Introduction

Entering 2026, Netflix reported more than 325 million paying subscribers worldwide at the end of 2025. This was higher than the 301.2 million reported at the end of 2024, showing that the platform is still growing even as streaming becomes more crowded. In the fourth quarter of 2025, Netflix reported revenue of USD 12.05 billion, up 17.6% from the same period a year earlier. Net income was about USD 2.42 billion, up about 29%, and earnings were USD 0.56 per share.

In the third quarter of 2025, revenue was USD 11.51 billion, which was about 17% higher than a year earlier and close to company expectations. This report reviews the latest subscriber counts worldwide and in major countries, and links them to viewing activity, key revenue factors, and market position to highlight where growth is strongest and where it may be slowing.

Editor’s Choice

- Netflix crossed 325 million paid memberships during Q4 2025, keeping it the largest streaming platform by paid scale.

- Netflix ended 2024 with about 301.6 million paid subscribers, so 2025 delivered a sizable jump in total members.

- In Q4 2025, Netflix’s revenue was USD 12.051 billion, up 17.6% YoY.

- In Q4 2025, Netflix reported net income of USD 2.419 billion and EPS of USD 0.56.

- Q4 2025 operating margin was 24.5%, demonstrating strong profitability despite significant content output.

- In Q3 2025, revenue reached USD 11.510 billion, up 17.2% YoY.

- Q3 2025 operating margin was 28.2%, higher than Q4, as costs and releases can shift by quarter.

- For the full year 2025, Netflix reported revenue of USD 45.2B and an operating margin of 29.5%.

- Netflix said 2025 ad revenue rose more than 2.5x to over USD 1.5B, showing ads are becoming a real growth engine.

- The ad-supported plan reached about 94M monthly active users as of May 2025.

- Netflix said members watched 96B hours in H2 2025, up 2% YoY; viewing of Netflix originals rose 9% YoY in that period.

- For 2026, Netflix forecasts revenue of USD 50.7B to USD 51.7B (12% to 14% YoY) and an operating margin of 31.5%, with ad revenue expected to roughly double.

- Netflix expects content amortisation to grow about 10% in 2026, with a heavier impact in the first half of the year.

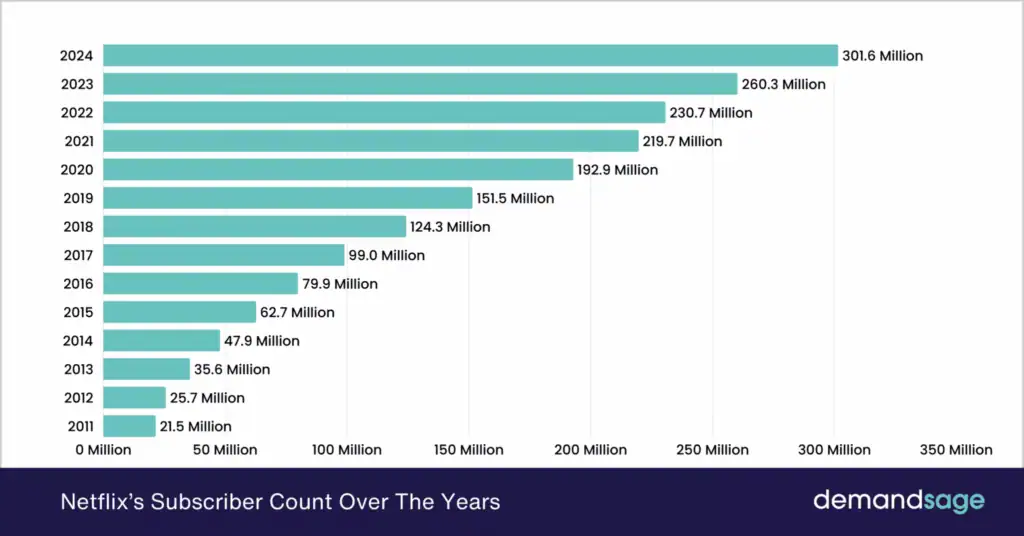

Netflix Subscriber Count

- Netflix had about 301.6 million paid subscribers at the end of 2024, the last quarter in which it still reported a total of regular subscribers.

