Introduction

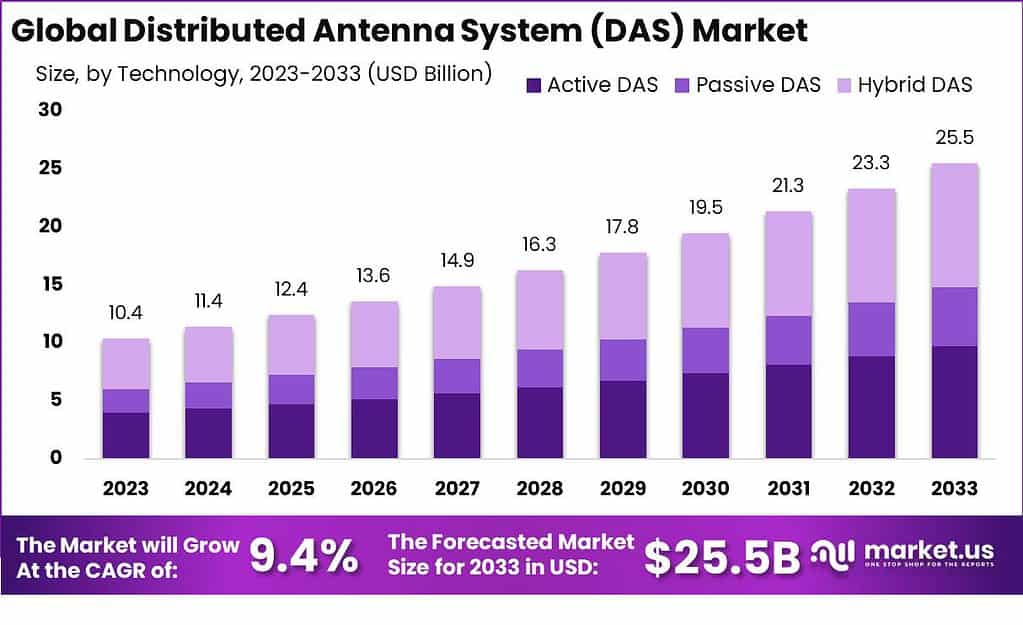

The Global Distributed Antenna Systems (DAS) Market is expected to grow from USD 10.4 billion in 2023 to USD 25.5 billion by 2033, at a CAGR of 9.4%. DAS enhances wireless signal coverage and capacity in territories like large buildings, stadiums, airports, and urban areas where direct signals are weak. The increasing rollout of 5G technology, rising mobile data traffic, and expansion of IoT applications are major growth drivers. Hybrid DAS technology leads the market with a 42% share due to its flexibility and scalability for large venues.

Carrier ownership dominates with 38% market share, driven by telecom providers investments to optimize network performance. Public venues and safety applications hold over 23% market share, emphasizing the importance of reliable communication in crowded spaces. North America leads regionally, contributing 40% of the market revenues, driven by investments and regulations supporting enhanced connectivity. Key players include CommScope Inc., Corning Inc., and SOLiD Inc., who focus on innovation and market expansion.

The Distributed Antenna System (DAS) market is gaining momentum as buildings and public spaces struggle with weak wireless signals from single towers that can’t penetrate thick walls or crowds. DAS spreads antennas across areas to boost coverage evenly, handling calls, data, and emergencies without drops. It’s become essential in malls, hospitals, stadiums, and offices where people expect seamless phone and internet service indoors and out. The shift to data-heavy apps like video calls and streaming makes reliable DAS a baseline for modern venues.

Top driving factors stem from exploding mobile data use, with smartphones and tablets demanding steady high-speed connections everywhere. 5G rollout cranks up the need, as its short waves need dense antenna networks to work right in cities and indoors. Smart city projects wire up traffic, safety, and utilities over wireless, while public safety rules mandate strong signals for first responders. Urban growth packs more users into tight spots, overwhelming old setups.

Demand analysis highlights commercial buildings leading at over 40%, from offices to retail where dropped calls hurt business. Healthcare follows for patient monitoring and staff coordination, then transportation hubs like airports. Outdoor DAS surges in stadiums and campuses for crowd events. Asia-Pacific races ahead with city booms and 5G pushes, while North America holds steady on upgrades.

Top Key Takeaways

- Hybrid DAS leads technology segments with 42% market share, favored for its ability to balance cost and performance in diverse environments.

