Introduction

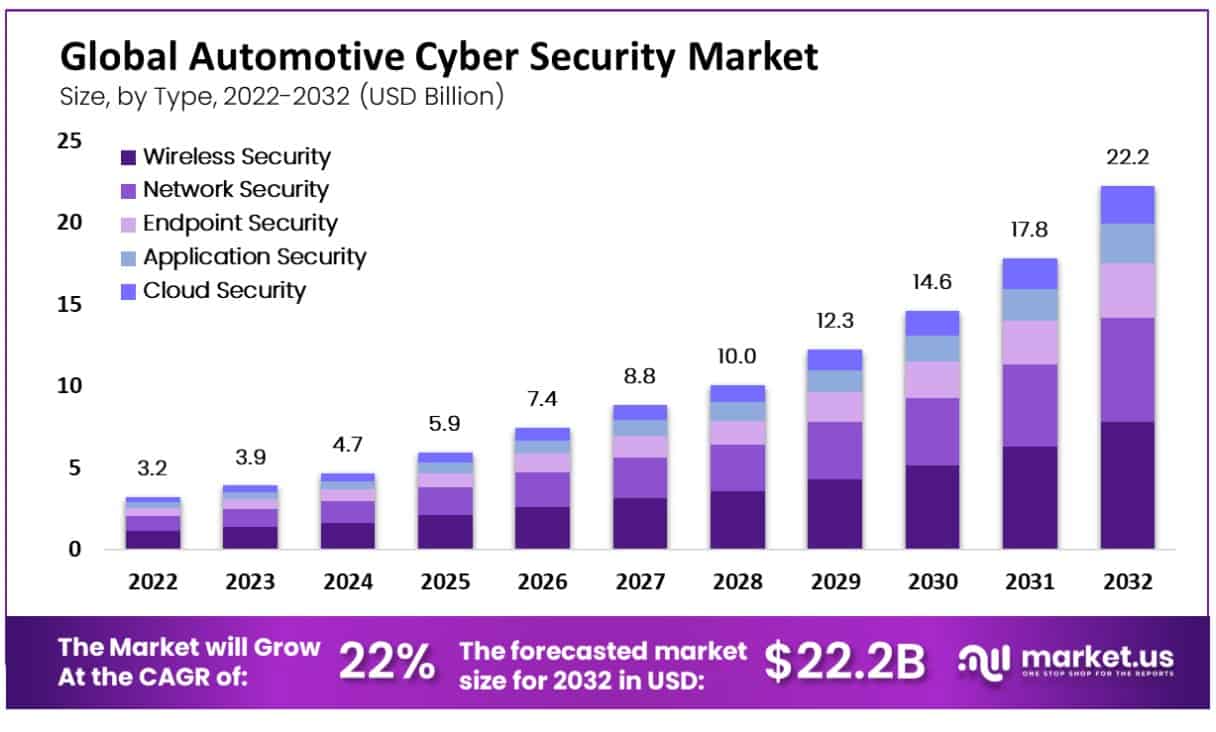

The Global Automotive Cyber Security Market is valued at USD 3.9 billion in 2023 and projected to reach USD 22.2 billion by 2032, growing at a CAGR of 22%, driven by rising cyber-attacks on connected vehicles due to more electronics, telematics, and infotainment systems. The automotive cyber security market covers the tools, software, and services used to protect connected vehicles and the systems around them from digital attacks.

Modern vehicles now operate like networked computers on wheels, with many electronic control units, in-vehicle networks, and constant data exchange with mobile apps, cloud platforms, charging networks, and roadside infrastructure. As connectivity has increased, cyber security has become a core part of vehicle safety, reliability, and brand trust, not only an IT requirement.

This market includes protection across the full vehicle lifecycle, from secure design and code testing during development to monitoring, incident response, and software patching after the vehicle is on the road. It also spans multiple layers, such as secure boot and hardware security modules, network intrusion detection, secure gateways, encryption and identity management, and secure over-the-air updates.

Demand is being shaped by both passenger vehicles and commercial fleets, where uptime, remote diagnostics, and centralized fleet management make cyber resilience a daily operational priority. Cyber security in automotive is increasingly treated as an engineering discipline that sits alongside functional safety and quality.

Vehicle makers, suppliers, and software partners are being pushed to prove security by design, document risk controls, and maintain secure operations throughout the vehicle’s service life. As a result, the market is expanding beyond standalone products into long-term security programs, managed services, and continuous compliance support.

Top Key Takeaways

- The global automotive cyber security market grows at a CAGR of 22% from 2023 to 2032.

- Wireless security is the leading type segment, holding the largest share among security types (majority share in 2022).

- Passenger cars form the largest vehicle segment, reflecting their higher connectivity and exposure to attacks.

- The infotainment application segment accounts for about 37% of market share, the highest among applications.

- Asia Pacific captured around 36% of global revenue in 2022, the largest regional share.

