Earned Wage Access Market Size

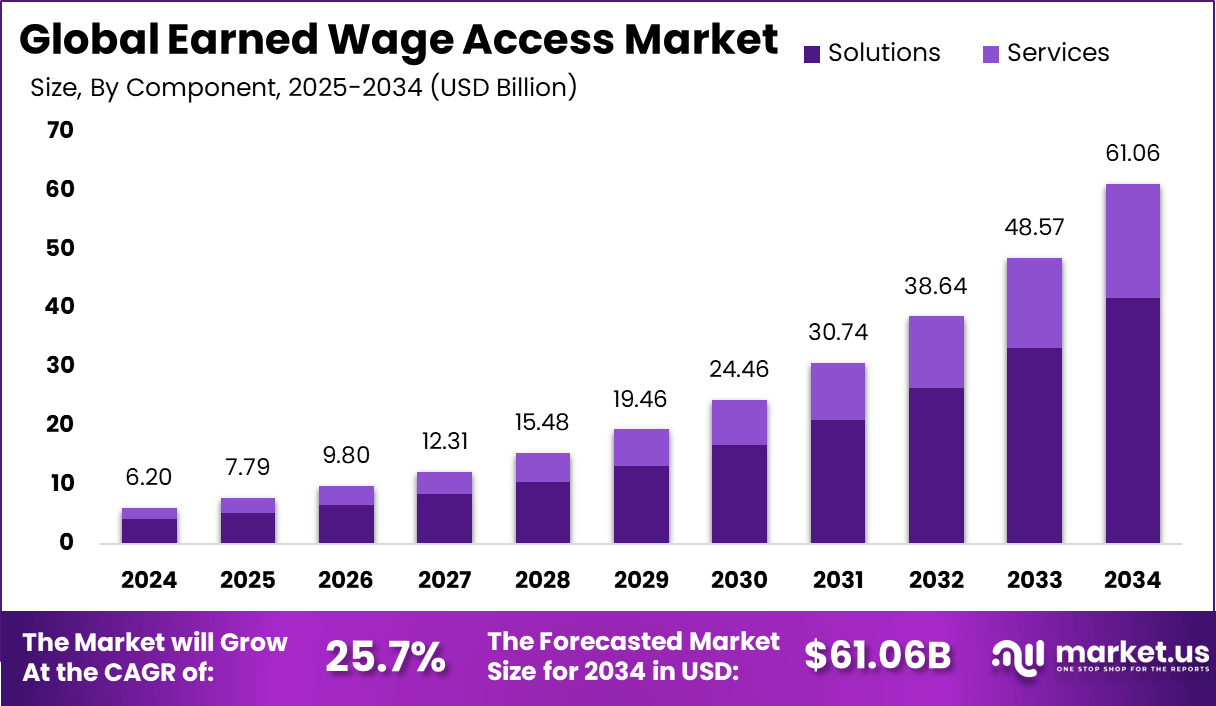

The Global Earned Wage Access (EWA) Market is projected to reach approximately USD 61.06 billion by 2034, rising sharply from USD 6.2 billion in 2024. This growth reflects a strong CAGR of 25.7% during the forecast period from 2025 to 2034. The expansion of this market can be attributed to the increasing demand for real-time salary access, improved financial wellness programs, and rising adoption among employers to enhance employee retention.

