Introduction

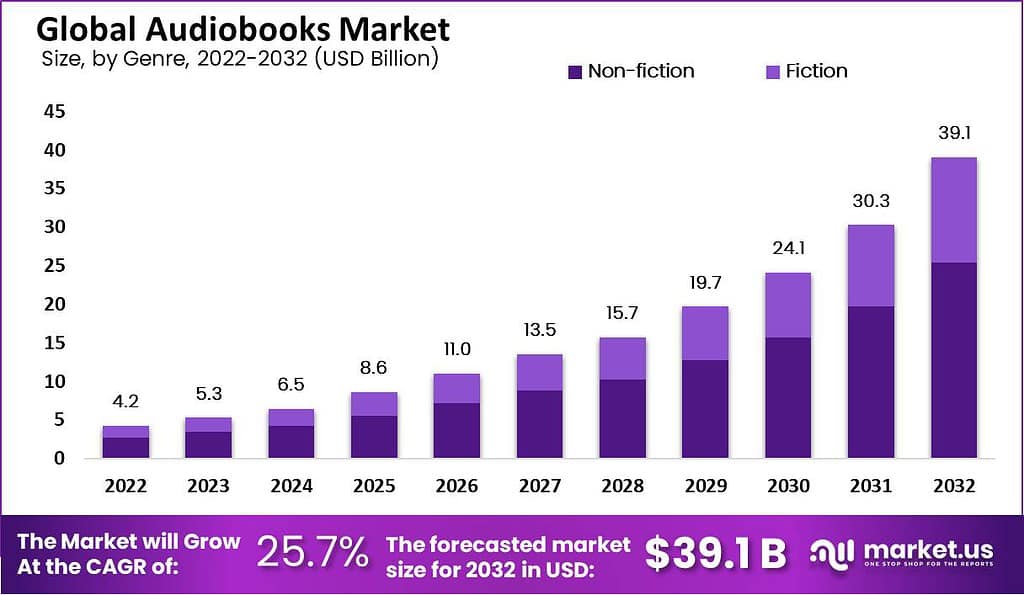

The Global Audiobooks Market is growing very fast, rising from about USD 5.3 billion in 2023 to around USD 39.1 billion by 2032, supported by a strong CAGR of 25.7% as listeners increasingly prefer on-the-go, audio-based consumption across smartphones and digital platforms. Audiobooks serve commuters, multitaskers, visually impaired users, and digital-first readers by delivering book content through recorded narration, mainly via apps and online platforms. Growth is supported by smartphone penetration, subscription services, exclusive audio-first content, and recommendation engines such as Spotify’s graph-based system introduced in January 2024.

Audiobooks market lets people listen to books read aloud instead of reading them on paper or screens. These spoken stories and lessons come through apps on phones, cars, or speakers, covering fiction like thrillers and romance plus non-fiction such as self-help or history. Listeners grab them from stores like Audible or Spotify, often by subscription, and the setup fits busy lives where folks hear books during drives or workouts.

Top driving factors come from more smartphones that make listening easy anywhere and a shift to audio content over reading time. Busy workers and students pick audiobooks for quick learning, while cars with voice play add comfort on long trips. Demand stays high among young adults who mix listening with chores, with fiction leading sales but business books gaining ground. North America buys the most now, but places like India and China grow fast as cheap data spreads and local stories get voiced.

Key Takeaways

- The global audiobooks market is expected to grow from USD 5.3 billion in 2023 to about USD 39.1 billion by 2032, at a CAGR of 25.7%.

- The Non-fiction segment accounts for more than 65% of the market by genre.

- Smartphones hold over 44% share as the preferred listening device.

- Adults represent more than 78% of the target audience segment.

- The One-time Download distribution channel captures over 65% share of the market.

- Audible’s share of the audiobook platform market is around 63.4%.

- Over 50% of listeners prefer to listen at home, about 30% in the car, and roughly 70% of users multitask while listening.

- North America leads with the largest regional share, while Asia Pacific records the fastest growth rate in the forecast period.

Key Statistics

- According to Voices, audiobooks are emerging as one of the fastest-growing forms of audio content, with strong engagement across listener groups.

- About 67% of listeners say they read more because of audiobooks, showing their role in increasing overall reading habits.

- The narrator plays a critical role in listener satisfaction, as nearly 60% have stopped an audiobook because they did not enjoy the narrator’s performance.

