Introduction

Drone Statistics: The drone market covers civil, commercial, and public sector uses of uncrewed aircraft and their software, sensors, and services. Scale can be observed in operational metrics rather than speculative sizes. In the United States, 822,039 drones were registered as of July 2025, including 433,407 commercial units and 460,375 certificated remote pilots. In Europe, more than 1.6 million drone operators are registered under a unified regulatory framework, which has increased cross-border operational consistency. These figures indicate a large installed base with growing professionalization on both sides of the Atlantic.

Top Editor’s Choice

- 853,857 drones are registered in the United States.

- Drones over 0.55 pounds must be registered.

- 270,183 people have earned remote pilot certification.

- By 2025, more than 2.67 million commercial drones are expected to operate worldwide.

- The drone workforce includes about 2.1 million people globally, with over 33,000 registered drone companies.

- In the past year, 126,000 new jobs were created in the drone sector.

- Global drone revenue is projected to grow to USD 63.6 billion by 2025.

- Major investors like Goldman Sachs, Baidu, and Rise Fund have invested over USD 1 billion in drones.

- Most countries require registration for drones over 250 grams.

- The drone sector averages USD 27.2 million per funding round, with 2,000+ investors across 7,000+ rounds.

- The industry holds over 29,000 patents and 6,000+ grants, showing strong R&D activity.

- As of 2024, the FAA registered 855,860 drones in the U.S.

- Of these, 96% are owned by men, while 4% are owned by women.

- The drone services market is forecasted to hit USD 63.6 billion by 2025.

- DJI dominates drone manufacturing, holding 79% global share in 2023, 54% global share in 2024, and 80% share in the U.S.

Drone Market Size

According to Market.us, The global drone market is projected to rise from USD 36.4 billion in 2024 to approximately USD 95.4 billion by 2034, advancing at a compound annual growth rate of 10.1% between 2025 and 2034. Growth is being supported by expanding applications in defense, agriculture, logistics, infrastructure, and surveillance, where drones are increasingly valued for their efficiency and ability to operate in complex environments. Continuous innovation in AI-driven flight systems, autonomous navigation, and real-time imaging is further reinforcing their role as critical tools across industries.

Top driving factors are cost, safety, and regulation. Independent field studies report substantial resource savings from drone use in agriculture, with water use reduced by 70 to 95% and pesticide consumption lowered by up to 40 percent, while maintaining coverage quality. Infrastructure inspection has shown 30 to 40% cost reductions compared with traditional methods, reflecting faster data collection and less shutdown time. The formalization of Remote ID and the EU open and specific categories has created clearer compliance pathways, which has supported enterprise adoption.

