Introduction

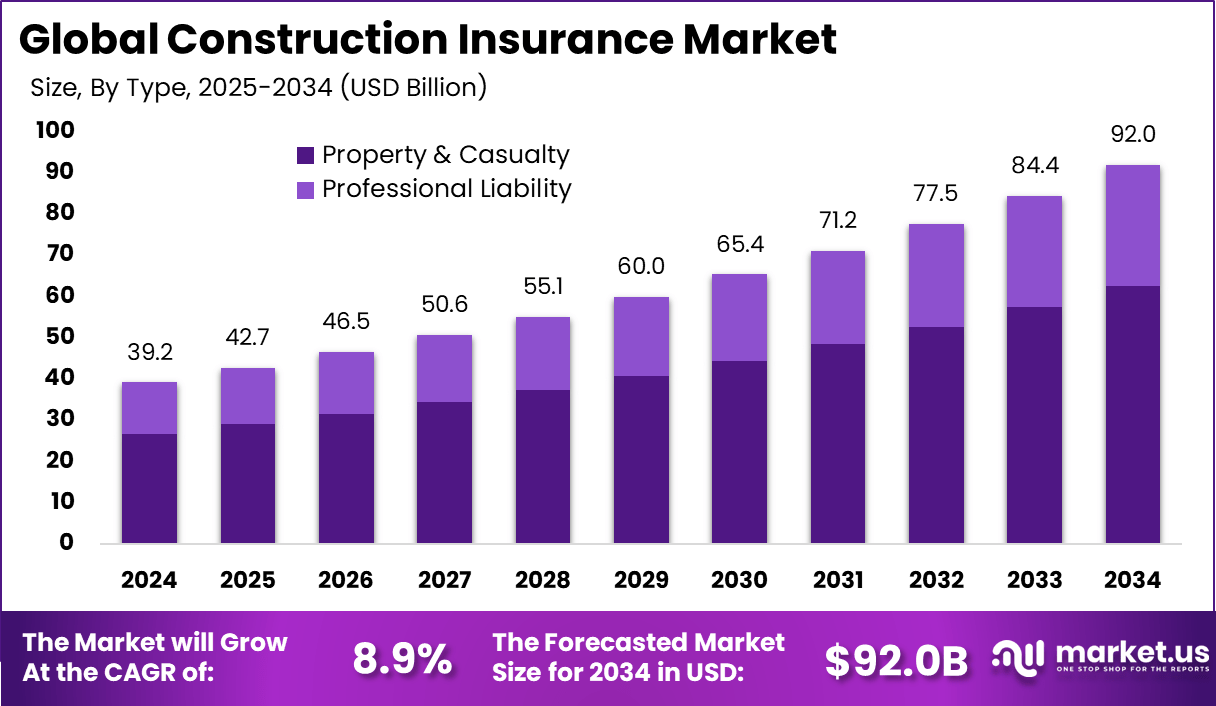

The Global Construction Insurance Market is projected to expand from USD 39.2 billion in 2024 to approximately USD 92.0 billion by 2034, registering a CAGR of 8.9% during the forecast period from 2025 to 2034. The growth is driven by rising infrastructure development, increasing construction investments, and growing awareness of risk management across large-scale projects.

The construction insurance market is growing steadily as construction activities increase worldwide. This market provides essential financial protection against risks such as accidents, property damage, delays, and legal liabilities that are common in construction projects. With projects becoming more complex and involving multiple contractors, the demand for tailored insurance that covers a broad spectrum of potential issues has risen significantly. Insurers are offering specialized policies to meet the diverse needs of commercial, residential, and infrastructure construction, helping stakeholders manage risks effectively and ensure project continuity.

One of the major drivers is the global expansion of construction activity in residential, commercial and infrastructure sectors, which increases the need for risk transfer solutions. Technological, environmental and regulatory complexity in construction projects also elevates risk exposure and thereby demand for insurance. For example, the growth of green building initiatives, supply chain volatility and skilled-labor shortages all raise the potential for project setbacks or claims.

