across international borders. It covers first-mile pickup, international air and sea freight, customs brokerage, last-mile delivery, and reverse logistics. This market supports retailers, marketplaces, and consumers who engage in global online trade and depends heavily on logistics providers, courier companies, and digital tracking systems.

Key Insight Summary

- The market is projected to grow from USD 98.4 Billion in 2024 to nearly USD 1,000 Billion by 2034, at a strong 26.10% CAGR.

- In 2024, the Standard Delivery segment dominated with 78.6% share.

- By product category, Apparels led the market, capturing 38.4% share.

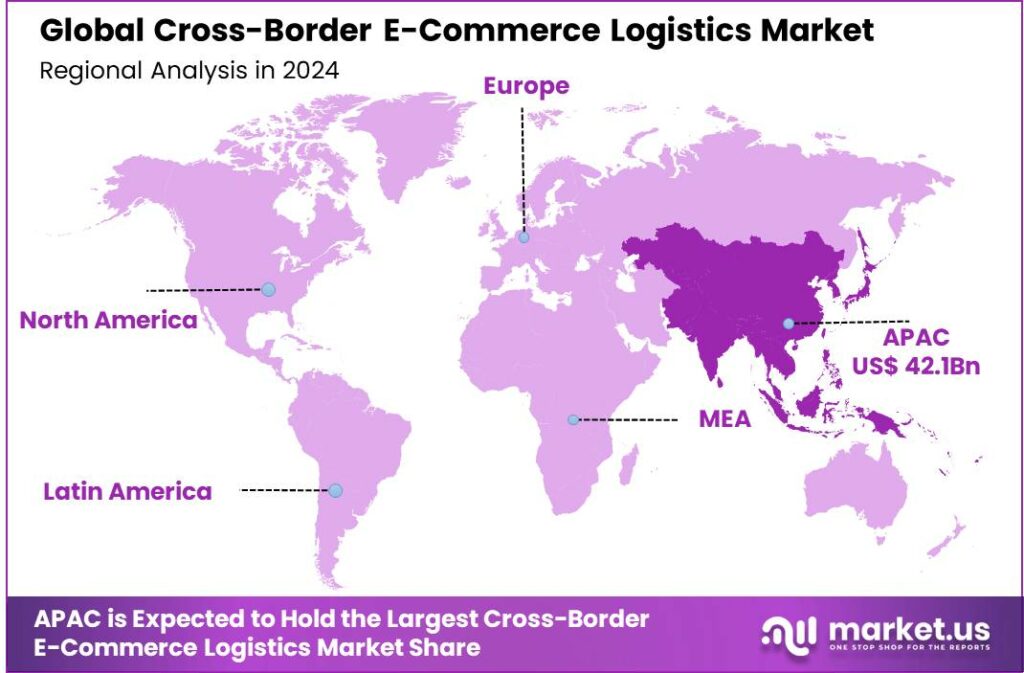

- Regionally, Asia-Pacific held the top position with 42.8% share and revenues of about USD 42.1 Billion in 2024.

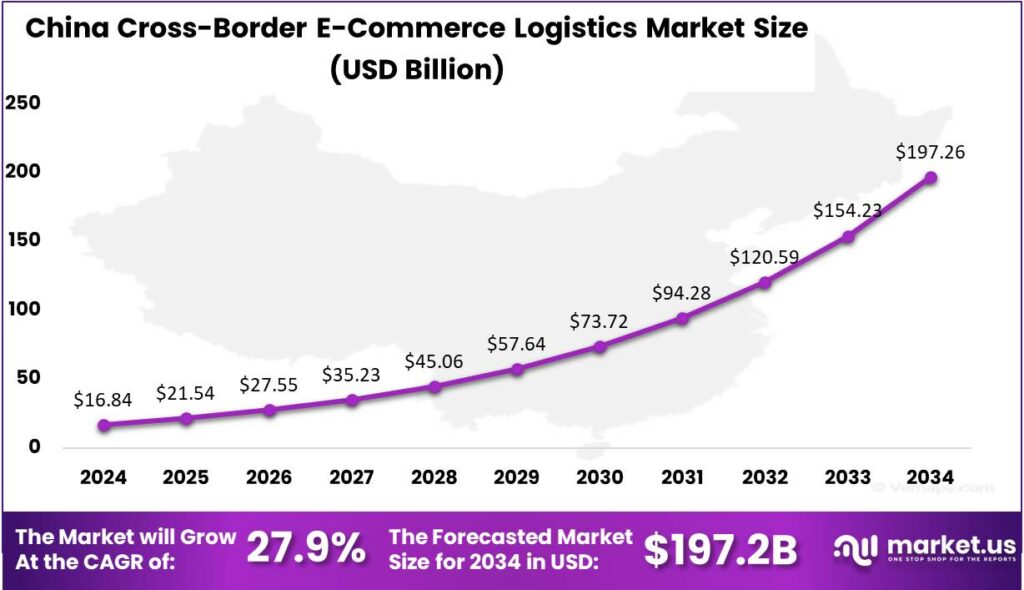

- Within Asia-Pacific, the China market was valued at USD 16.84 Billion in 2024, and is forecast to expand at a rapid 27.9% CAGR.

