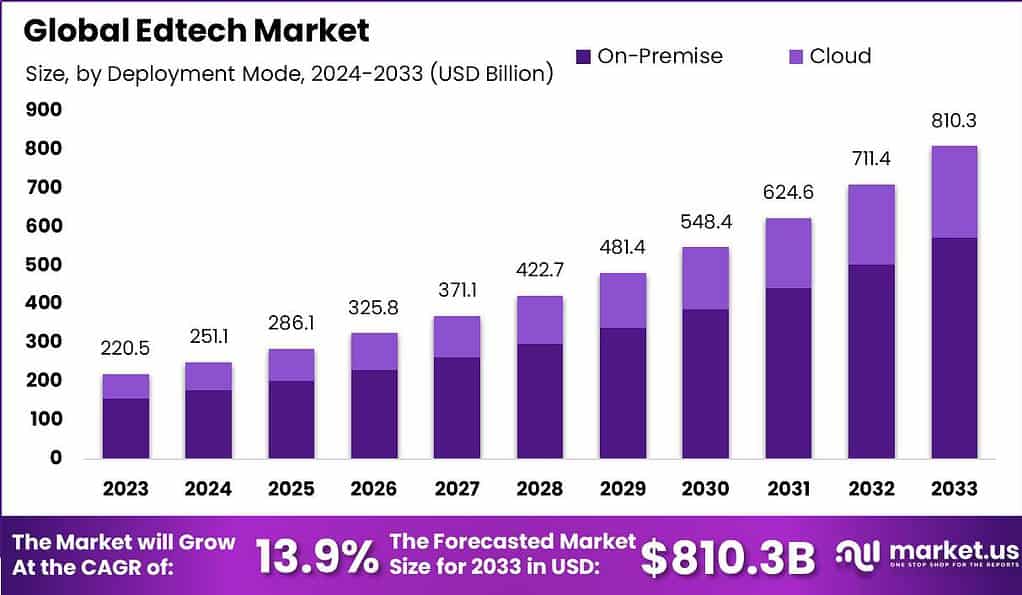

EdTech Market Size

The global edtech market sector is showing steady expansion, moving from USD 220.5 billion in 2023 to an anticipated USD 810.3 billion by 2033. This reflects a compound annual growth rate of 13.9% during the period from 2024 to 2033. In 2023, North America emerged as the leading region, accounting for more than 37.3% of the global share and generating approximately USD 82.24 billion in revenue. The region’s dominance can be attributed to advanced digital infrastructure, high adoption of online learning platforms, and strong investments in personalized education technologies.

The EdTech (Educational Technology) Market consists of digital tools, platforms, hardware, and services designed to enhance learning, teaching, administration, and assessment in education. It includes online learning platforms, learning management systems, virtual and augmented reality educational tools, adaptive learning software, classroom collaboration tools, hardware such as tablets and VR headsets, content / curriculum providers, and ancillary services such as tutoring, upskilling, and credentialing.

Key Insight Summary

- The market is projected to expand from USD 220.5 billion in 2023 to about USD 810.3 billion by 2033, growing at a CAGR of 13.9%.

- North America led in 2023 with 37.3% share, generating revenues of around USD 82.24 billion, reflecting strong digital learning adoption.

- The Middle East & Africa held 31.0% share, supported by rising digital literacy and government-driven initiatives.

- Europe captured 29.6% share, maintaining its strong presence in digital education solutions.

- Asia-Pacific accounted for 24.1%, driven by rapid digitalization and the rising demand for quality education.

- Latin America held a smaller share of 5.9%, but showed promising growth potential as adoption of EdTech solutions accelerates.

- By deployment, On-Premise solutions dominated with 70.8% share in 2023, highlighting reliance on localized setups despite cloud adoption trends.

- Hardware solutions contributed 40.7% share, showing the continued demand for devices and physical learning tools.