Key Statistics

- According to coolest-gadgets, automotive cybersecurity incidents have caused serious damage to car companies worldwide, affecting different parts of the industry in different ways.

- Data and privacy breaches are the most common type of attack, accounting for 31% of all incidents, and they risk exposing sensitive information and harming consumer trust.

- Service interruptions and business disruptions make up 23% of incidents, often leading to operational delays and financial losses.

- Vehicle theft, break-ins, and system control attacks also represent 23% of cyber incidents, showing how connected vehicles can be targeted by hackers.

- Other cybercrimes such as fraud, system manipulation, location tracking, and rule violations account for 10% of total attacks.

- These trends underline the need for strong cybersecurity measures to protect vehicles, data, and the overall automotive ecosystem.

Top Driving Factors

Growth is being driven by the rapid rise of connected features, including telematics, infotainment, digital keys, V2X connectivity, and app-based remote functions, all of which increase the number of entry points that attackers can target. The shift to software-defined vehicles and over-the-air software delivery is also a major factor, because frequent updates require strong identity controls, secure update pipelines, and monitoring to prevent tampering.

In parallel, tighter cyber security expectations from regulators, insurers, and enterprise fleet buyers are pushing OEMs and suppliers to invest earlier in secure architecture, testing, and post-sale monitoring to reduce recall risk and reputational damage.

Demand Analysis

Demand is strongest where connectivity is highest and operational impact is most visible, such as premium passenger vehicles, electric vehicles, and commercial fleets with always-on telematics. Buyers are increasingly requesting end-to-end coverage, including threat modeling and secure development practices, penetration testing, supply-chain risk checks, in-vehicle intrusion detection, and security operations support after deployment.

Demand is also rising for solutions that can scale across vehicle platforms and supplier ecosystems, because OEMs must manage security across many third-party components and software modules. Over time, purchasing is expected to move toward continuous services and platform-based security, as vehicle software becomes more dynamic and security needs become ongoing rather than project-based.

Increasing adoption of technology

- More cars now have always‑connected infotainment, telematics, over‑the‑air updates, and cloud links, so security tools for wireless, network, endpoint, and applications are being built into the vehicle from the start.

- Adaptive security, intrusion detection, encryption, and secure gateways are being added as standard in passenger and commercial vehicles to monitor traffic, block attacks, and protect in‑vehicle networks.

Business benefits

- Strong cyber security helps protect passenger safety, avoid costly recalls, and reduce the risk of data theft or remote vehicle control, which can damage brand trust.

- Secure connected features (infotainment, remote diagnostics, telematics) enable new services and revenue streams while helping meet regulations and OEM cyber standards at the same time.

Vulnerabilities and Impact

- More ways to attack: As vehicles use more electronics and stay connected, there are more points where attackers can try to break in.

- Supply chain risk: Cyber threats can affect many companies involved in making and supporting vehicles, not just the vehicle itself.

- Need for stronger protection: The rise in cyber risks compared with current security levels shows the need for better and more reliable defenses.

Key Market Segment

Based on Type

- Wireless Security

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

Based on Vehicle Type

- Passenger Cars

- Commercial Vehicles

Based on Application

- On-board Diagnostic

- Communication

- Safety Systems

- Infotainment

- Telematics

Top Key Players

- Intel Corporation

- Argus Cyber Security

- NXP Semiconductors N.V

- Guardknox Cyber-Technologies Ltd.

- Argus Cyber Security

- Vector Informatik GmbH

- Arilou Technologies

- Arxan Technologies, Inc.

- Bayerische Motoren Werke (BMW) AG

- Broadcom Inc.

- C2A Security Ltd.

- Centri Technology Inc

- Dellfer, Inc.

- ESCRYPT GmbH

- Ford Motor Company

- Guardknox Cyber-Technologies Ltd.

- Mocana Corporation

- Nvidia Corporation

- Saferide Technologies Ltd

- Toyota Motor Corporation

- Trillium Secure Inc.

- Upstream Security

- Volkswagen AG

- Other key players

Recent Deveopment

- March, 2025 – PlaxidityX (formerly Argus) partnered with Deloitte Spain to launch an AI-driven Vehicle Security Operations Center solution for fleet cybersecurity.

- April, 2025 – Upstream released its 2025 Global Automotive Cybersecurity Report analyzing ransomware surge, China EV cyber risks, and vSOC needs.

Conclusion

The automotive cyber security market is expanding rapidly due to the growing connectivity in modern vehicles and rising cyber threats from advanced electronics and cloud systems. Wireless security leads the technology segments, passenger cars dominate vehicle types, and infotainment applications hold the largest share at 37%, while Asia Pacific commands around 36% of global revenue.

As automakers integrate more features like telematics and over-the-air updates, stronger protection becomes essential to ensure passenger safety, prevent costly recalls, comply with regulations, and maintain customer trust in an increasingly digital driving environment.

Read More – https://market.us/report/automotive-cyber-security-market/