Analysts’ Viewpoint

The market is driven by the rapid growth of global e-commerce and rising consumer demand for access to international products. Affordable internet access, mobile commerce expansion, and digital payment adoption are further accelerating cross-border trade. Competitive pricing, wider product selection, and consumer preference for global brands are fueling demand. At the same time, logistics companies are adopting advanced tracking, warehousing automation, and customs clearance technologies to improve efficiency.

Government initiatives promoting international trade and free-trade agreements also support market development. Demand is strong from online marketplaces and retailers seeking to expand their global reach. Consumers in emerging markets are increasingly purchasing goods from international platforms to access brands not available locally.

Developed regions such as North America and Europe remain major sources of outbound cross-border shipments, while Asia-Pacific is becoming both a major exporter and importer of e-commerce goods. High-value categories such as fashion, electronics, beauty products, and health supplements dominate demand. Seasonal shopping events like Singles’ Day, Black Friday, and Cyber Monday significantly increase cross-border logistics activity.

Role of Generative AI

Generative AI is playing a transformative role in cross-border e-commerce logistics by automating complex operational tasks that traditionally required human intervention. It helps optimize network design by exploring numerous configurations to improve cost and service simultaneously. This technology enables autonomous planning by continuously evaluating and refining logistics plans based on changing conditions.

It also generates synthetic data to simulate rare events such as supply chain disruptions, helping companies prepare better. Additionally, generative AI automates the creation of customs documentation, shipment descriptions, and helps identify errors or missing information to reduce human mistakes and speed up processes. This technological shift is making logistics operations more efficient and responsive to market demands.

Investment and Business Benefits

Investment opportunities are expanding in digital logistics platforms, regional fulfillment centers, and last-mile delivery solutions in emerging markets. Companies offering automated customs clearance, cross-border payment integration, and AI-driven logistics management are attracting capital. Partnerships between global logistics players and local delivery providers are also creating new avenues for investment. Additionally, solutions addressing sustainability, such as green packaging and carbon-efficient transport, are emerging as priority areas for investors.

Cross-border e-commerce logistics provides businesses with broader market access, higher revenue potential, and enhanced customer satisfaction. Retailers gain the ability to sell globally without establishing physical stores in every country. Logistics providers benefit from growing parcel volumes and long-term service contracts with e-commerce platforms. Consumers benefit from faster, more reliable deliveries and easier access to global brands. Over time, efficient logistics networks also support lower delivery costs and improved competitiveness.

The market is strongly influenced by customs regulations, trade policies, and taxation rules in importing and exporting countries. Compliance with international trade agreements, value-added tax (VAT) requirements, and product safety regulations is essential. Customs documentation and clearance processes remain major challenges for logistics providers, especially in developing regions. Regulatory harmonization initiatives, such as simplified cross-border trade agreements, are helping reduce complexity. Data privacy and digital transaction regulations also affect logistics platforms integrated with e-commerce systems.

Regional Highlights: A Global Perspective

In 2024, Asia-Pacific led the market with a 42.8% share, generating about USD 42.1 billion in revenue. China played a central role, with its cross-border e-commerce logistics market valued at USD 16.84 billion and set to grow at a CAGR of 27.9%. This dominance is supported by China’s strong digital ecosystem, large-scale manufacturing capacity, and government policies promoting cross-border trade and logistics innovation.

In 2024, the China Cross-Border E-Commerce Logistics Market reached an estimated value of USD 16.84 billion, reflecting the nation’s rapidly growing position in global digital trade. This surge has been primarily driven by the increasing appetite for international products among Chinese consumers, coupled with robust export activity facilitated by Chinese merchants selling through global online marketplaces.

Emerging Trends

In 2025, cross-border e-commerce logistics is seeing rapid adoption of AI-powered supply chains that allow for real-time shipment tracking and faster customs clearance. Companies are increasingly using multi-carrier shipping solutions to provide more cost-effective and reliable deliveries. Fulfillment strategies are shifting towards localized warehouses closer to consumers to reduce delivery times and shipping costs.

