Introduction

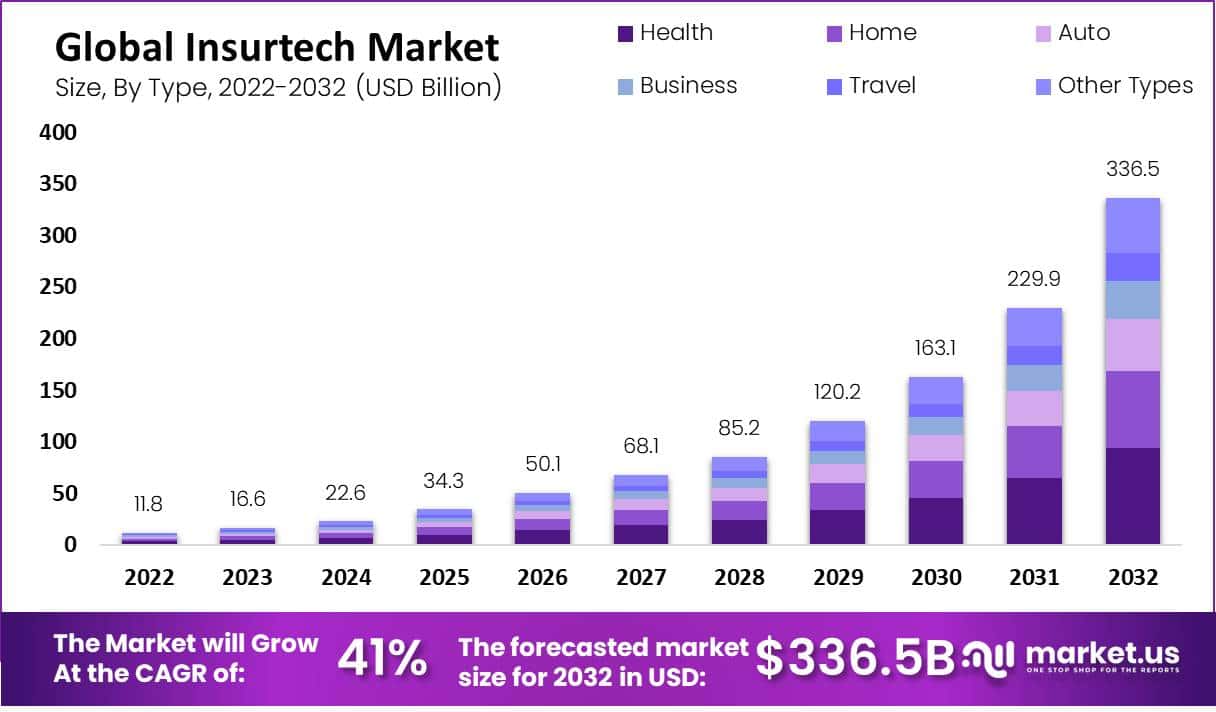

The Global Insurtech Market was valued at USD 16.6 billion in 2023 and is expected to reach USD 336.5 billion by 2032, growing at a CAGR of 41.0% as digital tools like AI, blockchain, IoT, and cloud platforms transform insurance underwriting, claims, and customer service. The insurtech market refers to the use of digital technologies to improve how insurance products are designed, sold, and serviced.

Insurers are increasingly adopting software platforms, data analytics, and automation to modernize traditional insurance processes. This shift is helping companies reduce manual work, improve accuracy, and respond faster to customer needs. As a result, insurtech is becoming an important part of the overall insurance ecosystem.

Insurtech solutions are being applied across the insurance value chain, including underwriting, policy management, claims handling, and customer engagement. Technologies such as artificial intelligence, cloud computing, and application programming interfaces are enabling insurers to process large volumes of data in real time.

These tools support better risk assessment and more personalized insurance offerings. Adoption is being observed across life, health, property, and specialty insurance segments. The market is also influenced by changing customer behavior and regulatory expectations. Policyholders increasingly prefer digital interactions and clear policy terms, which is encouraging insurers to simplify products and improve transparency.

At the same time, regulators are supporting digital transformation while focusing on data protection and compliance. Together, these factors are supporting steady expansion of the insurtech market across developed and emerging economies.

Top Key Takeaways

- Cloud computing holds over 22.8% share by technology, offering scalability and fast deployment for insurers.

- Managed services account for more than 36% of services revenue, providing expertise to help insurers adopt new models.

- Health insurance leads by type, driven by demand for digital platforms connecting providers, carriers, and customers.

- North America had 33.6% of global revenue, while Asia Pacific is the fastest-growing region due to smartphone growth and emerging economies.

Key Statistics

- According to gitnux.org, quarterly InsurTech funding declined by 57% quarter over quarter in the first quarter of 2022, reflecting a slowdown in investment.

- About 74% of consumers are willing to receive computer generated insurance advice, showing rising acceptance of digital guidance.

- Nearly 50% of customers are open to sharing personal data in return for lower insurance premiums.

