POS Terminals Market Size

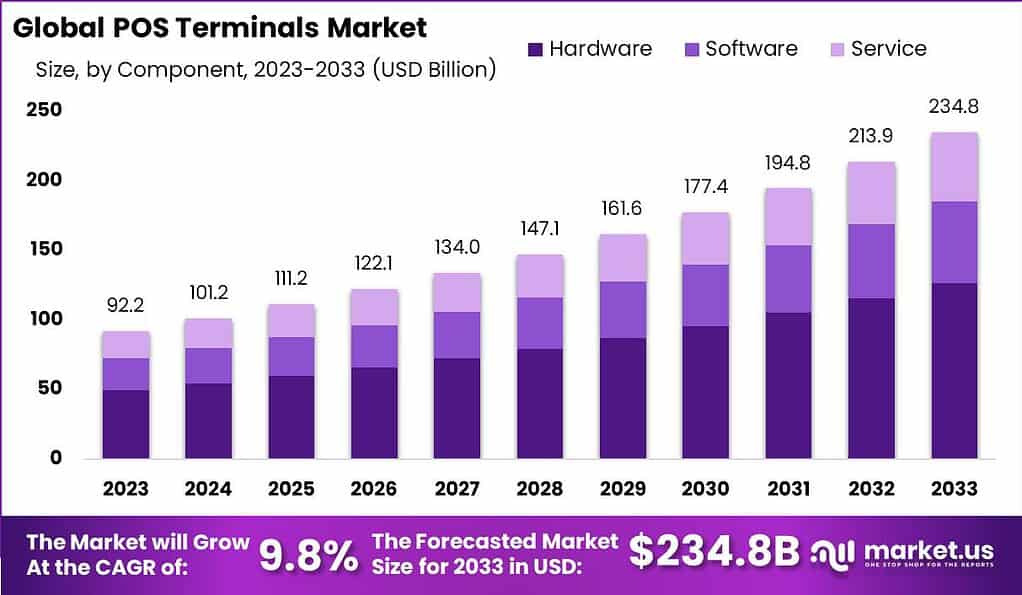

The Global POS Terminals Market is forecasted to expand from USD 101.2 billion in 2024 to nearly USD 234.8 billion by 2033, registering a CAGR of 9.8% during 2024-2033. The growth of this market is being fueled by the increasing adoption of digital payment solutions, the rising demand for contactless transactions, and the integration of advanced technologies such as cloud-based systems and AI-driven analytics into POS platforms.

The Point of Sale (POS) terminals market consists of electronic devices that facilitate payment transactions at the point where a customer makes a purchase. These terminals serve a wide range of establishments including retail stores, restaurants, and service providers. Over time, POS terminals have evolved from simple card-processing machines to integrated systems that handle payments, inventory tracking, sales monitoring, and customer management. Their adoption helps businesses streamline operations and improve transaction accuracy.

Top driving factors for the POS terminals market include the rising shift from cash to electronic payments, the growth in retail and hospitality sectors, and the increasing demand for contactless and mobile payment options. Consumer preferences have steered towards faster, more convenient transaction methods, boosting the use of POS systems with NFC and mobile wallet capabilities. Additionally, government initiatives promoting financial inclusion and digital payments have significantly encouraged the deployment of POS infrastructure, especially in emerging markets and smaller cities.

Key Takeaways

- The market is projected to rise from USD 92.2 Billion in 2023 to USD 234.8 Billion by 2033, expanding at a 9.8% CAGR between 2024 and 2033.

- The Hardware segment accounted for the largest share, contributing 54% of the global market.

- By product type, Fixed POS Terminals dominated, with a share of 62%.

- In deployment, Cloud-Based solutions captured over 50% share, reflecting the growing preference for cloud-enabled POS functionalities.

- From an operating system perspective, Windows/Linux platforms held more than 48% of the market.

- By application, the Retail sector led adoption, securing a dominant share of 40%+.