Key Takeaways

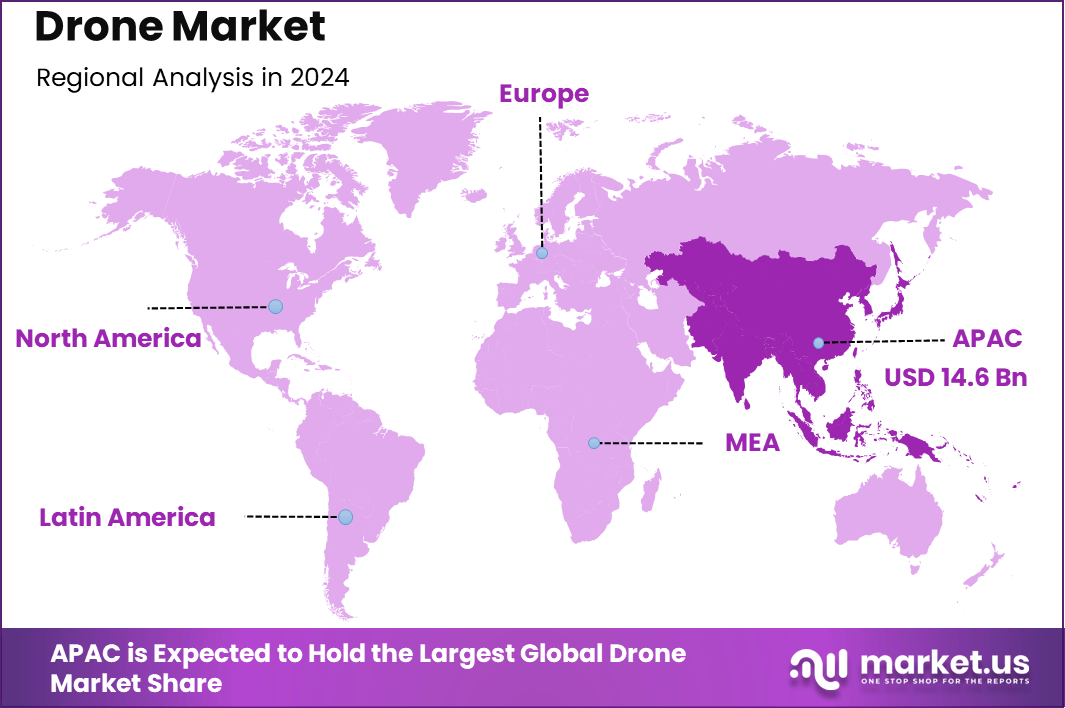

- In 2024, APAC led the market, capturing over 40.2% share, with revenue of USD 14.63 billion.

- Growth was driven by China, Japan, and India, adopting drones for both commercial and military purposes.

- The Rotary Wing Drone segment dominated in 2024, holding a 61.1% share.

- Fixed-Wing Drones increased market share from 31.7% in 2019 to 38.9% in 2024, showing rising adoption for long-range and endurance applications.

- On the application side, the Military segment led with 48.8% share in 2024.

- Defense, border security, and intelligence operations were the key drivers for this dominance.

- These trends highlight the strategic role of drones in modern military operations and the region’s push for technological advancement.

Regional Analysis

In 2024, the Asia-Pacific region led the global market, capturing more than 40.2% of the overall share and generating USD 14.63 billion in revenue. This dominance stems from significant manufacturing capabilities, rapid adoption in commercial and defense activities, and favorable regulatory measures that encourage drone deployment. Countries in the region are leveraging drones for disaster response, agricultural productivity, and smart city development, solidifying APAC’s position as the primary hub for global drone industry growth.

Emerging Trend Analysis

Growth of Autonomous and AI-Enabled Drones

In 2025, the drone market is heavily driven by advancements in autonomous flying capabilities and AI-powered technologies. These innovations enable drones to perform complex tasks with minimal human intervention, such as obstacle avoidance, intelligent route planning, and real-time data analytics.

The growing use of AI enhances the efficiency and safety of drones across various applications including agriculture, infrastructure inspection, delivery services, and surveillance. Hybrid designs combining the strengths of fixed-wing and multi-rotor drones are also becoming popular, providing greater flexibility and longer flight durations.

These technological leaps contribute to expanding drone functionalities beyond simple imaging to include precise data collection, crop monitoring, and logistics optimization. The integration of IoT and cloud connectivity supports remote management and faster decision-making, creating a new ecosystem around drone operations. As a result, drones are becoming indispensable tools in industries requiring automation, real-time monitoring, and rapid delivery.

Key Market Segments

Type Analysis

Rotary Wing Drone Segment Dominates with 61.1% Share in 2024

In 2024, the Rotary Wing Drone segment held the dominant position in the drone market, capturing a commanding 61.1% share. Rotary wing drones are highly favored due to their vertical takeoff and landing capabilities, making them versatile for various applications including surveillance, inspection, and delivery in confined or urban environments. Their ability to hover, maneuver precisely, and operate effectively in diverse terrains contributes to their widespread adoption. The segment’s dominance reflects the strong demand across commercial, industrial, and defense sectors requiring flexible and adaptable drone solutions.

Drone Market Share, By Type Analysis, 2019-2024 (%)

| Type | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Fixed-Wing Drone | 31.7% | 33.1% | 34.6% | 36.0% | 37.7% | 38.9% |

| Rotary Wing Drone | 68.3% | 66.9% | 65.4% | 64.0% | 62.3% | 61.1% |

Application Analysis

Military Segment Leads Application Side with 48.8% Share in 2024

On the application front, the Military segment led the drone market in 2024 with a 48.8% share. Military use of drones spans reconnaissance, surveillance, target acquisition, and payload delivery. The high adoption in this sector is driven by the critical need for enhanced battlefield intelligence, risk mitigation for personnel, and operational efficiency. The integration of advanced technologies such as AI and autonomous navigation further propels the military segment’s leadership, reflecting continuous investments in drone capabilities to maintain strategic advantages.