- In education segments, K-12 led with 55.9% share, underscoring strong early-stage technology integration in schools.

- By application, the Business segment was largest with 68.1%, reflecting the dominance of corporate training and professional upskilling.

Key EdTech Statistics

- In the United States, students who engage with devices for more than 60 minutes per week show better academic outcomes, demonstrating how digital tools enhance learning effectiveness.

- According to Skillademia’s research, eLearning boosts information retention by 25% to 40%, while 84% of learners report higher engagement when using gamified EdTech platforms, showing the strength of interactive formats.

- From a human resources perspective, 61% of HR leaders now consider online credentials to be as credible as traditional ones, validating the acceptance of online education in professional hiring and advancement.

- The EdTech sector is expected to grow at a 15% CAGR in the coming years, highlighting strong momentum across education and corporate training segments.

- The corporate EdTech market is currently valued at $27.5 billion, reflecting a large and expanding demand for professional learning and continuous education solutions.

- In higher education, more than 70% of colleges plan to launch new online undergraduate programs within the next three years, signaling a structural shift toward digital-first higher education.

Market Overview

Demand is strong in K-12 (primary and secondary schools), higher education, and corporate training/upskilling. In K-12, digital curriculum, interactive learning, and assessment tools are popular. In higher education, demand comes for online degree programs, MOOCs, and blended/hybrid learning formats. In corporate sectors, demand is rising for upskilling and continuous learning, to keep pace with changing job skills. Regions with large populations and rising incomes, especially in Asia-Pacific, Africa, and parts of Latin America, show fast growing demand because of both unmet education needs and increasing access to devices and connectivity.

Technologies such as AI and machine learning are increasingly used for adaptive learning, automated grading, content recommendations, and analytics of learner behaviour. Immersive technologies like virtual reality (VR) and augmented reality (AR) are being adopted for simulations and experiential learning. Mobile learning (apps for phones and tablets) is growing because many students already use these devices. Cloud-based solutions and SaaS models allow scalable deployment without heavy up-front hardware. Blockchain is being explored in some places for secure credentials and transcripts.

Educators, institutions, and learners choose EdTech solutions to improve learning outcomes, to reach remote or underserved learners, and to reduce costs over time (less travel, fewer printed materials). Institutions use EdTech to deliver content more flexibly, scale to large numbers of students, and adapt curriculum faster. Corporates adopt EdTech for workforce upskilling to keep skills relevant. Learners adopt because of convenience, ability to learn at their own pace, access to global content, and ability to get credentials or certificates from anywhere.

Investment and Business benefits

Investment opportunities remain significant as funding rounds average over USD 14 million per deal. Public-private partnerships and government initiatives in digital literacy contribute to sustained capital flow. Many startups innovate in AI-powered school management, AR learning tools, gamified education, and language localization, attracting global investor interest.

Business benefits include improved teaching efficiency, higher student retention and success rates, and cost reduction in delivering education. Schools gain better analytics and tools for monitoring student progress. Collaboration between educators and learners is streamlined through online platforms, facilitating virtual support and resource sharing. Data privacy and security have become priorities as systems evolve to protect student information.

The regulatory environment is still developing, commonly applying e-commerce and IT laws to EdTech, especially in markets like India. Consumer protection, data privacy, and advertising standards guide the sector, but specific EdTech regulations are often lacking. Self-regulatory bodies and consortiums are emerging to address ethical practices and compliance. Ensuring digital equity and safeguarding user data remain critical issues.

Driver Analysis

Growing Adoption of Digital Learning Tools

One key driver of the EdTech market is the widespread adoption of digital learning tools by both educators and learners. The push for remote and hybrid learning models, especially after the COVID-19 pandemic, has made digital platforms, educational apps, and online courses critical components of education.

These tools offer personalized learning experiences using technologies like AI, which adapts content to individual student needs. For instance, AI-powered adaptive quizzes and chatbots improve engagement and help tailor learning pathways, making education more accessible and effective. The increased use of tablets, laptops, and cloud-based learning management systems supports this shift, enabling education that is flexible and available anytime.

