Introduction

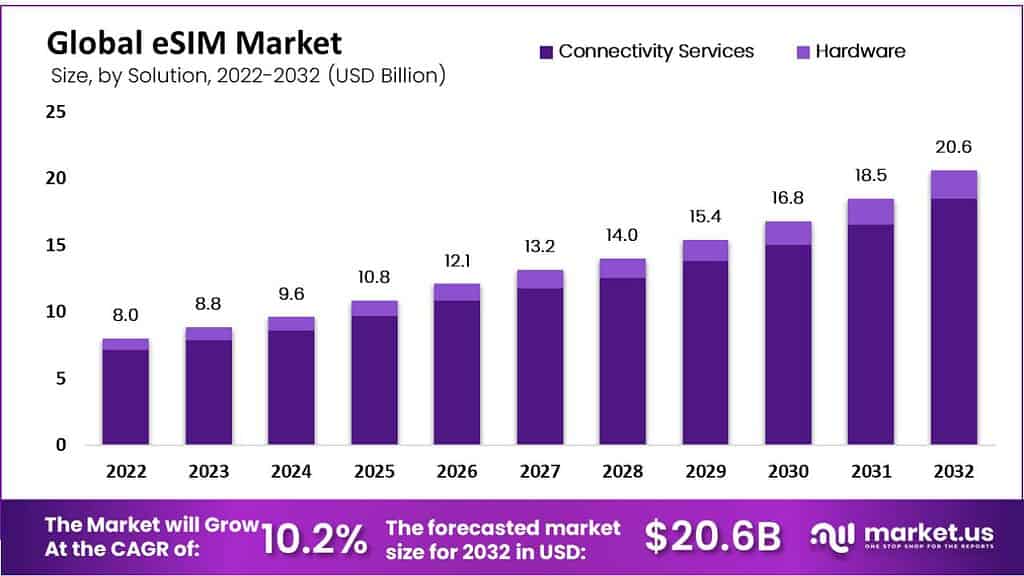

The Global eSIM Market grows from USD 8.8 billion in 2023 to USD 20.6 billion by 2032, at a CAGR of 10.2%, as embedded digital SIMs enable easier carrier switching and connectivity in smartphones, cars, IoT devices, and wearables. The eSIM market refers to the ecosystem of embedded, programmable SIM technology that is built into a device and activated through software instead of a removable plastic SIM card. Adoption is being accelerated across smartphones, tablets, laptops, wearables, connected cars, and industrial IoT devices because onboarding can be completed remotely. This approach reduces physical handling and enables faster connectivity for both consumers and enterprises.

Key Statistics

- According to scoop.market.us, Apple leads eSIM adoption with a 22% share, reflecting strong usage among iOS smartphone users.

- Among young users aged 18 to 24, eSIM adoption stands at 24%, showing high interest in new and advanced mobile technologies.

- Users still relying on 3G networks show a 17% eSIM adoption rate, indicating a gradual shift away from physical SIM cards.

- Tablets record a 23% eSIM adoption rate, slightly lower than smartphones, as they are mainly used for entertainment and productivity needs.

- Consumer awareness of eSIM technology differs across countries, pointing to gaps in education, availability, and marketing efforts.

Market growth is also being supported by the steady expansion of compatible device shipments and the rising focus on digital customer journeys in telecom services. Carrier support and standardized eSIM frameworks are improving, which is making eSIM activation more consistent across regions and device types. As a result, eSIM is increasingly positioned as a baseline connectivity feature rather than a premium add on. From an industry structure perspective, the market spans device manufacturers, mobile network operators, eSIM platform providers, and remote SIM provisioning infrastructure vendors. More business models are being enabled, including digital only mobile plans, quick travel connectivity, multi profile subscriptions, and enterprise fleet connectivity management. Operational efficiency is being improved because provisioning, switching, and lifecycle controls can be managed through centralized platforms.

Top Key Takeaways

- Connectivity services hold 89.48% share by solution, driven by network plans, IoT management, and remote provisioning.

- Automotive leads verticals with 27% share, supporting connected cars, telematics, and global LTE in vehicles.

- North America dominates regionally with 42.24% share and USD 3.37 billion revenue in 2022.

