Introduction

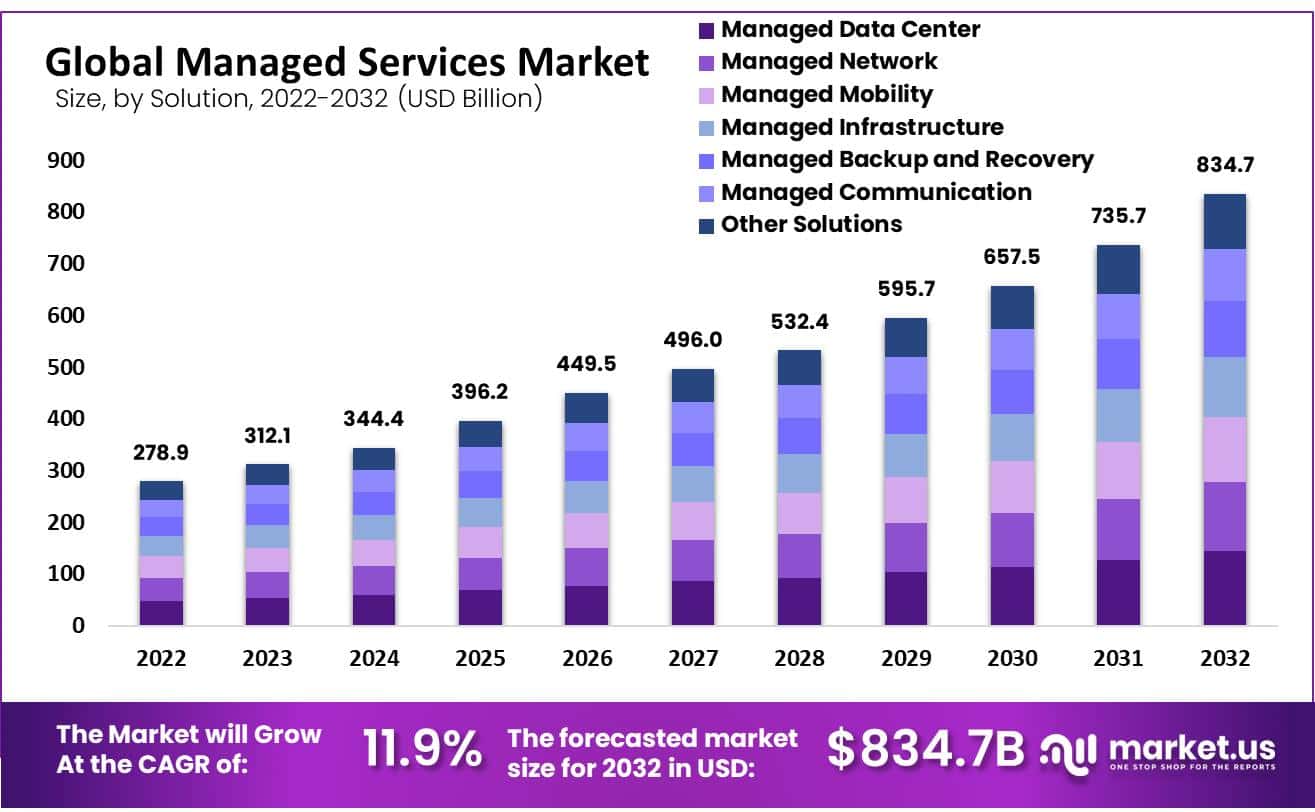

The global Managed Services Market is valued at about USD 312.1 billion in 2023 and is projected to reach USD 834.7 billion by 2032, growing at a CAGR of 11.9% as organizations outsource complex IT and business functions to improve efficiency, cut costs, and focus on core strategies. This growth is driven by cloud adoption, increasing cybersecurity needs, digital transformation, and rising demand from both large enterprises and SMEs across BFSI, IT & telecom, healthcare, manufacturing, retail, and government.

Managed Services market involves outsourcing IT operations like network management, security, and cloud setup to specialized providers who handle day-to-day maintenance and improvements. These services let companies focus on core business while experts deal with complex tech needs, often through subscription models that cover everything from data centers to cybersecurity. Providers step in to monitor systems, fix issues before they hit, and align tech with business goals across sectors like finance, healthcare, and telecom.

Top driving factors stem from businesses chasing cost cuts by handing off IT headaches to pros, plus the rush to cloud setups that need constant oversight. Rising cyber threats push firms toward round-the-clock protection, while a shortage of in-house talent makes outsourcing a smart move for handling AI and IoT rollouts.

Demand picks up as companies prioritize scalable tech amid digital shifts, with large players leading for specialized help and smaller ones jumping in for affordable cloud access. North America holds strong ground, but Asia Pacific surges on rapid digitization and security investments.

Top Key Takeaways

- Solutions: Managed data center leads with about 17.3% share in 2022 (CAGR 10.6%), while managed security is the fastest‑growing solution at 11.2% CAGR.