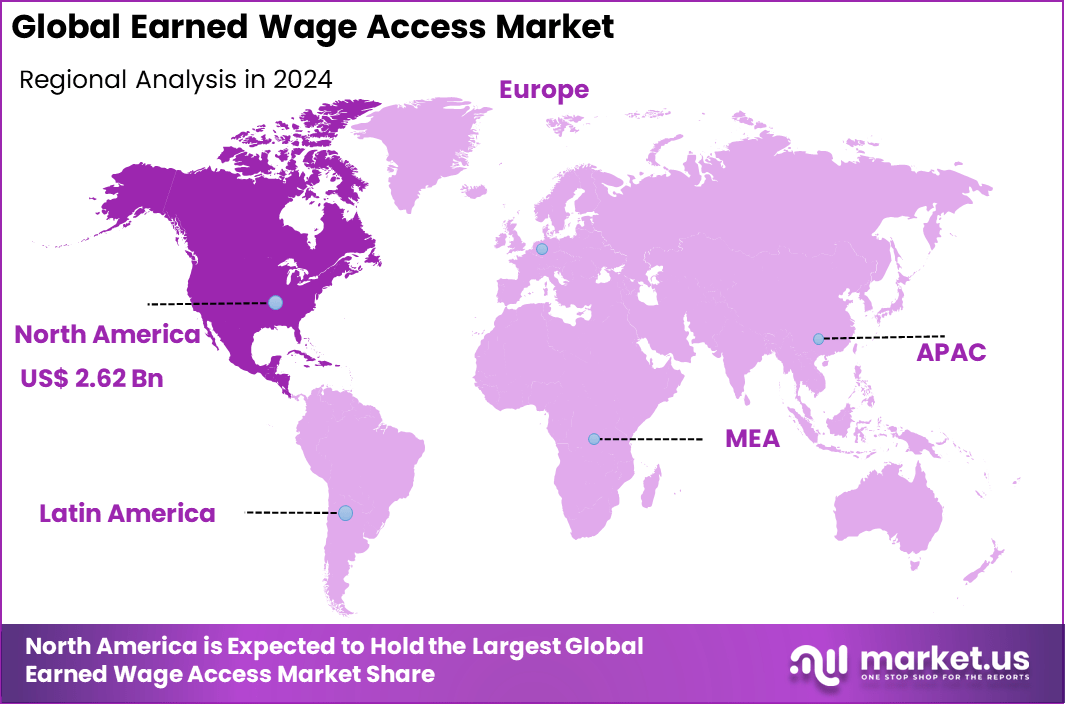

In 2024, North America held a dominant market position, capturing over 42.4% of the global share, valued at USD 2.62 billion in revenue. This leadership is supported by widespread digital payment adoption, advanced payroll infrastructure, and strong regulatory backing for financial inclusion initiatives. The region’s early embrace of fintech innovations and partnerships between employers and EWA service providers continue to drive consistent market penetration and user trust.

According to FlexWage, nearly 97% of full-time employees in the U.S. experience some level of financial stress, with 87% stating it affects their daily lives in measurable ways. Around 72% of workers express ongoing concern about their overall financial stability, while 62% specifically feel stressed about their personal financial situation. The burden of inflation, cited by 80% of employees, remains a significant factor affecting financial well-being across all demographics.

Insights from LLCBuddy indicate that about 28% of employees earning between USD 50,000 and USD 99,999 live paycheck to paycheck, and approximately 70% of them carry some form of debt. Financial strain has also been shown to affect productivity, with 48% of U.S. workers admitting that money-related worries distract them at work. Overall, an estimated 80% of the American workforce lives paycheck to paycheck, underscoring the growing demand for financial solutions that provide stability.

The adoption of Earned Wage Access (EWA) solutions has proven beneficial in this context. Around 77% of EWA users report reduced financial stress, while 72% note improved confidence and a stronger sense of control over their finances. These findings highlight the increasing importance of EWA as a financial wellness tool that helps employees manage their earnings more flexibly and maintain better financial health.

Top Market Takeaways

- The global EWA market was valued at USD 6.2 Billion in 2024 and is projected to grow at a strong 25.7% CAGR, driven by increasing adoption of real-time pay access and employee financial wellness solutions.

- The Solutions segment dominated with 68% share, supported by the rapid adoption of employer-integrated and direct-to-consumer (D2C) wage access platforms.

- Cloud-based deployment led with 81%, reflecting its scalability, seamless integration with payroll systems, and reduced IT maintenance costs.

- Large enterprises represented 59.7% of total adoption, as organizations focus on employee retention, engagement, and financial inclusion through EWA programs.

- The Retail & E-commerce sector accounted for 21%, highlighting strong adoption among high-turnover and hourly-wage workforces.

- North America held a leading 42.4% share, supported by mature fintech ecosystems and the growing emphasis on employer-led pay flexibility initiatives.

