Introduction

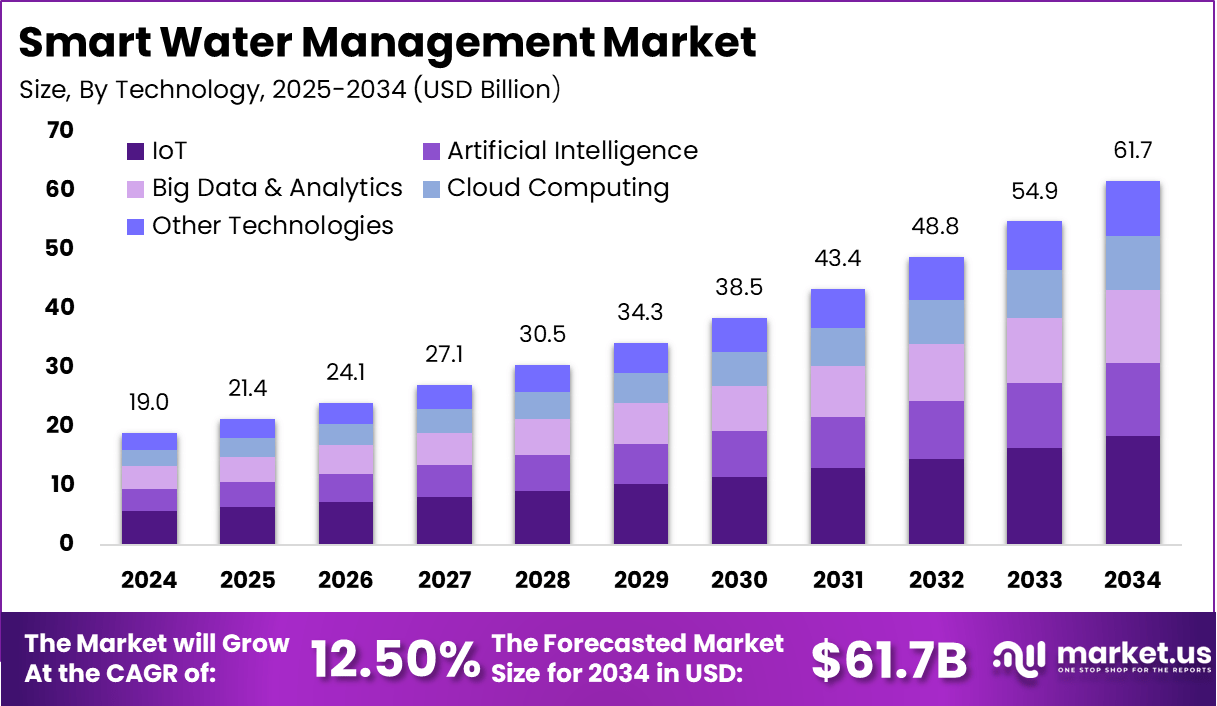

The Global Smart Water Management Market is projected to grow from USD 19.01 billion in 2024 to approximately USD 61.7 billion by 2034, expanding at a CAGR of 12.5% between 2025 and 2034. The market growth is driven by increasing water scarcity, rising adoption of digital monitoring systems, and growing investments in smart infrastructure for efficient water distribution and leakage management.

The smart water management market is growing steadily, driven by the increasing global need to manage water resources more efficiently amid rising water scarcity and aging infrastructure. This market revolves around deploying digital technologies that enable real-time monitoring, data analytics, and automation to optimize water usage across municipal, industrial, and agricultural sectors. The shift towards smart city initiatives further propels its adoption as an essential solution for urban water sustainability and operational efficiency.

Top driving factors for this market include the urgent demand for clean and safe water caused by population growth and urban expansion, alongside the pressing impacts of climate change creating water shortages. Regulatory pressures mandating sustainable water use and leakage reduction also incentivize investment in smart water systems. Advancements in Internet of Things (IoT), AI-powered analytics, cloud computing, and sensor technologies make smart water management increasingly practical and cost-effective to implement.

Key Takeaways

- Market Growth: The global Smart Water Management Market is projected to rise from USD 19.01 Billion in 2024 to USD 61.7 Billion by 2034, reflecting substantial growth driven by technological innovation and sustainability efforts.

- Strong CAGR: The market is forecasted to expand at a robust 12.5% CAGR, supported by increasing global emphasis on water conservation, efficient resource utilization, and digital infrastructure deployment.

- Solutions Lead the Market: The Solutions segment accounted for 45% of total market share, indicating high adoption of integrated software and hardware systems for smart water monitoring and control.

- Residential Demand: The Residential sector held 40% share among end users, driven by growing awareness of water efficiency, leak detection technologies, and automated metering solutions.

