Introduction

Biometric Authentication In Banking Statistics: Biometric authentication is indisputably one of the key components of secure financial systems today. This world is characterised by the rise of financial fraud and digital banking becoming the norm rather than the exception. It is no longer sufficient to use a password or PIN. By 2025, banks will not only use but also spend billions of dollars on biometric tools. They aim to ensure security, improve the customer experience, and reduce operational costs.

The banking sector is undergoing a technological and trust-driven metamorphosis. The adoption of global biometric technologies across mobile banking apps, ATMs, online platforms, and digital wallets is driving this change.

The article discusses biometric authentication in banking, including market value, adoption levels, and the financial impact in 2025.

Editor’s Choice

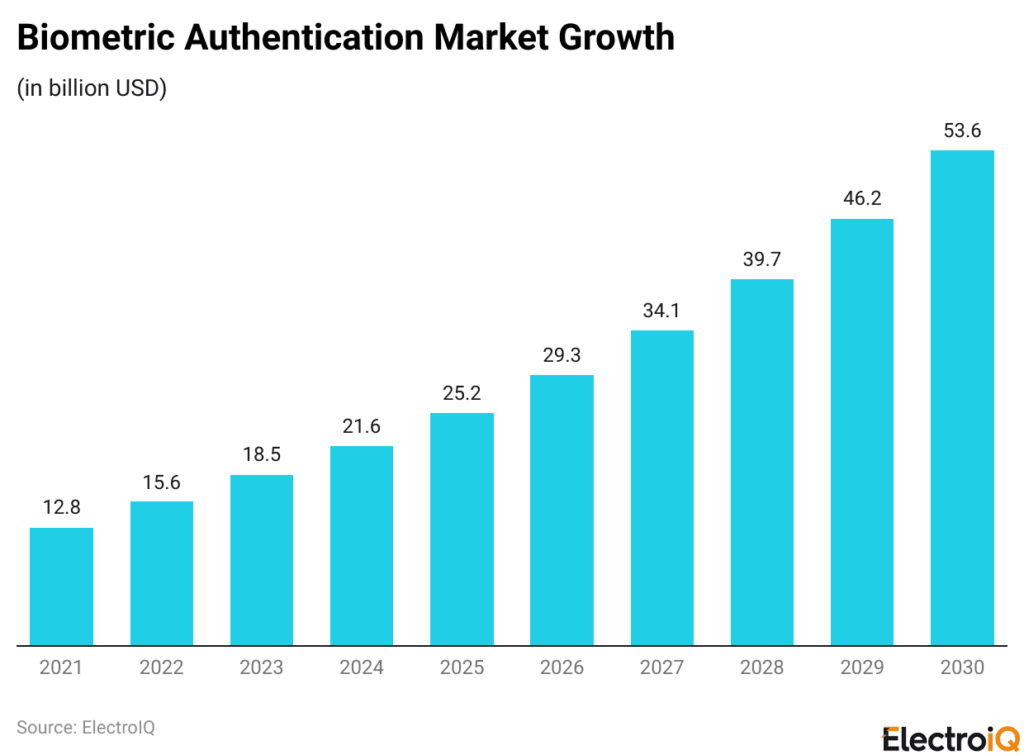

- The global biometric authentication market was worth more than US$15 billion in 2022 and is expected to reach over US$53 billion by 2030, driven by increasing fraud and the demand for seamless digital access.

- Digital trust in financial institutions was a major factor in the 7.8 times faster growth of these institutions between 2017 and 2024, indicating a strong correlation between trust, biometrics, and business expansion.

- Only 18% of customers would consider leaving a bank that they trust; thus, the trust established by biometrics is a crucial factor in customer loyalty.

- Consumer concerns have not diminished, as 53% are worried about data privacy and 58% about hacking; therefore, it is essential to combine technology with transparency.

- Biometric features are enabled on approximately 80% of smartphones across major regions worldwide, indicating consumer acceptance of biometrics worldwide.

- In terms of user opinions, almost 50% believe that biometrics are making processes faster and more convenient, particularly for online payments and digital transactions.

- Mobile-first strategies based on biometric authentication can help banks cut operating expenses by as much as 25%.

- Smooth biometric onboarding can significantly enhance customer experience, as evidenced by a 103-point Net Promoter Score differential between successful and unsuccessful digital account openings.