Drone Market Share, By Application Analysis, 2019-2024 (%)

| Application | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Consumer | 16.6% | 16.4% | 16.3% | 16.1% | 15.9% | 15.7% |

| Commercial | 34.3% | 34.6% | 34.8% | 35.0% | 35.3% | 35.5% |

| Construction | 55.2% | 55.5% | 55.8% | 56.1% | 56.6% | 56.7% |

| Agriculture | 7.8% | 8.0% | 8.1% | 8.2% | 8.4% | 8.5% |

| Oil & Gas | 5.9% | 5.8% | 5.7% | 5.6% | 5.5% | 5.3% |

| Mining | 3.1% | 3.0% | 2.9% | 2.8% | 2.8% | 2.7% |

| Public Safety & Law Enforcement | 15.5% | 15.4% | 15.3% | 15.2% | 15.0% | 15.1% |

| Others | 12.5% | 12.3% | 12.2% | 12.0% | 11.7% | 11.7% |

| Military | 49.1% | 49.0% | 48.9% | 48.9% | 48.8% | 48.8% |

Driver Analysis

Expanding Commercial Use and Regulatory Support

A major driver for the drone market is the expanding range of commercial applications. Industries such as agriculture are adopting drones for precision farming – performing soil analysis, crop spraying, and yield prediction. The logistics sector is also investing heavily in drone delivery to improve last-mile efficiency and reduce costs. Infrastructure inspection and public safety agencies use drones for fast, detailed surveys and emergency response.

Government support through clearer regulations and frameworks further encourages drone adoption. Many countries are developing rules to allow beyond visual line of sight (BVLOS) operations and harmonizing standards to ease drone integration with traditional airspace. Such regulatory clarity helps build trust and opens larger market opportunities for drone manufacturers and service providers.

Restraint Analysis

Regulatory Complexities and High Operational Costs

Despite growth, the drone industry faces several restraints. Regulatory complexities remain a prominent concern. Many regions still have strict or unclear regulations governing remote piloting, flight altitudes, and privacy issues. Obtaining certifications and compliance for large-scale drone deployments can be lengthy and costly.

Operational costs, including hardware investment, maintenance, and skilled personnel training, also limit widespread adoption—especially for small and medium-sized enterprises. Battery life and payload capacity restrictions pose additional technical limitations for many commercial uses. Together, these factors slow market penetration and require ongoing innovation and cooperation with regulators to overcome.

Opportunity Analysis

Emerging Markets and Innovative Use Cases

Emerging markets in Asia-Pacific, Latin America, and Africa represent significant growth opportunities for the drone industry. Rising digital infrastructure, expanding transportation networks, and growing industrial activity increase demand for drones across agriculture, delivery, and public safety sectors. Tailoring drone solutions to local needs and affordable pricing models can unlock untapped potential in these regions.

Meanwhile, innovative use cases such as hydrogen-powered drones, maritime surveillance, and multi-drone coordinated missions are pushing market boundaries. Advances in materials, AI, and connectivity also enable new services like asset risk management and environmental monitoring. These expansions provide fresh revenue streams and attract investment, fueling the drone ecosystem’s long-term growth.

Challenge Analysis

Supply Chain Disruptions and Geopolitical Risks

A significant challenge facing the drone market is supply chain disruption and geopolitical tensions. Shortages of critical electronic components, trade restrictions, and tariffs impact manufacturing costs and availability. The U.S.–China strategic rivalry has led to fragmented supply chains, with dual ecosystems emerging around these key players, complicating global sourcing strategies.

Furthermore, governments are imposing export controls and strict security policies intended to protect sensitive technologies but which also increase operational friction for manufacturers and service providers. Navigating these complex geopolitical dynamics requires robust risk management and diversification strategies. Balancing innovation while complying with security demands remains a persistent challenge for industry stakeholders.

Key Market Segments

By Type

- Fixed-Wing Drone

- Rotary Wing Drone

By Application

- Consumer

- Commercial

- Construction

- Agriculture

- Oil & Gas

- Mining

- Public Safety & Law Enforcement

- Others

- Military

Top Key Players in the Drone Market

- DJI

- Delair

- Aeronavics Ltd.

- Autel Robotics

- Dragonfly Inc.

- Ehang

- Yuneec International

- Denel Dynamics

- Parrot

- Aerovironment Inc.

- Teledyne FLIR LLC

- SenseFly SA, an AgEagle company

- Skydio

- Wingtra

- Flyability