Introduction

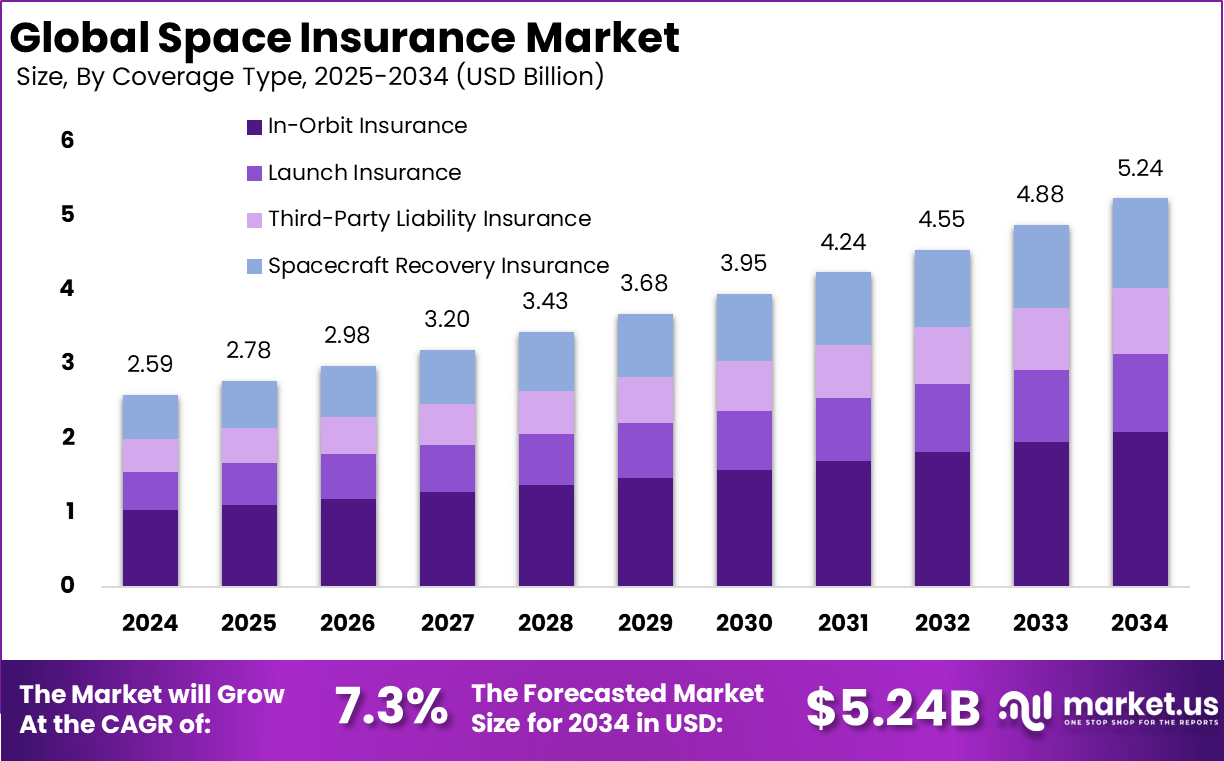

According to Market.us, The Global Space Insurance Market is projected to reach USD 5.24 billion by 2034, up from USD 2.59 billion in 2024, reflecting a 7.3% CAGR between 2025 and 2034. In 2024, North America held a dominant position, accounting for over 41% of the market, with revenues totaling USD 1.06 billion.

The Space Insurance Market is evolving steadily as an essential part of the expanding space industry. It provides financial protection against risks linked to satellite launches, space missions, and operations in orbit. This market covers potential financial losses from events such as launch failures, satellite malfunctions, and collisions caused by space debris. With over 6,000 satellites orbiting Earth and increasing commercial and government activities, demand for space insurance is growing to safeguard significant investments and innovations in space technology.

Top driving factors include the surge in global satellite launches for communication, weather monitoring, and navigation. Lower launch costs and technological advances in satellite manufacturing have widened space access, attracting private ventures and startups. Government and military initiatives expanding their space programs add further impetus, making insurance necessary to protect high-value assets like military satellites. Notably, over 2,500 private space companies are now engaged globally, diversifying demand and risk profiles for insurers.

Top Market Takeaway

- In 2024, the In-Orbit Insurance segment led with a 40% share, reflecting the increasing priority of protecting satellites throughout their operational lifecycle.

- The Commercial segment dominated with 52%, underscoring the surge in private sector involvement as more than 2,500 private companies are now engaged in space activities globally.

- Brokers and agents held a commanding 71% share, reinforcing their role in bridging satellite operators with insurers as launches accelerate.

- North America captured over 41%, supported by advanced space infrastructure, frequent launches, and expanding private sector participation. The region also benefits from players like SpaceX, which has already launched over 2,600 Starlink satellites.

- The market’s growth aligns with the broader space economy, which generates around USD 160 billion annually, with satellite launches averaging USD 62 million per mission.

Role of Generative AI

Generative AI is reshaping space insurance by automating complex tasks such as risk assessment and claims processing. It helps underwriters analyze vast amounts of data faster and with greater accuracy, saving about 40% of their time typically spent on administrative duties. This efficiency allows insurers to simulate catastrophe scenarios, enhancing their ability to manage space-related risks and detect fraudulent claims by recognizing intricate patterns that traditional methods might miss. As a result, operational productivity and customer service experience improve significantly in this highly specialized insurance sector.

The impact of generative AI extends further to predictive analytics in the insurance space, where it aids in tailoring coverage and pricing strategies based on evolving market behaviors. By leveraging historical and real-time data, AI enables personalized underwriting and dynamic risk management, helping space insurers stay responsive to fast-changing technology and regulatory environments. These advancements position generative AI as a crucial enabler for handling the growing complexities in space insurance as commercial space activities expand.