- The concept of Decentralised identity (SSI) is gaining traction as the future of digital banking, with annual growth estimated at about 90%.

Biometric Authentication Market Size

(Reference: techmagic.co)

- The advent of biometrics has made it easier for users to authenticate without passwords, as the latter can be replaced by unique physical or behavioural traits.

- In the present-day scenario, where users’ convenience is losing out to security breaches, organizations in every sector are opting for biometric solutions at a fast pace.

- Biometric methods like fingerprint scanning, facial recognition, and voice recognition have become the go-to not only for lifestyle and consumer products industries but also for the healthcare sector.

- This massive demand has led experts to forecast a US$15 billion worldwide biometric authentication market in 2022.

- Technology developments, the extensive use of biometric features in everyday consumer gadgets, and greater attention to secure online access are seen as the main factors driving such large-scale market growth to over US$53 billion by 2030.

The Role of Biometrics In Building Digital Trust And Financial Growth

- Digital trust has become a main factor in the growth of the financial industry.

- According to studies, the growth rate of financial establishments with strong digital trust was 7.8 times higher than those without it, demonstrating that trust does translate into measurable business performance.

- A trusting bank customer is, to a very large extent, not considering changing providers; only 18% would consider leaving a trusted bank.

- This converts the investment in trust-building technologies into a strategic decision for growth rather than merely an operational cost.

- The centrality of biometrics in this trust-making process lies in its ability to enable secure user authentication without passwords.

- It is the trust generated by biometrics that is the main contributor to the companies’ higher growth rates.

- Some 53% of consumers remain sceptical, and they see the use of AI as a possible cause of data privacy problems, while 58% consider the risk of data hacking to be very high.

- Such concerns emphasise that transparency and communication are as vital as having highly secure systems in place.

- Given that digital fingerprints are very sensitive, banks will have to be very diligent regarding the collection, storage, and utilization of biometric data.

- The trend in the use of artificial intelligence by banks is gradually changing to “trusted intelligence”, where customers are made to see the benefits of their data.

- At the same time, raising the security bar, biometrics becomes an integral part of the customer relationship, the building of digital trust, and the unfolding of a long-term business strategy when done with respect.

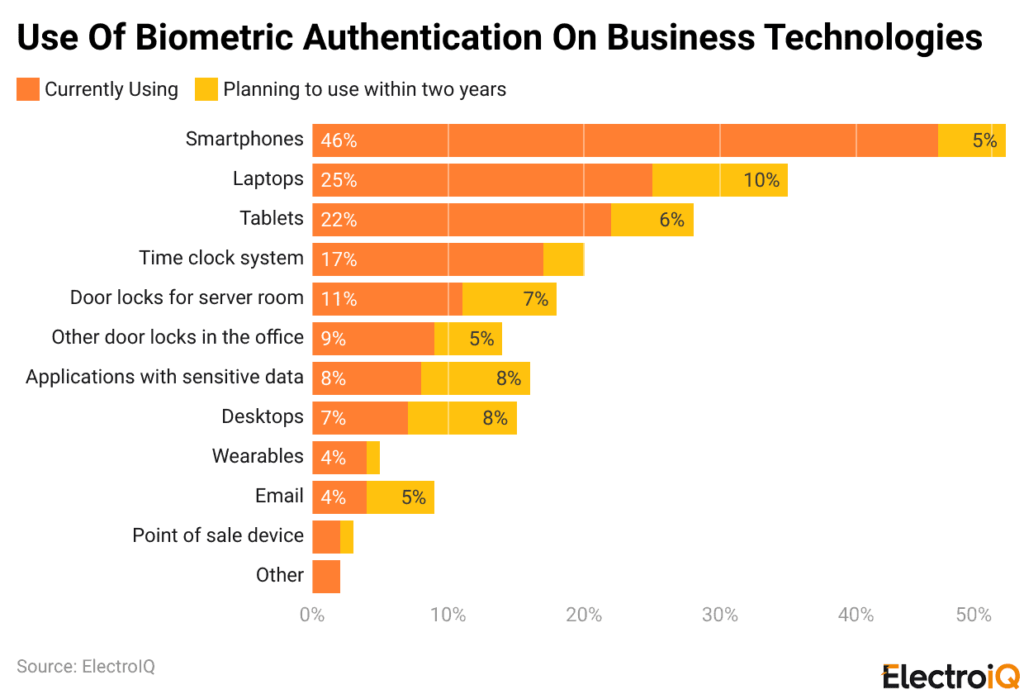

Use of Biometric Authentication On Business Technologies

(Reference: coolest-gadgets.com)

- The statistics illustrate how rapidly biometric technology is being integrated into daily life, and at the same time, they indicate the public’s split view of its application.

