Introduction

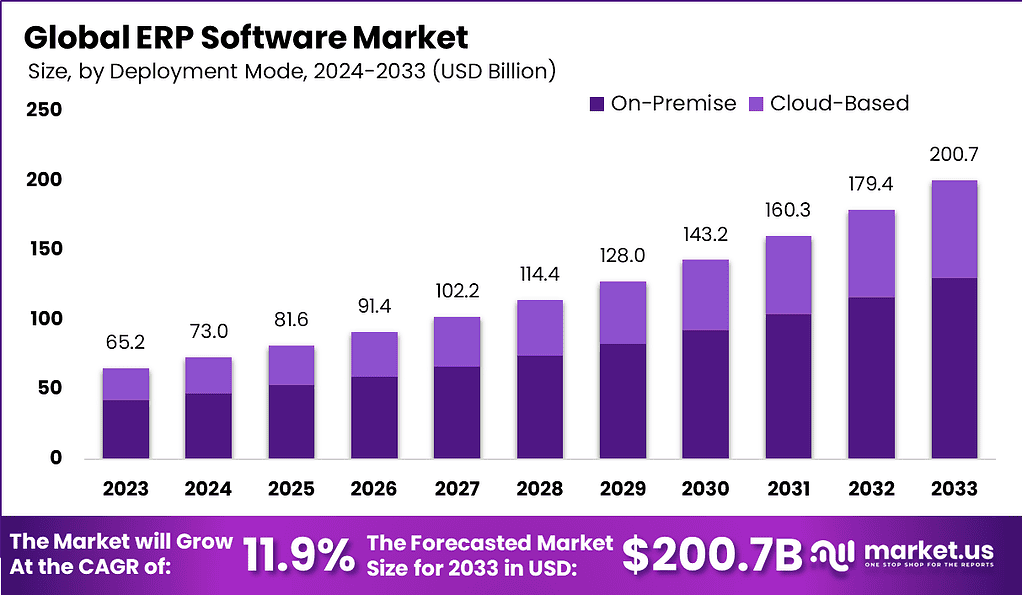

The Global ERP Software Market reached USD 65.2 billion in 2023, set to expand to USD 200.7 billion by 2033 at a 11.9% CAGR from 2024-2033. ERP Software Market centers on integrated software systems that help businesses manage core operations like finance, supply chain, human resources, and customer relations from a single platform. These systems provide a unified view of data across departments, enabling better decision-making and streamlined workflows. Modern ERP solutions increasingly incorporate cloud deployment and intelligent technologies to meet evolving business needs.

A key driving factor is the demand for operational efficiency through data integration. ERP software connects diverse business functions in real time, reducing manual efforts and errors, which translates into significant cost savings and productivity gains. The need for scalable solutions that support remote work and digital transformation also fuels growth, with cloud-based ERPs offering flexible resource use and accessibility for businesses of all sizes.

Demand analysis shows strong interest from industries requiring complex coordination such as manufacturing, retail, and healthcare. These sectors use ERP to optimize inventory, production, and compliance processes. Businesses increasingly seek industry-specific ERPs tailored to their unique workflows, further driving adoption. Both small enterprises and large corporations benefit from easier data management and automated reporting, supporting ever-increasing regulatory demands.

Top Market Takeaways

- On-premise leads deployment at 64.8% share for control and security.

- Finance tops functions with 29.1% revenue from ledger and compliance tools.

- Large enterprises claim 67.3% due to complex operations and resources.

- Manufacturing holds 24.5% industry share via production and supply chain optimization.

- North America drives 39.7% global revenue at USD 25.9 billion in 2023.

- 95% organizations see process improvements; 80% enable new apps.

Key Statistics

- According to softwaresuggest, about 55%-75% of ERP projects fail to meet their intended objectives, and this high failure rate is mainly linked to inadequate testing quality and insufficient business process re-engineering during implementation.

- It is reported that 64% of companies prefer SaaS ERP solutions, while 21% look for fully cloud-based deployments and 15% still opt for on-premise systems, showing how cloud adoption has reshaped ERP decision making.

- Interest in cloud ERP has grown sharply, rising from 4% in 2013 to 42% in 2022, which highlights how organizations increasingly rely on cloud infrastructure for core business systems.