Another key trend is the focus on improving customer experience through multilingual support and AI-driven chatbots that handle inquiries efficiently, especially regarding shipment delays and customs requirements. Sustainability is also gaining attention, with increased use of green packaging and energy-efficient transport options in global logistics.

Growth Factors

The rise of global online shopping is a major driver of growth in cross-border e-commerce logistics. More consumers want access to products unavailable locally, which increases international shipments. Improved global logistics networks and payment systems are making it easier and more trustworthy to purchase from overseas vendors.

Technology advancements like AI and automation reduce shipping times and complexity, further encouraging cross-border sales. Growing internet penetration and smartphone use in emerging markets also expand the customer base, fueling demand for seamless international deliveries. These factors work together to make cross-border logistics a critical part of global e-commerce expansion.

Driver

Growing Global Consumer Demand for Diverse Products

One key driver of the cross-border e-commerce logistics market is the steadily increasing global consumer demand for products that are not available locally. Consumers today are more willing than ever to shop internationally because they seek unique and specialized items, better quality, or competitive prices unavailable in their domestic markets.

This growing interest in cross-border purchases is pushing logistics providers to enhance their services, offering faster shipping, improved tracking, and more reliable delivery to meet rising consumer expectations. The expansion of global e-commerce platforms like Amazon and Alibaba further fuels this demand by connecting sellers and buyers across countries seamlessly.

Moreover, rising middle-class populations with increasing disposable incomes in emerging markets are driving higher volumes of international online shopping. The proliferation of smartphones and mobile commerce apps makes cross-border transactions easier and more accessible, encouraging more consumers worldwide to buy from overseas sellers. These factors collectively create strong momentum for cross-border logistics as businesses strive to meet global shoppers’ needs efficiently and cost-effectively.

Restraint

High Costs and Complexities of Cross-Border Logistics

Despite the growth, cross-border e-commerce logistics faces significant restraints due to the high costs and complexities involved in international shipping. Air freight and transportation expenses are generally higher for cross-border shipments compared to domestic deliveries. These increased costs can affect pricing and make it harder for merchants to maintain competitive prices while ensuring timely delivery.

The complexity of navigating differing import/export rules, taxes, and duties can also cause shipment delays that negatively impact the customer experience. Sellers who lack clear knowledge or support struggle with these challenges, which sometimes leads to lost sales or increased returns. These factors restrain the growth of cross-border logistics as companies must balance operational costs with the demand for faster, more transparent delivery.

Opportunity

Adoption of Advanced Technology in Logistics

An important opportunity for the cross-border e-commerce logistics sector lies in adopting advanced technologies such as blockchain, artificial intelligence, and automation. These innovations help streamline supply chain operations, improve shipment tracking, reduce fraud, and speed up customs clearance processes.

For example, blockchain technology enhances transparency and security during freight management by securely recording digital transactions across the logistics chain. Meanwhile, AI-powered analytics optimize delivery routes and predict potential delays, improving efficiency and customer satisfaction.

The rise of automated warehouses and smart fulfillment centers closer to international customers also presents a chance for logistics companies to reduce shipping times and costs. Real-time tracking and multi-carrier shipping solutions allow better control and proactive management of deliveries worldwide. As these technologies become more widespread, they will enable logistics providers to offer faster, cheaper, and more reliable cross-border services that meet growing market demand.

Challenge

Navigating Regulatory Compliance and Customs Delays

One of the biggest challenges facing cross-border e-commerce logistics is managing regulatory compliance and overcoming customs-related delays. Each country has its own import regulations, taxes, and documentation requirements, which can be difficult and time-consuming to navigate. These regulatory hurdles often result in shipment holds or unexpected costs that frustrate both sellers and consumers. Many businesses, especially small and medium-sized enterprises, find it challenging to stay up to date with constantly changing customs laws and policies.

Additionally, the last-mile delivery in foreign countries can be complicated by limited infrastructure or lack of established local partnerships. These obstacles increase the risk of delayed or failed deliveries, harming buyer trust and loyalty. Efficiently coordinating cross-border logistics while meeting diverse regulatory standards demands specialized knowledge and flexible systems, making regulatory compliance a persistent obstacle for the industry.

Key Market Segments

By Delivery Type

- Standard Delivery

- Same-day Delivery

By Industry Vertical

- Apparels

- Consumer Electronics

- Automotive

- Healthcare

- Food and Beverage

- Others

Top Key Players in the Market

- A.P. Moller – Maersk

- Amazon.com, Inc.

- Aramex PJSC

- CEVA Logistics SA

- Deutsche Post AG

- DSV A/S

- FedEx Corp.

- Kuehne + Nagel Management AG

- SEKO Logistics

- United Parcel Service, Inc.

- Others

Read More – https://market.us/report/cross-border-e-commerce-logistics-market/