Leidos delivered non-GAAP EPS of $2.76, beating estimates by ~6%, though Q4 revenue of $4.21 billion missed consensus by 2.5% due to a six-week government shutdown and prior-year extra work week. GAAP EPS rose 19% to $2.53, and free cash flow hit a record Q4 of $452 million. Shares dropped ~8.4% on Feb 17 as the revenue miss and a softer-than-expected 2026 revenue guide weighed on sentiment.

About Leidos

Leidos Holdings, Inc. (NYSE: LDOS) is a Fortune 500 technology and engineering leader providing solutions across defense, intelligence, civil, and health markets. Headquartered in Reston, Virginia, the company was formed in 2013 through the separation of the former Science Applications International Corporation (SAIC) and today employs approximately 47,000 people globally.

Leidos serves the U.S. Department of Defense, Intelligence Community, Department of Homeland Security, Veterans Administration, and a growing base of commercial and international clients. Its portfolio spans integrated air defense systems, cybersecurity, IT modernization, health services, energy infrastructure, and maritime autonomy.

Top Financial Highlights

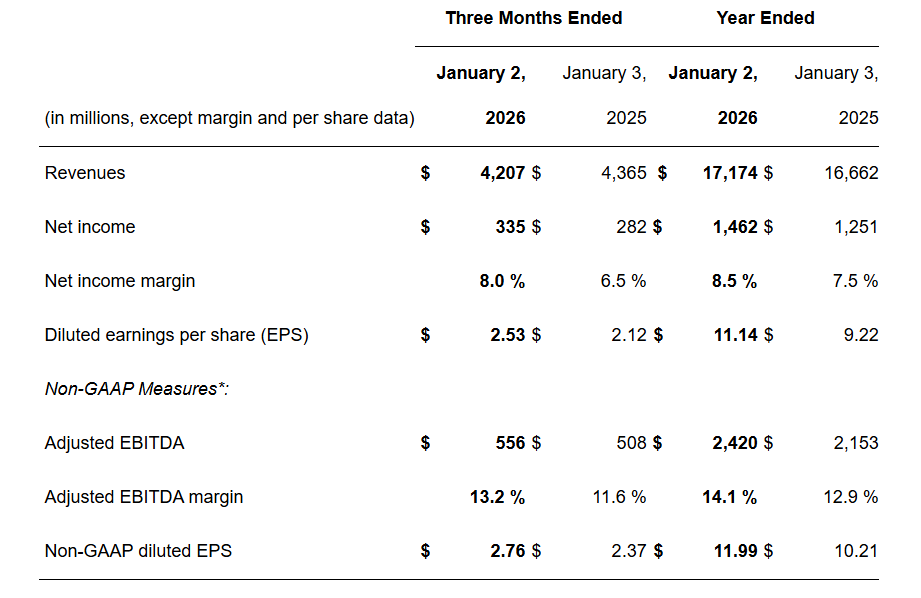

- Q4 Revenue reached USD 4.21 billion, reflecting a 4% decline YoY.

- FY 2025 Revenue totaled USD 17.2 billion, increasing 3% YoY.

- Q4 Net Income was USD 335 million, up 19% YoY, with a margin of 8.0%.

- FY 2025 Net Income stood at USD 1.46 billion, rising 17% YoY, with a margin of 8.5%.

- Q4 Diluted EPS came in at USD 2.53, growing 19% YoY.

- FY 2025 Diluted EPS reached USD 11.14, up 21% YoY.

- Q4 Non GAAP Diluted EPS was USD 2.76, increasing 16% YoY.

- FY 2025 Non GAAP Diluted EPS totaled USD 11.99, rising 17% YoY.

- Q4 Adjusted EBITDA reached USD 556 million, representing a 13.2% margin and 9% YoY growth.

- FY 2025 Adjusted EBITDA was USD 2.42 billion, with a 14.1% margin, up 12% YoY.

- Q4 Operating Cash Flow hit a record USD 495 million.

- FY 2025 Operating Cash Flow totaled USD 1.8 billion.

- Q4 Net Bookings reached USD 5.6 billion, with a book to bill ratio of 1.3x.

- FY 2025 Backlog stood at USD 43.6 billion, indicating strong order visibility.

- FY 2026 Guidance projects revenue between USD 17.5 billion and USD 17.9 billion.

- Non GAAP EPS is expected between USD 12.05 and USD 12.45.

