Introduction

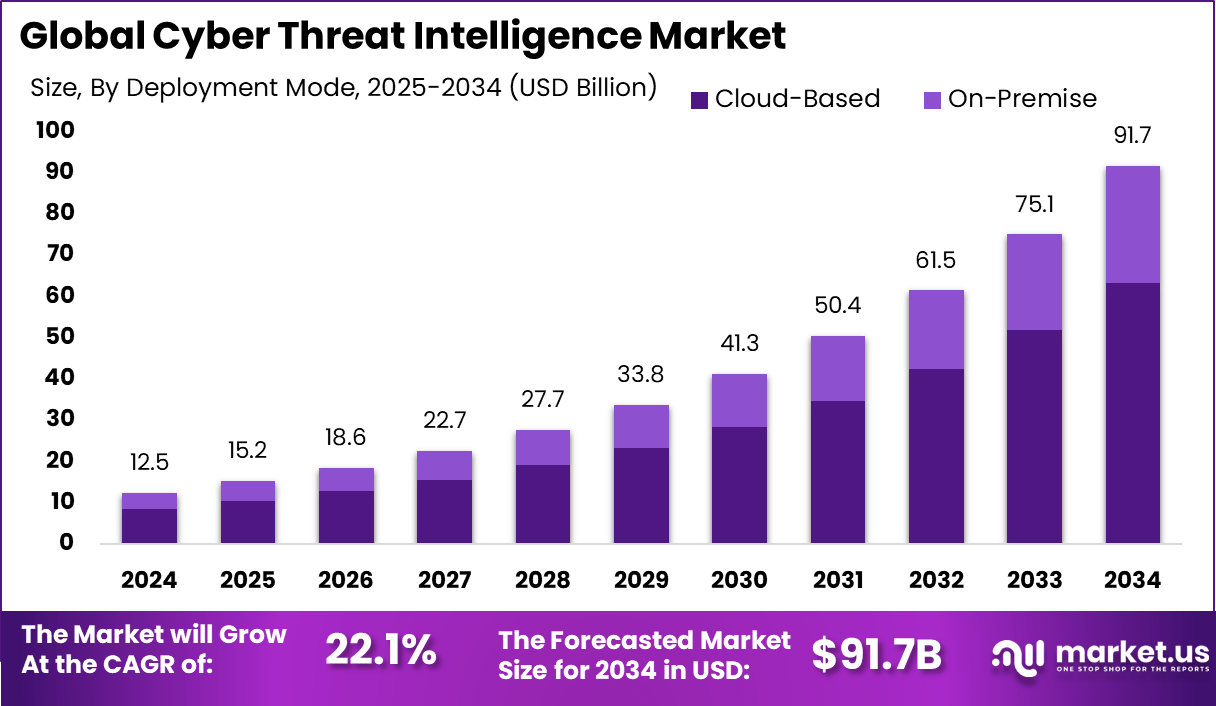

The Global Cyber Threat Intelligence Market is projected to expand significantly, reaching USD 91.7 billion by 2034, up from USD 12.5 billion in 2024. This growth reflects a strong CAGR of 22.1% during the forecast period from 2025 to 2034. The rapid rise is being driven by the growing frequency of sophisticated cyberattacks, increasing regulatory compliance requirements, and the rising demand for advanced threat detection and response solutions across industries such as banking, defense, healthcare, and critical infrastructure.

The cyber threat intelligence market has emerged as a critical field enabling organizations to anticipate, detect, and respond to threats before they materialize. It encompasses structured processes for collecting, analyzing, and applying intelligence about potential cyber risks. This proactive orientation enhances decision‑making and strengthens cyber‑resilience by furnishing context‑rich insights about threat actors, attack vectors, and emerging vulnerabilities. The result is a shift from reactive defense toward predictive and strategic security postures.

The Threat Intelligence Market is entering a phase of rapid transformation as organizations seek proactive measures to counter increasingly complex cyber risks. The demand for structured and actionable intelligence has grown significantly, supported by expanding digital infrastructures and heightened exposure to attacks across industries. The steady rise of cyber incidents is compelling enterprises to move from reactive strategies to intelligence-led security practices that improve both readiness and resilience.

One of the strongest signals of market maturity is the rapid rise in the number of enterprises actively deploying intelligence frameworks. By 2024, close to 5,916 companies were expected to integrate these solutions, reflecting the growing perception that traditional security controls are no longer sufficient.