This trend has been accelerated by rising internet penetration and mobile device availability worldwide. Education institutions from schools to corporate training programs are integrating these technologies to meet demands for flexible and scalable learning solutions. Interactive content such as virtual reality, gamification, and eBooks are replacing traditional teaching methods, creating a more immersive and engaging learning environment. This widespread uptake is a significant factor propelling the global EdTech market growth, as more organizations invest in digital transformation to enhance learning outcomes and operational efficiency.

Restraint Analysis

Digital Divide and Infrastructure Challenges

A major restraint facing the EdTech market is the digital divide that limits access to technology and reliable internet in many regions. While urban and developed areas benefit from high-speed connectivity and modern devices, rural and low-income populations struggle to access these digital resources.

This hinders the equitable adoption of EdTech solutions, especially in developing countries where infrastructure deficits and lack of digital literacy remain significant barriers. For instance, students in remote areas may find it difficult to participate in online classes or access digital libraries due to limited internet bandwidth and device availability.

Additionally, many educational institutions lack the IT infrastructure or funding needed to implement and maintain advanced digital learning platforms. This shortfall can affect not only access but also the quality and consistency of digital education delivery. Addressing these constraints requires considerable investment in connectivity, hardware, and training, which not all governments or institutions can afford immediately. Without overcoming these infrastructure issues, the potential reach and impact of EdTech solutions remain limited, slowing overall market expansion.

Opportunity Analysis

Expansion of Personalized and AI-driven Learning

A promising opportunity in the EdTech space lies in the expansion of AI-driven personalized learning solutions. AI technologies enable platforms to analyze learner behavior and performance in real time, adjusting content difficulty and style to match individual needs. This can significantly improve learning effectiveness by providing customized feedback and tailored lesson plans. For example, adaptive learning engines can identify areas where students struggle and automatically offer extra exercises or alternative explanations, supporting a mastery-based learning approach.

The growing interest in AI tutoring, virtual reality classrooms, and gamified education offers EdTech companies new avenues for innovation. These technologies not only enhance engagement but also provide data-driven insights to educators for improving curriculum design. Furthermore, as the workforce demands continual upskilling, EdTech platforms that offer personalized corporate training or lifelong learning services are positioned to capture expanding markets. This shift toward more learner-centric models represents a key growth area, attracting both investment and user adoption.

Challenge Analysis

Market Saturation and Intense Competition

One significant challenge the EdTech market faces is saturation and fierce competition. Since the sector has attracted many startups and established firms, the market has become crowded, making differentiation harder. For example, numerous companies offer similar online learning platforms or apps, leading to vendor fragmentation and customer confusion. This crowded environment increases pressure on businesses to innovate continuously and invest heavily in marketing and product development to maintain relevance and capture market share.

Besides competition, user resistance to new technologies in traditional educational institutions presents a hurdle. Teachers and students accustomed to conventional methods may be slow to adopt digital tools without sufficient training and support. Additionally, privacy concerns related to data analytics and AI use in education require companies to comply with strict regulations, adding complexity and costs. Successfully navigating these competitive and operational challenges is crucial for companies to sustain growth and achieve long-term success in the EdTech industry.

Key Market Segments

Deployment Mode

- Cloud

- On-Premise

Type

- Hardware

- Software

- Content

Sector

- K-12

- Preschool

- Higher Education

- Other Sectors

End-User

- Business

- Consumer

Top Market Leaders

- Coursera Inc.

- BYJU’S

- Chegg Inc.

- 2U Inc.

- Amazon Inc.

- Blackboard Inc.

- Edutech

- Google LLC

- edX Inc.

- Instructure, Inc.

- Udacity, Inc.

- upGrad Education Private Limited

- Other Key Players

Read More – https://market.us/report/edtech-market/