Balchem (NASDAQ: BCPC) delivered a landmark year, crossing the $1 billion revenue threshold for the first time. Q4 adjusted EPS came in at $1.31, beating the consensus estimate of $1.18 by 11%, while revenue of $263.6 million topped forecasts of $259.6 million by 1.6%. Despite the earnings beat, shares declined approximately 3.1% in pre-market trading to $175.14, suggesting profit-taking near 52-week highs.

About Balchem Corporation

Balchem Corporation (NASDAQ: BCPC), headquartered in Montvale, New Jersey, is a global specialty performance ingredients company founded in 1967 by Dr. Leslie Balassa and a group of entrepreneurs and investors. The company develops, manufactures, and markets specialty ingredients and products for the nutritional, food, pharmaceutical, animal health, medical device sterilization, plant nutrition, and industrial markets worldwide.

Balchem operates through three segments: Human Nutrition & Health (HNH), Animal Nutrition & Health (ANH), and Specialty Products. The company leverages core technologies in chelation, microencapsulation, and choline production to create value-added solutions.

As of the latest data, Balchem has a market capitalization of approximately $5.55 billion, trades at a P/E ratio of ~36.1x trailing earnings, offers a dividend yield of 0.55% ($0.96 per share), and employs approximately 1,361 people across 21 manufacturing sites globally. The company became publicly traded in 1970 and has made transformative acquisitions, including SensoryEffects (2014), Albion International (2016), and Kappa Bioscience (2022).

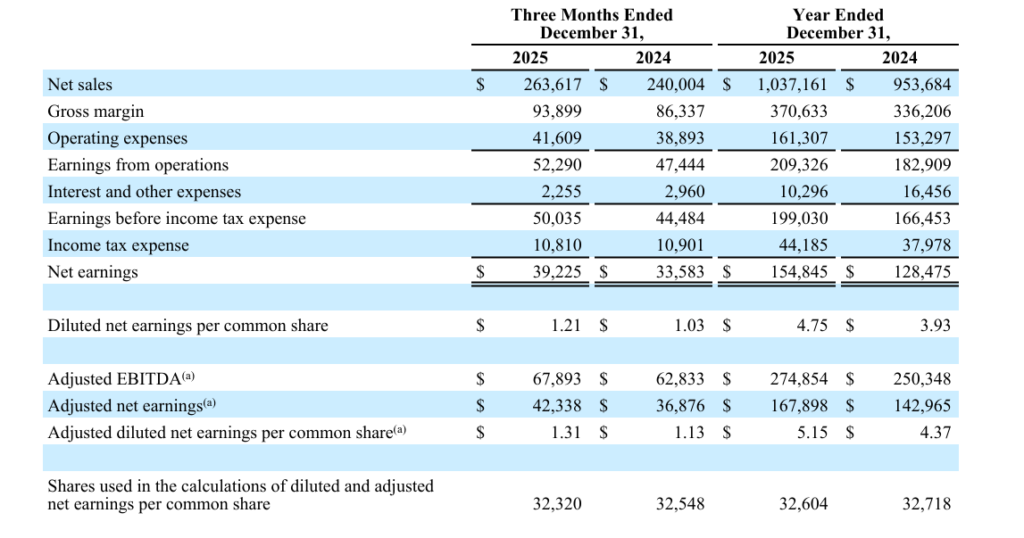

Top Financial Highlights

- Q4 2025 net sales reached USD 263.6 million, reflecting a 9.8% year over year increase.

- Full year 2025 net sales totaled a record USD 1.037 billion, rising 8.8% year over year and surpassing USD 1 billion for the first time.

- Q4 GAAP net income stood at USD 39.2 million, marking a 16.8% increase compared to the prior year period.

- Full year GAAP net income reached a record USD 154.8 million, up 20.5% year over year.

- Q4 GAAP earnings per share were USD 1.21, increasing 17.5% year over year, while adjusted earnings per share were USD 1.31, up 15.9%.

- Full year GAAP earnings per share rose to a record USD 4.75 from USD 3.93 in the previous year, while adjusted earnings per share increased to USD 5.15 from USD 4.37.

- Q4 adjusted EBITDA amounted to USD 67.9 million, reflecting an 8.1% year over year increase with a margin of 25.8%.

- Full year adjusted EBITDA reached a record USD 274.9 million, growing 9.8% compared to the prior year.

- Q4 gross margin totaled USD 94 million, representing 35.6% of sales, with a decline of 40 basis points year over year due to higher manufacturing input costs.

- Q4 operating cash flow generated USD 67.3 million, while free cash flow reached USD 51.2 million.

- Full year free cash flow achieved a record USD 173.6 million.

- Cash on hand stood at USD 75 million, while net debt declined to USD 89 million, resulting in a leverage ratio of 0.3x.

- Q4 performance in the Human Nutrition and Health segment generated USD 166.1 million, increasing 12.7% year over year.

- Q4 performance in the Animal Nutrition and Health segment generated USD 61.2 million, reflecting a 4.9% increase.

- Q4 performance in the Specialty Products segment generated USD 34.8 million, rising 6.0% year over year.

- Annual dividend per share increased by 10% to USD 0.96, marking the seventeenth consecutive year of double digit dividend growth.

- Approximately 685,000 shares were repurchased at an average price of about USD 158 per share.

Full Year 2025 Financial Highlights

Results for Period Ended December 31, 2025 (unaudited)

- Record full year net sales reached USD 1.037 billion, reflecting an 8.8% increase compared to the prior year.

- Record GAAP net earnings totaled USD 154.8 million, rising 20.5% year over year and resulting in record GAAP earnings per share of USD 4.75, compared to USD 3.93 in the previous year.

