Introduction

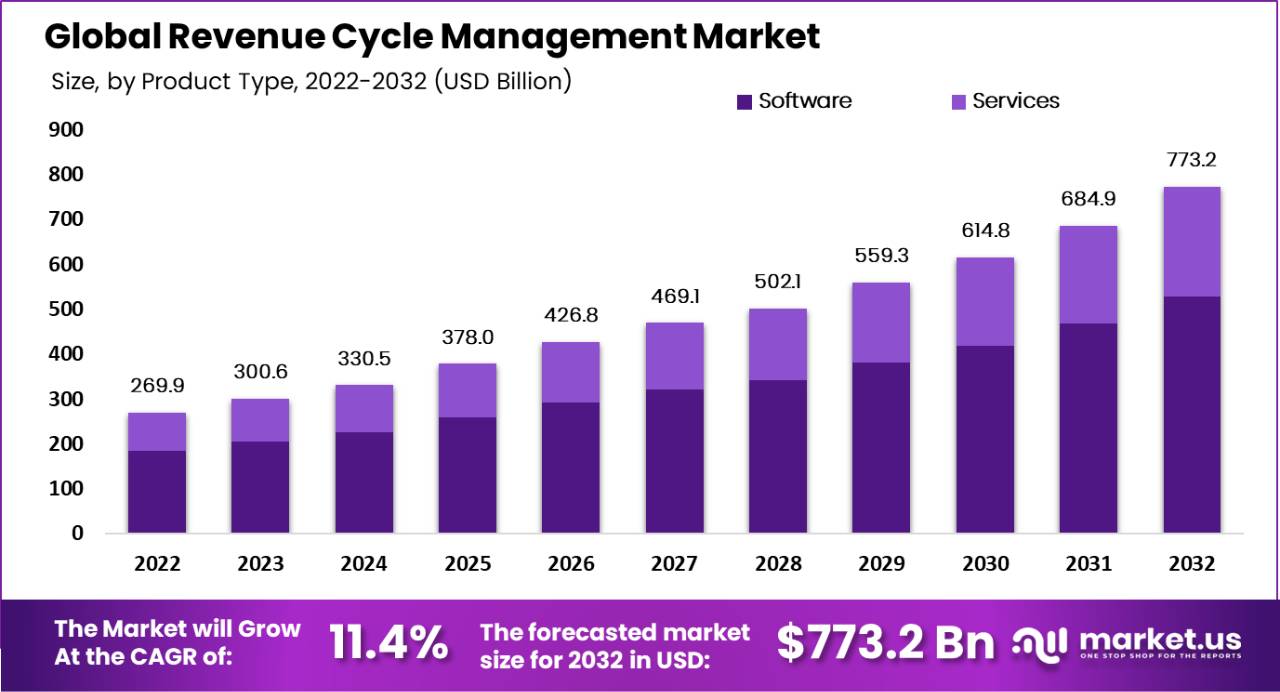

The Global Revenue Cycle Management Market is growing strongly, from about USD 300.6 billion in 2023 to around USD 773.2 billion by 2032, at a CAGR of 11.4%, as healthcare providers digitize and optimize billing, coding, and reimbursement workflows. Revenue cycle management (RCM) refers to the set of practices and technologies used by healthcare providers to manage the financial process that begins when a patient first interacts with a care facility and ends when all payments are collected.

The scope of RCM includes patient registration, insurance eligibility verification, clinical coding, medical billing, claims submission, denial handling, and final payment reconciliation. It serves to ensure optimal financial performance by reducing errors, improving claim approvals, and securing timely collections from payers and patients. RCM has become essential to healthcare administration as reimbursement systems grow more complex and providers aim to align operational performance with financial stability.

The primary drivers of the revenue cycle management market are linked to rising healthcare costs, evolving reimbursement models, and the growing need for efficiency in billing and collections. Healthcare providers face increasing regulatory demands and administrative burdens that make manual revenue cycle processes inefficient and error-prone.

The adoption of electronic health records (EHR), integrated RCM systems, and advanced technologies such as automation and artificial intelligence is accelerating as organisations seek to streamline workflows, reduce claim denials, and improve cash flow. High deductibles and greater patient financial responsibility further emphasize the need for robust RCM solutions that provide real-time visibility into financial processes.