Top Driving Factors

First, demand for frictionless digital onboarding is being increased, as users expect mobile plans to be activated in minutes without store visits or physical logistics. Second, multi device connectivity is being prioritized, especially for wearables and tablets where physical SIM slots add design complexity and reduce space for batteries and sensors. Third, the growth of IoT and connected vehicle deployments is creating a strong need for remote provisioning, which supports large scale rollouts across multiple geographies. Fourth, supply chain and operational cost pressure is encouraging the removal of plastic SIM manufacturing, packaging, distribution, and inventory management. Fifth, security and compliance requirements are being strengthened, and eSIM based provisioning can support controlled credential management and enterprise policy enforcement when paired with modern device management tools.

Demand Analysis

Demand is being driven by two distinct streams. Consumer demand is being led by premium and mid range smartphones that increasingly ship with eSIM capability, along with travel use cases where users want fast temporary connectivity without buying a local SIM. Enterprise demand is being accelerated by IoT device fleets, logistics tracking, smart meters, healthcare devices, and connected vehicles, where remote provisioning reduces field maintenance and avoids downtime during carrier changes. In addition, demand is being reinforced by operators and MVNOs as digital acquisition becomes a major growth lever, because eSIM enables lower cost customer acquisition and faster plan conversions through app based activation.

Use Cases

Consumer Smartphones and Wearables

eSIM technology is widely used in smartphones, smartwatches, and fitness bands. It allows users to switch mobile operators digitally without changing a physical SIM card. This improves user convenience and supports multi-network connectivity for travel and daily use.

International Roaming and Travel Connectivity

eSIM enables travelers to activate local or global data plans remotely. This use case reduces roaming costs and removes the need to purchase physical SIM cards abroad. It is widely adopted by frequent travelers and international business users.

Internet of Things (IoT) Devices

eSIM is used in connected devices such as smart meters, asset trackers, and industrial sensors. It supports remote provisioning and lifecycle management of devices deployed across different regions. This makes large-scale IoT deployments easier to manage and more cost efficient.

Automotive and Connected Vehicles

In vehicles, eSIM supports navigation, real-time traffic updates, emergency services, and in-car infotainment. It allows automakers to provide continuous connectivity across borders. This use case is important for connected and autonomous vehicle ecosystems.

Enterprise and Corporate Mobility

Enterprises use eSIM to manage employee devices centrally. It helps IT teams control network access, switch carriers, and reduce hardware handling. This improves operational efficiency and supports remote and hybrid work models.

Smart Home and Consumer Electronics

eSIM is used in smart home devices such as security systems, cameras, and energy management solutions. It ensures stable connectivity without relying fully on local Wi-Fi networks. This enhances reliability for critical home applications.

Kwy Market Segment

Based on Solution

- Hardware

- Connectivity Services

Based on Vertical

- Automotive

- Consumer Electronics

- Energy & Utilities

- Manufacturing

- Retail

- Transportation & Logistics

- Other Verticals

Based on Application

- Connected Cars

- Laptops

- M2M

- Smartphones

- Tablets

- Wearables

- Other Applications

Top Key Players

- Gemalto N V

- Giesecke+Devrient GmbH

- STMicroelectronics N V

- Infineon Technologies AG

- Valid S A

- Kigen Ltd

- Deutsche Telekom AG

- KORE Wireless

- NXP Semiconductors N V

- Sierra Wireless

- Thales Group

- Workz Group

- Other Key Players

Recent Development

- June 2025 – STMicroelectronics promoted ST4SIM-300M industrial-grade eSIM compliant with GSMA SGP.32 for IoT with over-the-air updates.

- January 2025 – Infineon launched OPTIGA Connect Consumer OC1230, the world’s smallest GSMA-compliant eSIM on 28nm process for wearables and smartphones with 25% better power efficiency.

Conclusion

The eSIM market is growing steadily as more phones, cars, and IoT devices use built-in digital SIMs instead of plastic cards. Connectivity services make up most of the revenue, with strong use in connected cars and other smart devices, while North America leads adoption today. Companies like eSIM because it saves space, cuts logistics costs, supports remote activation, and is better for the environment, so usage is likely to keep rising across consumer and industrial devices. Read More – https://market.us/report/esim-market/