Digital Signage Market Statistics and Facts

Updated · Dec 08, 2025

WHAT WE HAVE ON THIS PAGE

Introduction

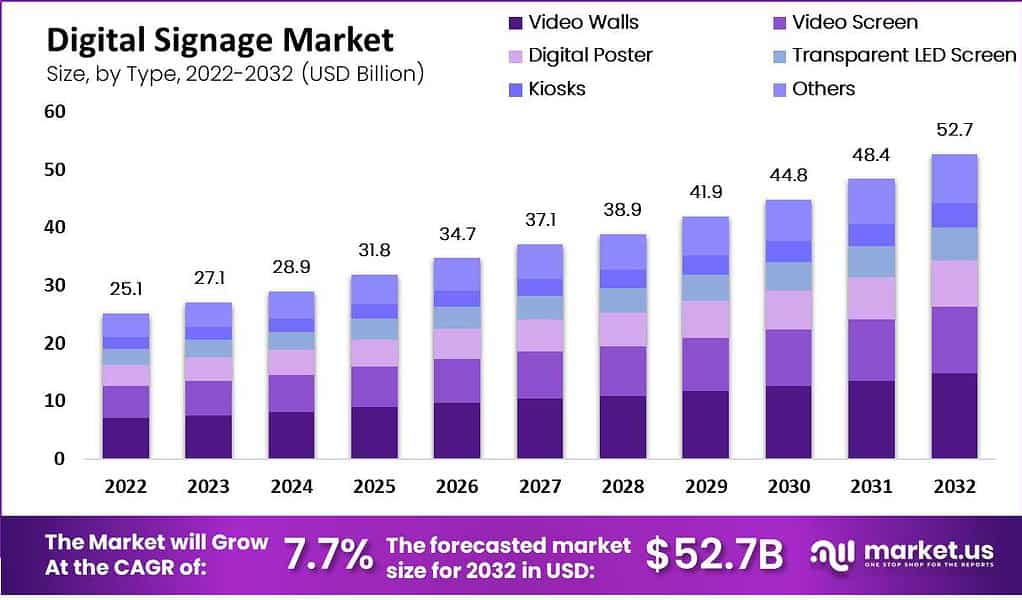

The Global Digital Signage Market, encompassing video screens, walls, posters, and kiosks with hardware, software, and services using LED/LCD/projection tech, was valued at USD 27.1 billion in 2023 and is projected to reach USD 52.7 billion by 2032 at a 7.7% CAGR, fueled by retail demand, urbanization, and digitalization. Video screens led type share at 21% in 2022, hardware dominated components at over 57%, and retail topped applications at more than 20%, with North America leading regionally while Asia-Pacific grows rapidly. Restraints include online ad shifts and COVID impacts, but trends like AI integration and biometrics boost opportunities.

Key drivers come from shops wanting sharper 4K/8K screens to pull in buyers, plus cloud tools that let chains update messages from afar without hassle. Retail boom and smart city projects add push, as do cheaper hardware and IoT links for personalized ads based on crowd flow. Falling costs on displays help smaller spots jump in too.

Demand holds strong in retail and hospitality where firms chase better customer pull amid online competition, with hardware leading sales over software. Healthcare and transport pick up fast for wayfinding and alerts, though high setup fees slow some adopters. Growth looks solid through the decade on better tech and urban builds.

Top Key Takeaways

- Market grows from USD 27.1 billion (2023) to USD 52.7 billion (2032) at 7.7% CAGR.

- Video screen segment held 21% share in 2022.

- Hardware components captured over 57% revenue share in 2022.

- Retail application led with more than 20% global revenue in 2022.

Key Statistics

- According to llcbuddy, in the last month, 70% of Americans reported seeing at least one digital display.

- 90% of all information sent to the human brain is visual in nature.

- Nearly 30% of the brain’s cortex is dedicated to processing visual data.

- The human brain processes visual information 60,000 times faster than text, while only 8% of the brain processes touch and 3% processes sound.

- About 15% of users operate between 15 and 99 digital displays, compared to 33% of users who manage 1 to 24 screens.

- 52.9% of religious institutions use projectors and digital signage systems to deliver sermons.

- 64% of digital signage users identify higher consumer engagement as the main benefit of the technology.

- 75% of patients and caregivers who view hospital messages on digital signage say the content improves their hospital experience and provides useful health information.

- 84% of merchants report that digital signage improves brand recognition compared to traditional advertising channels.

- 97% of students prefer receiving information from digital sources rather than non-digital formats.

- Among educators, 53% want to increase the use of digital resources, while 44% prefer to continue using them at current levels.

- Based on wifitalents, 70% of shoppers have made a purchase after being influenced by digital signage advertising.

- 60% of customers find digital signage more engaging than traditional static signs.

- Nearly 80% of consumers have entered a store after seeing a digital signage advertisement.

- Around 65% of consumers have interacted directly with digital signage displays.

- 72% of audiences consider digital signage more attention-grabbing than traditional advertising methods.

- Retail stores that use digital signage have recorded a 31% increase in sales.

- Digital signage adoption can improve customer experience and satisfaction by up to 50%.

- 55% of consumers use their smartphones while viewing digital signage, enabling dual-screen engagement.

- Digital signage displays can increase customer dwell time by as much as 15%.

- 81% of customers report that their in-store purchase decisions are influenced by digital signage content.

Key Market Segment

By Type

- Video Screen

- Video Walls

- Digital Poster

- Transparent LED Screen

- Kiosks

- Others

By Components

- Software

- Hardware

- Service

By Technology

- LED

- LCD

- Projection

Top Key Players

- Samsung Electronics

- Daktronics

- Exceptional 3D

- LG Electronics

- Panasonic Corporation

- Sony Corporation

- Leyard Optoelectronic Co., Ltd.

- Scala

- E Ink Holdings Inc.

- NEC Corporation

- Deepsky Corporation Ltd.

- Omnivex Corporation

- Others

Recent Development

- February, 2025, Leyard showcased Micro LED at ISE.

- June, 2025, Samsung launched Color E-Paper signage. February 2025, company showcased AI signage at ISE. September 2025, Samsung expanded Toyota partnership with signage units.

- July, 2025, Daktronics announced Grass Valley partnership for LED signage.

Conclusion

Digital signage enables dynamic advertising in retail for personalized promotions, real-time info in airports and stations, customer engagement via interactive kiosks in hospitality, financial news displays in banking to cut wait times, and educational content in institutions. These systems leverage remote CMS for efficiency. In summary, robust 7.7% growth underscores its role in modern advertising amid urbanization, though online competition challenges persist; focus on APAC and AI features positions leaders like Samsung and LG strongly.

Read More – https://market.us/report/digital-signage-market/

Sources

Aruna is an editor at Techno Trenz and knows a lot about SEO. She is good at writing and editing articles that readers find helpful and interesting. Aruna also makes charts and graphs for the articles to make them easier to understand. Her work helps Techno Trenz reach many people and share valuable information.