Introduction

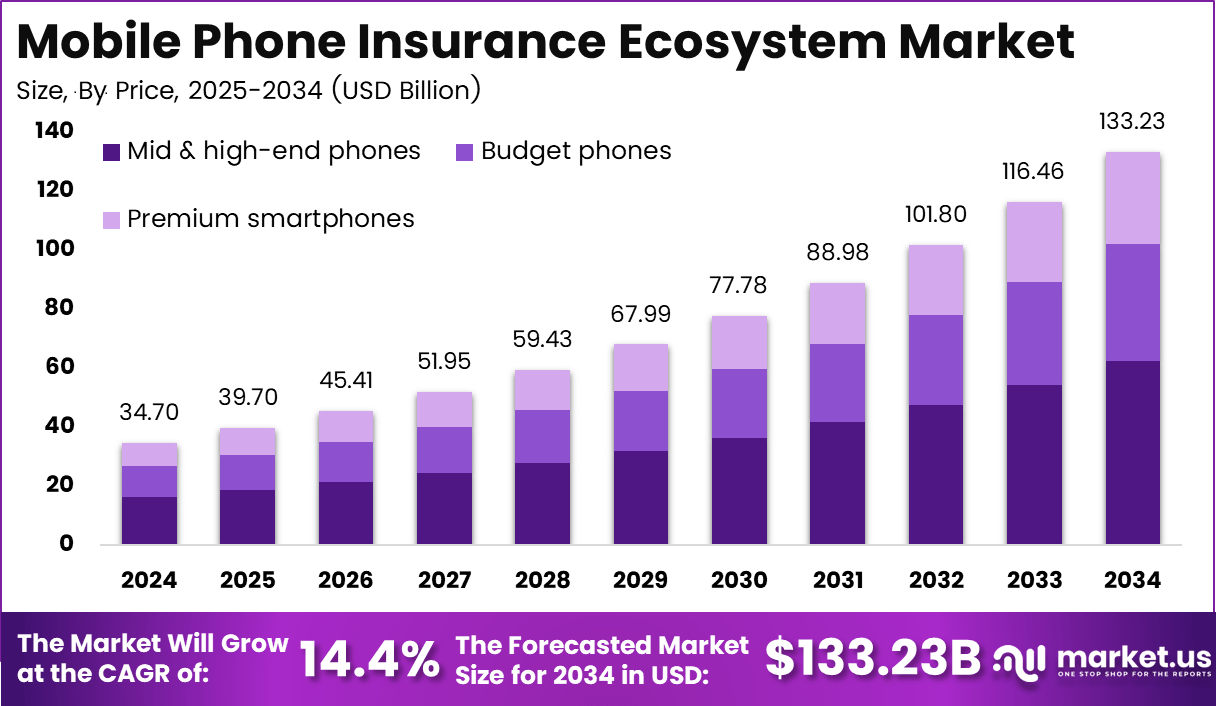

The Global Mobile Phone Insurance Ecosystem Market is forecasted to increase from USD 34.7 billion in 2024 to nearly USD 133.23 billion by 2034, advancing at a CAGR of 14.4% between 2025 and 2034. The growth of this market is being fueled by rising smartphone penetration, higher replacement costs of premium devices, and increasing consumer awareness of insurance coverage for theft, accidental damage, and technical malfunctions.

The Mobile Phone Insurance Ecosystem Market refers to the network of insurers, mobile operators, retailers, device manufacturers, and service providers that offer protection plans for smartphones and other handheld devices. These plans cover risks such as accidental damage, screen breakage, theft, loss, liquid damage, and mechanical or electrical failures beyond the standard warranty. The ecosystem includes underwriting services, claims management, repair networks, replacement providers, and digital platforms that manage customer interactions. It supports both individual consumers and enterprises that insure mobile device fleets.

Top driving factors in this market include the increasing penetration and adoption of smartphones globally. As smartphones become more advanced, expensive, and integral to daily life, consumers are more aware of the need to protect their investments against damage, loss, and theft. The rising cost of repairs and replacements further encourages users to purchase insurance plans. Additionally, partnerships between insurance providers, retailers, and telecom operators simplify the buying process by offering bundled insurance with new device purchases or mobile plans, boosting market acceptance.