Alongside this expansion, the formation of dedicated Cyber Threat Intelligence (CTI) teams has accelerated, with adoption projected at 53.29%, indicating that organizations are institutionalizing intelligence capabilities at a strategic level. This development highlights a clear movement toward defense architectures that prioritize foresight over response.

Cloud-based intelligence solutions are also emerging as a critical growth driver. Their scalability, flexibility, and ability to integrate diverse data streams have made them central to modern cybersecurity strategies. Small and medium enterprises, which traditionally lacked access to advanced tools, are now actively adopting cloud-driven intelligence platforms. By the end of 2024, adoption among SMEs was expected to reach 66%, a notable milestone in broadening access to advanced cybersecurity.

Key Insights

- The Global CTI Market is projected to expand from USD 12.5 billion in 2024 to about USD 91.7 billion by 2034, registering a strong CAGR of 22.1% during the forecast period.

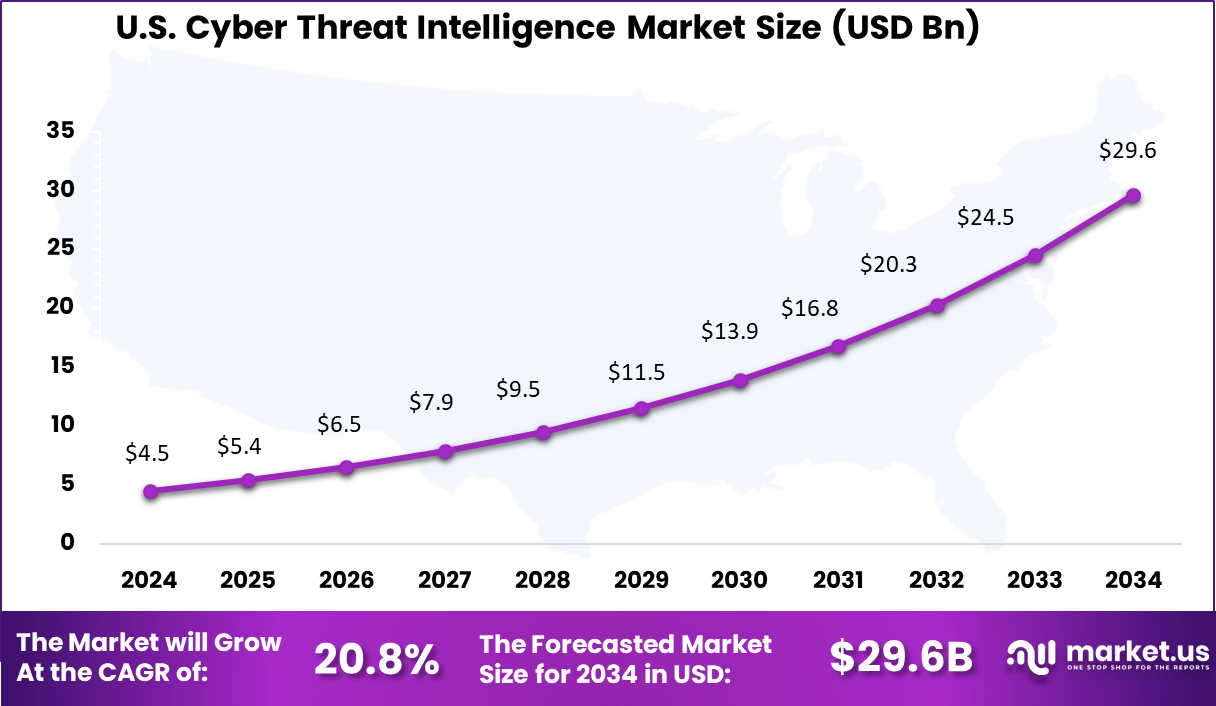

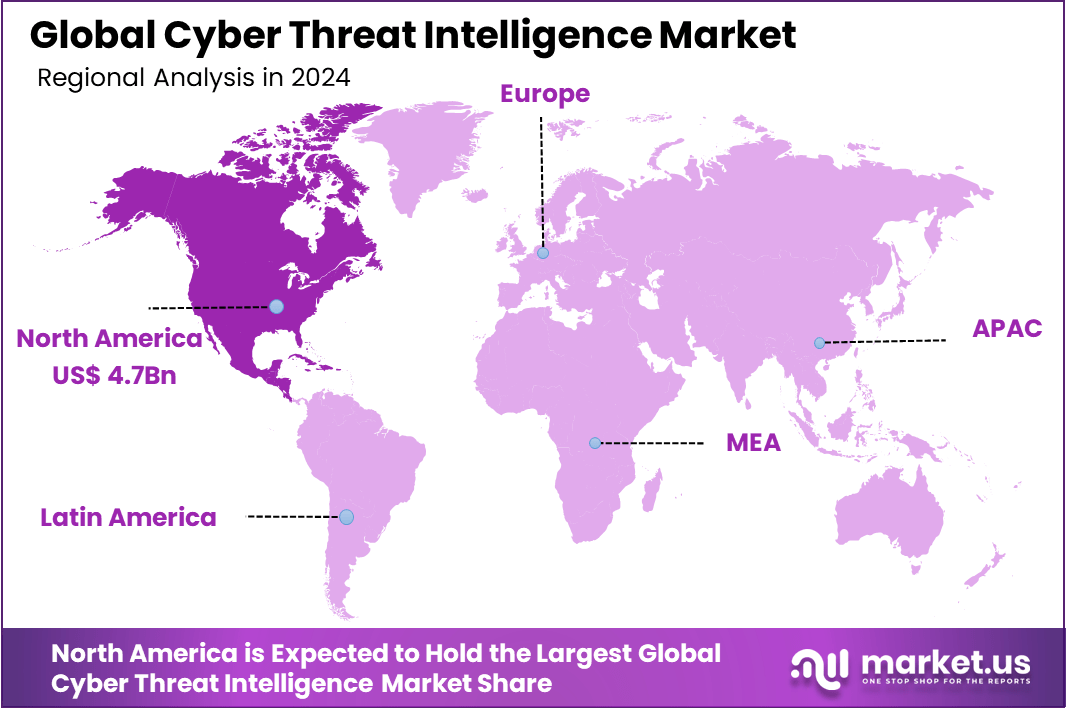

- North America led in 2024 with more than a 38% share, generating USD 4.7 billion in revenue. Within this, the U.S. contributed USD 4.5 billion, underlining its dominance.

- The U.S. market is forecast to reach nearly USD 29.6 billion by 2034, supported by a 20.8% CAGR between 2025 and 2034.

- By Component, Solutions captured 63% share in 2024, reflecting strong adoption of advanced platforms for proactive threat detection.

- By Deployment, Cloud-Based models dominated with a 69% share, enabled by scalable infrastructure and faster integration with enterprise security frameworks.

- By Organization Size, Large Enterprises accounted for 61% share, emphasizing their investments in CTI platforms for real-time risk management and advanced threat hunting.