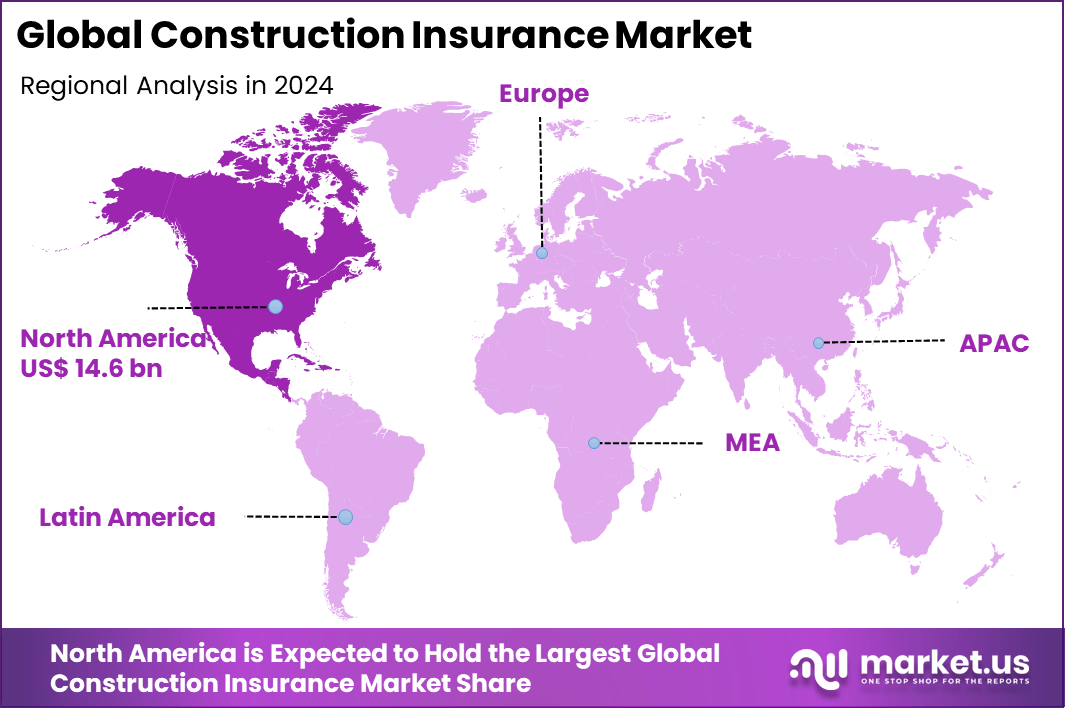

Demand for construction insurance is particularly strong in regions undertaking large infrastructure programmes and in countries with regulatory mandates requiring insurance coverage for construction projects. For example, in 2024 North America held a dominant share of the market with approximately 37.3% of revenue in one estimate.

Market Scope and Forecast

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 39.2 Bn |

| Forecast Revenue (2034) | USD 92 Bn |

| CAGR (2025-2034) | 8.9% |

| Largest market in 2024 | North America [37.3% market share] |

Key Insight Summary

- The global Construction Insurance Market is projected to grow from USD 39.2 Billion in 2024 to USD 92.0 Billion by 2034, registering a strong 8.9% CAGR, supported by increasing infrastructure investments and risk management needs.

- North America dominated with a 37.3% share in 2024, generating around USD 14.6 Billion in revenue, driven by active construction projects and stringent safety regulations.

- The United States contributed USD 13.9 Billion in 2024 and is expected to expand at a steady 5.8% CAGR, reflecting rising demand for project-specific and liability coverage in large-scale developments.

- By type, Property and Casualty Insurance led with 68% share, emphasizing its importance in safeguarding against site damage, third-party liability, and operational risks.

- By application, the Agency Channel held 46% share, underscoring the critical role of intermediaries in providing customized coverage solutions for contractors, builders, and developers.