Key Insights Summary

- By phone type, Mid & High-end phones dominated the market, capturing 46.7% share, supported by rising adoption of premium smartphones with higher repair and replacement costs.

- By coverage, Physical damage protection led the segment, holding 34.5% share, reflecting consumer demand for safeguarding devices against accidental damage.

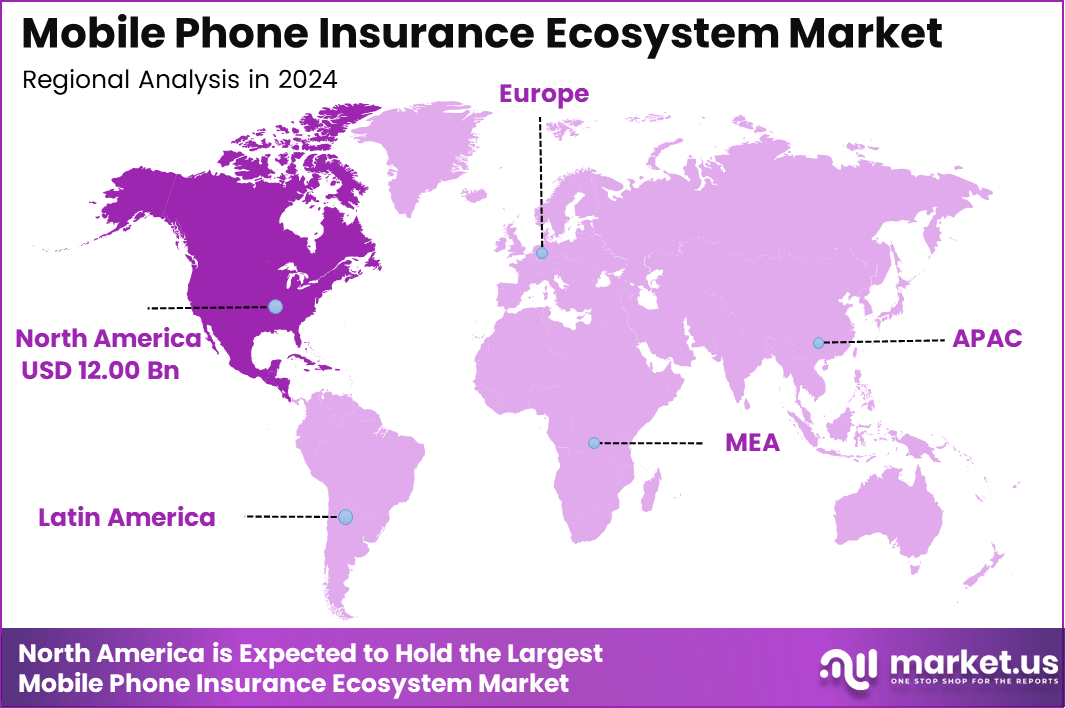

- Regionally, North America accounted for 34.6% of the global market, highlighting strong penetration of insurance services in mature smartphone markets.

- The U.S. market was valued at USD 9.60 Billion in 2024, expanding at a strong 11.5% CAGR, underpinned by high smartphone ownership rates and demand for extended protection plans.

Analysts’ Viewpoint

Demand is high among consumers purchasing mid-range and premium smartphones, as these devices represent significant financial investments. Mobile operators and retailers are bundling insurance with device sales, creating convenient access for customers. Enterprises with large employee device deployments are adopting insurance to minimize downtime and reduce costs associated with damage or loss. Demand is especially strong in regions with high smartphone adoption, such as North America, Europe, and Asia-Pacific. Developing markets are also experiencing increased uptake as device affordability improves and financing options expand.

Technology adoption is reshaping the mobile phone insurance ecosystem. Digital platforms and mobile apps are enabling seamless policy enrollment, claims filing, and real-time claim tracking. Artificial intelligence and machine learning are being used to assess claims more accurately, detect fraud, and automate approvals. Blockchain solutions are being explored for secure policy management and transparent claims handling. Telematics and diagnostic tools integrated into mobile devices allow insurers to remotely assess device health and usage patterns, supporting tailored policy pricing.