- By Application, Security Information and Event Management (SIEM) led with a 26% share in 2024, driven by its role in consolidating, analyzing, and contextualizing threat intelligence data.

- By Industry Vertical, BFSI held 20% share, reflecting heightened exposure to cyberattacks and stricter regulatory compliance mandates across financial institutions.

Regional Analysis

The US Cyber Threat Intelligence Market is gaining strong traction as organizations prioritize proactive defense strategies against advanced cyber risks. In 2024, the market stood at nearly USD 4.5 Billion, and it is set to expand significantly, reaching about USD 11.5 Billion by 2029 and close to USD 29.6 Billion by 2034. This growth reflects a projected CAGR of 20.8% from 2025 to 2034, supported by the rising frequency of attacks, rapid digitalization, and the growing importance of intelligence-driven security frameworks across critical industries.

In 2024, North America held a dominant market position, accounting for more than 38% share and generating USD 4.7 billion in revenue. This leadership is attributed to the strong presence of cybersecurity solution providers, high adoption of advanced digital technologies, and government initiatives to strengthen national cyber defense frameworks. The region’s enterprises are also heavily investing in AI-driven threat detection, predictive analytics, and real-time monitoring, which continue to reinforce North America’s leading position in the global landscape.

Driver Factor

Increasing Frequency and Sophistication of Cyberattacks

One of the primary forces propelling the Cyber Threat Intelligence market is the rising number and complexity of cyberattacks targeting organizations worldwide. Cybercriminals are constantly developing new methods to bypass traditional security measures, forcing businesses to adopt advanced intelligence solutions that provide real-time insights into emerging threats and attack techniques.