Investment and Business benefits

Investment opportunities abound as the market evolves with new tech-driven insurance products. The growing interest in sustainable and resilient infrastructure projects creates demand for innovative insurance solutions. Insurtech startups and established providers are increasing capital deployment to develop smarter policies and claims systems. Public-private partnerships and government infrastructure programs also present fertile ground for investment. Investors benefit from the expanding need for comprehensive risk management in construction, especially in sectors like data centers and life sciences where insurance demand is surging.

Business benefits from construction insurance include financial security against project delays, accidents, and legal claims. Insurance fosters confidence among stakeholders, facilitating smoother project financing and execution. Customizable policies help optimize coverage costs by focusing on actual risk profiles. Enhanced risk management support from insurers also contributes to fewer losses and better safety practices. This, in turn, can lead to lower premiums and improved overall project outcomes, making insurance an invaluable tool in construction business strategies.

Regional Analysis

In 2024, North America led the global market, accounting for over 37.3% of total revenue and generating around USD 14.6 billion. The region’s dominance is supported by strict regulatory frameworks, high-value construction activities, and strong adoption of comprehensive insurance policies to mitigate project-related risks and financial uncertainties.

Role of Generative AI

Generative AI is transforming construction insurance by improving risk assessment and underwriting processes. It analyzes large sets of historical and real-time data to produce faster, more accurate risk profiles. This technology reduces manual work and speeds up decision making, helping insurers manage complex construction project risks efficiently. For example, generative AI can generate synthetic data to test and refine models, cutting down the time needed to assess policies and claims. Studies show about 40% of insurers are adopting AI tools to automate underwriting and fraud detection in 2025, pointing to its growing influence in the sector.

Beyond speed and precision, generative AI also enhances fraud detection by identifying unusual claim patterns that human examiners may miss. It uses predictive analytics to model potential future risks, allowing insurers to anticipate new threats early. Its ability to customize insurance products based on project specifics and customer data adds more value for clients. By 2025, over 35% of construction insurance firms report improved operational efficiency linked directly to generative AI adoption, highlighting its significant role in modernizing this market.

Emerging Trends

A key trend is the use of technology integration, including digital tools and AI, in risk assessment and policy management. This shift supports more accurate pricing and quicker claim settlements. For instance, parametric insurance, which pays out based on predefined triggers like weather events, is gaining traction and accounted for nearly 15% of new policies in 2025. Insurers are also focusing on eco-friendly and sustainable construction insurance products to respond to growing green building trends, which have grown by 20% in policy offerings over the past year.

Another trend is the expansion of coverage to tackle emerging risks such as supply chain disruptions and cybersecurity threats in construction projects. These complex risks are driving demand for customized insurance solutions tailored to large infrastructure and offsite construction methods. The rise in large-scale projects globally has pushed insurers to create more specialized coverage options suited to the intricacies of modern construction, with the share of such policies increasing by around 12% in 2025.

Growth Factors

One main driver is the rise in global infrastructure investment, which increases construction activity and the associated risks needing coverage. Governments around the world are mandating insurance for construction projects, pushing up demand. This regulatory environment has led to a reported 18% growth in construction insurance uptake in many regions. Additionally, more awareness among contractors and project owners about risk mitigation has boosted the market, with companies increasingly seeing insurance as essential for project stability.

Technological advancements in construction, such as automation and prefabrication, are also contributing to market growth. These innovations create new risk profiles and require updated insurance products. Market data indicates that construction firms using advanced technologies are requesting insurance policies that cover new technology-related risks, contributing roughly 10% to the insurance product development rate. This shift supports broader adoption of construction insurance as projects become more complex.

Key Market Segments

By Type

- Professional Liability

- Property & Casualty

By Application

- Agency

- Bancassurance

- Digital & Direct Channels

Top Key Players in the Market

- AIG

- Tokio Marine

- ACE&Chubb

- XL Group

- QBE

- Zurich Insurance

- AXA

- Beazley

- Munich Re

- Allianz

- Mapfre

- Manulife

- Nationwide

- State Farm

- Berkshire Hathaway

- Liberty Mutual

- Other Key Players

Source of information – https://market.us/report/construction-insurance-market/