- Carrier ownership dominates ownership segments with 38% market share, driven by carriers’ control of infrastructure for seamless network management and upgrades.

- Public venues & safety represent the largest application segment with over 23% market share, highlighting critical demand for dependable communication in large, dense environments like stadiums and transit hubs.

- North America holds a dominant regional share of approximately 40%, reflecting high investments in telecom infrastructure and strict regulatory mandates promoting DAS adoption.

Key Statistics

- According to scoop.market.us, CommScope Inc. holds the largest market share at 15%.

- TE Connectivity Ltd. follows closely with a 14% market share.

- Advanced RF Technologies, Inc. accounts for 13% of the overall market.

- RFI Technology Solutions captures an 11% share, reflecting strong industry participation.

- BTI Wireless and Anixter Inc. each hold a 9% market share.

- Boingo Wireless, Inc. appears twice in reported data, showing a combined presence of around 14%.

- CenRF Communications Limited holds a 7% share, completing the competitive landscape.

- The distribution reflects a highly competitive market where leading companies maintain substantial and closely aligned shares

Market Facts

- 5G rollout pushes DAS demand hard in crowded spots like stadiums and airports, where signals need to reach everywhere without dropping.

- Indoor setups lead the way as buildings block outdoor towers, forcing teams to wire up offices and malls for steady phone and data links.

- Asia-Pacific jumps ahead fast with city builds and mobile booms in places like China and India pulling in more installs every month.

- Smart city projects tie DAS into traffic lights and sensors, making sure IoT gear talks back without hiccups in busy zones.

- Public safety rules kick in for hospitals and transit hubs, where first responders count on clear comms no matter the crowd size.

Key Market Segment

By Technology

- Active DAS

- Passive DAS

- Hybrid DAS

By Ownership

- Neutral-Host Ownership

- Carrier Ownership

- Enterprise Ownership

By Application

- Education Sector & Corporate Offices

- Public Venues & Safety

- Hospitality

- Healthcare

- Industrial

- Airport & Transportation

- Other Applications

Top Key Players

- Anixter Inc.

- Cobham PLC

- Antenna Products Corporation

- CommScope Inc.

- Tower Bersama Group

- SOLiD Inc.

- TE Connectivity Ltd

- Corning Inc.

- Comba Telecom Systems Holdings Ltd

- Boingo Wireless Inc.

- American Tower Corporation

- Other Key Players

Future Outlook

The Distributed Antenna System (DAS) market will expand steadily through 2035, propelled by the global rollout of 5G networks, surging mobile data traffic, and demand for reliable indoor and outdoor coverage in high-density venues like stadiums, airports, and urban centers. Integration with small cells, IoT ecosystems, and smart city initiatives will drive adoption, while Asia-Pacific leads growth amid rapid urbanization and telecom infrastructure investments.

Opportunities

- 5G network densification requiring DAS for enhanced capacity and low-latency coverage in congested urban areas.

- Smart city projects integrating DAS with IoT sensors for public safety, traffic management, and connected infrastructure.

- Expansion into transportation hubs like subways, tunnels, and highways to eliminate dead zones and support emergency communications.

- Hybrid DAS solutions combining active and passive systems for cost-effective scalability in commercial buildings and enterprises.

- Partnerships between telecom operators and DAS providers to deploy cloud-managed platforms for remote monitoring and optimization.

Challenges

- High upfront deployment costs for complex installations in large venues and challenging environments like tunnels.

- Technical integration hurdles with existing legacy networks during 5G upgrades and multi-operator sharing.

- Power consumption and maintenance demands for active DAS systems in remote or hard-to-access locations.

- Spectrum interference and capacity limitations in ultra-dense deployments supporting massive IoT connectivity.

- Regulatory delays and varying compliance standards across regions for RF emissions and site approvals.

Conclusion

The Distributed Antenna Systems market is poised for steady expansion, underpinned by the global 5G rollout, surging data traffic, and growing demand for reliable wireless coverage in complex indoor environments. Hybrid DAS technology’s versatility and carrier ownership models provide scalable, high-performance solutions meeting diverse connectivity needs. Public venues and safety applications emphasize the critical nature of DAS in modern infrastructure. Continuous innovation by key players and regulatory support will further accelerate DAS adoption and integration with emerging technologies like IoT, ensuring robust, ubiquitous wireless connectivity across sectors.

Read More – https://market.us/report/distributed-antenna-system-das-market/