Introduction

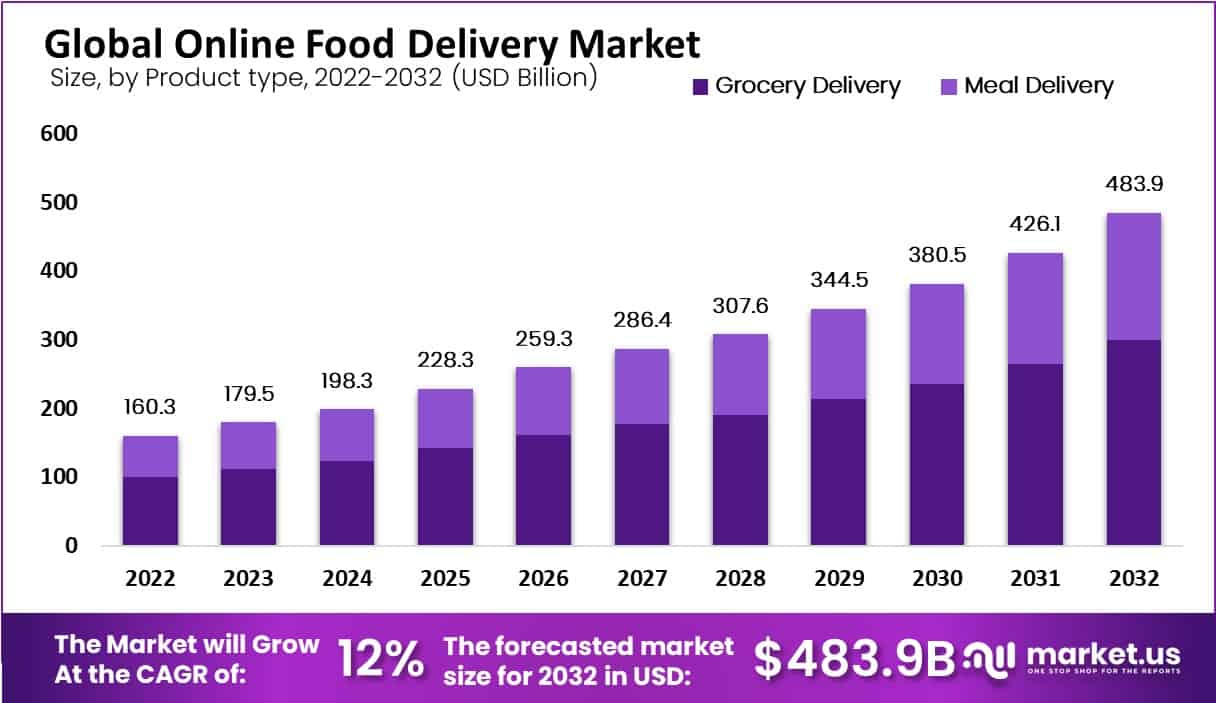

The Global Online Food Delivery Market is projected to grow from USD 179.5 billion in 2023 to about USD 483.9 billion by 2033, at a CAGR of 12%, driven by busy lifestyles, smartphone penetration, and app-based convenience for both meals and groceries. Online food delivery lets users browse restaurant or grocery menus on apps or websites, place and pay for orders digitally, and receive doorstep delivery, a model that surged further during COVID-19 as contactless services became essential. Growth is supported by AI- and ML-enabled personalization, demand forecasting, and route optimization, but profitability pressures, intense competition, and last‑mile logistics remain key issues.

Online Food Delivery market lets people order food from restaurants using apps and websites. Riders bring meals right to the door for quick lunches, dinners, or snacks from local places or big chains. Apps like DoorDash or Zomato make it easy to pick food and track the ride.

Top driving factors come from more phones and fast internet that help order food anytime. Busy city people like getting meals quick without cooking. Apps give deals and many choices to keep users coming back.

Demand stays high in cities with young workers who order for jobs or fun. Grocery orders add more sales too. North America has the biggest apps, but Asia grows fast from crowded towns and low ride costs.

Top Key Takeaways

- Grocery delivery leads product type with over 62% share, reflecting strong demand for at-home grocery fulfillment.

- Platform-to-consumer delivery accounts for more than 65% of orders, aggregating multiple restaurants on a single platform.

- Mobile applications dominate access with over 73% share, far ahead of websites.

- Asia Pacific holds more than 37% share and about USD 59.5 billion revenue, led by China, India, and Japan.

- Global users exceeded 1.6 billion in 2023, up 12% year-on-year; rural usage alone increased 25%.

- By 2027, around 2.5 billion people are expected to use online food delivery, including roughly 1.6 billion in Asia.