Emerging trends

Emerging trends in space insurance reveal a notable shift towards coverage tailored for new space activities such as private space stations, space tourism, and asteroid mining. These sectors introduce unique risks that require innovative insurance products and adaptive risk models. With satellite launches increasing dramatically – for instance, the global active satellites count rose by nearly 2,000 within a year – insurers are developing specialized policies that address launch failures, orbital risks, and space debris damage. These innovations reflect the industry’s effort to keep pace with the commercial space sector’s rapid evolution.

Another significant trend is the integration of advanced data analytics and AI-driven solutions to improve risk evaluation and claims handling. Insurers are increasingly combining aviation and aerospace insurance expertise to cover new ventures such as reusable rockets and space tourism flights. This convergence creates demand for more comprehensive policies that can address liability in mixed environments and support emerging technologies, underscoring a move towards broader, more flexible coverage solutions in the next phase of space insurance.

Growth Factors

Growth in space insurance is driven by the surge in commercial satellite deployments and government space initiatives. The increase in satellite launches, fueled by the demand for global connectivity and earth observation, pushes the need for insurance protection against launch failures and operational disruptions. The rapid development of reusable launch vehicles further amplifies this demand, as insurers must account for new types of risks associated with these technologies. These factors combine to broaden the customer base for space insurance and create opportunities for product innovation.

Government and military investments are also major growth contributors. Governments worldwide are intensifying their space exploration programs, including manned missions and lunar expeditions, which involve high financial risks needing insurance coverage. In addition, the rising awareness about space debris has led to new insurance products focused on collision liability and debris damage, reflecting the evolving nature of space risks. Such large-scale governmental involvement not only fuels market volume but also encourages insurers to develop tailored solutions for public sector space ventures.

Government-led investments

Government-led investments play a key role in advancing space insurance markets across regions. For example, North America dominates the space insurance market thanks to substantial investments in space exploration and satellite technology. The region’s established aerospace infrastructure and regulatory frameworks provide insurers with a stable environment to innovate and expand coverage options. The strong presence of leading space companies and governmental agencies in this region underpins sustained demand for space insurance products.

In India, the government allocated Rs 13,416.20 crore in its 2025-26 budget for the space sector, emphasizing the expansion of satellite technology and geospatial capabilities. This investment backs private sector-led research and innovation, with a Rs 1,000 crore venture capital fund targeted at boosting private space industry participation. Such financial commitments encourage growth in specialized insurance tailored for the burgeoning Indian space industry, supporting both infrastructure development and insurance coverage needs for local space operations.

Driver

Rising Satellite Launches and Space Activities

The growing number of satellite launches worldwide is a key driver of the space insurance market. With expanding demands for global communication, navigation, weather monitoring, and defense, companies and governments are launching more satellites than ever. This rise in launches increases the need for insurance coverage to protect these costly space assets against launch failures, in-orbit malfunctions, or damages caused by space debris.

Furthermore, the surge in commercial space ventures, including private space exploration and satellite constellations for internet connectivity, is fueling demand. This dynamic expansion in space activities boosts insurers’ opportunities to offer tailored coverage solutions for various mission phases, driving the overall market growth steadily.

Restraint

High Premium Costs and Limited Insurance Options

One of the significant restraints for space insurance is the high cost of premiums resulting from the inherent risks and complexities of space missions. Insurance providers face challenges in underwriting due to the unpredictable nature of space operations and the technical sophistication involved, which leads to expensive coverage plans. These high costs can be a major barrier for smaller companies or emerging space ventures with limited budgets.

Additionally, the insurance product range remains narrow because each space mission is unique, making standardized solutions difficult to develop. This lack of variety confines insurers to offering limited options, reducing flexibility for clients and potentially slowing broader adoption of space insurance policies.

Opportunity

Insurance Models for Mega-Constellations

An emerging opportunity in the space insurance market lies in the rise of mega-constellations—networks of hundreds or thousands of small satellites designed to provide global coverage. This trend pushes the development of innovative insurance products such as parametric or bulk policies that cover groups of satellites under a single contract, simplifying risk management.

These new models enable insurers to offer more efficient, cost-effective solutions suitable for large satellite fleets, opening up a fresh market segment. As private companies and governments deploy more of these constellations, the demand for such specialized insurance products is expected to grow rapidly, supporting market expansion.

Challenge

Risk Assessment and Limited Historical Data

A major challenge for the space insurance market is accurately assessing risks due to limited historical data and uncertainties inherent in space missions. Unlike traditional insurance sectors, space activities involve novel technologies and complex environments where few precedents exist, making actuarial modeling difficult.

This lack of data increases the difficulty for insurers to price policies correctly and manage potential catastrophic losses. Moreover, the fast pace of technological evolution requires continuous adaptation of risk evaluation methods, demanding significant expertise and investment from insurance providers to keep pace with emerging space risks.

Key Market Segments

By Coverage Type

- Launch Insurance

- In-Orbit Insurance

- Third-Party Liability Insurance

- Spacecraft Recovery Insurance

By End-User

- Commercial

- Government and Civil

- Defense

By Distribution Channel

- Direct Sales

- Brokers and Agents

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Top Key Players in the Market

- AXA XL

- Munich Re

- Swiss Re

- Lloyd’s of London

- Global Aerospace

- Atrium Underwriters

- AIG (American International Group)

- Allianz Global Corporate & Specialty (AGCS)

- Marsh McLennan (Insurance Broker)

- Willis Towers Watson (WTW)

- BRIT Insurance

- Others

Discover More – https://market.us/report/space-insurance-market/