Consumers adopt mobile phone insurance to mitigate financial risks from device damage or loss and to ensure quick replacement or repair. For enterprises, insurance minimizes disruption to employee productivity by providing reliable coverage for device fleets. Retailers and mobile operators adopt these solutions to enhance customer loyalty, generate additional revenue streams, and differentiate their service offerings. Insurance providers use these programs to expand into fast-growing digital markets and strengthen relationships with customers through added-value services.

Role of Generative AI

Generative AI is reshaping the mobile phone insurance ecosystem by automating complex and time-consuming tasks like underwriting, claims processing, and customer communication. It enables insurers to analyze vast amounts of data quickly, allowing for personalized insurance recommendations and pricing tailored to individual risk profiles. This technology also accelerates claims settlement by extracting and validating claim information efficiently, reducing delays and human errors.

Additionally, generative AI helps detect fraud through pattern recognition and anomaly analysis, safeguarding insurers from financial losses. Its ability to generate synthetic data supports better risk assessment and product innovation, enabling insurers to design highly customized policies that meet diverse customer needs, especially as smartphones become more advanced and costly.

Investment and Business Benefits

There are strong investment opportunities in digital-first insurance providers, insurtech platforms, and repair networks that integrate seamlessly with insurance programs. Startups focusing on AI-driven claims management and blockchain-based policy solutions are attracting capital. Partnerships between telecom operators, retailers, and insurers present opportunities for bundled offerings and expanded distribution. Emerging markets with growing smartphone penetration represent significant potential for insurers offering affordable, flexible plans tailored to local purchasing power.

Mobile phone insurance provides businesses with benefits such as increased revenue through cross-selling, improved customer retention, and stronger brand loyalty. Telecom operators benefit from reduced customer churn and enhanced service bundles. Retailers gain recurring revenue opportunities while offering value-added services to customers. For insurers, the growing number of mobile users worldwide ensures a stable and expanding market. Enterprises benefit by protecting investments in employee devices, reducing unexpected costs and downtime.

The mobile phone insurance market is influenced by financial regulations governing insurance products, consumer protection laws, and data privacy requirements. In many regions, insurers must comply with licensing requirements to offer device protection plans. Regulations such as the General Data Protection Regulation (GDPR) in Europe and similar frameworks globally require secure handling of customer information collected during policy enrollment and claims management. Consumer protection rules also mandate clear disclosures on coverage terms, exclusions, and pricing.

Regional Analysis

In 2024, North America dominated the market with a 34.6% share, generating about USD 12.0 billion in revenue. The region’s leadership is driven by a high concentration of premium smartphone users, strong partnerships between insurers and telecom operators, and a well-established consumer base that prioritizes device protection services.

Emerging Trends

The mobile phone insurance market is moving towards more digital, customer-centric experiences. Insurance providers are increasingly offering bundled packages that include phone insurance with mobile plans or extended warranties, providing convenience and cost benefits. Digital claims processing through apps and automation is becoming standard, improving turnaround times and customer satisfaction.

Personalization is rising, with pricing and coverage tailored through data analytics and telematics. Subscription-based models are gaining popularity, giving customers flexibility with predictable monthly payments. Cybersecurity insurance coverage for phones is also emerging as a response to growing digital threats. Finally, AI and machine learning tools are widely adopted for smarter fraud detection and efficient claims handling.

Growth Factors

The growth of mobile phone insurance is strongly driven by the increasing adoption of smartphones globally and the rising costs of these devices. Higher device prices push consumers to seek financial protection against damage, theft, or loss. Expanding smartphone usage in emerging markets with growing disposable incomes also fuels demand.

The convenience of digital platforms and mobile apps for buying and managing insurance simplifies access and appeals to tech-savvy users. Collaborations between insurers and mobile network operators help embed insurance offerings into mobile plans, boosting uptake. Awareness of risks related to phone damage or theft encourages consumers to invest in protection. Technological advancements, including AI for quicker claims processing and fraud control, further enhance operational efficiency and customer experience, supporting more growth.

