Indroduction

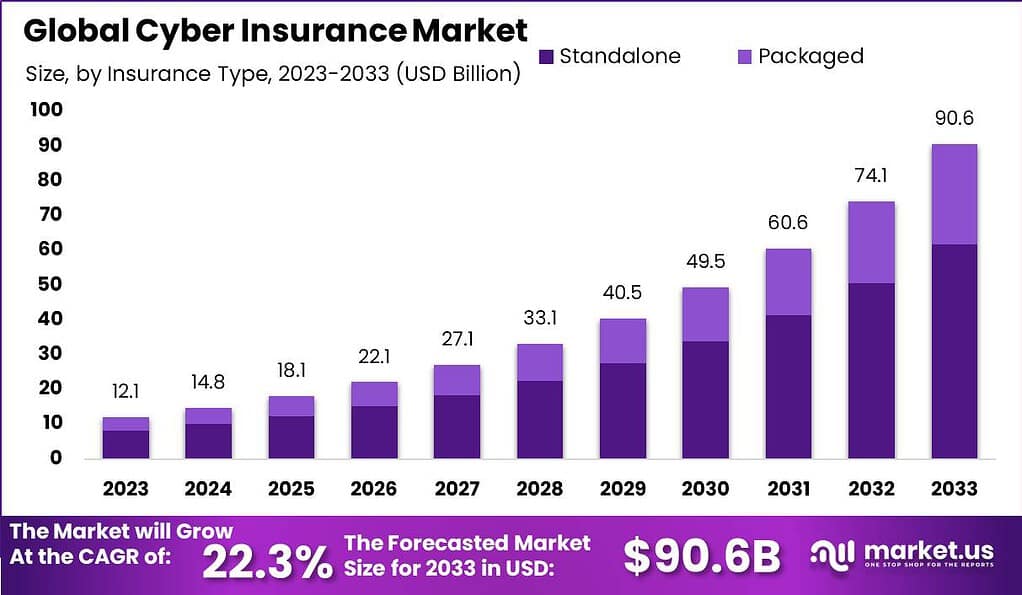

The Global Cyber Insurance Market is projected to grow from USD 12.1 billion in 2023 to USD 90.6 billion by 2033, at a CAGR of 22.3%, driven by rising cyber threats like ransomware (ransom payments doubled to $1.1 billion in 2023) and regulatory pressures such as GDPR and CCPA. Standalone policies dominated insurance types at over 68.2% share in 2023 for specialized coverage against breaches and theft; third-party coverage led at 62.1% to protect against external claims, legal fees, and IP theft.

Large enterprises captured 72.4% in enterprise size due to high data exposure and global operations, while BFSI topped verticals at 28.3% handling sensitive financial data amid strict compliance needs.North America held 37.6% revenue share (USD 4.5 billion) in 2023 from frequent attacks on tech/finance sectors; 87% of decision-makers worry about inadequate protection, with manufacturing hit hardest by ransomware (67% incidence).

The Cyber Insurance market is picking up speed as companies face more frequent and costly cyber attacks that threaten their operations and finances. This coverage helps businesses recover from data breaches, ransomware demands, and business disruptions by paying for response costs, legal fees, and lost income. With digital tools everywhere – from cloud storage to remote work – firms can’t afford to ignore the financial hit from cyber incidents, making insurance a practical safety net alongside firewalls and training.

Rising cyber threats like ransomware and phishing top the list of drivers, pushing about 45% of claims from business interruptions alone. Tougher rules on data protection, such as quick breach reporting, force companies to buy coverage or face huge fines. The boom in cloud services and IoT gadgets widens the attack surface, while growing awareness of hidden risks in supply chains adds urgency. Small businesses, often overlooked before, now seek simple policies to match their budgets.

Challenges include evolving threats complicating risk pricing, high claim costs, and SME adoption barriers, but trends like AI risk assessment, tailored policies, and COTS integration offer growth; key players include AIG, Chubb, and Zurich via acquisitions like Travelers’ $435 million Corvus buy in January 2024.

Key Statistics

- According to Spyhunter, 77% of companies are inadequately prepared for a cyber attack.

- Small businesses with fewer than 100 employees face a 350% higher risk of social engineering attacks.

- 95% of cybersecurity issues result from human error, making employee mistakes a major vulnerability.

- Phishing accounts for 83% of reported cyber incidents, showing its dominance across attack types.

- Effective training reduces human-error-related liability claims, improving organizational resilience.

- Having an incident response plan lowers the financial damage caused by cyber attacks, strengthening recovery.

- Small businesses remain primary targets, generating 56% of cyber insurance claims.

- Based on Heimdal Security, cyber insurance claims declined by around 50% in 2025.

- The average value of a cyber insurance claim reached $115,000 in 2025.

