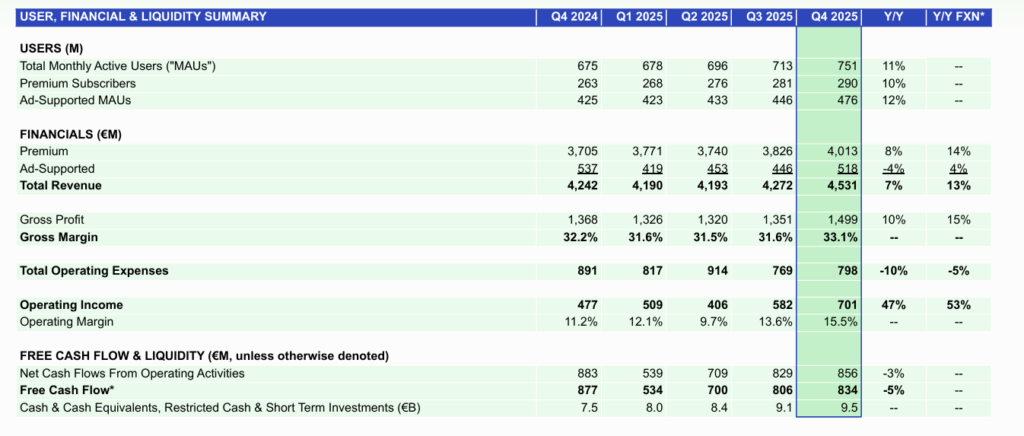

Spotify crushed Q4 2025 with revenue of €4.5B (up 13% YoY), EPS of €4.43, and record MAUs of 751M. Premium subscribers hit 290M (+10% YoY). Shares surged 12-15% in pre-market/after-hours trading on the beat and strong profitability.

About Spotify

Spotify Technology S.A. (NYSE: SPOT) dominates the global music streaming market, offering on-demand audio content including music, podcasts, and audiobooks to over 750M monthly active users. Founded in 2006 and headquartered in Luxembourg City, Luxembourg, Spotify operates in 180+ countries, with a freemium model driving massive scale and personalization via AI-powered recommendations.

The company boasts a market capitalization of around $94-132B (recently ~$94B at ~$457/share), reflecting its growth trajectory amid profitability inflection. Trading at a trailing P/E of 37-162x (elevated due to rapid earnings ramp), Spotify pays no dividend but generated record €2.9B in full-year free cash flow. With ~5,800 employees, Spotify paid over $11B to the music industry in 2025 alone, underscoring its pivotal role in creator economics.

Top Financial Highlights

- Q4 2025 total revenue surged 13% YoY (constant currency) to €4.5B, marking accelerated growth from prior quarters.

- Premium revenue (subscription) climbed 14% YoY to €4.01B, fueled by 290M premium subscribers (+10% YoY, +9M sequentially).

- Advertising revenue rose 4% YoY (7% ex-podcast optimization) to ~€490M, with music ads offsetting podcast softness.

- Q4 gross margin expanded 83 bps YoY to 33.1%, driven by favorable content costs and scale efficiencies.

- Q4 operating income hit a record €701M (+47% YoY), beating forecasts by €81M; full-year op income grew >50% to deliver 13% margin.

- Q4 net income reached ~€1.17B, with diluted EPS of €4.43 (massive beat vs. €2.85 consensus).

- Full-year 2025 revenue grew 13% to ~€16.95B, with gross profit up 20%.

- Q4 free cash flow was €834M, contributing to full-year record €2.9B (+~€600M YoY).

- Cash position: Ended Q4 with €9.5B in cash and short-term investments, providing ample liquidity for growth and buybacks.

- User metrics: Record 751M MAUs (+11% YoY, +38M net adds); drove highest-ever engagement via “Spotify Wrapped.”

- Q1 2026 guidance: Revenue €4.5B (~15% growth, despite €35M FX headwind); gross margin 32.8%; op income €660M; MAUs 759M (+8M); subs 293M (+3M).

Financial Summary

Revenue

Revenue reached €4,531 million in the fourth quarter, reflecting year-over-year growth of 7%, or 13% on a constant currency basis. Growth was primarily supported by an 8% increase in Premium revenue, equivalent to 14% growth in constant currency terms, driven by continued subscriber expansion.

Ad-Supported revenue declined by 4% year over year. However, on a constant currency basis, it increased by 4%. Currency headwinds negatively impacted overall revenue performance, reducing reported year-over-year growth by approximately 580 basis points compared with the 620 basis points factored into prior guidance.

Profitability

Gross margin improved to 33.1% in the fourth quarter, representing an increase of 83 basis points year over year. Premium segment performance benefited from revenue growth that outpaced music costs, net of marketplace programs and audiobook expenses. These gains were partially offset by higher video podcast costs.

Operating income totaled €701 million in the fourth quarter. This result reflected revenue growth and margin expansion, alongside increased marketing and personnel-related expenses, excluding social charges. Operating expenses also included €50 million in social charges. By the end of the fourth quarter, the company employed 7,323 full-time employees globally.