Driver Analysis

Rising Smartphone Adoption and High Device Value

The expansion of the mobile phone insurance market is primarily driven by the rapid increase in smartphone adoption worldwide. More people are using smartphones as essential everyday tools for communication, work, and entertainment. With this rise in smartphone use, especially premium and advanced models, consumers are increasingly seeking protection for these costly devices against accidental damage, theft, and loss.

The high price of modern phones combined with their fragile design makes insurance an attractive option to mitigate costly repairs or replacements. For example, in markets like the UK, smartphone ownership is projected to reach 95% by 2025, pushing insurance adoption upward alongside. Insurance providers and mobile carriers are capitalizing on this trend by offering bundled insurance plans with new phone sales, simplifying access, and encouraging consumers to sign up for coverage at the point of purchase.

Additionally, digital platforms have made it easier to buy policies online and manage claims, enhancing user convenience and trust. This seamless integration and growing awareness about the financial benefit of mobile insurance are driving market growth steadily, particularly in North America and Asia Pacific, where smartphone penetration is high and rising.

Restraint Analysis

High Premium Costs and Limited Awareness

Despite growing demand, the mobile phone insurance market faces resistance due to high premium costs, especially in price-sensitive regions and among lower-income groups. Many potential customers perceive insurance premiums as expensive relative to their income, which discourages them from purchasing coverage. This is particularly true in emerging markets and rural areas where cost sensitivity is greater, and awareness about insurance benefits is limited. The lack of standardized pricing and varied coverage options across providers also contribute to consumer confusion and hesitancy.

Additionally, segments of the population remain unsure about the claimed benefits versus the actual cost of insurance, causing slow uptake in some regions. The financial burden of premiums combined with concerns over claim denial or complicated claim processes dampens enthusiasm for mobile phone insurance. This situation limits the market’s reach and slows growth, especially where smartphone penetration is still growing but insurance uptake remains low.

Opportunity Analysis

Integration of Technology and Customized Insurance Plans

The mobile phone insurance market has significant opportunity for growth through the integration of advanced technologies and tailored insurance products. The use of artificial intelligence in risk assessment and claims processing has improved efficiency, lowered operational costs, and enhanced user experience. Insurers can offer flexible premium payment models, personalized coverage plans, and instant claim approvals through digital platforms, attracting a broader customer base. This technology-driven convenience opens doors for new market segments, from casual users to premium smartphone owners.

Moreover, the expanding digital ecosystem, including e-commerce and online device sales, allows insurance companies to bundle their services with phone purchases effectively. Emerging markets in Asia Pacific and the Middle East show rising smartphone adoption and growing awareness about mobile security, providing fertile ground for market expansion. Adding coverage for new mobile features like digital wallets and cybersecurity also elevates the offerings, positioning insurers to tap into users’ comprehensive needs for device protection in a connected world.

Challenge Analysis

Increasing Claims Costs and Market Competition

One of the main challenges facing the mobile phone insurance ecosystem is the rising cost of claims due to more frequent incidents of theft, accidental damage, and the increased sophistication of smartphones. Advanced devices with foldable screens and high-cost components demand more expensive repairs or replacements. This raises insurers’ risk exposure and may force premiums higher, which could discourage some consumers from purchasing insurance. Managing the cost of claims while maintaining affordable pricing is a delicate balance insurers must navigate.

In addition to cost management, the market is becoming highly competitive. Insurers must innovate continuously to attract customers, differentiating their offerings with superior service, faster claims responses, and bundled benefits. The proliferation of players including telecom operators, retailers, and third-party insurers intensifies competitive pressure. This crowded landscape mandates strategic partnerships and strong brand trust to retain and grow customer bases, making sustainability and innovation essential for long-term success.

Key Market Segments

By Phone Type

- Budget phones

- Mid & high-end phones

- Premium smartphones

By Coverage

- Physical damage

- Internal component failure

- Theft & loss protection

- Virus & data protection

- Others

Top Key Players

- Apple Inc.

- American International Group, Inc.

- Assurant, Inc.

- Asurion

- AT&T Intellectual Property.

- AmTrust Financial

- Brightstar Corp.

- GoCare Warranty Group

- SquareTrade, Inc.

- Taurus Insurance Services Limited

- Others

Discover More – https://market.us/report/global-mobile-phone-insurance-ecosystem-market/