- Enterprise size: Large enterprises account for 54.6% of revenue in 2022 (CAGR 10.4%), while SMEs are the faster‑growing segment with 10.5% CAGR as they rely on MSPs instead of in‑house IT.

- Managed information services: Business Process Outsourcing (BPO) holds 37.4% share (CAGR 10%), with Project & Portfolio Management the fastest‑growing at 10.2% CAGR.

- Deployment: On‑premise deployments still dominate with 67.2% share in 2022 (CAGR 10.9%), while hosted/cloud managed services grow faster at 11.5% CAGR.

- End‑use: BFSI leads with 18% share in 2022 and 11.6% CAGR, while retail is the fastest‑growing end‑use at 10.3% CAGR due to e‑commerce, omnichannel, and analytics needs.

- Regions: North America holds 36.6% share in 2022 with 10.6% CAGR, while Asia Pacific is the fastest‑growing region at 11.2% CAGR on the back of rapid digitalization and smart city initiatives.

Key Statistics

- According to scoop.market.us, nearly 94% of organizations are either planning to adopt or already using cloud services such as Office 365, AWS, and cloud backup to simplify and modernize their IT operations.

- Among small and medium-sized businesses, about 71% believe cloud services will be critical to their future success, confirming strong long-term reliance on cloud infrastructure.

- Almost 49% of businesses outsource IT functions to allow key staff to focus on core business activities, while 46% rely on external providers for specialized skills such as cybersecurity and disaster recovery.

- Managed IT services provide 24/7 monitoring with up to 99.99% network uptime, while also reducing the rising costs and inefficiencies linked to aging IT systems.

- These services help free up nearly 65% of IT budgets that are typically spent on routine maintenance, allowing firms to redirect spending toward growth and innovation.

- The combined use of big data, cloud technologies, and mobile strategies can drive up to 53% higher business growth, highlighting the strategic value of digital transformation.

- Partnerships with Managed Service Providers support businesses in optimizing IT infrastructure for scalability and innovation, while complementing internal IT teams rather than replacing them.

- In the UK, 45% of businesses planned to increase IT spending by 10% to 20% in 2023 compared to the prior year, positioning managed IT services as a flexible and scalable solution for evolving technology needs.

Key Market Segment

By Solution

- Managed Data Center

- Managed Network

- Managed Mobility

- Managed Infrastructure

- Managed Backup and Recovery

- Managed Communication

- Managed Information

- Managed Security

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By Managed Information Service

- Business Process Outsourcing

- Business Support Systems

- Project & Portfolio Management

- Other Services

By Deployment

- On-premise

- Hosted

By End-Use

- BFSI

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Media & Entertainment

- Retail

- Other End-Use Industries

Top Key Players

- International Business Machines Corporation

- Accenture PLC

- Alcatel-Lucent Enterprise

- AT&T Inc.

- Avaya Inc.

- Ericsson

- Fujitsu Limited

- Lenovo Group Limited

- BMC Software, Inc.

- CA Technologies

- Cisco Systems, Inc.

- Others

Use Cases

IT Infrastructure Management

Managed services handle daily IT tasks like server upkeep and network monitoring for small businesses. This frees owners to focus on sales and growth without hiring full-time tech staff. Companies see fewer outages and steady uptime as providers fix issues before they disrupt work.

Network Upgrades and Support

Firms use managed services for large network refreshes across offices, with 24/7 help during rollouts. Providers test gear, manage changes, and support new sites to cut downtime. One case cut costs while upgrading secure tech in multiple regions.

Cloud Migration and Scaling

Startups and enterprises turn to managed cloud services to move apps to the cloud fast without big upfront costs. Providers optimize setups for growth, security, and backups to handle demand spikes. This supports quick data recovery after failures.

Disaster Recovery Planning

Businesses rely on managed services for backups and recovery plans to protect against floods or cyberattacks. Power plants and distributors avoid revenue loss with online parts ordering and remote access. Plans ensure quick restores with minimal data loss.

Healthcare and Remote Operations

Health systems outsource WAN and LAN management to modernize clinics over wide areas. Providers deploy hardware and ongoing support to keep services running without staff gaps. This aids remote work and focuses teams on patient care.

Recent Development

- December, 2025, IBM announced acquisition of Confluent to build AI data platform enhancing managed services.

- September, 2025, Accenture acquired IAMConcepts to strengthen identity management in managed cybersecurity services.C

Conclusion

The managed services market stands poised for sustained expansion. It is fueled by the outsourcing of IT complexities to specialized providers. This enables businesses to prioritize strategic growth over operational burdens.Dominant segments like managed data centers, large enterprises, business process outsourcing, on-premise deployments, and BFSI underscore robust demand. North America leads regionally amid rapid Asia-Pacific growth.Despite hurdles from cybersecurity threats, integration issues, and regulations, opportunities in generative AI automation, cloud shifts, and emerging markets remain strong. Innovations from key players like IBM, Accenture, and Cisco bolster a future of predictive, efficient services that transform enterprise landscapes.

Read More – https://market.us/report/managed-services-market/