- Variety reports that Netflix said it would stop reporting quarterly membership numbers and average revenue per member starting with Q1 2025 and would focus more on revenue and major milestones.

(Source: DemandSage)

- According to Reuters, Netflix ended Q1 2024 with 269.6 million global subscribers, up from about 260.3 million at the end of Q4 2023.

- Netflix grew from 260.28 million subscribers in 2023 to 301.6 million in 2024, adding 41.32 million subscribers and 15.9% year-over-year growth.

Netflix’s subscriber count over the years:

| Year | Netflix Subscribers |

| 2024 | 301.6 million |

| 2023 | 260.28 million |

| 2022 | 230.7 million |

| 2021 | 219.7 million |

| 2020 | 192.9 million |

| 2019 | 151.5 million |

| 2018 | 124.3 million |

| 2017 | 99 million |

| 2016 | 79.9 million |

| 2015 | 62.7 million |

| 2014 | 47.9 million |

| 2013 | 35.6 million |

| 2012 | 25.7 million |

| 2011 | 21.5 million |

Latest Update on the Warner Bros Deal

- Netflix Investor Relations announced that Netflix agreed to acquire Warner Bros in a deal valued at about USD 82.7 billion (about USD 72 billion equity value), and the plan keeps the separation of Discovery Global, expected in Q3 2026, before the deal closes.

- Reuters published that Netflix later revised the bid into an all-cash offer, and the deal is expected to face major regulatory review

Netflix Ad-Supported Plan and Facts

- According to Reuters, Netflix reported that its ad-supported tier reached 94 million users globally in May 2025, up from 70 million in November 2024.

- The ad-supported tier represented about 55% of new sign-ups in countries where the plan is available (as referenced in the May 2025 update).

- Netflix said the ad-supported tier had 40 million global monthly active users in May 2024, rising from 5 million a year earlier.

- Netflix said about 40% of sign-ups in countries where the plan is offered were choosing the ad tier at the time of its May 2024 update.

- Netflix planned to launch an in-house advertising technology platform by the end of 2025 to give advertisers better tools to buy ads and measure results.

- Netflix rolled out the ad-supported plan in November 2022, starting in Canada and Mexico on November 1 and expanding to markets like the United States and United Kingdom on November 3.

- The “Basic with Ads” plan launched at around USD 6.99 per month in key markets.

- In a report from TVTechnology, Netflix told advertisers that its ad-supported plan reaches more 18- to 34-year-olds than any United States broadcast or cable network.

Password-Sharing Crackdown Lifted US Sign-Ups

- Antenna via its Twitter account, Netflix saw a clear jump in US daily sign-ups right after it introduced its new password-sharing rules in May 2023.

- According to Antenna, in the first 6 days after the policy change, Netflix recorded the 4 biggest US sign-up days that Antenna had seen in about 4.5 years of tracking the service.

- After Netflix shared its crackdown update on May 23, 2023, US sign-ups accelerated quickly in the following days.

- Netflix added around 100,000 new US sign-ups on May 26 and again on May 27, 2023.

- Average daily sign-ups during that period rose to about 73,000 per day.

- This level was 102% higher than the average daily sign-ups seen over the prior 60-day period.

- The post-policy sign-up spike was even stronger than the jump seen during the COVID lockdown period shown in its tracking chart.

Netflix Subscribers By Country

- The United States is Netflix’s largest market, with about 81.44 million subscribers.

- As per DemandSage, the United Kingdom ranks second with about 18.40 million subscribers.

- Germany has about 16.59 million Netflix subscribers.

- Brazil also has about 16.59 million subscribers, which highlights Netflix’s strong reach in Latin America.