- AI/ML usage on platforms rose 22% in 2023; sustainable packaging and eco options are expected to increase 30% by 2024.

Key Statistics

- According to Deliverect, 72% of restaurants identify high commission fees as their biggest challenge with delivery platforms, with charges ranging between 15% and 35% per order, placing pressure on restaurant margins.

- Customer satisfaction data shows that 38% of customers are frustrated by late deliveries, particularly during peak hours when delays are most common.

- Sustainability is becoming a key decision factor, as 64% of consumers actively look for restaurants using eco-friendly packaging and sustainable delivery practices.

- Around 95% of restaurants use AI-enabled tools for inventory management, menu optimization, reservations, or other operational tasks, helping reduce delivery times through route optimization and improve delivery accuracy.

- Drone delivery technology, though still emerging, is gaining momentum, with autonomous aerial deliveries expected to account for 8% of total food delivery orders by the end of 2025, especially in urban and suburban areas.

- Customer preferences increasingly favor advanced platforms, with 89% of users choosing services that offer sophisticated tracking features, including real-time GPS tracking and AI-powered live chat support.

- Based on BusinessofApps, China is the largest food delivery market, valued at USD 40.2 billion in 2024, reflecting strong consumer adoption and high order volumes.

- The global food delivery app industry is projected to reach USD 213 billion by 2030, driven by urbanization, mobile penetration, and changing eating habits.

- Uber Eats is the most popular food delivery app globally, while Delivery Hero has the highest number of collective users across its platform portfolio.

- In the United States, DoorDash dominates the food delivery market with more than 65% market share, highlighting its leadership in coverage, partnerships, and user engagement.

- According to Zego, 69% of Gen Z consumers regularly use food delivery apps, making them the most engaged age group in digital food ordering.

- Gen Z places food delivery orders an average of 4.5 times per month, exceeding the ordering frequency of older age groups.

- About 63% of individuals aged 18 to 29 have used a food delivery app within the past 90 days, highlighting strong short-term engagement among younger consumers.

Use Cases

Everyday Convenience

People use apps like Uber Eats or DoorDash to get hot food delivered fast when they are busy, tired, or stuck at home. Parents order kids’ meals during school runs, and office workers skip cooking by picking lunch options with real-time tracking. This saves time and offers more choices than local spots.

Restaurant Growth

Small eateries join platforms to reach new customers far away, boosting sales without extra staff. Chains like Domino’s use them for quick promotions and loyalty deals to keep regulars ordering often. Data from orders helps owners adjust menus based on what sells best.

Special Events and Diets

During parties or game nights, groups order bulk food like pizzas or wings for crowds. Users with allergies or vegan needs filter menus easily to find safe picks with clear labels. Late-night shifts or travel stops rely on 24/7 delivery for snacks.

Business and Subscriptions

Offices subscribe for weekly team lunches to build morale without planning hassles. Grocery add-ons let users mix meals with fresh items, cutting extra trips. Gig drivers earn flexible income by picking shifts around their schedules.

Key Market Segment

By product type

- Grocery Delivery

- Meal Delivery

By type

- Platform To Consumer Delivery

- Restaurant To Consumer Delivery

By platform type

- Mobile Applications

- Websites

By business model

- Logistics-focused Food Delivery System

- Order-focused Food Delivery System

- Restaurant-specific Food Delivery System

Top Key Players

- Doordash Inc.

- Roofoods Limited (Deliveroo)

- Grubhub Inc.

- Delivery Hero SE

- Uber Technologies Inc.

- Zomato Limited

- Domino’s Pizza Inc.

- Papa John’s International Inc.

- me (Ali baba)

- Pizza Hut

- McDonald’s Corp.

- Other Key Players

Recent Development

- September, 2025, DoorDash added restaurant reservations and robot deliveries in some US markets.

- February, 2025, Grubhub launched 2025 Restaurant Leadership Council with restaurant partners.

- November, 2025, Delivery Hero revenue grew twenty two percent using AI for better customer experience.

Conclusion

The online food delivery market is moving into a mature, high-volume phase, supported by strong growth in both meal and grocery delivery and by the deep integration of mobile apps into everyday life. Grocery delivery, platform-to-consumer models, and mobile applications now anchor the core of the ecosystem, while Asia Pacific leads in scale and future user growth. Although profitability, last‑mile logistics, and competition with dine‑in experiences remain challenges, continued use of AI, expansion into health and wellness offerings, and diversification into new geographies position online food delivery as a long-term fixture in global consumption habits.

Read More – https://market.us/report/online-food-delivery-market/