This evolution in attack sophistication has heightened the urgency for organizations to proactively identify threats and protect sensitive data, pushing demand for actionable threat intelligence tools and services. Moreover, the shift towards digital transformation, with expanded cloud adoption and remote work environments, has broadened the attack surface, making organizations more vulnerable to cyber risks.

With regulatory mandates on cybersecurity tightening globally, enterprises are investing heavily in CTI solutions to build resilient cyber defenses. This growing awareness of advanced cyber threats and regulatory compliance requirements collectively drives rapid market growth, as companies seek to stay ahead of attackers with insightful threat intelligence.

Restraint Factor

Privacy and Data Sensitivity Concerns

Despite the growing need for Cyber Threat Intelligence, the market faces significant challenges related to privacy and the handling of sensitive data. Sharing detailed threat information and intelligence across organizations raises privacy issues and regulatory complexities. Businesses must carefully balance the benefits of exchanging threat data with the risks of exposing confidential or personally identifiable information, which inhibits large-scale collaboration and data sharing.

Additionally, compliance with diverse international data protection laws, such as GDPR in Europe and CCPA in the U.S., creates barriers that limit the scope and efficiency of intelligence sharing. The cost and technical challenges of securing information exchange channels add to these hurdles, restricting wider adoption of CTI solutions, especially for smaller firms without extensive cybersecurity budgets or expertise. These privacy concerns remain a crucial restraint to market expansion.

Opportunity Analysis

Growth of Cloud-Based Threat Intelligence Solutions

An important growth opportunity lies in the increasing adoption of cloud-based cyber threat intelligence platforms. Cloud technology offers scalable, flexible, and cost-effective solutions that enable organizations to monitor and respond to cyber threats in real time. Cloud-based systems facilitate easier integration with existing security infrastructures and provide enhanced data analytics capabilities, which improves the speed and accuracy of threat detection and response.

Furthermore, Threat Intelligence as a Service (TIaaS) models are emerging to support small and medium-sized enterprises (SMEs) that may not have the resources to maintain in-house security teams. These subscription-based services deliver expert-driven threat analysis and actionable insights, making advanced threat intelligence accessible and affordable for a broader range of businesses. This trend bolsters market growth by addressing the diverse needs of various industries and increasing the overall cybersecurity posture.

Challenge Analysis

Talent Shortage in Cybersecurity Professionals

One of the biggest challenges facing the Cyber Threat Intelligence market is the shortage of qualified professionals who can effectively analyze, interpret, and act on threat intelligence data. The rapid expansion of cyber threats has outpaced the supply of skilled cybersecurity experts, creating a talent gap that limits the ability of organizations to fully leverage CTI tools.

Without adequate expertise, companies may rely heavily on automated systems or outsource key functions, potentially missing subtle but critical threat indicators. This shortage is particularly acute for mid-sized and smaller enterprises that cannot compete with larger firms offering higher salaries and better benefits for cybersecurity talent. The scarcity of trained personnel compromises the effectiveness of threat intelligence investments, making skills development a pressing market challenge.

Key Market Segments

By Component

- Solutions

- Threat Intelligence Platforms

- Security Information and Event Management (SIEM)

- Log Management

- Risk and Compliance Management

- Services

- Managed Services

- Professional Services

- Consulting

- Training

- Integration

By Deployment Mode

- On-Premise

- Cloud-Based

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Application

- Security Information and Event Management (SIEM)

- Risk Management

- Incident Response

- Security Analytics

- Others (e.g., malware analysis, threat hunting)

By Industry Vertical

- BFSI

- IT & Telecom

- Government & Defense

- Healthcare

- Retail & E-commerce

- Manufacturing

- Energy & Utilities

- Others

Top Key Players Covered

- IBM Corporation

- Optiv Security, Inc.

- Dell Technologies, Inc.

- Lookingglass Cyber Solutions, Inc.

- Webroot Inc.

- LogRhythm, Inc.

- Check Point Software Technologies Ltd.

- McAfee LLC

- Anomali

- Farsight Security, Inc.

- Splunk, Inc.

- Juniper Networks, Inc.

- Symantec Corporation

- Others

Discover More @ https://market.us/report/cyber-threat-intelligence-market/