- Geographically, Asia-Pacific was the leading region, contributing 38% of the global share, with revenues above USD 35 Billion.

The adoption of POS technology in the restaurant industry has become widespread, with about 90% of operators using POS data to refine discounting, loyalty programs, menu optimization, and marketing strategies. In 2024, nearly 43% of restaurant operators are expected to explore new POS platforms with greater mobility and cloud integration, reflecting a strong move toward more advanced and flexible solutions.

Handheld POS terminals have experienced rapid growth, rising from under 30% adoption in 2017 to 61% in 2022. This shift aligns with the broader transition to cloud-based systems, which are projected to reach a value of over USD 30 billion by 2031, growing at a CAGR of 25% from USD 3.9 billion in 2022. The demand for EMV-compliant terminals has also surged, with adoption increasing by 590% in the past five years.

Consumer preferences are shaping these changes, as 65% of U.S. POS terminals now accept Apple Pay, supporting the rise of digital wallets. At the same time, 86% of small business owners believe mobile POS enhances customer service, though challenges remain, particularly in reducing manual entry errors that account for over 70% of transaction inaccuracies in retail.

Demand analysis shows a continued expansion driven by the need for efficient and secure payment processing. The pandemic accelerated contactless payment adoption, further increasing the demand for mobile POS (mPOS) and cloud-based solutions. Businesses seek these technologies not just for payment acceptance but also for enhanced operational control through integrated inventory and sales analytics. Small and medium-sized enterprises find mPOS systems appealing due to lower setup costs and portability, which help in expanding their customer payment options in physical and remote locations.

Role of Generative AI

Generative AI plays an important role in transforming POS terminals by enabling smarter, data-driven customer experiences. It allows these systems to analyze customer purchase history and behaviors to provide personalized product suggestions, which helps businesses increase cross-selling and up-selling opportunities. Additionally, generative AI improves loyalty programs by predicting which rewards will most appeal to individual customers, ultimately boosting repeat business and satisfaction.

Beyond marketing, it enhances inventory management by forecasting product demand and automating restocking alerts, reducing human error and stock outages. The AI-driven POS systems also strengthen security with real-time fraud detection using machine learning models that identify unusual transaction patterns to prevent unauthorized activities. These advancements make POS terminals more than just transaction devices – they become essential tools for business intelligence and operational efficiency.

Emerging Trends

Several emerging trends shape the POS terminal landscape in 2025. One major trend is the adoption of mobile POS systems, which provide greater flexibility by allowing payments anywhere on the sales floor or at remote locations. Unified commerce is gaining traction, where POS systems seamlessly integrate online, in-store, and mobile shopping channels to offer real-time inventory updates and consistent customer experiences.

Personalized shopping experiences using AI-based data insights are becoming common, moving away from one-size-fits-all approaches. Contactless and biometric payment methods continue to rise, meeting consumer demand for speed and convenience. Self-checkout terminals and QR code ordering are also expanding, particularly in hospitality, helping businesses automate service and reduce wait times while keeping customer interaction personalized.

Growth factors

Growth factors driving POS terminal adoption include widespread digitalization of businesses and evolving consumer preferences toward contactless payments, accelerated by the COVID-19 pandemic. The increasing penetration of smartphones and internet connectivity, even in semi-urban and rural areas, is expanding the user base for POS technologies. Government policies supporting digital payments and financial inclusion, such as national digital initiatives and demonetization efforts in markets like India, have created a favorable environment for POS growth.

Retail and hospitality sectors remain key adopters, leveraging advanced POS systems to improve operational efficiency and enhance customer satisfaction. The demand for modular, secure, and cost-effective POS solutions continues to rise as businesses aim to meet the expectations of tech-savvy shoppers.

Driver Analysis

Growing Demand for Contactless Payments

The increasing adoption of contactless payment methods is a strong driver for the POS terminals market. Consumers and businesses are favoring tap-and-go payments, QR codes, and digital wallets because they offer convenience, speed, and hygiene benefits, especially following changes in shopping behaviors during the COVID-19 pandemic.