- Only 3% of businesses use ERP systems out of the box, and the remaining companies require some level of customization, with 33%-48% requesting moderate customization and 10%-19% seeking highly personalized ERP configurations.

- Around 95% of organizations improve their processes after implementing ERP, supported by evidence that ERP systems help achieve 30% cost savings in purchasing and inventory control and deliver an 11% average reduction in inventory costs.

- Only 9% of companies report no ROI benefits after implementation, showing that most businesses gain measurable operational improvements from ERP adoption.

- Based on data from FinancesOnline and PR Newswire, ERP adoption is most common in manufacturing (21%), followed by banking and financial services (16%), and telecom (13%), while more than 55% of retail companies plan hybrid ERP deployment strategies.

- Surveys from Panorama Consulting Group indicate that 31.6% of ERP team members are very satisfied with their systems, although 21.1% express dissatisfaction, reflecting mixed user experience outcomes across industries.

- Research by Technology Evaluation Centers shows that nearly half of companies are implementing or upgrading ERP systems, demonstrating strong long-term demand.

- Deloitte reports that 69% of private organizations accelerated digital transformation during the pandemic, including ERP adoption, and 43% are planning digital transformation initiatives within the next year.

- Additional Deloitte findings reveal that 25% of finance leaders prioritize capability fit when selecting ERP software, while extensibility, user experience, and total cost of ownership each influence 15% of decision makers.

Key Market Segment

Deployment Mode Segments

- Cloud

- On-premises

Business Function Segments

- Finance

- Supply Chain

- HR

- Other Functions

Enterprise Size Segments

- Small Enterprises

- Large Enterprises

- Medium Enterprises

End-Use Industry Segments

- Retail

- Aerospace & Defense

- BFSI

- Manufacturing & Services

- Government

- Telecom

- Other Industry Verticals

Top Key Players

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- IBM Corporation

- Sage Group plc

- Infor

- Unit4

- Epicor Software Corporation

- Workday Inc.

- Ramco Systems Limited

- Plex Systems Inc.

- IFS AB

- Other Key Players

Future Outlook

The ERP software market is set for continuous growth, driven by digital transformation initiatives across industries aiming to streamline operations, enhance data integration, and support real-time decision-making. Cloud-based ERP solutions are gaining traction due to their scalability, cost-effectiveness, and ease of deployment. AI, machine learning, and IoT integration are reshaping ERP capabilities by enabling predictive analytics, automation, and industry-specific customization. The market is expanding rapidly in emerging economies with growing manufacturing and service sectors, though challenges remain in implementation complexity and user adoption.

Opportunities

- Growing demand for cloud-based ERP solutions offering flexibility and remote access for distributed workforces.

- Integration of AI and advanced analytics to provide real-time insights and automate complex business processes.

- Increasing preference for industry-specific ERP modules catering to unique sector requirements like manufacturing, retail, and healthcare.

- Expansion in emerging markets driven by rising digitization and the need for efficient supply chain management.

- Development of user-friendly interfaces and mobile ERP applications enhancing accessibility and adoption.

Challenges

- High cost and complexity of ERP implementation, especially for small and medium-sized enterprises.

- Resistance to change and lack of sufficient user training disrupting smooth adoption and utilization.

- Integration difficulties with existing legacy systems causing data silos and workflow disruptions.

- Scalability issues with some ERP solutions failing to adapt to growing business needs quickly.

- Data security and compliance challenges in managing sensitive information across diverse geographies.

Recent Development

- October, 2023, Accenture partnered with SAP SE for cloud ERP and generative AI acceleration.

- May, 2023, Fortis Payment Systems allied with Sage for integrated ERP payments.

- March, 2023, SAP launched cloud ERP for mid-sized firms.

Conclusion

ERP software’s evolution underscores its pivotal role in unifying enterprise operations, with on-premise dominance and finance functions steering efficiency amid digital transformation waves led by North America’s mature ecosystem and giants like SAP and Oracle. Large enterprises and manufacturing sectors anchor adoption through scalable integrations that slash inventory costs and boost real-time compliance, while cloud shifts and AI enhancements promise agility for SMEs and global supply chains. Despite integration hurdles with legacy systems, the sector’s high success rates in process optimization position it to empower data-driven strategies across retail, BFSI, and beyond, fostering resilience in volatile economic landscapes as remote access and predictive analytics redefine business agility worldwide.

Read More – https://market.us/report/erp-software-market/