- Around 41% of policyholders are likely to switch insurers if digital capabilities are weak or outdated.

- AI can automate up to 50% of insurance claims handling, helping insurers speed up processing and reduce manual work.

- Blockchain technology can reduce administrative costs in insurance by up to 30%, mainly by cutting paperwork and manual checks.

- Automation can lower the cost of a claims journey by as much as 30%, improving operational efficiency.

- AI based fraud detection can improve detection rates by around 60% compared with traditional manual reviews.

- Based on coinlaw.io, claims processing times on insurtech platforms are reduced by up to 65% due to the use of automation and AI.

- User satisfaction with insurtech models is 25% higher than with traditional insurers, showing strong preference for digital-first services.

- Paperless operations in insurtech companies help cut administrative costs by nearly 60%, while also improving efficiency and reducing paperwork.

- According to internetnewstimes, Digital banking is experiencing rapid global expansion as consumers shift toward faster, more convenient financial services. In 2025, more than 3.6 billion people are expected to use online banking, reflecting strong demand for mobile access, instant payments, and AI-enhanced financial tools.

Top Driving Factors

Growth in the insurtech market is being driven by rising risk complexity and the need for faster and more accurate insurance operations. Cyber threats, climate volatility, and health-related uncertainties are increasing loss frequency and severity, which is pushing insurers to adopt advanced analytics and real-time risk assessment tools.

Digital underwriting, automated claims processing, and AI-led fraud detection are being used to improve efficiency and reduce human error. In addition, customer expectations for seamless digital experiences are encouraging insurers to modernize legacy systems and expand digital distribution channels.

Demand Analysis

Demand for insurtech solutions is being shaped by policyholders seeking faster onboarding, transparent pricing, and quicker claim settlements. Small and mid-sized enterprises are showing stronger interest in flexible and usage-based insurance products that align better with their operational risks.

Insurers are also increasing demand for platforms that support automation and data integration, as operational cost control remains a priority. Overall demand is being reinforced by the need to manage emerging risks more effectively while maintaining service quality and regulatory compliance.

Use Cases

Digital Policy Distribution

Insurance products are distributed through mobile apps, websites, and partner platforms. This improves reach and reduces dependency on physical agents. Faster onboarding increases customer acquisition efficiency.

AI-Based Risk Assessment

Machine learning models are used to assess risk using real-time and historical data. Underwriting decisions become more accurate and consistent. This supports fair pricing and better portfolio management.

Automated Claims Processing

Claims are processed using AI, image recognition, and workflow automation. Settlement time is reduced from weeks to hours or days. Fraud detection accuracy is also improved.

Usage-Based Insurance

Premiums are calculated based on actual usage data such as driving behavior or device activity. This model improves pricing transparency. It also encourages safer customer behavior.

Fraud Detection and Prevention

Advanced analytics are applied to detect abnormal patterns in claims and policies. Suspicious activities are flagged early. This reduces financial losses and operational risks.

Customer Engagement and Support

Chatbots and virtual assistants handle policy queries and service requests. Customer support becomes available around the clock. Operational costs are reduced while service quality improves.

Personalized Insurance Products

Data analytics enables customized coverage based on individual needs. Customers receive relevant policy recommendations. This improves satisfaction and retention.

Blockchain-Based Policy Management

Blockchain is used for secure policy records and smart contracts. Transparency and trust are enhanced across stakeholders. Manual reconciliation efforts are reduced.

Health and Wellness Monitoring

Wearables and health apps are integrated with insurance platforms. Real-time health data supports preventive care programs. Insurers can design incentive-based wellness policies.

Embedded Insurance Solutions

Insurance is integrated directly into e-commerce, travel, and mobility platforms. Coverage is offered at the point of purchase. This increases adoption and convenience for end users.

Key Market Segment

By Type

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Other Types

By Deployment

- On-Premise

- Cloud-Based

By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Other Technologies

By Services

- Consulting

- Support & Maintenance

- Managed Services

By End-User

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Other End-Users

Top Key Players

- Damco Group

- DXC Technology Company

- KFin Technologies

- Majesco

- Oscar Insurance

- OutSystems

- Quantemplate

- Shift Technology

- Trov Insurance Solutions LLC

- Wipro Limited

- Zhongan Insurance

- Other Key Players

Recent Development

- February, 2025 – DXC Technology Company strengthened its insurance software and services portfolio by enhancing digital policy administration and claims modernization solutions for global insurers.

- January, 2025 – KFin Technologies continued upgrading its digital platform infrastructure to support technology-driven insurance servicing and data management across financial services clients.

Conclusion

The insurtech market grows fast as digital tools like AI, blockchain, IoT, and cloud platforms change how insurance works from underwriting to claims and customer service. Cloud computing and managed services lead the technology and service areas, while health insurance tops the product lines and North America holds the biggest regional share. Insurers adopt these solutions to serve customers better, cut costs, and enter new markets, though legacy systems and regulations slow some progress as digital insurance becomes standard.

Read More – https://market.us/report/insurtech-market/