Free Cash Flow and Liquidity

Free cash flow amounted to €834 million during the fourth quarter. The company maintained a strong liquidity position, supported by €9.5 billion in cash and cash equivalents, restricted cash, and short-term investments.

Gross Margin

Monthly Active Users

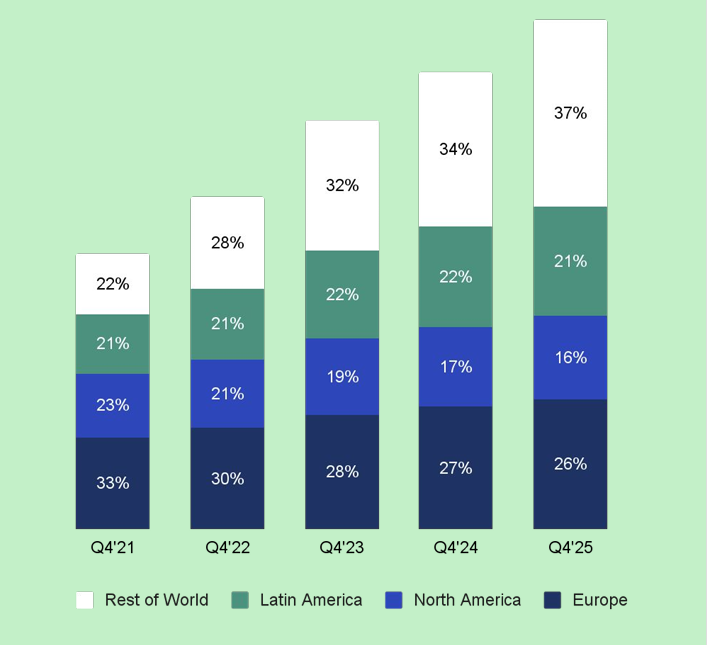

- Europe’s share declined steadily from 33% in Q4’21 to 26% in Q4’25, indicating a gradual moderation in its overall contribution over the five-year period.

- North America also experienced a consistent decline, decreasing from 23% in Q4’21 to 16% in Q4’25, reflecting a relative shift in geographic revenue mix.

- Latin America remained comparatively stable, fluctuating narrowly between 21% and 22%, demonstrating consistent regional contribution without major volatility.

- Rest of World showed the strongest upward trend, rising significantly from 22% in Q4’21 to 37% in Q4’25, highlighting increasing revenue diversification and stronger growth momentum outside traditional core markets.

Total MAUs

| Quarter | Europe | North America | Latin America | Rest of World |

| Q4’21 | 33% | 23% | 21% | 22% |

| Q4’22 | 30% | 21% | 21% | 28% |

| Q4’23 | 28% | 19% | 22% | 32% |

| Q4’24 | 27% | 17% | 22% | 34% |

| Q4’25 | 26% | 16% | 21% | 37% |

Beat or Miss?

| Metric | Reported | Difference/Analysis |

| Revenue (Q4) | €4.5B | Beat expectations (~€4.52B consensus); +13% YoY. |

| EPS (Q4) | €4.43 | Massive +55% surprise vs. €2.85 forecast. |

| Gross Margin (Q4) | 33.10% | Beat with +83 bps YoY expansion on content efficiencies |

| Operating Income (Q4) | €701M | +€81M above forecasts; record high |

| MAUs (Q4) | 751M | Beat by 6-8M; record net adds of 38M |

What Leadership Is Saying?

“We closed out what we dubbed as the Year of Accelerated Execution with another solid quarter, delivering a strong finish to 2025. In Q4, we met or exceeded guidance across all key metrics. We marked our highest quarter ever for MAU net additions.”-Alex Norström, Co-CEO

“Overall, we are pleased with our strong quarter four finish. Total revenue grew at an accelerated 13% to €4.5 billion. Premium revenue rose 14% versus 13% last quarter and was primarily driven by subscriber growth.”–Christian Luiga, CFO

Historical Performance

| Category | Q4 2025 | Q4 2024 | Change (%) |

| Revenue | €4.5B | €4.0B | 13% |

| Net Income | €1.17B | N/A | Strong profitability inflection |

| Operating Income | €701M | €477M | 47% |

Revenue accelerated to double-digits on subscriber gains; op income more than doubled from prior-year levels amid gross margin expansion to 33.1%.

Key Competitor

| Category | Q4 2025 Revenue | Q4 2024 Revenue | Change (%) |

| Spotify | €4.5B | €4.0B | +13% |

| Tencent Music | ~$1.0B | ~$0.85B | +18% (online music) |

| SiriusXM/Pandora | ~$2.3B | ~$2.3B | Flat |

How the Market Reacted?

Spotify shares rocketed 12.28% in pre-market trading to ~€466 post-earnings, with intraday gains hitting 15% amid the blowout user metrics, EPS beat, and record profitability. The bullish reaction reflects investor enthusiasm for sustained double-digit growth, margin expansion to 33%, and a cash pile exceeding €9.5B supporting AI investments and buybacks. Even as some analysts trimmed 2026 targets citing valuation, the report’s execution reinforced Spotify’s leadership in a consolidating streaming landscape.