- Mexico has about 13.87 million Netflix subscribers.

- Netflix has about 13.57 million subscribers in France.

- Chasing France closely, India has about 12.37 million subscribers.

- Canada has about 9.05 million subscribers.

- Japan also has about 9.05 million subscribers.

- South Korea has about 8.36 million subscribers.

- Based on these estimates, the United States has about 4 times as many subscribers as the United Kingdom, underscoring the US market’s importance.

- These figures should be treated as third-party estimates, as Netflix no longer regularly publishes country-by-country subscriber totals.

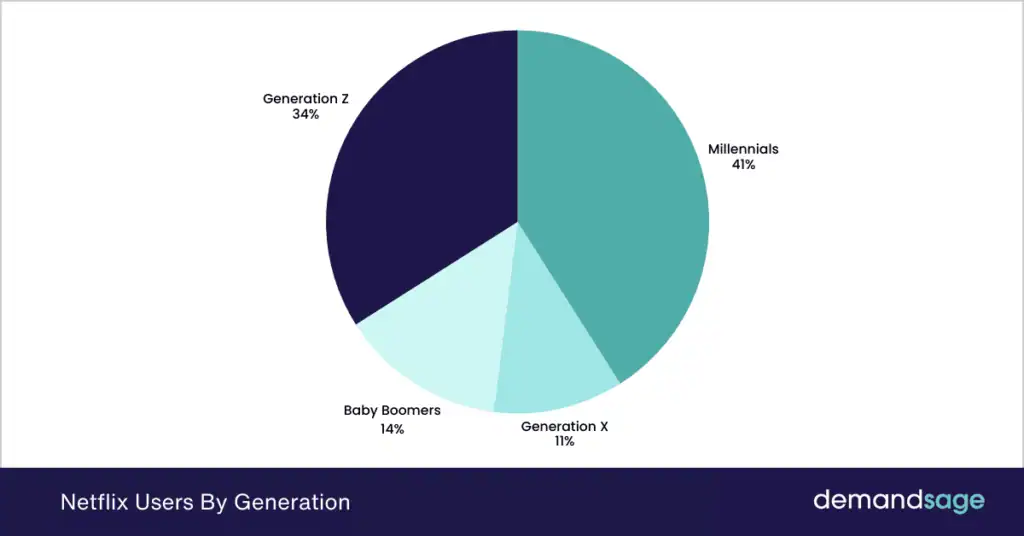

Netflix User Demographics

- Women make up 51% of Netflix users, while men make up 49%.

| Gender | Share Of Netflix Subscribers |

| Females | 51% |

| Males | 49% |

- The typical Netflix user is often described as a millennial with an annual income under USD 50,000.

- About 68% of Netflix members have some college or no college education, while around 33% have a bachelor’s degree or higher.

(Source: DemandSage)

- Netflix users by generation are: Millennials (41%), Generation Z (34%), Baby Boomers (14%), and Generation X (11%).

The distribution of Netflix users based on Generation:

| Generation | Share of Users |

| Millennials | 41% |

| Generation Z | 34% |

| Baby Boomers | 14% |

| Generation X | 11% |

Netflix User Engagement

- Netflix users spend about 1 hour and 3 minutes per day on the platform on average.

- Netflix holds about 21% of the US SVOD market share, close to Amazon Prime Video at 22%.

- As per a News10 report, 47% of Americans prefer Netflix over other streaming platforms, ahead of Amazon Prime Video at 14% and Hulu at 13.6%.

The distribution of the SVOD market share in the United States:

| SVOD Platform | Market Share |

| Amazon Prime Video | 22% |

| Netflix | 21% |

| Max | 13% |

| Disney+ | 12% |

| Hulu | 10% |

| Paramount+ | 9% |

| Apple TV+ | 8% |

| Peacock | 1% |

| Other | 3% |

- According to DemandSage estimates, Netflix subscribers by region are EMEA 101.13 million, USA and Canada 89.63 million, Asia Pacific 57.54 million, and Latin America 53.33 million.

