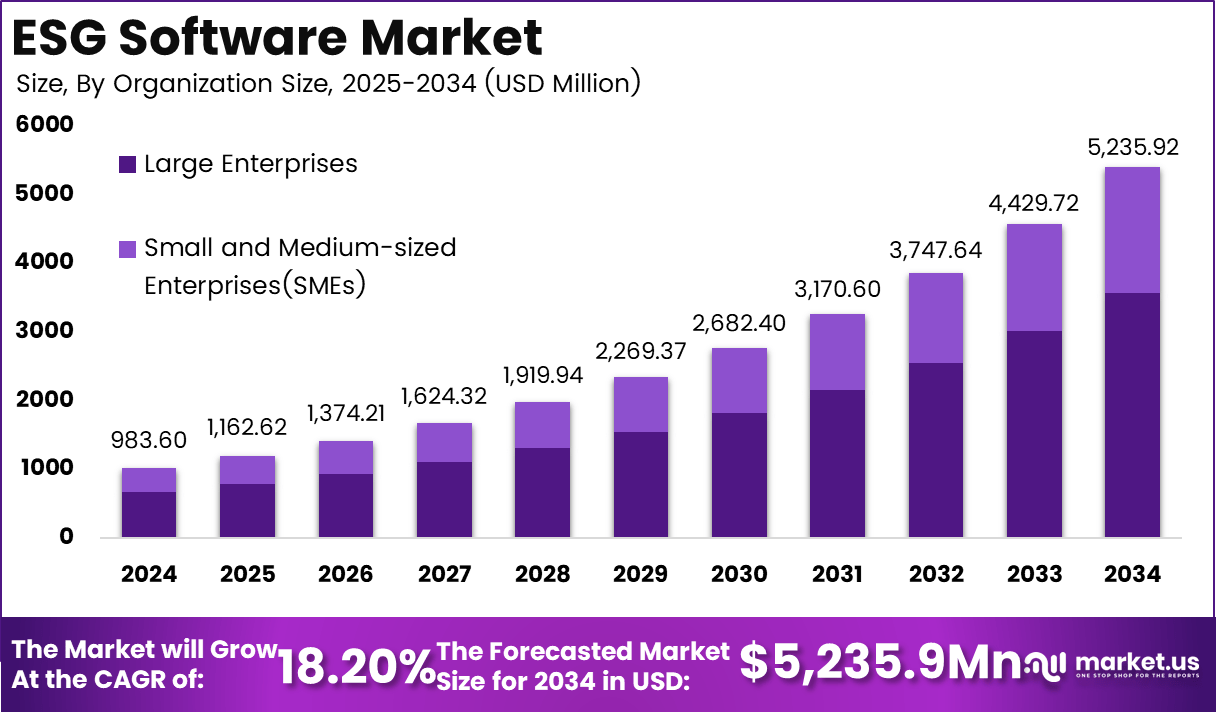

According to Market.us, The Global ESG Software Market is expected to reach around USD 5,235.9 million by 2034, rising from USD 983.6 million in 2024, at a strong CAGR of 18.2% between 2025 and 2034. The growth is being driven by the increasing emphasis on sustainability reporting, regulatory compliance, and corporate transparency.

Organizations are adopting ESG software to streamline data collection, enhance performance tracking, and align operations with environmental and social goals. In 2024, North America led the market with a 36.7% share, generating nearly USD 360.9 million in revenue, supported by advanced digital infrastructure and early regulatory adoption.

The ESG software market is rapidly evolving, with organizations increasingly relying on digital platforms to manage, track, and report their environmental, social, and governance performance. These tools are becoming essential for compliance, risk management, and strategic decision-making, especially as regulatory and investor expectations grow more demanding.

A key driver for the ESG software market is the surge in regulatory requirements worldwide. Governments and regulatory bodies are mandating detailed ESG disclosures, such as the Corporate Sustainability Reporting Directive (CSRD) in Europe and similar frameworks in the U.S. and Asia. Investor demand for transparent, auditable ESG data is also pushing companies to adopt these platforms, as sustainability performance is now a major factor in investment decisions.

Demand for ESG software is rising across all sectors, but the energy and utilities industry is seeing the fastest growth, driven by decarbonization targets and climate risk disclosure mandates. Small and medium-sized enterprises (SMEs) are also adopting ESG software at a rapid pace, thanks to the availability of affordable, cloud-based solutions tailored to their needs. The IT and telecommunications sector is another high-growth area, with companies prioritizing automated carbon accounting and supply chain transparency.