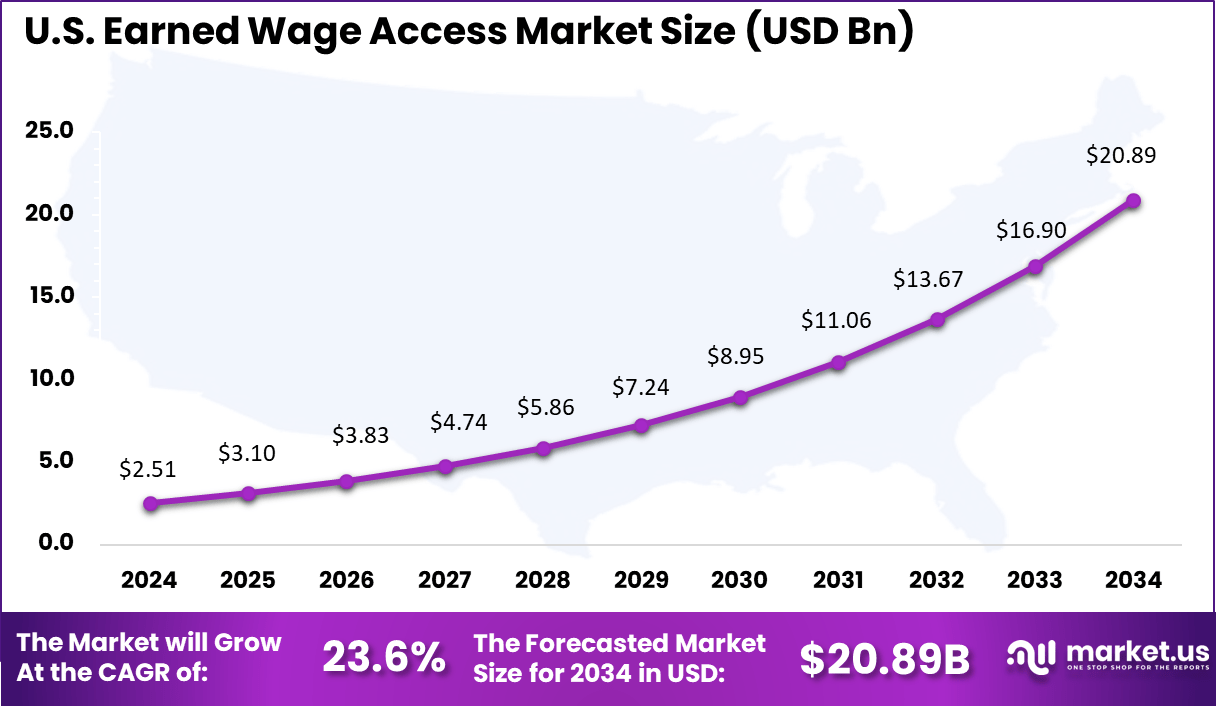

- The US market alone reached USD 2.51 Billion, underscoring strong workforce demand for on-demand pay access and sustained investment in digital compensation infrastructure.

Analysts’ Viewpoint

Top driving factors for EWA adoption include rising employee financial stress due to inflation and everyday expenses. Surveys reveal that nearly 97% of full-time workers face financial stress, with 80% worried about inflation. This stress detracts from productivity and job satisfaction, prompting employers to offer EWA as a financial wellness benefit. Additionally, high turnover industries view EWA as a useful retention tool because 78% of users say early wage access increases loyalty and job-seeking preference. The shift in employee expectations towards flexibility and control over earnings in an on-demand economy further boosts EWA’s appeal.

Emerging trends see more companies adopting cloud-based EWA platforms and integrating them with existing HR systems to enhance user experience. The focus on employee retention and satisfaction fuels this expansion, especially in high-turnover sectors like retail and hospitality. Collaborations with fintech and neobanks are opening new avenues for growth, making these services more accessible and scalable. Furthermore, the shift towards financial inclusion aims to reach underserved populations and promote greater economic stability.

