Introduction

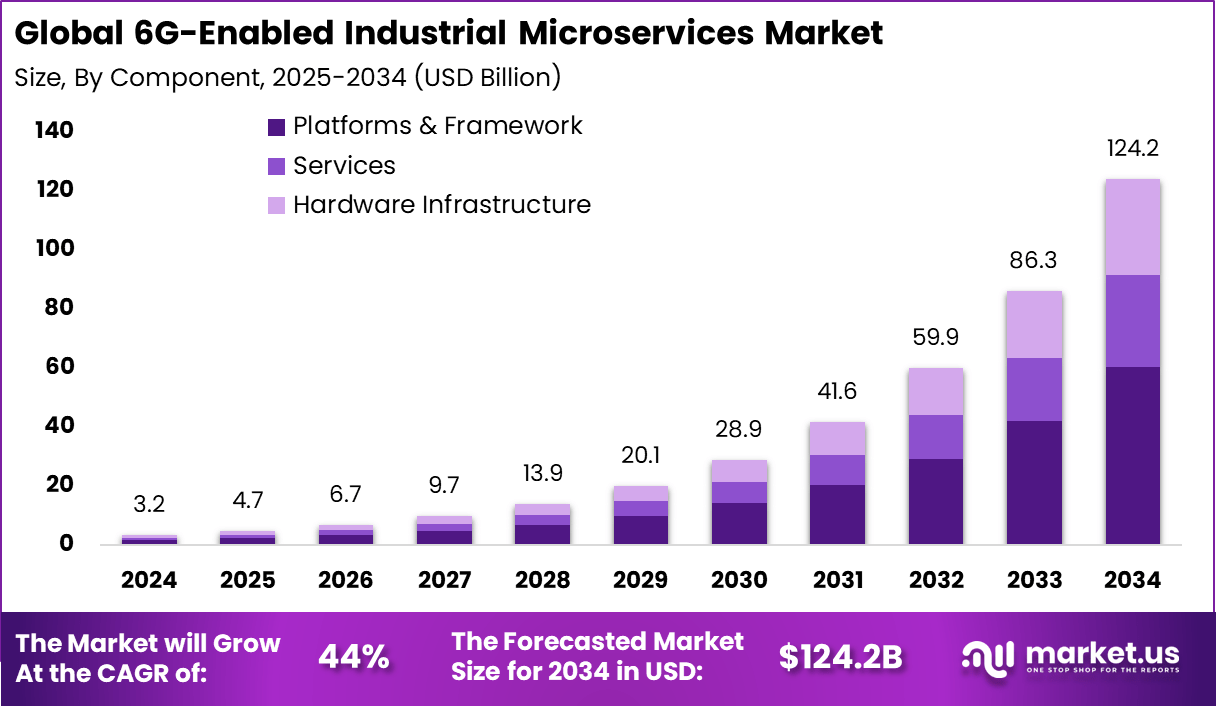

According to Market.us, The global 6G-Enabled Industrial Microservices Market earned USD 3.2 billion in 2024 and is expected to grow from USD 4.7 billion in 2025 to around USD 124.2 billion by 2034. This growth reflects a compound annual growth rate (CAGR) of 44% over the forecast period. In 2024, North America held a leading market position with a share of over 35.5%, generating revenue of USD 1.1 billion.

The 6G-Enabled Industrial Microservices Market embodies the fusion of next-generation 6G wireless connectivity with modular microservices architectures tailored for industrial applications. This integration empowers industries to break down complex software into scalable, independent services that can be deployed and updated swiftly. With 6G networks delivering ultra-low latency, terabit-level speeds, and AI-driven networking, these microservices support real-time automation, autonomous operations, and digital twin simulations.

Key Insight Summary

- Platforms & frameworks lead with 48.6%, acting as the core foundation for integrating industrial microservices into enterprise ecosystems.

- On-premise deployment holds 52.6%, showing organizations’ preference for secure, localized control of mission-critical operations.

- Large enterprises dominate with 70.5%, as they deploy 6G-powered microservices to manage complex, large-scale industrial systems.

- Smart manufacturing & industrial automation applications represent 32.6%, driven by Industry 4.0 initiatives and the need for real-time process optimization.

- North America contributes 35.5%, supported by strong R&D activities, early-stage pilot projects, and advanced technology infrastructure.

- The US market reached USD 0.97 billion and is expanding at a robust CAGR of 40.0%, underscoring its leadership in next-generation industrial connectivity and automation.

Analysts’ Viewpoint

Demand analysis reveals steady growth driven by industries’ increasing requirements for ultra-high-speed, dependable communication to run advanced manufacturing and logistics systems. The adoption of smart manufacturing initiatives and government funding, especially in North America and Asia-Pacific, accelerates this trend. Approximately 35% of the market share is held by North America due to mature cloud infrastructure and investments in 6G ecosystem development. Enterprises demand 6G-enabled microservices for faster decision-making and enhanced IoT edge intelligence, making it a strategic priority for nearly half of industrial organizations in these regions.

Technologies increasingly adopted alongside 6G in industrial microservices include massive MIMO and beamforming for efficient handling of dense networks, integrated satellite-terrestrial networks to extend coverage, and intelligent orchestration platforms to dynamically manage computing resources. These technologies collectively ensure seamless network performance, especially in environments crowded with connected devices. Industrial users also leverage AI and machine learning integrated within these systems for predictive analytics and automation, boosting productivity and asset utilization.