- Listeners often tune in during daily routines, including commutes 63%, household chores 54%, and relaxing moments such as baths or falling asleep 44%

- When choosing their next audiobook, half of listeners look for specific titles, while the other half prefer to browse for new content.

- Browsing habits vary by gender, with 58% of women likely to browse titles, compared to 42% of men, while 58% of men prefer seeking a specific book.

- More than half of listeners prefer fiction over non-fiction, with fiction accounting for 56% of overall listening preferences.

- A high-quality narrator is considered essential, with 64% of listeners saying narration quality is key to a good audiobook experience.

- About 30% of listeners find audiobooks more immersive than traditional reading, indicating strong emotional and sensory engagement.

- A significant 59% of listeners have stopped an audiobook midway because they did not enjoy the narrator, reinforcing the importance of voice performance.

- Around 20% of listeners would not consider AI-narrated audiobooks, showing resistance to synthetic voices.

- About 33% are open to AI narration but still strongly prefer human narrators, indicating conditional acceptance.

- Only 13% say they are very open to AI-narrated audiobooks, expecting them to provide an experience similar to human-narrated content.

- Based on EdisonResearch, children’s audiobook listening remains strong, with 53% of audiobook listeners who have children reporting that their kids also listen, and 77% of these parents say audiobooks provide an important break from screens.

- Subscriptions continue to rise, as 63% of listeners in the past year subscribe to at least one audiobook service, slightly higher than the 62% reported in 2023.

- Digital library usage is significant, with 46% of current audiobook consumers borrowing a digital audiobook from a library app within the last year.

- Piracy remains a concern for the industry, as 47% of recent listeners accessed at least one audiobook for free through YouTube or other file-sharing platforms.

- Fiction continues to dominate sales revenue, accounting for 64% of total audiobook revenue, with top genres including General Fiction 21%, Science Fiction/Fantasy 14%, and Romance 11%.

- Several genres show rapid growth, with History/Biography/Memoir up 22%, Health and Fitness up 20%, Religious or Faith-based up 17%, and Romance up 14%, making them the fastest-expanding categories in the audiobook market.

Use Cases

- Commuting and Travel: Workers listen to audiobooks on trains or drives to pass time and learn skills like business strategies. Travelers use them on long flights to stay entertained without screens. Over 60% of users pick this for daily trips, cutting stress and boosting productivity.

- Exercise and Multitasking: Runners or gym users play audiobooks during workouts for hands-free stories or facts. Parents cook or clean while hearing kids’ tales or self-help guides. This fits modern routines, letting people absorb content without pausing chores.

- Professional Learning: Teams use audiobooks for training on leadership or industry trends during remote work. Companies see 25% higher completion rates when adding them to portals. Adults pick them for quick skill gains in management or tech.

- Education and Kids: Students with reading issues or English learners use audiobooks to build vocabulary and fluency. Schools add them to classes for diverse styles, aiding comprehension. Kids gain pronunciation from narrated stories at home.

- Home and Smart Devices: Families stream via smart speakers in kitchens for shared listening without phones. Subscriptions give unlimited access, growing use in homes. Drivers connect to car systems for safe, voice-controlled playback.

Key Market Segment

By genre

- Fiction

- Non-fiction

By preferred device

- Smartphones

- Laptops and Tablets

- Personal Digital Assistants

- Other Preferred Devices

By target audience

- Kids

- Adults

By distribution channel

- One-time Download

- Subscription-Based

Top Key Players

- Apple Inc.

- Audible Inc

- Barnes & Noble Booksellers Inc.

- com

- Google LLC

- PLAYSTER

- Rakuten Group Inc.

- Storytel AB

- F.Howes Ltd.

- Others

Recent Development

- May, 2025, Audible grew its library with AI narrated audiobooks from print and ebooks.

- November, 2025, Google updated support for auto narrated audiobooks from ebooks.

- December, 2025, Apple launched Year in Review for Books app showing top books and audiobooks read that year.

Conclusion

The audiobooks market is growing fast as a key part of digital media. It changes how people enjoy books through audio on mobile devices. Non-fiction leads in genres, while smartphones, adults, and one-time downloads shape the main segments. North America holds the top spot now, with Asia Pacific set to grow quickest. Mobile access, smart device links, smart suggestions, and special audio content drive this shift. Competition from free options and rules create hurdles, but new ideas in discovery and quality keep audiobooks central to reading and learning.

Read More – https://market.us/report/audiobooks-market/