Growth in this market is primarily driven by the rising costs of living, which push employees to seek early access to their earnings. Nearly 97% of full-time workers in the U.S. report financial stress, with many living paycheck to paycheck, further accelerating demand for EWA solutions. Employers view these services as strategic tools to improve job satisfaction and reduce turnover. As digital payment technology advances, more businesses are incorporating EWA into their benefits programs to boost workforce loyalty and operational efficiency.

U.S. Market Size

The U.S. EWA market is recognized as one of the most developed and fastest-growing globally. Its expansion is being propelled by the growing need for financial flexibility among employees and the steady increase in employer participation. By the end of 2024, more than 55 million U.S. workers had access to EWA services, reflecting a significant cultural and technological shift toward on-demand pay models that enhance employee satisfaction and financial control.

North America leads the Global Earned Wage Access (EWA) Market, capturing approximately 42.4% of the total global share in 2024. This regional dominance is largely driven by the United States, which alone generated about USD 2.51 billion in revenue and is projected to expand at a robust CAGR of 23.6%. The market’s strong position can be attributed to the early adoption of EWA programs by large employers, the increasing emphasis on financial wellness initiatives, and the region’s advanced fintech ecosystem that supports real-time payroll innovations.

Driver

Rising Employee Financial Stress Boosts Demand

Financial pressure on workers today is intense, with many living paycheck to paycheck. This drives a strong demand for Earned Wage Access services, which allow employees to access wages they have already earned before payday. Employers see this as a way to help workers manage cash flow issues without resorting to high-interest loans, making EWA a valued benefit that can improve employee satisfaction and retention. Particularly in sectors with high turnover, offering EWA helps companies attract and keep talent while supporting worker well-being. The rising living costs and economic uncertainty amplify this trend, making financial wellness tools like EWA increasingly essential for businesses.

Restraint

Regulatory Uncertainty Limits Growth

Despite growing adoption, EWA faces significant challenges due to unclear regulations across different regions. Governments and regulators are still figuring out how to classify and oversee EWA programs, causing confusion around fee limits, disclosures, and consumer protections. This uncertainty makes employers and providers cautious, slowing wider implementation. Additionally, regulatory scrutiny aims to prevent EWA from turning into a predatory lending alternative, but the lack of consistent rules complicates compliance and operational planning. Until clearer frameworks emerge, this regulatory ambiguity remains a major barrier for the market.

Opportunity

Expanding Financial Inclusion and Real-time Payments

EWA programs hold great promise to help underserved segments like hourly workers and gig economy freelancers, offering them expanded financial access and control. Advances in real-time payment systems enable instant wage transfers, which can prevent costly short-term borrowing and reduce financial stress. This integration of EWA with payroll and fintech platforms creates opportunities for more personalized, scalable solutions that empower employees financially. There is also scope for partnerships between EWA providers and digital banks or fintech firms to extend reach and embed these services within broader financial wellness ecosystems.

Challenge

Avoiding Dependency While Ensuring Responsible Use

A key challenge is managing the balance between offering easy access to earned wages and preventing overuse that could lead to financial strain. Some users may become dependent on early wage access, potentially causing paycheck shortfalls later on. This risk calls for transparent pricing, consumer education, and safeguards to avoid turning EWA into a cycle of dependency similar to payday lending. Employers and providers must carefully align EWA offerings with responsible use practices and regulatory requirements while monitoring the impact on workers’ long-term financial health.

Key Market Segments

Component

- Solutions

- Employer-Integrated EWA

- Direct-to-Consumer (D2C) EWA

- Services

Deployment Mode

- Cloud-Based

- On-Premise

End-User

- Large Enterprises

- SMEs

Industry Vertical

- Retail & E-commerce

- Hospitality

- Healthcare

- Transportation & Logistics

- Manufacturing

- BFSI

- Others

Top Key Players in the Earned Wage Access Market

- DailyPay

- Earnin

- PayActiv

- Even (U.S., acquired by Walmart)

- Rain

- FlexWage

- Wagestream

- Refyne

- CloudPay NOW

- Instant Financial

- Hastee

- Branch

- Other Key Players

Source of Information – https://market.us/report/earned-wage-access-market/