Introduction

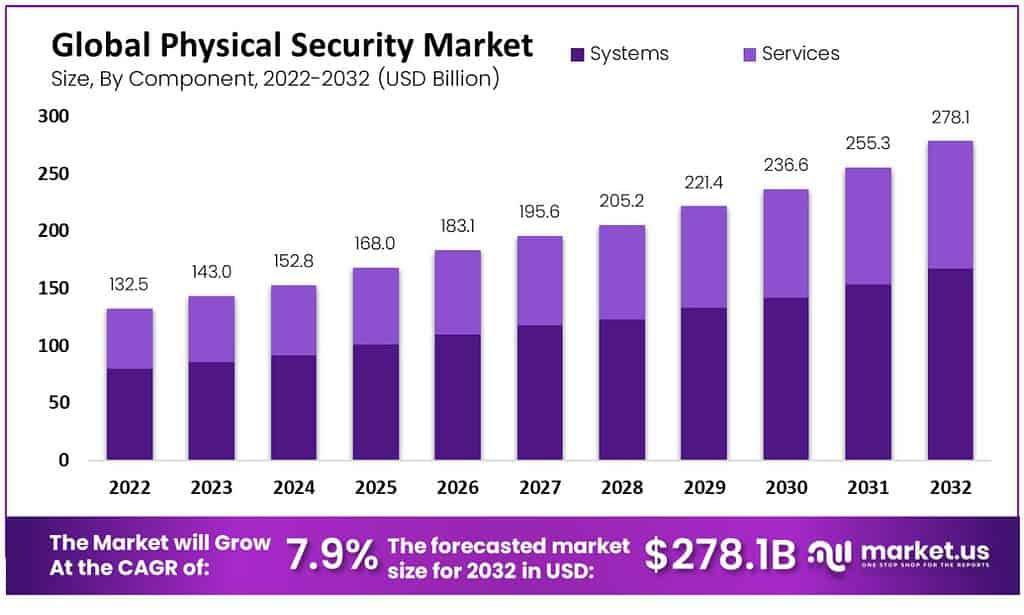

The Global Physical Security Market is valued at USD 143.5 billion in 2023 and projected to reach USD 278.1 billion by 2032, growing at a CAGR of 7.9%, as rising crime, terrorism, and infrastructure needs drive demand for video surveillance, access control, and intrusion detection systems. The physical security market focuses on protecting people, property, and physical assets from unauthorized access, theft, property damage, and physical threats.

This market includes solutions such as access control systems, video surveillance, intrusion detection, perimeter security, and security services. These systems are widely used across commercial buildings, industrial facilities, transportation hubs, government infrastructure, and residential areas. The growing need for safety and risk prevention has kept physical security as a critical part of overall security planning.

In recent years, physical security has moved beyond basic guarding and alarm systems. Greater use of digital technologies has improved monitoring, response time, and threat detection capabilities. Organizations are increasingly integrating physical security with IT and operational systems to achieve better control and visibility. This shift has strengthened the role of physical security as a long-term investment rather than a reactive cost.

The market continues to expand as security risks become more complex and diverse. Urbanization, infrastructure development, and higher public safety expectations are increasing demand across both developed and emerging economies. Physical security is now viewed as essential for business continuity, regulatory compliance, and protection of critical assets.

Top Key Takeaways

- Systems (video surveillance, access control, etc.) hold 60.0% share by component, essential for real-time threat detection.

- System integration accounts for 43.0% of services revenue, linking physical and digital security for better control.

- Government end-use verticals lead, driven by public safety and facility protection investments.

- North America commands 36.4% regional share, boosted by regulations and advanced adoption.

- Asia Pacific is expected to grow at 5.2% CAGR, fueled by smart city projects and urbanization.

Key Statistics

- According to gitnux.org, over 40% of organizations have moved their access control systems to cloud or hybrid environments to improve flexibility and ease of management.

- About 50% of large organizations still rely on older access control technologies, which are more vulnerable to cloning and security threats.

- More than 80% of new video surveillance camera installations now use IP-based cameras instead of traditional analog systems.

- Around 40% of organizations are planning to adopt AI-based video analytics to automatically detect unusual or suspicious activity.

- 42% of physical security breaches are caused by internal employees or insiders, showing that internal risks remain a major concern.

- Nearly 25% of employees report not feeling safe in their workplace environment.

- About 19% of data breaches are linked to physical security failures, such as stolen devices or lost documents.

- Around 18% of physical security administrators still manage access rights manually using spreadsheets, which increases the chance of errors and security gaps.

- Based on ZipDo, only 17% of organizations have a complete physical security plan, showing a large gap in preparedness.

- About 85% of security professionals believe physical security is essential to an overall security strategy.

- Laser-based perimeter detection systems can reduce false alarms by up to 70%, helping security teams respond more effectively.