Key reasons for adopting 6G-enabled industrial microservices center on boosting productivity, reducing downtime, and enhancing operational agility. The ability to process and analyze large data streams in real time allows industries to anticipate equipment failures and optimize resource deployment immediately. Moreover, the digital twin technology enabled by these microservices facilitates simulation and testing scenarios ahead of production, minimizing errors and saving costs. Enhanced cybersecurity features offer peace of mind, especially for sectors like finance, healthcare, and defense where sensitive data protection is paramount.

Investment and Business Benefits

Investment opportunities in this market are substantial and growing, driven by the demands of advanced manufacturing and digital transformation. Capital inflows are directed toward infrastructure upgrades, AI integration services, cybersecurity solutions, and microservices orchestration technologies. Emerging economies in Asia-Pacific are fostering research and development through governmental incentives, while mature markets like North America benefit from streamlined regulations and public-private partnerships that support rapid deployment.

From a business benefits perspective, 6G-enabled microservices offer increased scalability, cost efficiency, and flexibility in deploying industrial applications. Businesses achieve greater operational resilience through decentralized computing at the edge, which reduces latency and bandwidth dependency on central cloud servers. Finally, firms gain competitive advantages by rapidly adapting to changing production requirements and customer demands, enabled by agile microservices architectures.

Emerging trends

Emerging trends in this market show a strong shift towards ultra-reliable, low-latency communication, and integrated AI services embedded directly into microservices architectures. The focus on building a highly intelligent network ecosystem that supports real-time processing and autonomous decision-making is gaining momentum. Latest industry insights indicate that by 2034, this market could expand at a CAGR of around 44%, driven by continuous innovations in AI, edge computing, and sensing technologies that are shaping future industrial ecosystems.

Growth Factors

The growth of 6G-enabled microservices is primarily fueled by the increasing demand for ultra-high-speed and low-latency connectivity in smart factories and automation systems. The drivers include the proliferation of IoT devices, the need for digital twins, and advancements in AI that enable predictive analytics and autonomous systems. Recent updates show that government-led investments – particularly in countries like India – are accelerating research initiatives and creating testbeds to support rapid deployment and commercialization of 6G technologies, further fueling industry confidence and adoption.

Driver

Integration of AI, Edge Computing, and 6G Connectivity

The 6G-enabled industrial microservices market is primarily driven by the convergence of AI, edge computing, and ultra-high-speed 6G connectivity. This integration supports the deployment of agile microservice architectures that enable real-time automation and distributed intelligence in industrial applications. By processing vast streams of data from Industrial IoT devices with minimal latency, industries can optimize operations, enhance predictive maintenance, and improve overall responsiveness.

Furthermore, AI-powered security measures such as quantum-resistant encryption and real-time threat detection enhance the protection of industrial networks from cyber threats. This combination allows for new applications like autonomous robotics and digital twins, which help industries increase productivity and reduce downtime while maintaining competitiveness in their digital transformation efforts.

Restraint

High Infrastructure and Deployment Costs

One significant restraint to the growth of 6G-enabled industrial microservices is the high cost of infrastructure deployment. Implementing 6G requires substantial investment in next-generation antennas, base stations, and edge computing resources to deliver ultrafast, low-latency connectivity. These up-front capital requirements can be a major barrier, especially for smaller companies and regions with limited financial capabilities.

The high financial burden can slow down market adoption as organizations carefully evaluate return on investment. Additionally, the cost challenge affects the ability to achieve widespread network coverage, which could limit growth in regions unable to afford such expensive infrastructure.

Opportunity

Growth in Industrial Automation and Smart Factories

The expanding industrial automation and smart factory sectors represent a compelling opportunity for 6G-enabled industrial microservices. With 6G’s ultra-reliable and low-latency communication, factories can implement complex automation systems requiring real-time data exchange and precise control. This supports networks of interconnected sensors, machines, and robots that improve productivity and reduce operational errors.

6G-based microservices enable real-time monitoring, AI-driven predictive maintenance, and digital twin simulations, allowing manufacturers to anticipate and address issues before they affect production. As smart factories grow, the demand for reliable, high-speed 6G communication networks will increase, offering significant market expansion potential.

Challenge

Managing Complex Heterogeneous Systems

A pressing challenge in deploying 6G-enabled industrial microservices lies in managing the complexity of diverse devices and systems within industrial settings. Industrial IoT ecosystems include a wide array of sensors, machines, edge devices, and cloud services that must seamlessly interoperate to maintain performance and quality of service.

Resource constraints on edge devices, such as limited processing power and storage, complicate microservices deployment. Additionally, securing these networks from evolving cyber threats while preserving real-time responsiveness requires robust frameworks and continuous optimization. Overcoming these integration and management difficulties is crucial to unlocking the full benefits of 6G-enabled industrial microservices.

Key Market Segments

By Component

- Platforms & Framework

- Services

- Hardware Infrastructure

By Deployment Model

- On-Premise

- Cloud-Based

- Hybrid / Edge-Cloud Integration

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application

- Smart Manufacturing & Industrial Automation

- Predictive Maintenance

- Supply Chain & Logistics Optimization

- Robotics & Autonomous Systems

- Industrial IoT & Edge Intelligence

- Digital Twin & Simulation

- Cybersecurity & Risk Management

- Others

Top Key Players in the Market

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- NEC Corporation

- ZTE Corporation

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google Cloud (Alphabet Inc.)

- Siemens AG

- General Electric (GE Digital)

- Schneider Electric SE

- Rockwell Automation, Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Fujitsu Ltd.

- Capgemini SE

- Other Major Players

Source of Information – https://market.us/report/6g-enabled-industrial-microservices-market/