Introduction

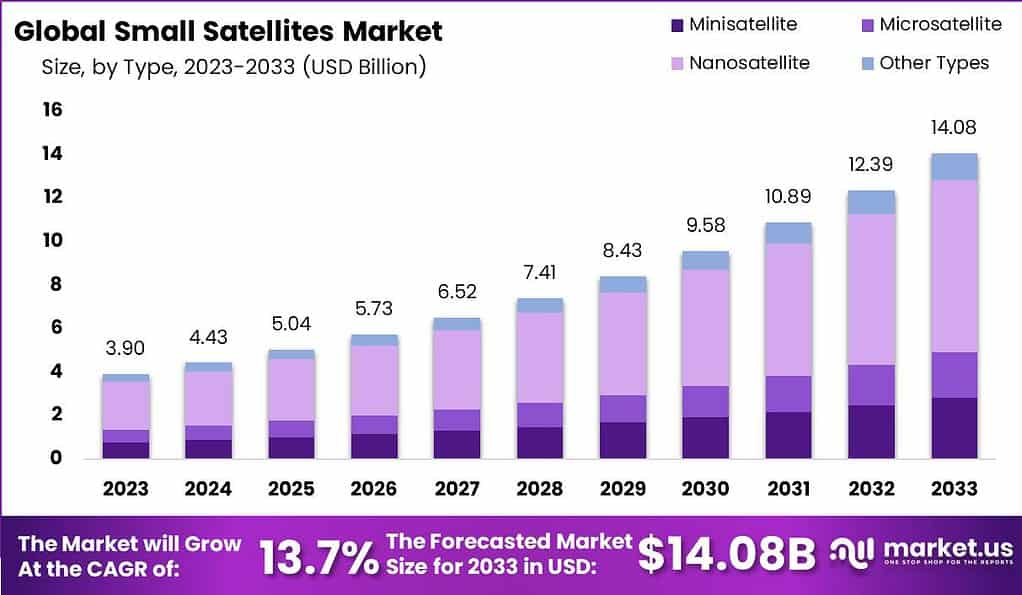

The Global Small Satellites Market is expanding rapidly from USD 4.43 billion in 2024 to USD 14.08 billion by 2033, at a CAGR of 13.7%, fueled by lower costs, faster development, and demand for Earth observation, communication, and research missions. Small satellites are compact and lightweight spacecraft used for communication, earth observation, research, and testing new space technologies. They are much smaller than traditional satellites and can be built and launched in a shorter time.

These satellites are often deployed in groups to cover large areas and collect data more frequently. Their lower cost and faster development make them suitable for commercial companies, research organisations, and government agencies. Small satellites are now an important part of modern space missions because they offer flexibility and faster access to space.

The main factors driving this segment are lower costs, faster deployment, and wide use cases. Small satellites cost less to design, build, and launch, which allows more organisations to enter the space sector. Advances in electronics and miniaturisation have improved performance while keeping size small.

Growing demand for earth imaging, weather tracking, and global connectivity also supports adoption. Shared launch services and standard satellite designs further reduce barriers and simplify mission planning.Demand for small satellites is increasing as industries and governments look for affordable and reliable space solutions.

Communication companies use them to expand network coverage, while agriculture and environmental agencies rely on them for regular monitoring and data collection. Defence and research organisations value small satellites for testing and rapid mission deployment. As space activity becomes more commercial and data driven, small satellites are seen as a practical and scalable option to meet growing space needs.

Top Key Takeaways

- Nanosatellites dominate types with over 56% share in 2023, favored for affordability and quick deployment in compact missions.

- Earth observation and remote sensing lead applications with over 45% share, supporting environmental monitoring, agriculture, and disaster response.

- Commercial end-users hold over 48% share, driving telecom, imaging services, and constellations for global connectivity.

- North America commands over 47% regional share in 2023, backed by innovation hubs, government funding, and private sector launches.

Key Statistics

- According to Wifitalents, more than 2,600 active satellites were orbiting the Earth in 2023, reflecting rapid expansion of space-based infrastructure.

- The number of small satellites such as CubeSats increased by 77% between 2019 and 2022, driven by lower launch costs and growing commercial demand.

- Satellite broadband internet services surpassed 3 million global subscribers in 2023, showing rising reliance on space-based connectivity.

- Over 60% of global satellite communications capacity is delivered by GEO satellites, which continue to play a key role in broadcasting and wide-area coverage.

- Nearly 98% of the active satellite fleet operates in low Earth orbit, highlighting the strong shift toward LEO constellations for communication and data services.

- The satellite communications segment accounted for 27% of total satellite industry revenue in 2022, underlining its importance within the broader space economy.

Key Market Segment

By Type

- Minisatellite

- Microsatellite

- Nanosatellite

- Other Types

By Application

- Earth Observation and Remote Sensing

- Satellite Communication

- Science and Exploration

- Mapping and Navigation

- Space Observation

- Other Applications

By End-User

- Commercial

- Academic

- Government and Military

- Other End-Users

Top Key Players

- Airbus S.A.S.

- GomSpace

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Planet Labs Inc.

- Sierra Nevada Corporation

- Thales Group

- Aerospace Corporation

- The Boeing Company

- Other Key Players

Use Cases

- Earth observation and imaging: Small satellites are widely used to capture images of the Earth. These images help track land use, urban growth, forests, and water bodies. Governments and private companies rely on this data for planning and monitoring.

- Weather monitoring and climate tracking: Small satellites collect data on temperature, clouds, rainfall, and atmospheric conditions. This data supports weather forecasting and climate studies. It also helps in early warnings for storms and floods.

- Satellite communication services: These satellites support voice, data, and internet communication. They are useful in remote and rural areas where ground networks are limited. Emergency communication during disasters also depends on such satellites.

- Internet of Things connectivity: Small satellites connect sensors and devices located in oceans, deserts, and industrial sites. They enable tracking of assets, pipelines, and shipping containers. This use case is growing across logistics and energy sectors.

- Navigation and tracking support: Small satellites assist in tracking ships, aircraft, and vehicles. They improve location accuracy and safety. This is important for aviation, maritime operations, and fleet management.

- Scientific research and space experiments: Universities and research institutions use small satellites for space research. They support experiments in physics, space weather, and astronomy. Lower costs make frequent missions possible.

- Defense and security applications: Small satellites support border monitoring and surveillance. They help in secure communication and situational awareness. Rapid deployment is a key advantage for defense users.

- Agriculture monitoring: Farmers and agribusiness firms use satellite data to monitor crop health and soil conditions. This supports better irrigation and yield planning. It also helps detect drought and pest impact early.

Recent Development

- June, 2025 – Airbus completed assembly and shipment of a new optical small satellite constellation (CO3D) for launch, enhancing global Earth observation capabilities with high-resolution imagery. These satellites were transported to the launch site in French Guiana for Vega-C launch preparations.

- Dec, 2025 – GomSpace secured a contract worth €1.2 million with the European Space Agency to develop a secure, next-generation NanoCom satellite communications product under the SECUSAT program, targeting enhanced cybersecurity for future missions.

Conclusion

The small satellites market reflects a shift toward accessible space tech, led by nanosatellites, Earth observation uses, and commercial demand.North America drives current scale, but constellations and miniaturization open doors for broader adoption despite debris and regulatory hurdles.Cost savings, versatility, and IoT integration position smallsats as key enablers for global connectivity, monitoring, and exploration in coming years.

Read More – https://market.us/report/small-satellites-market/