- Operating cash flow is forecast at approximately USD 1.75 billion.

Beat or Miss?

| Metric | Reported | Analyst Estimate | Difference |

| Q4 Revenue | $4.21B | $4.31B | Miss by 2.5% |

| Q4 Non-GAAP EPS | $2.76 | $2.60–$2.61 | Beat by ~6% |

| Q4 Adjusted EBITDA | $556M | $538.5M | Beat by 3.2% |

| FY2025 Revenue | $17.17B | $17.22B | Miss by 0.3% |

| FY2025 Non-GAAP EPS | $11.99 | $11.76 | Beat by 2.0% |

| FY2026 Revenue Guide (midpoint) | $17.7B | ~$17.9B | Below by 1.1% |

| FY2026 EPS Guide (midpoint) | $12.25 | ~$12.25 | In Line |

The revenue miss was primarily attributable to two factors: a six-week government shutdown during Q4 2025 and an extra work week in Q4 2024’s fiscal calendar. Management noted that, normalized for both factors, Q4 revenue would have grown approximately 4% organically. The EPS beat reflected strong program execution, margin expansion, and a 4.4% reduction in diluted share count through buybacks.

What Leadership Is Saying?

“Our strong quarterly and annual performance highlights the resilience of our team and the strength of our strategy. Despite a dynamic market, we delivered solid revenue growth, strong earnings, and robust cash flow, positioning us well for future investment. We remain focused on advancing our customers’ critical national security priorities while strategically shaping our portfolio around key growth areas, including space and maritime, energy infrastructure, digital modernization and cyber, mission software, and managed health services”. Says CEO Tom Bell – Strategy & Vision

“2025 was an exceptional year for Leidos, marking the third consecutive year of double-digit non-GAAP earnings and cash flow growth. We are focused on delivering sustainable long-term growth. Despite external market pressures, performance exceeded initial projections across nearly all key metrics, enabling us to raise guidance twice this year and exceed the top end of our margin, earnings, and cash flow ranges this quarter.” Says CFO Chris Cage – Financials & Execution

Summary of Operating Results

Cash Flow summary

- In Q4, Leidos generated USD 495 million in operating cash flow, marking the strongest fourth quarter performance in company history. Performance was supported by solid EBITDA generation, improved collections, and disciplined working capital management.

- Investing activities totaled USD 33 million in the quarter, primarily related to property, equipment, and software investments. Quarterly free cash flow reached USD 452 million, with a strong 127% conversion rate.

- Financing outflows were USD 357 million, including USD 305 million in share repurchases and USD 55 million in quarterly dividends. Capital deployment reflects a balanced approach between shareholder returns and operational reinvestment.

- For the full year, operating cash flow reached USD 1.75 billion. Annual free cash flow totaled USD 1.63 billion, with a 104% conversion rate. Free cash flow increased 26%, or 32% on a per share basis, demonstrating strong underlying earnings quality.

- Annual investing activities amounted to USD 405 million, while financing activities totaled USD 1.15 billion. As of January 2, 2026, the company reported USD 1.1 billion in cash and equivalents and USD 4.6 billion in total debt, maintaining liquidity flexibility.

- On February 13, 2026, the Board of Directors declared a cash dividend of USD 0.43 per share. The dividend will be paid on March 31, 2026, to shareholders of record as of March 16, 2026.

New Business Awards and Backlog Position

- Net Bookings reached USD 5.6 billion in Q4 and USD 17.5 billion for FY2025. Book to bill ratios stood at 1.3x for the quarter and 1.0x for the full year.

- Year End Backlog totaled USD 49.0 billion, of which USD 9.7 billion was funded. The backlog position provides multi year revenue visibility and program stability.

Major Contract Awards

- Air Base Air Defense – Missile Defense (ABADS-MD): The U.S. Air Force awarded Leidos a five year, USD 2.2 billion contract to deploy ALPS and MRADR systems. These passive sensor platforms support survivable base defense without emitting detectable signals. The systems integrate advanced sensing and GPU accelerated signal processing to deliver long range air surveillance and real time command integration.

- Air Force Cloud One Next (C1N) ACSS: A potential six year, USD 455 million award was secured to modernize enterprise cloud architecture. The program focuses on Zero Trust frameworks, automation, and multi cloud orchestration to accelerate application migration and improve secure data access for operational teams.