- Nearly 85% of security managers say gaps in physical security contribute to cyber incidents, linking physical and digital risks.

- Access control systems can cut unauthorized access incidents by up to 80%, improving site security.

- Biometric access controls can increase security efficiency by around 30%, by reducing manual checks and errors.

- Around 63% of facilities lack proper alarm verification processes, which can lead to delayed or incorrect responses.

Top Driving Factors

One of the main driving factors is the rising concern over crime, theft, and unauthorized access in public and private spaces. Businesses and governments are prioritizing physical safety to protect employees, customers, and infrastructure. Increased incidents related to property damage, trespassing, and workplace violence have further strengthened the need for reliable security systems. This has supported steady demand for surveillance and access control solutions.

Another important driver is the expansion of critical infrastructure such as airports, data centers, power plants, and transportation networks. These facilities require strong physical protection due to their economic and social importance. Regulatory requirements related to safety and security have also encouraged organizations to adopt standardized physical security measures. Compliance needs are pushing investments across sectors such as banking, healthcare, and utilities.

Growth Factors

Technological advancement is a major growth factor shaping the physical security market. Improvements in cameras, sensors, and monitoring systems have increased accuracy and reduced false alerts. Integration with digital platforms has made security operations more efficient and easier to manage. These improvements have encouraged upgrades and replacement of older systems.

Growth is also supported by rising investments in commercial real estate and smart infrastructure projects. As new buildings and industrial sites are developed, physical security is being included at the design stage. Small and medium-sized businesses are increasingly adopting affordable security solutions to protect assets and operations. This broader adoption across organization sizes is expected to support sustained market growth.

Use Case

- Commercial Buildings and Offices

Physical security systems help control employee and visitor access across office spaces. Surveillance and access management reduce unauthorized entry and protect business assets. These systems also support workplace safety compliance. - Residential and Smart Housing

Homes use cameras, alarms, and smart locks to improve personal safety. These systems allow residents to monitor activities remotely and receive alerts. Demand is supported by rising safety concerns in urban areas. - Retail Stores and Shopping Malls

Retail security focuses on theft prevention and customer monitoring. Cameras and alarm systems help reduce losses and improve store operations. They also support safer shopping environments. - Industrial Facilities and Manufacturing Plants

Industrial sites use physical security to protect machinery, raw materials, and workers. Restricted access zones help prevent accidents and misuse. Security systems also reduce operational disruptions. - Critical Infrastructure and Utilities

Power, water, and telecom facilities require continuous monitoring to avoid service interruptions. Physical security helps prevent sabotage and unauthorized access. These systems are essential for national and public safety. - Transportation and Logistics Hubs

Airports, ports, and rail stations use security systems to manage large passenger and cargo movement. Surveillance improves safety and incident response. These solutions also support regulatory compliance. - Healthcare Facilities

Hospitals use physical security to protect patients, staff, and medical equipment. Controlled access helps secure sensitive areas. Surveillance systems also improve emergency handling. - Educational Institutions

Schools and universities use security systems to safeguard students and staff. Cameras and access control help monitor campus activity. These systems support rapid response to safety incidents.

Key Market Segment

Component

- Systems

- Physical Access Control System (PACS)

- Video Surveillance System

- Perimeter Intrusion Detection And Prevention

- Physical Security Information Management (PSIM)

- Physical Identity & Access Management (PIAM)

- Fire And Life Safety

- Services

- System Integration

- Remote Monitoring

- Other Services

End-Use Verticals

- Transportation

- Government

- Retail

- Residential

- Industrial

- BFSI

- Other End-User Verticals

Top Key Players

- Honeywell International Inc.

- Robert Bosch GmbH

- Genetec Inc.

- Cisco Systems Inc.

- Axis Communications AB

- Pelco

- Hanwha Techwin America

- Johnson Controls

- ADT LLC

- Siemens

- Anixter Inc.

- Other Key Players

Recent Development

- December, 2024 – Genetec Inc. released the 2025 State of the Physical Security Report highlighting accelerating hybrid-cloud adoption, increased IT involvement in security purchasing decisions, and rising interest in AI-powered features across physical security systems.

- September, 2025 – Honeywell International Inc. was recognised as a leader in the Physical Security Industry Company Evaluation Report 2025 for its smart platforms, global expansions, and integration of AI analytics into its security offerings.

Conclusion

The physical security market grows steadily as crime, terrorism, and infrastructure needs push for better protection through video, access control, and detection systems. Systems like PACS and video surveillance lead components, while system integration tops services, with government and large enterprises driving use across BFSI, retail, and other sectors, and North America ahead regionally. Rising threats and smart city projects will keep demand strong, even with high costs and integration issues, as integrated physical-digital security becomes standard for safety and compliance.

Read More – https://market.us/report/physical-security-market/