This shift has pushed businesses across retail, hospitality, and healthcare sectors to invest in modern POS terminals equipped to handle contactless transactions efficiently. As a result, the market is expanding with enhanced POS systems that support these payment types, helping businesses improve transaction speed and customer satisfaction.

Moreover, government initiatives and digital transformation efforts in many regions are further supporting contactless payment adoption. These policies encourage businesses to upgrade to POS terminals capable of seamless contactless processing, boosting digital payment ecosystems and reducing cash handling. This combination of evolving consumer preferences and supportive regulatory frameworks is fueling consistent market growth worldwide, driving POS terminal product innovation and increasing deployment in new segments.

Restraint Analysis

Security Concerns and Data Breaches

Despite the growing market, security concerns present a significant restraint for POS terminal adoption. As POS systems handle sensitive customer payment data, they are a prime target for cyberattacks and data breaches. Incidents of hacking, malware, and fraud create apprehension among businesses and customers about the security and privacy of transactions. This hesitance slows down the full adoption of new POS technologies, especially wireless and cloud-based solutions that depend heavily on internet connectivity.

Additionally, the increasing complexity of POS systems with integrated financial solutions and customer relationship management tools raises the stakes for security vulnerabilities. Businesses face the challenge of investing in advanced security measures, such as biometric authentication and encryption, to protect data and comply with standards. The need for ongoing security upgrades also increases operational costs, which can be prohibitive for smaller enterprises, limiting market expansion in certain segments.

Opportunity Analysis

Expansion in Emerging Markets and Mobile POS

The POS terminals market holds considerable growth opportunity in emerging markets, driven by increasing digitalization and smartphone penetration. Countries with growing retail and hospitality sectors are rapidly adopting mobile POS (mPOS) terminals due to their portability and cost-effectiveness. These portable devices allow businesses to process transactions in diverse locations, including remote and rural areas, where infrastructure challenges have limited traditional fixed POS deployments.

Furthermore, governments in many developing countries promote financial inclusion and digitization, creating a favorable environment for mobile payment solutions. The rise of mobile internet and affordable smartphones accelerates acceptance, especially among small and medium-sized enterprises. This trend not only widens the POS terminal customer base but also encourages vendors to develop versatile, easy-to-use mPOS solutions with integrated CRM and analytics features to support business growth.

Challenge Analysis

High Initial Investment and Infrastructure Gaps

A core challenge faced by businesses in adopting POS terminals is the high initial investment cost. Purchasing modern POS hardware, integrating software, and maintaining systems require substantial capital, which may be difficult for small businesses and startups to commit upfront. This financial barrier can delay or restrict technology adoption, especially in price-sensitive markets.

Infrastructure limitations in certain regions also pose difficulties. Reliable internet access, electricity supply, and technical support networks are essential for the smooth functioning of advanced POS systems. In areas with underdeveloped infrastructure, these challenges hinder the rollout and consistent operation of POS terminals. Businesses in such locations may either continue with cash-heavy transactions or resort to less efficient payment methods until these infrastructure gaps are resolved.

Key Market Segments

By Component

- Hardware

- Software

- Service

Product Type

- Fixed POS Terminals

- Wireless POS Terminals

- Mobile POS Terminals

Deployment

- On-Premise

- Cloud-Based

Operating System

- Window/Linux

- Android

- iOS

End-User

- Restaurants

- Retail

- Hospitality

- Healthcare

- Warehouse

- Other End-Users

Top Kеу Рlауеrѕ

- Acrelec

- AURES Group

- HM Electronics

- Hewlett Packard Development LP

- NCR Corp.

- Oracle

- Presto Group

- Qu Inc.

- Quail Digital

- Revel Systems

- Toast Inc.

- Toshiba Corp.

- Other Key Players

Discover More – https://market.us/report/pos-terminals-market/