- Common Hypersonic Glide Body (C-HGB): A USD 151 million contract modification was awarded by the U.S. Army. The extension supports continued development of long range, high speed missile capabilities aligned with national defense acceleration priorities.

- Defense Information Systems Agency (DISA) CESO: Under a new USD 142 million award, Leidos will modernize classified IT environments. The program emphasizes cloud enablement, cybersecurity reinforcement, DevSecOps integration, and secure enterprise system upgrades for mission critical operations.

Historical Performance

Q4 FY2025 vs Q4 FY2024

| Category | Q4 FY2025 | Q4 FY2024 | Change (%) |

| Revenue | $4.21B | $4.37B | -3.60% |

| GAAP Net Income | $335M | $282M | 18.80% |

| GAAP Diluted EPS | $2.53 | $2.12 | 19.30% |

| Non-GAAP Diluted EPS | $2.76 | $2.37 | 16.50% |

| Adjusted EBITDA | $556M | $508M | 9.40% |

| Adjusted EBITDA Margin | 13.2% | 11.6% | +160 bps |

| Operating Cash Flow | $495M | $294M | 68.40% |

| Net Income Margin | 8.0% | 6.5% | +150 bps |

Despite the top-line decline, Leidos demonstrated significant improvement across every profitability and cash flow metric. Net income surged 19% even as revenue contracted, reflecting the company’s improved program execution, fixed-price contract efficiencies, and disciplined cost management.

Segment Performance

| Segment | Q4 FY2025 Revenue | Q4 FY2024 Revenue | YoY Change | Q4 FY2025 Non-GAAP Margin |

| National Security & Digital | $1.85B | $1.89B | -2.50% | 11.3% |

| Health & Civil | $1.21B | $1.33B | -9.30% | 22.4% |

| Commercial & International | $610M | $604M | 1.00% | 9.7% |

| Defense Systems | $546M | $539M | 1.30% | 10.3% |

The Health & Civil segment saw the steepest revenue decline at 9.3%, impacted by the government shutdown and the DHMSM transition to sustainment. However, it maintained the highest margin in the company at 22.4%. Defense Systems showed above-corporate growth, bolstered by ramped production of hypersonic glide bodies and IFPIC systems.

Competitor Comparison

| Metric | Leidos (LDOS) Q4 FY2025 | SAIC (SAIC) Q4 FY2025 | Booz Allen (BAH) Q4 FY2025 | CACI (CACI) Q4 FY2025 |

| Q4 Revenue | $4.21B | $1.84B | $3.00B | $2.30B |

| Q4 Revenue Growth (YoY) | -3.60% | 6.00% | 7.00% | 13.00% |

| Q4 Net Income | $335M | $98M | $193M | $157.9M |

| Q4 Adj. EPS | $2.76 | $2.57 | $1.61 | $8.40 |

| Q4 Adj. EBITDA Margin | 13.20% | 9.60% | 10.60% | 11.50% |

| FY Revenue | $17.17B | $7.48B | $12.0B | $8.6B |

| FY Revenue Growth | 3.00% | 3.10% | 12.00% | 12.60% |

| Book-to-Bill (Q4) | 1.3x | 0.7x | 0.71x | ~1.1x |

| Total Backlog | $49.0B | ~$21.9B | $37.0B | $31.4B |

Leidos remains the largest government IT services contractor by revenue among its peer group, with the highest EBITDA margins and the largest backlog at $49 billion. However, its Q4 top-line decline of -3.6% stands in contrast to robust growth posted by CACI (+13%), Booz Allen (+7%), and SAIC (+6%), though Leidos was uniquely impacted by the government shutdown timing within its fiscal calendar. CACI and Booz Allen both posted notably stronger full-year revenue growth of 12-13%, driven by organic expansion and AI-related demand.

How the Market Reacted?

Leidos shares declined 8.4% to close at $161.53 on February 17, 2026, marking their steepest single-day drop in recent months. The weakness was evident ahead of the open, with the stock down approximately 2.95% in pre-market trading as investors responded to a revenue shortfall and softer-than-expected 2026 guidance.

While the company delivered a solid earnings beat and record cash flow, the market appeared more focused on the 2026 revenue midpoint of $17.7 billion, which came in modestly below expectations. Despite the pullback, overall analyst sentiment remains constructive, with a majority of positive ratings and an average price target of $213.73, suggesting meaningful upside from the post-earnings level.