Demand for revenue cycle management solutions is expanding steadily across regions and care settings. Growth is most pronounced in markets with mature healthcare infrastructures where providers are under pressure to control operating costs and maximise reimbursement accuracy. Outsourcing of RCM services has increased, driven by the need for specialised expertise and cost advantages compared to in-house management

Top Key Takeaways

- Software holds about 68.2% share by product type, while services are the fastest-growing with a CAGR near 12.8%.

- Integrated RCM solutions command about 70.2% share, reflecting preference for platforms tightly linked with practice management and EHR systems.

- Web-based delivery leads with roughly 54.3% share; cloud-based models grow fastest at about 12.7% CAGR.

- Claims management is the largest function at around 36.7% share, critical for reducing denials and securing timely payments.

- Physician back offices account for about 39.8% of end-user share, with hospitals the fastest-growing users.

- North America holds about 56.8% of global revenue and is expected to grow near 11.7% CAGR, while Asia-Pacific is the fastest-growing region at about 12.6%.

Key Statistics

- According to Thoughtful.ai , 78% of patients want clear and accurate financial communication when dealing with healthcare providers, showing strong demand for transparency.

- About 92% of patients who have a positive administrative experience are more likely to recommend their provider, linking operational quality with patient trust.

- Each year, 5% to 10% of healthcare claims are denied, causing losses of up to USD 262 billion across the healthcare industry.

- Nearly 65% of denied claims are never resubmitted, highlighting inefficiencies in denial handling, while the cost of appeals ranges from USD 25 to USD 50 per claim.

- Around 90% of claim denials can be prevented through better front-end practices such as accurate coding and eligibility checks, and automated denial management can reduce denial rates by up to 75%.

- Administrative work accounts for 15% to 30% of total healthcare spending, reflecting inefficiency in traditional revenue cycle management processes.

Key Market Segment

By product type

- Software

- Services

By type

- Integrated

- Standalone

By delivery mode

- On-Premises

- Web-Based

- Cloud-Based

By function

- Claims Management

- Product Development

- Member Engagement

- Network Management

- Care Management

- Risk and Compliances

By end user

- Physician Back Offices

- Hospitals

- Diagnostic Laboratories

- Other End-Users

Top Key Players

- The SSI Group Inc.

- AllScripts Healthcare LLC

- Experian Health

- R1 RCM Inc.

- McKesson Corporation

- athenahealth Inc.

- Epic Systems Corporation

- NXGN Management LLC

- CareCloud Corporation

- Quest Diagnostics Inc.

- Cerner Corporation

- Other Key Players

Use Cases

- Patient registration and eligibility checks: Patient details and insurance information are verified at the start. This helps reduce claim rejections and improves billing accuracy.

- Medical coding and charge capture: Clinical services are converted into standard billing codes. This ensures that healthcare providers are paid correctly for every service delivered.

- Claims submission and management: Claims are prepared and sent to insurers in a structured way. Faster claim processing helps improve cash flow for hospitals and clinics.

- Denial management and follow ups: Denied or delayed claims are identified and corrected. This process helps recover lost revenue and reduces payment delays.

- Patient billing and payment collection: Clear bills are generated for patients, including copays and balances. Digital payment options make it easier for patients to pay on time.

- Accounts receivable management: Outstanding payments are tracked and monitored. This improves revenue visibility and reduces unpaid balances.

- Compliance and audit support: Billing processes are aligned with healthcare regulations. This lowers the risk of penalties and ensures transparent financial operations.

- Financial reporting and analytics: Revenue data is analyzed to understand performance trends. Healthcare providers use these insights to improve operational efficiency and planning.

Recent Development

- October, 2025, athenahealth introduced an AI‑native version of athenaOne with new revenue cycle features like automated insurance selection, liability estimates, and denial advice at no extra cost.

- December, 2024, Epic updated its Access & Revenue Cycle suite to add more self‑service tools and automation for patient access and billing workflows.

Conclusion

The revenue cycle management market is becoming a core pillar of healthcare IT as providers modernize how they bill, code, and get paid in an increasingly complex reimbursement environment. Software-led, integrated, web- and cloud-based RCM platforms, focused on claims management and serving physician offices and hospitals, now anchor the ecosystem, with North America leading and Asia-Pacific catching up fast. Despite high implementation costs, regulatory change, and interoperability gaps, ongoing adoption of AI, analytics, and value-based care models positions RCM as essential for improving financial performance, reducing errors, and supporting more patient-centric care.

Read More – https://market.us/report/revenue-cycle-management-market/