- Ransomware accounted for 60% of large cyber insurance claims, remaining the leading cost driver.

- Manufacturing firms filed 33% of all cyber insurance claims, making them the most affected sector.

- The cyber insurance market reached $20.56 billion in 2025, reflecting continued growth.

- Cyber insurance adoption increased to 62% of firms in 2025, rising from 49% in 2024.

Top Market Takeaways

- The standalone insurance type segment dominated with over 68.2% market share in 2023, reflecting strong demand for specialized cyber coverage to address complex cyber threats across industries.

- Third-party coverage held the largest share at 62.1%, indicating the importance of liability protection for businesses against external claims, legal fees, and intellectual property theft related to data breaches.

- Large enterprises accounted for more than 72.4% of the market share in 2023, driven by their extensive exposure to cyber risks and regulatory complexity; they invest heavily in tailored cyber insurance solutions to safeguard global operations.

- The BFSI vertical led with 28.3% market share, driven by the sector’s high-value financial data, increasing cyberattacks, and stringent regulatory demands for data protection, making cyber insurance critical for risk management.

- North America as a region captured a dominant revenue share of 37.6% (approximately USD 4.5 billion in 2023), reflecting high cyberattack prevalence on technology and financial sectors, along with stringent regulatory compliance requirements.

Market Facts

- Ransomware tops the list of threats, driving most big claims as attackers target supply chains and smaller firms with smarter tactics.

- Businesses with cyber coverage build stronger defenses, widening the gap over uninsured ones through better detection and quick response steps.

- North America still leads in coverage, but Europe and Asia ramp up fast due to tougher data rules and rising attack reports.

- Strict privacy laws like GDPR push more companies to buy policies that cover fines, breaches, and downtime from hacks.

- Market stays competitive with steady rates and plenty of options, though new AI risks and social engineering keep insurers on alert.

Key Market Segment

By Insurance Type

- Standalone

- Packaged

By Coverage Type

- First-Party Coverage

- Third-Party Coverage

By Enterprise Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI

- IT & Telecommunications

- Healthcare

- Retail & E-Commerce

- Government

- Other Industry Verticals

Top Key Players

- American International Group, Inc.

- Aon PLC

- The Chubb Corporation

- Zurich Insurance Group Ltd

- Allianz SE

- AXIS Capital Holdings Limited

- Beazley PLC

- Lockton Companies, Inc.

- Munich Re Group

- The Travelers Companies, Inc.

- CNA Financial Corporation

- Liberty Mutual Group

- Other Key Players

Future Outlook

The cyber insurance market is poised for explosive growth through 2032, reaching over $100 billion globally, driven by escalating ransomware attacks, AI-enhanced threats, and stringent regulations like GDPR and CCPA that mandate breach reporting and risk mitigation. Premiums are stabilizing amid ample capacity, but demand surges from digital transformation, cloud adoption, and supply chain vulnerabilities, with insurers bundling proactive services like audits and AI risk assessments. Emerging markets like Asia-Pacific show the fastest expansion as businesses prioritize resilience against sophisticated cyber risks.

Opportunities

- Expansion into SMEs and emerging markets with affordable, tailored policies amid rising digital adoption and regulatory mandates.

- AI and ML integration for dynamic underwriting, predictive risk modeling, and automated claims to enhance pricing accuracy.

- Bundling cyber coverage with proactive services like security audits, training, and breach response for comprehensive resilience.

- Coverage for evolving risks such as supply chain attacks, cloud outages, and AI-related liabilities in enterprise ecosystems.

- Penetration into personal lines for identity theft and online fraud protection as consumer awareness grows.

Challenges

- Underwriting complex, rapidly evolving risks like ransomware and AI-driven attacks with limited historical data for accurate pricing.

- Balancing premium affordability for SMEs while maintaining profitability amid high claim frequency and severity.

- Regulatory compliance gaps, including data privacy laws that complicate policy design and increase fines exposure.

- Shortage of specialized cyber underwriters and expertise to assess third-party vendor risks effectively.

- Silent cyber exposure in traditional policies leading to unexpected claims and accumulation risks from widespread attacks.

Conclusion

The cyber insurance market continues to expand amid escalating cyber threats like ransomware and data breaches, with standalone policies, third-party coverage, large enterprises, and BFSI sectors leading due to specialized needs for liability protection and regulatory compliance.North America maintains regional dominance through proactive risk strategies and stringent laws like CCPA, while trends such as AI-driven risk assessments, tailored solutions, and SME adoption signal broader resilience-building across industries.Despite challenges in risk pricing and standardization, innovations in preventive services and parametric coverage position cyber insurance as vital for digital transformation, enabling businesses to mitigate financial and reputational impacts effectively.

Read More – https://market.us/report/cyber-insurance-market/