- The same sources claim these market-share and regional figures are third-party estimates, because Netflix no longer publishes most of this breakdown publicly.

Here is a table showing Netflix Subscribers by region:

| World Region | Netflix Subscribers |

| Europe, the Middle East, and Africa | 101.13 million |

| U.S.A. and Canada | 89.63 million |

| Latin America | 53.33 million |

| Asia Pacific | 57.54 million |

Netflix Revenue and Password-Sharing Impact

- Netflix Newsroom published, the company estimates that more than 100 million households were sharing Netflix accounts before the new password-sharing rules were introduced.

- As per Netflix, the company rolled out new account-control options across 103 countries to help members manage who can access their accounts.

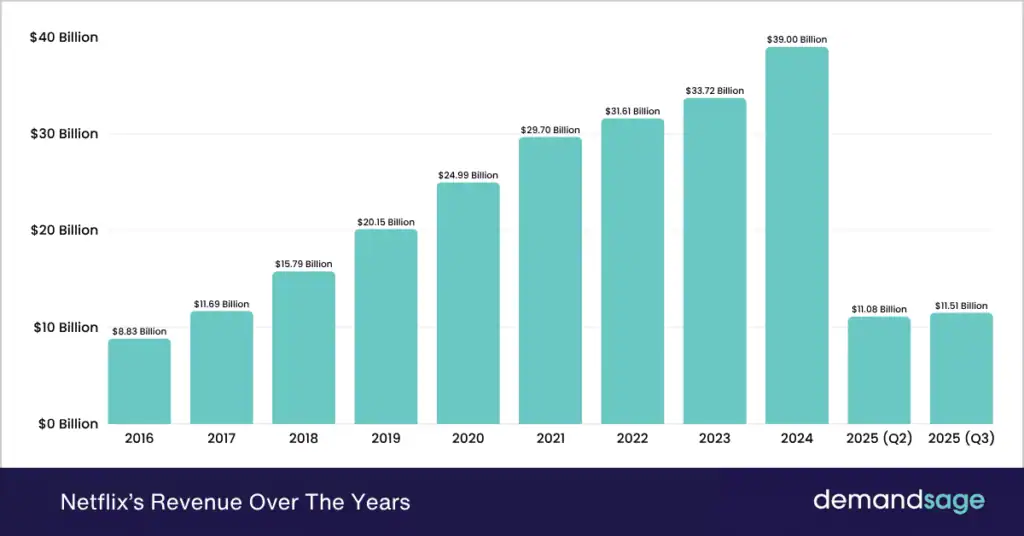

Netflix Revenue Performance

- According to The Wall Street Journal and The New York Times, Netflix generated USD 11.51 billion in revenue in Q3 2025.

- According to the same sources, revenue increased by USD 0.43 billion from Q2 to Q3 2025, representing about 3.9% quarter-over-quarter growth.

- Netflix reported earnings per share of USD 5.87, which came in below market expectations of around USD 6.94 to USD 6.96.

- Net income for Q3 2025 stood at about USD 2.5 billion, also below analyst estimates.

(Source: DemandSage)

- Netflix disclosures note that this earnings miss was mainly due to a one-time USD 619 million tax expense related to a dispute with Brazilian authorities.

- As per company statements, 17% year-over-year revenue growth was driven by subscriber growth, price increases in several markets, and higher advertising revenue.

- Netflix also credited popular titles such as Wednesday Season 2, Happy Gilmore 2, and KPop Demon Hunters for supporting revenue growth.

- Netflix shares fell by about 6% in after-hours trading after the earnings release due to weaker-than-expected profit figures.

Netflix Revenue Trend

- Netflix revenue reached USD 39.00 billion in 2024, up from USD 33.724 billion in 2023.

- Netflix’s revenue growth from USD 29.698 billion in 2021 to USD 31.61 billion in 2022, reflecting steady expansion.