- People are of different minds about it in the case of travel: while 42.6% of American citizens think that the use of facial recognition at airports could enhance the safety of the airports, a large percentage of 32.5% still disagree, which mirrors the issue of privacy and surveillance that people are still worried about.

- Notwithstanding these doubts, the corporation that conducts identity verification is investing more and more, and the amount is expected to grow from 5 billion US dollars in 2017 to 18 billion US dollars by 2027, which is a clear indication of strong institutional and commercial trust in these tools.

- Almost half of the people surveyed claimed that biometric identification speeds up and simplifies processes, especially for online payments, which is why roughly 80% of smartphones in North America, Western Europe, and the Asia Pacific already have biometric features turned on.

- Besides phones, adoption is growing; by 2028, around 90% of new cars sold globally will have voice assistants built in, and that will completely change how people communicate with vehicles.

- All these trends together support the prediction that the worldwide biometric technology market will surpass USD 50 billion, highlighting the market’s expanding contribution in areas such as security, mobility, and digital experiences.

The Business Case For Investing In Biometric Technology

- The deployment of cutting-edge biometric solutions must be grounded in clear, quantifiable business outcomes.

- Research conducted by top consulting firms indicates that the return on investment in biometrics goes well beyond security and generates value through lower fraud losses, improved operational efficiency, and stronger customer relationships.

- Among the main benefits of biometrics is its ability to eliminate friction in online transactions, a factor Bain & Company considers a key driver of customer dissatisfaction and churn.

- The number is big: there is a 103-point difference in Net Promoter Score between customers who succeed in digital account opening on the first try and those who do not.

- Biometric technology simplifies the most important customer journeys by reducing the processes of authentication and onboarding.

- Fast, smooth, one-tap authentication not only strengthens security but also noticeably increases customer satisfaction, retention, and loyalty in the long run.

- The Boston Consulting Group says banks can realise up to 25% in operating cost cuts by fully embracing mobile-first strategies built on biometric authentication.

- Accenture has also conducted research in line with the above-mentioned finding; it points out that banks with strong omnichannel approaches can reduce their cost-to-serve by as much as 20%.

- The major part of this efficiency comes from a decrease in customer service calls related to password resets and access issues, demonstrating that biometrics can deliver savings that are evident while also enhancing the overall customer experience.

Decentralised Identity And The Next Era Of Digital Banking

- Accenture cites the explosive growth of decentralised or self-sovereign identity (SSI) as a digital banking trendsetter, attracting the financial sector with its projected annual growth rate of approximately 90%.

- This sudden growth is an indication of a major shift in how identity and trust are managed in the financial industry.

- In this scenario, there are no large central databases storing customer data; instead, individuals control their information through secure digital “identity wallets.”

- Banks and other organizations will seek access only to the specific credentials necessary for a transaction through a permission process.

- This user consent method fortifies customers’ trust, aligns with their privacy preferences, and significantly reduces the risk of large-scale data leakage, thereby enhancing security and making banking more user-friendly.

Conclusion

Biometric Authentication in Banking Statistics: The use of biometric authentication is gaining rapid ascendancy as a key element of contemporary banking. It is changing the entire scenario by enabling financial institutions to secure digital interactions and win over customers’ trust. As the threat of fraud grows and digital channels become the norm, biometrics presents the powerful trifecta. This includes high security, seamless user experience, and significant cost savings. Market growth forecasts, plentiful consumer adoption, and visible improvements in trust, efficiency, and loyalty all indicate strategic value. Biometrics offers benefits beyond mere authentication.

However, the privacy issue remains. Yet, responsible integration and open data policies are enabling banks to come closer to trusted, customer-centric models. The future looks bright for biometrics as a foundation for safe, smart, and resilient digital banking ecosystems. Decentralised identity is the next big thing.