Introduction

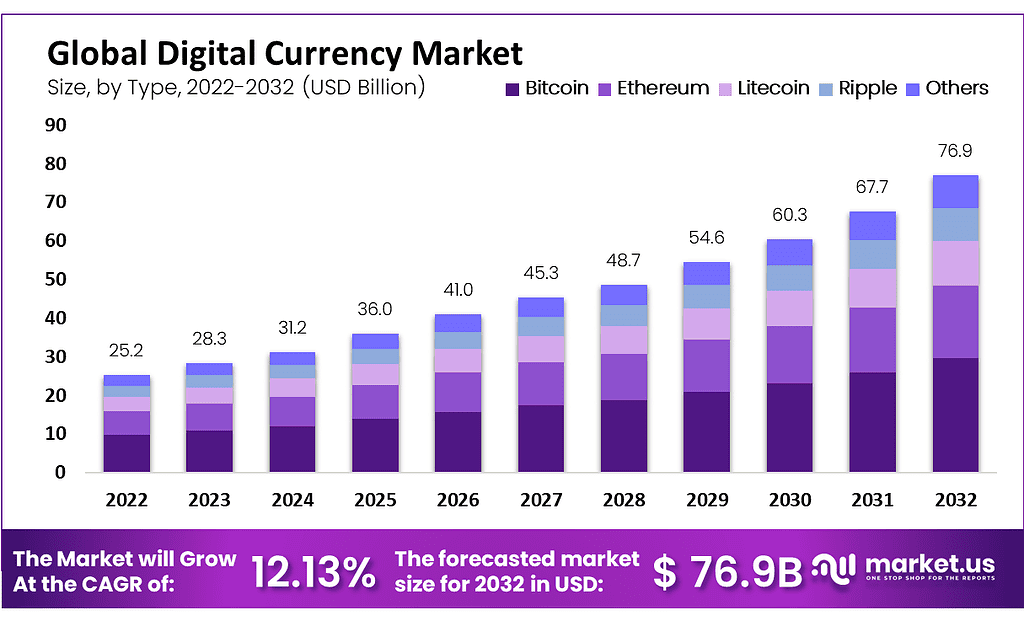

The Global Digital Currency Market stood at USD 28.3 billion in 2023, on track for USD 76.9 billion by 2032 with a 12.13% CAGR from 2023-2032. Bitcoin leads types, hardware tops components via ASICs for mining, while trading dominates end-users and Asia Pacific claims largest regional revenue. Growth ties to blockchain security, investor surge, and Ethereum smart contracts, despite volatility. Decentralized ledgers enable crypto like Bitcoin and Ethereum, with mining validating transactions and software handling exchanges. Hardware efficiency cuts energy use, fueling adoption in e-commerce and remittances amid regulatory shifts.

Digital Currency Market involves digital tokens and assets like cryptocurrencies that enable direct peer-to-peer payments through online systems without traditional banks. These currencies rely on technologies such as blockchain for secure, transparent transactions recorded on decentralized ledgers. People and businesses use them for everyday payments, investments, and cross-border transfers, making finance more accessible in many parts of the world.

Over time, digital currencies have grown from niche experiments to tools used by millions daily, with over 420 million people worldwide holding some form as of late 2025. They offer a way to store value and send money quickly, often bypassing high fees from conventional systems. This shift helps include those without bank accounts, especially in developing regions where mobile access is common.

Rising interest in decentralized finance pushes the digital currency market forward, as people seek alternatives to slow and costly traditional banking. Blockchain advancements make transactions faster and safer, drawing in users who value control over their funds. Global events like economic uncertainty boost demand, with more than 130 countries exploring their own digital versions to modernize payments.

Top Key Takeaways

- Market grows from USD 28.3 billion (2023) to USD 76.9 billion (2032) at 12.13% CAGR.

- Bitcoin generates largest type revenue with fastest growth via ETFs.

- Hardware dominates components; ASICs lead hardware on low-energy mining.

- Mining holds top process revenue; trading rules end-users.

- Asia Pacific takes highest regional share; North America rises on NFTs.

- Exchange software tops software segments for crypto-to-fiat conversions.

- Wallets project highest software CAGR with mobile tools for Ethereum and Bitcoin trades.

- Retail & e-commerce end-users eye fastest rise as payment methods spread.

Key Statistics

- According to forbes, between June 2023 and January 2024, women in India investing in Bitcoin or other cryptocurrencies increased by 300%, showing rapid growth in female participation.

- During this period, roughly one in five customers was female, mostly within the 18 to 34 age group, although regulatory changes make it difficult to identify the exact number of affected users.

