Introduction

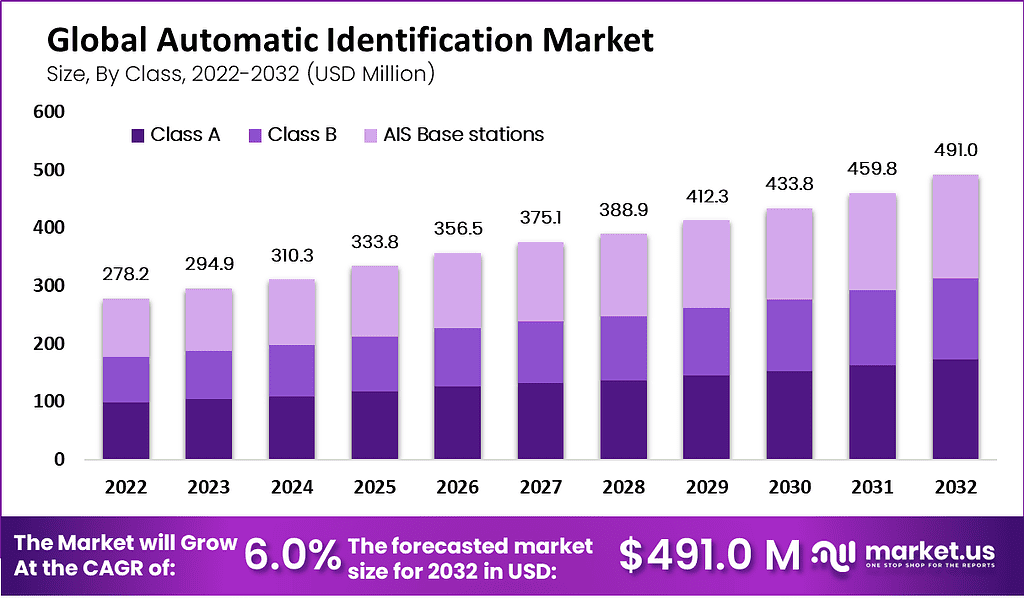

The Global Automatic Identification System (AIS) Market, focused on maritime tracking via Class A/B transponders and base stations, projects growth from USD 278.2 million in 2023 to USD 491.0 million by 2032 at a 6.0% CAGR, driven by vessel safety needs, IoT integration, and regulations. Key segments include vessel-based platforms (55% share in 2022), Class A devices for commercial ships, and vessels tracking applications, with Asia-Pacific leading at 32.6% market share (USD 90.6 billion revenue in 2022). Challenges like high costs and data privacy persist, but trends in AI, cloud, and emerging markets offer expansion.

The Automatic Identification System, or AIS, is a tracking setup used mainly in shipping to share vessel positions, speed, and identity in real time. Ships broadcast this data via VHF radio so nearby vessels, ports, and coast stations can avoid collisions and manage traffic better. It started as a safety tool under IMO rules for big cargo ships but now covers fishing boats and work vessels too, with satellite links filling gaps in open water.

Top driving factors include stricter rules like the IMO 2024 push for fishing vessels over 24 meters to fit AIS, plus rising sea trade that needs better oversight. Ports use it to cut wait times and fuel waste, while satellite tech boosts coverage in remote spots. Growth ties to more maritime traffic and links with IoT for smarter fleet ops.

Demand stays firm as shippers chase efficiency amid busy routes and green rules on emissions. Operators want real-time views to trim costs and risks, with Class A units leading for big ships and Class B picking up in smaller fleets. Expect steady pull from safety needs and port upgrades through 2030.

Top Market Takeaways

- Global AIS market grows from USD 278.2 million in 2023 to USD 491.0 million by 2032 at 6.0% CAGR.

- Vessel-based platforms captured 55% market share in 2022.

- Asia-Pacific led with 32.6% share and USD 90.6 billion revenue in 2022.

- Class A segment dominated in 2022 for commercial vessel compliance.

- AIS handles over 4,500 reports per minute across 140+ countries for 40 million users yearly.

Key Statistics

- According to scoop.market.us, the Class A segment held a predominant position in 2022, securing a major share of the AIS market. Its dominance was supported by its essential role in large commercial maritime operations that follow strict regulatory requirements for reliable tracking and communication.