- According to the same source, Netflix revenue increased from USD 8.83 billion in 2016 to USD 20.15 billion in 2019, highlighting long-term scale growth.

- Netflix generated USD 11.08 billion in Q2 2025 and USD 11.51 billion in Q3 2025, showing continued quarterly improvement.

- Netflix’s revenue trend suggests stronger monetisation through ads, pricing changes, and policy shifts such as the password-sharing crackdown.

Netflix’s revenue over the years:

| Year | Revenue |

| 2025 (Q3) | $11.51 Billion |

| 2025 (Q2) | $11.08 billion |

| 2024 | $39.00 billion |

| 2023 | $33.724 billion |

| 2022 | $31.61 billion |

| 2021 | $29.698 billion |

| 2020 | $24.99 billion |

| 2019 | $20.15 billion |

| 2018 | $15.79 billion |

| 2017 | $11.69 billion |

| 2016 | $8.83 billion |

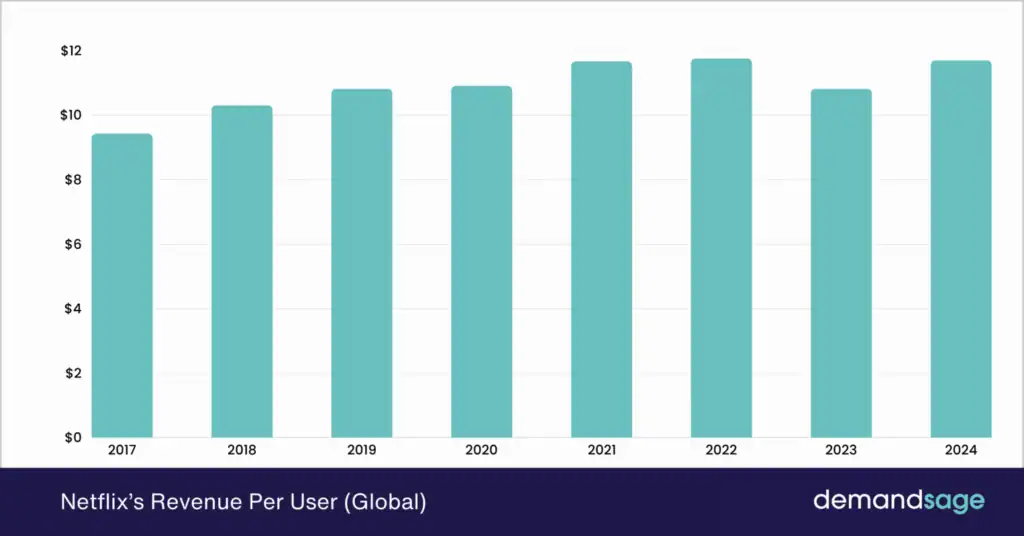

Netflix Global ARPU (Average Revenue Per User)

- According to industry estimates, Netflix’s global average revenue per user reached about USD 11.70 in 2024, up from USD 10.82 in 2023.

- As per market analysis, this increase reflects stronger monetisation through actions such as password-sharing controls and the wider rollout of the ad-supported plan.

(Source: DemandSage)

- Source data shows that Netflix’s ARPU had declined in 2023 from USD 11.76 in 2022, mainly due to pricing pressure and currency effects in some regions.

- The rebound in 2024 suggests Netflix successfully adjusted its pricing and product mix to improve revenue per user.

- Based on historical trends, Netflix’s ARPU has generally moved upward over time, rising from USD 9.43 in 2017 to USD 11.70 in 2024, despite short-term dips.

- From a research perspective, the ARPU recovery supports Netflix’s strategy to grow revenue even as subscriber growth matures in key markets.