- Record adjusted EBITDA amounted to USD 274.9 million, marking a 9.8% increase from the prior year.

- Record adjusted net earnings stood at USD 167.9 million, increasing 17.4% year over year and leading to record adjusted earnings per share of USD 5.15, compared to USD 4.37 in the previous year.

- Record cash flow from operations reached USD 216.6 million in 2025, while free cash flow achieved a record USD 173.6 million.

Beat or Miss?

| Metric | Reported | Estimated/Consensus | Difference |

| Q4 Adjusted EPS | $1.31 | $1.18 | +$0.13 / +11.0% beat |

| Q4 Revenue | $263.6M | $259.6M | +$4.0M / +1.6% beat |

| Q4 GAAP EPS | $1.21 | N/A | +17.5% vs. prior year |

| Q4 Adjusted EBITDA | $67.9M | N/A | +8.1% vs. prior year |

| Full-Year Revenue | $1.037B | N/A | +8.8% vs. prior year |

| Full-Year GAAP EPS | $4.75 | N/A | +20.9% vs. prior year |

Balchem delivered a convincing beat on both adjusted EPS and revenue. The adjusted EPS of $1.31 exceeded consensus by over 11%, driven by strong segment execution and favorable mix. Revenue topped estimates by 1.6%, with all three business segments posting growth in both sales and earnings.

What Leadership Is Saying?

CEO Ted Harris stated that in 2025 the company delivered record sales of $1,037,000,000, reflecting 8.8% year over year growth and surpassing the $1,000,000,000 milestone for the first time. All three segments supported performance, and the fourth quarter marked the 26th consecutive quarter of adjusted EBITDA growth. Management indicated confidence in continued revenue and earnings expansion in 2026.

CFO Carl Martin Bengtsson reported fourth quarter net sales of $264,000,000, up 9.8%, with gross margin at 35.6%, down 40 basis points due to higher input costs. Operating cash flow totaled $67,000,000, and cash stood at $75,000,000 at quarter end. Net debt declined to $89,000,000, with a net leverage ratio of 0.3.

Historical Performance

Q4 2025 vs. Q4 2024

| Category | Q4 2025 | Q4 2024 | Change (%) |

| Net Sales | $263.6M | $240.0M | +9.8% |

| GAAP Net Income | $39.2M | $33.6M | +16.8% |

| Adjusted EBITDA | $67.9M | $62.8M | +8.1% |

| GAAP EPS | $1.21 | $1.03 | +17.5% |

| Adjusted EPS | $1.31 | $1.13 | +15.9% |

| Gross Margin % | 35.60% | 36.00% | -40 bps |

| Operating Cash Flow | $67.3M | $52.3M | +28.7% |

| Free Cash Flow | $51.2M | $39.8M | 28.60% |

Full-Year 2025 vs. Full-Year 2024

| Category | FY 2025 | FY 2024 | Change (%) |

| Net Sales | $1,037.0M | $953.7M | +8.8% |

| GAAP Net Income | $154.8M | $128.5M | +20.5% |

| Adjusted EBITDA | $274.9M | $250.3M | +9.8% |

| GAAP EPS | $4.75 | $3.93 | +20.9% |

| Free Cash Flow | $173.6M | $147.2M | 17.90% |

Competitor Comparison

Specialty Chemicals Peers (Full-Year 2025 vs. 2024)

| Category | Balchem (BCPC) FY25 | Balchem FY24 | Δ (%) | Sensient Tech. (SXT) FY25 | Sensient FY24 | Δ (%) | Innospec (IOSP) FY25 | Innospec FY24 | Δ (%) |

| Revenue | $1,037M | $953.7M | +8.8% | $1,612M | $1,557M | +3.5% | $1,778M | $1,845M | -3.6% |

| Net Income | $154.8M | $128.5M | +20.5% | ~$134M* | ~$124M* | +7.5% (EPS basis) | $116.6M | $35.6M | +227% |

| GAAP EPS | $4.75 | $3.93 | +20.9% | $3.16 | $2.94 | +7.5% | $4.67 | $1.42 | +229% |

| Adj. EBITDA | $274.9M | $250.3M | +9.8% | N/A | N/A | ~+3.4% est. | $203.0M | $225.2M | -10% |

**Sensient net income estimated from GAAP EPS of $3.16 × ~42.4M diluted shares *

Key Insights Summary

Balchem outperformed both key competitors on top-line growth (+8.8%) and profitability expansion (+20.5% net income growth). Sensient’s FY25 revenue grew 3.5% with a GAAP EPS increase of 7.5%, while Innospec saw a 3.6% revenue decline, though its net income surged 227% largely due to the absence of a prior-year UK pension scheme buyout charge. Balchem’s adjusted EBITDA margin of ~26.5% significantly exceeds Sensient’s ~16% adjusted EBITDA margin and demonstrates the company’s premium positioning within specialty ingredients.

How the Market Reacted?

Despite the strong earnings beat on both EPS and revenue, Balchem’s stock price declined approximately 3.1% in pre-market trading on February 20, 2026, moving down to $175.14. The stock closed at $171.49 on the earnings day, representing a 2.01% decline, after touching an intraday low of $167.19 versus an open of $174.02.

The negative reaction came despite the company’s 11% EPS beat and record financial results, suggesting profit-taking after the stock had climbed 15.1% over the prior three months and was trading near its 52-week high of $183.01. Analyst sentiment remains constructive, with a consensus “Buy” rating and a 12-month price target of $176.00.

The overall market tone is cautiously bullish, as the company’s 26 consecutive quarters of adjusted EBITDA growth and record-setting financial performance reinforce confidence in Balchem’s long-term growth trajectory.