- The Vessel Based segment accounted for nearly 55% of the market share, driven by the rising need for advanced navigational tools on vessels. The segment’s leadership reflected the importance of improving maritime safety and ensuring efficient vessel movement across busy routes.

- The Vessels Tracking segment showed strong market leadership in 2022, supported by its ability to provide continuous real time information. This functionality strengthened decision making in maritime navigation and enhanced operational safety across international waters.

- The Asia Pacific region led the AIS market with more than 32.6% share and USD 90.6 billion in revenue, supported by extensive maritime routes and investment in port infrastructure. Strong regulatory frameworks further positioned APAC as a key region for AIS deployment.

- AIS transmission standards indicate that a single station sends a position report within one of 2250 time slots every 60 seconds, enabling structured and uninterrupted communication. An extensive global receiver network across 140 countries captures these signals and supports tracking for about 40 million users annually.

- AIS systems process more than 4,500 reports per minute with refresh rates as short as two seconds, showing the scalability and robustness of the technology. These capabilities make real time vessel monitoring possible on a global scale.

Use Cases

- Maritime Safety and Collision Avoidance: Automatic Identification System (AIS) broadcasts vessel positions, speeds, and courses in real time to help ships avoid collisions during voyages. Officers on watch use this data to track nearby traffic, predict close approaches, and adjust paths early. Ports integrate AIS for smoother traffic flow, cutting risks in busy areas.

- Fleet Management and Route Optimization: Shipping firms track fleets with AIS to monitor asset use, cut idle time, and plan better routes based on real-time data. Logistics teams see up to 20% faster deliveries and 15% less fuel use by optimizing paths with weather and congestion inputs. This extends to trucks and rail for end-to-end visibility.

- Security and Compliance Monitoring: Coast guards and navies watch for illegal fishing, smuggling, or piracy using AIS in sensitive zones like territorial waters. Authorities enforce rules on emissions and protected areas with satellite AIS for broad coverage. AI tools now spot threats faster for quicker responses.

- Search, Rescue, and Environmental Tracking: AIS guides rescue teams to distress signals with exact locations, aiding quick saves at sea. It tracks fishing to curb overfishing and monitors tankers near eco-zones for spills. Data also supports weather alerts and sea state shares for safer ops.

- Port and Infrastructure Support: Vessel Traffic Services use AIS for congestion control, berth planning, and incident response in harbors. Offshore sites like wind farms rely on it for safe coordination among support vessels. Aquaculture checks traffic patterns to avoid conflicts with new sites.

Key Market Segment

By Class

- Class A

- Class B

- AIS Base Stations

By Platform

- Vessel Based

- On-Shore

By Application

- Fleet Management

- Vessels Tracking

- Maritime Security

- Other Applications

Top Key Players

- Furuno Electric Co. Ltd

- Japan Radio Co. Ltd.

- Saab AB

- ExactEarth Ltd

- True Heading AB

- C.N.S. Systems AB

- ComNav Marine Ltd.

- Garmin Ltd

- Kongsberg Gruppen ASA

- L3 Technologies Inc.

- Orbcomm Inc.

- Others

Recent Development

- April, 2024, A market update highlighted steady expansion in the Automatic Identification System landscape. The growth of vessel monitoring requirements and stronger regulatory attention toward maritime safety supported wider adoption of AIS technologies. The update emphasized rising use of small-vessel AIS solutions and increasing integration of AIS data with maritime surveillance platforms.

- January, 2025, A new industry review presented a positive outlook for AIS adoption. The review indicated that demand for enhanced navigation intelligence, environmental monitoring, and coastal security continued to influence product development across leading AIS manufacturers. The study also noted growing interest in hybrid AIS systems that combine terrestrial and satellite-based capabilities.

Conclusion

AIS finds use in real-time vessel position reporting across 2,250 time slots per minute for collision avoidance in busy routes like the South China Sea, fleet optimization for global trade, maritime security against piracy, and onshore monitoring for port efficiency. In logistics and manufacturing extensions, it aids inventory via RFID/barcode, while healthcare applies biometrics for patient tracking—handling high-volume data to cut errors and boost compliance. Overall, steady 6% growth signals robust demand amid digital shifts, though SMEs face cost hurdles; vendors targeting APAC and AI enhancements hold strong positioning.

Read More – https://market.us/report/automatic-identification-system-market/