- IoT Integration: IoT technology represented 30% of the market, highlighting the critical role of connected sensors, analytics, and real-time monitoring in optimizing water networks.

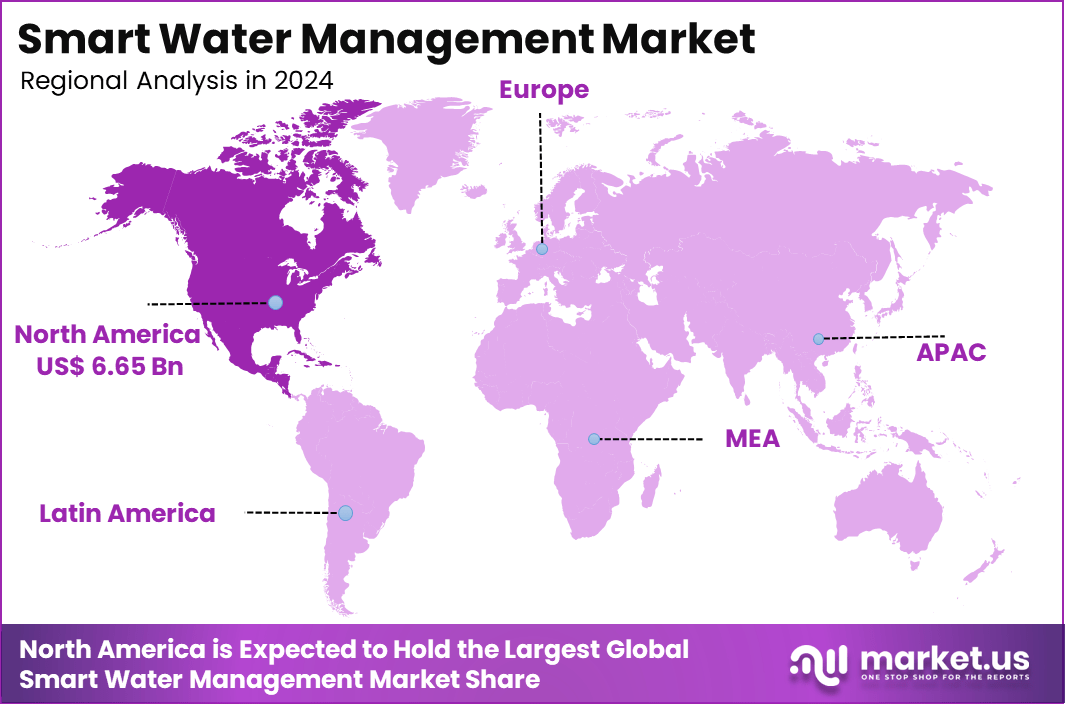

- Regional Dominance: North America led the global market with a 35% share, supported by advanced urban infrastructure, government-led smart city programs, and strong investments in water digitization.

- The US Market: The US alone was valued at USD 6.23 Billion in 2024 and is projected to grow at a healthy 10.4% CAGR, reaffirming its position as a leader in smart water management adoption and innovation.

Role of Generative AI

Generative AI is now a key player in smart water management, helping utilities and communities make smarter decisions. About 60% of water utilities globally use AI for predictive maintenance, which means they can spot leaks, predict equipment failures, and optimize water distribution before problems arise. This not only saves water but also reduces costs and keeps systems running smoothly. AI models can analyze complex data from sensors, weather forecasts, and usage patterns, making water management more precise and adaptive.

Emerging Trends

Digital transformation is reshaping how water is managed, with new trends gaining ground fast. Around 75% of new water projects now include digital twins – virtual models that simulate real-world water systems. These models help operators test scenarios, plan for emergencies, and improve efficiency. Other trends include decentralized water reuse, where water is treated and reused on-site, and the use of nature-based solutions like green roofs and constructed wetlands to filter and store water naturally.

Growth Factors

Urban demand and climate change are the biggest drivers behind the growth of smart water management. Roughly 80% of this growth is linked to cities expanding and climate events becoming more frequent. As populations grow, the need for reliable water supply increases, and climate change brings more droughts and floods. Smart technologies help cities adapt by providing real-time data, automating responses, and making water use more sustainable.

Government Led Investments

Governments are stepping up to fund water infrastructure, recognizing its importance for public health and economic stability. About 45% of water infrastructure funding now comes from government-led initiatives. These investments are focused on upgrading old systems, building new treatment plants, and supporting digital water management tools. Public funding also helps bring smart water solutions to underserved areas, ensuring more people have access to clean, safe water.