Key Takeaways

- The Environmental Management Software segment led the market with a 36.6% share, reflecting its crucial role in tracking sustainability metrics and improving environmental performance.

- Large Enterprises dominated by organization size with a 68.1% share, driven by the need for comprehensive ESG data tracking and formalized sustainability reporting frameworks.

- The Cloud deployment segment captured 69.7%, highlighting widespread adoption of scalable, real-time platforms for managing and analyzing ESG data.

- By industry vertical, the BFSI sector accounted for 19.7%, emphasizing its focus on sustainable finance, transparency, and compliance with ESG-related regulations.

- North America maintained a leading 36.7% market share, supported by stringent disclosure mandates, investor awareness, and advanced reporting technologies.

- The U.S. market generated USD 324.8 million in 2024, growing at a steady CAGR of 16.9%, establishing itself as the primary hub for ESG software innovation and adoption.

Market Dynamics

Regulatory Pressure as a Driver

Regulatory pressure is a major force pushing companies to adopt ESG software. Governments and financial regulators worldwide are introducing stricter rules for environmental, social, and governance disclosures. For example, the EU’s Corporate Sustainability Reporting Directive (CSRD) and the SEC’s climate disclosure rules in the U.S. require businesses to provide detailed, auditable ESG data.

These rules are making manual reporting methods outdated and risky, so companies are investing in digital ESG platforms to automate compliance and reduce the risk of penalties. As a result, ESG software is becoming essential for organizations that want to stay ahead of regulatory deadlines and maintain investor confidence.

This regulatory push is not limited to large corporations. Small and medium-sized enterprises (SMEs) are also feeling the pressure, especially as supply chain mandates and global reporting standards expand. Affordable, cloud-based ESG solutions are now available, helping SMEs meet compliance requirements without the high costs of legacy systems. The trend is clear: regulatory changes are making ESG software a must-have tool for businesses of all sizes, not just a nice-to-have for sustainability leaders.

High Implementation Costs as a Restraint

One of the biggest barriers to ESG software adoption is the high cost of implementation. Many organizations, especially SMEs, struggle to justify the upfront investment in licensing, integration, and ongoing support. Integrating ESG software with existing enterprise systems like ERP or CRM often requires customization and specialized expertise, which can drive up expenses. For example, aligning ESG metrics with fragmented data sources may need niche consultants or additional staff, further increasing the total cost.

These costs are a particular challenge for smaller businesses that lack dedicated sustainability budgets. Without clear short-term returns, some companies hesitate to invest in ESG software, especially if they do not have internal expertise. This creates a gap in adoption rates, with larger firms moving faster while smaller ones lag behind. The high cost of entry remains a significant restraint on the broader adoption of ESG software across all sectors.

Data Analytics and Automation as an Opportunity

The rise of advanced data analytics and automation is opening new opportunities in the ESG software market. AI-powered tools can automate data extraction, anomaly detection, and predictive modeling, cutting report preparation costs by over 90% in some cases. These technologies allow companies to handle large datasets, track Scope 3 emissions across supply chains, and generate real-time sustainability insights. As a result, ESG software is moving beyond basic compliance to become a strategic tool for proactive sustainability management.

Organizations are also leveraging IoT devices and blockchain to collect real-time environmental data and enhance transparency. This convergence of technologies is setting new standards for ESG disclosures and verification, making it easier for companies to benchmark their performance and build stakeholder trust. The opportunity lies in using these innovations to turn ESG reporting into a competitive advantage, not just a compliance exercise.

Lack of Standardized Metrics as a Challenge

A key challenge facing the ESG software market is the lack of universal standards for measuring and reporting ESG factors. Different organizations use varied frameworks, definitions, and data collection methods, leading to inconsistent reports that confuse investors and regulators. For example, carbon emissions or social responsibility metrics may be reported differently across companies, making it hard to compare sustainability performance. This lack of standardization limits the ability of ESG software to deliver reliable, comparable data across industries and regions.

The absence of clear standards also complicates integration efforts and undermines user confidence in the accuracy of ESG data. Stakeholders increasingly demand independent verification, but without standardized assurance frameworks, ESG data risks being viewed as less credible than financial data. This challenge is slowing the pace of adoption and making it harder for companies to demonstrate real progress on sustainability goals.

Top Key Players

- Datamaran

- EcoVadis

- NAVEX Global, Inc.

- OneTrust, LLC

- Refinitiv

- SAS Institute Inc.

- Sustainalytics

- TruValue Labs

- Verisk 3E

- Wolters Kluwer N.V.

- Other

Read More – https://market.us/report/esg-software-market/