- A Mudrex survey of 8,976 Indian participants reported that 69% were male, 29% were female, and 2% did not disclose their gender, with an overall 3:1 male-to-female ratio among investors.

- The survey showed that 49.5% of respondents earned below INR 5 lakh, and 58.5% had invested in both equities and crypto assets.

- Based on scoop.market.us, by the end of 2021 nearly 300 million people worldwide owned cryptocurrency, showing strong global adoption of digital assets.

- The global cryptocurrency market recorded a capitalization of £621 billion in 2022, reflecting sustained investor activity.

- Market projections indicate a 12.5% compound annual growth rate for the global cryptocurrency sector through 2030.

- A survey by Forbes Advisor shows that 65% of the investing public has invested in cryptocurrencies, pointing to rising interest in this asset class.

- In the UK, a separate Forbes Advisor survey reports that 9% of individuals currently hold cryptocurrency investments.

- Research from the Financial Conduct Authority supports this, noting that 4.97 million people in the UK, close to 10% of the population, own some form of cryptocurrency.

- Forecasts suggest that the UK’s cryptocurrency user base will expand to 22.23 million users by 2027.

- Age demographics reveal that individuals aged 18 to 34 are twice as likely to own cryptocurrency compared to those aged 35 to 54, highlighting a generational gap in adoption.

- These trends illustrate the rising relevance of cryptocurrencies across global and country specific markets.

Key Market Segment

Type Segments

- Bitcoin

- Bitcoin Cash

- Ethereum

- Litecoin

- Ripple

- Other Types

Component Segments

- Hardware

- Software

Hardware Segments

- Central Processing Unit

- Graphics Processing Unit

- Application-Specific Integrated Circuit

- Field Programmable Gate Array

Software Segments

- Mining Software

- Exchange Software

- Wallet

- Payment

- Other Software

Process Segments

- Mining

- Transaction

End-User Segments

- Banking

- Gaming

- Government

- Healthcare

- Trading

- Retail & E-commerce

- Other end-users

Top Key Players

- Advanced Micro Devices, Inc.

- Finance

- Bit Fury Group Limited

- Bit Go, Inc.

- Bit Main Technologies Holding Company

- Intel Corporation

- NVIDIA Corporation

- Ripple

- Xapo Holdings Limited

- Xilinx, Inc.

Future Outlook

Digital currencies stand poised for broader integration into global finance, driven by blockchain advancements and rising acceptance in trading, e-commerce, and remittances. Innovations in efficient mining hardware and user-friendly wallets will accelerate adoption, particularly in regions with strong manufacturing bases like Asia Pacific. Ethereum’s smart contracts and Bitcoin’s stability as a store of value will bridge traditional and decentralized systems, while regulatory clarity from central banks fosters trust. E-commerce partnerships and mobile transaction tools promise everyday use, countering volatility with stablecoins and NFTs for new asset classes. Overall, the sector eyes mainstream financial inclusion amid evolving tech and policy landscapes.

Opportunities

- Emerging market tech upgrades spur hardware and software demand.

- E-commerce alliances expand retail payment adoption.

- Mobile wallet innovations fuel trading accessibility.

- Bitcoin ETFs attract institutional global investments.

- Energy-efficient ASICs lower mining entry barriers.

Challenges

- Price volatility undermines investor confidence.

- Cyberattacks expose transaction vulnerabilities.

- Regulatory voids enable misuse and fraud.

- Decentralization resists central controls.

- Mining’s high energy demands inflate costs.

Recent Development

- November, 2025, Advanced Micro Devices, Inc. unveiled a strategy to expand AI and compute leadership supporting cryptocurrency mining through high-performance GPUs

- November, 2025, Bitfury Group Limited launched a $1 billion initiative to advance ethical blockchain infrastructure and AI computing

Conclusion

Digital currency markets continue to evolve rapidly, propelled by blockchain’s decentralized security and the rising appeal of assets like Bitcoin and Ethereum among investors and businesses seeking alternatives to traditional finance. Adoption surges in trading, e-commerce, and remittances, with hardware innovations like efficient ASICs supporting mining dominance and software advancements enabling seamless wallets and exchanges, particularly in Asia Pacific’s leading revenue share. While regulatory uncertainties and security vulnerabilities present ongoing hurdles, clearer frameworks and central bank digital currencies promise broader integration into everyday transactions, fostering financial inclusion for unbanked populations worldwide. Emerging trends in smart contracts, NFTs, and stablecoins bridge private and public systems, positioning the sector for sustained expansion as technological efficiencies and consumer familiarity outweigh volatility risks, ultimately reshaping global payment landscapes toward greater transparency and accessibility.

Read More – https://market.us/report/digital-currency-market/