Regional Analysis

In 2024, North America held a dominant position, accounting for more than 35% of the global market and generating about USD 6.65 billion in revenue. The United States led within the region, contributing around USD 6.23 billion, supported by strong government initiatives and the widespread implementation of IoT and AI technologies in water utility systems. With a projected CAGR of 10.4%, the U.S. market continues to play a central role in advancing smart water management solutions globally.

Investment and Business benefits

Investment opportunities are strong due to growing government and private sector funding focused on upgrading outdated water infrastructure and developing smart city water frameworks. Social capital and impact investors show interest in companies delivering innovative water monitoring and management solutions. These investments aim to accelerate the deployment of advanced water technologies globally.

Business benefits from smart water management systems are clear: enhanced system efficiency, significant cost savings, improved customer satisfaction, and reduced environmental footprint. Utilities experience fewer service disruptions and can plan maintenance activities more effectively. Improved data insights allow for better forecasting and resource planning.

Driver

Growing Global Water Demand

The expanding global population and rapid urbanization are creating an urgent need for efficient water management systems. With increasing water scarcity and aging infrastructure struggling to meet rising consumption, cities and utilities are compelled to adopt smarter water management solutions. These technologies enable real-time monitoring, leak detection, and optimized distribution that help save precious water resources. The growing pressure to manage water efficiently supports steady demand growth in this sector.

This driver is especially strong in regions facing acute water shortages such as parts of North America, Europe, and the Middle East. Utilities there are investing in modern systems to reduce losses and improve supply reliability. Advances in IoT sensors and data analytics make it easier for these systems to deliver actionable insights for conservation. Overall, the need to meet rising water demand sustainably is fueling the adoption of smart water management technologies.

Restraint

High Initial Capital Investment

One major restraint in expanding smart water management is the high upfront cost of deploying the necessary infrastructure. Implementing smart meters, sensors, and integrated data management platforms requires significant capital. Many water utilities operate with tight budgets and often cannot allocate sufficient funds for these new technologies without impacting other priorities.

Moreover, the water sector is typically highly regulated with slow technology adoption cycles. The lack of government subsidies or financial incentives to offset these costs makes utilities cautious about large investments. The slow return on investment timeline, often taking several years, further discourages rapid deployment, limiting the pace at which smart water management can be adopted.

Opportunity

Smart Cities and Urban Infrastructure

The global smart city movement presents a substantial opportunity for growth in smart water management. As cities seek to become more efficient and sustainable, integrating smart water solutions is a priority. These solutions help cities optimize water usage, reduce waste, cut costs, and improve overall resource management, aligning with broader environmental and smart urban development goals.

Adoption of smart water meters, automated distribution systems, and wastewater management technologies is expected to accelerate as more cities incorporate these solutions into their infrastructure plans. Government initiatives supporting digital transformation and sustainability create favorable conditions for expanded market growth in this space. The smart city revolution thus opens up long-term demand prospects for smart water technologies.

Challenge

Long Implementation and ROI Periods

A key challenge for smart water management is the extended period required to implement solutions and realize financial benefits. Deploying smart water infrastructure involves multiple complex components, including sensors, communication devices, data analytics, and control systems. Integrating these into existing municipal water systems can take years.

The delay in generating a positive return on investment poses difficulties for utilities that face ongoing financial pressures from losses like water theft and non-revenue water. The slow pace of technology adoption in this regulated sector slows competitive pressure to innovate. Utilities must carefully manage costs while aiming to accelerate ROI through operational efficiencies to overcome this challenge.

Key Market Segments

By Offering

- Water Meter

- AMR Meters

- AMI Meters

- Solutions

- Enterprise Asset Management

- Security

- Analytics & Data Management

- Smart Irrigation Management

- Advanced Pressure Management

- Leak Detection

- Others (Mobile Workforce Management, etc.)

- Services

- Professional Services

- Managed Services

By Technology

- IoT

- Artificial Intelligence

- Big Data & Analytics

- Cloud Computing

- Other Technologies

By End-User

- Residential

- Commercial

- Industrial

Top Key Players in the Market

- ABB Ltd.

- Badger Meter Corporation

- Honeywell International Inc.

- Hydropoint Data Systems Inc.

- IBM Corporation

- Itron Inc.

- Landis+Gyr Corporation

- Neptune Technology Group

- Oracle Corporation

- Schneider Electric SE

- Siemens AG

- Suez Water Technologies & Solutions

- TaKaDu

- Trimble Inc.

- Xenius Corporation

- Ayyeka Services

- KETOS

- Elster Group SE

- Global Water Management LLC

- i2O Water Ltd

- Other Key Players

Source of Information – https://market.us/report/global-smart-water-management-market/