Netflix’s average monthly revenue per membership:

| Year | Netflix’s Global ARPU |

| 2024 | $11.7 |

| 2023 | $10.82 |

| 2022 | $11.76 |

| 2021 | $11.67 |

| 2020 | $10.91 |

| 2019 | $10.82 |

| 2018 | $10.31 |

| 2017 | $9.43 |

Netflix ARPU by Region

- According to industry estimates, US and Canada generated the highest Netflix revenue per user in 2024, at about USD 17.26 per month.

- As per the same estimates, Europe, the Middle East, and Africa recorded an average revenue per user of about USD 11.11, placing the region well below North America but above other international markets.

- Source analysis shows that Latin America delivered an average revenue per user of around USD 8.00, reflecting lower pricing and income levels compared with developed markets.

- According to industry data, Asia Pacific had the lowest ARPU at about USD 7.34, even though it remains one of Netflix’s fastest-growing regions in terms of subscribers.

- From a research standpoint, these regional differences highlight Netflix’s pricing strategy: higher-income markets drive revenue, while emerging regions support long-term subscriber growth.

Netflix Market Capitalization

- According to market estimates, Netflix is currently valued at about USD 527.48 billion, placing it among the top 20 most valuable companies worldwide.

- As per market data, Netflix’s market capitalization increased by about 36.24% in 2025, continuing its strong upward trend.

- Source analysis shows that the largest jump occurred in 2024, when Netflix’s valuation rose by about 82.05%, from USD 213.09 billion in 2023 to USD 387.93 billion.

- 2023 marked a strong recovery year, with Netflix’s market value growing by about 62.39% after a difficult period.

- In 2022, Netflix experienced a sharp decline, with market capitalization falling by about 50.94% to USD 131.22 billion, the lowest level in recent years.

- Earlier, Netflix’s market value stood at USD 267.46 billion in 2021 and USD 238.89 billion in 2020, showing that volatility has been part of its growth journey.

- From a research perspective, the strong rebound since 2023 reflects renewed investor confidence, driven by subscriber growth, higher revenue per user, and improved monetisation strategies.

Netflix’s Market Cap by year:

| Year | Netflix Market Cap |

| 2025 | $527.48 billion |

| 2024 | $387.93 billion |

| 2023 | $213.09 billion |

| 2022 | $131.22 billion |

| 2021 | $267.46 billion |

| 2020 | $238.89 billion |

| 2019 | $141.98 billion |

Netflix Workforce, Reach, and Viewing Behaviour

- According to Statista, Netflix employs about 14,000 full-time employees worldwide, reflecting the scale of its global operations.

- Netflix’s workforce is 51.6% female, 45.8% male, and about 1.4% identify as other genders.

- Source data shows the largest gender gap is in IT roles, where around 59% of employees are male.

- Women are more represented than men in Creative and Corporate roles at Netflix.

- Netflix Help Centre announced that Netflix is available in more than 190 countries, following its international expansion that began in 2010.

- As per Netflix disclosures, the service is not available in China, Russia, North Korea, Syria, or Crimea.

- Source reports confirm Netflix exited Russia following the country’s invasion of Ukraine, while growth in China remains limited due to strict regulations and censorship.

- Viewing behaviour studies indicate that the average Netflix user takes about 5 days to binge-watch a full series.

- Source research reveals that around 8.4 million users worldwide attempt to complete an entire series within the first 24 hours of release.

- Audience usage data shows that the average Netflix subscriber watches about 60 movies per year, roughly one every 6 days.

- Source analysis shows that about 80% of Netflix viewing comes from titles recommended by Netflix’s algorithm, highlighting the strong role of personalized suggestions in driving engagement.

Conclusion

Netflix’s performance highlights a mature yet still expanding streaming platform with strong global scale and improving monetization. Growth is now driven less by raw subscriber additions and more by higher revenue per user, advertising, pricing discipline, and tighter account controls. Regional differences in ARPU show how developed markets fund expansion in faster-growing regions.

High engagement levels, effective content recommendations, and a large international footprint support long-term demand. Overall, Netflix’s data points to a business shifting successfully from rapid expansion to sustainable, profit-focused growth.