LiDAR Market Size

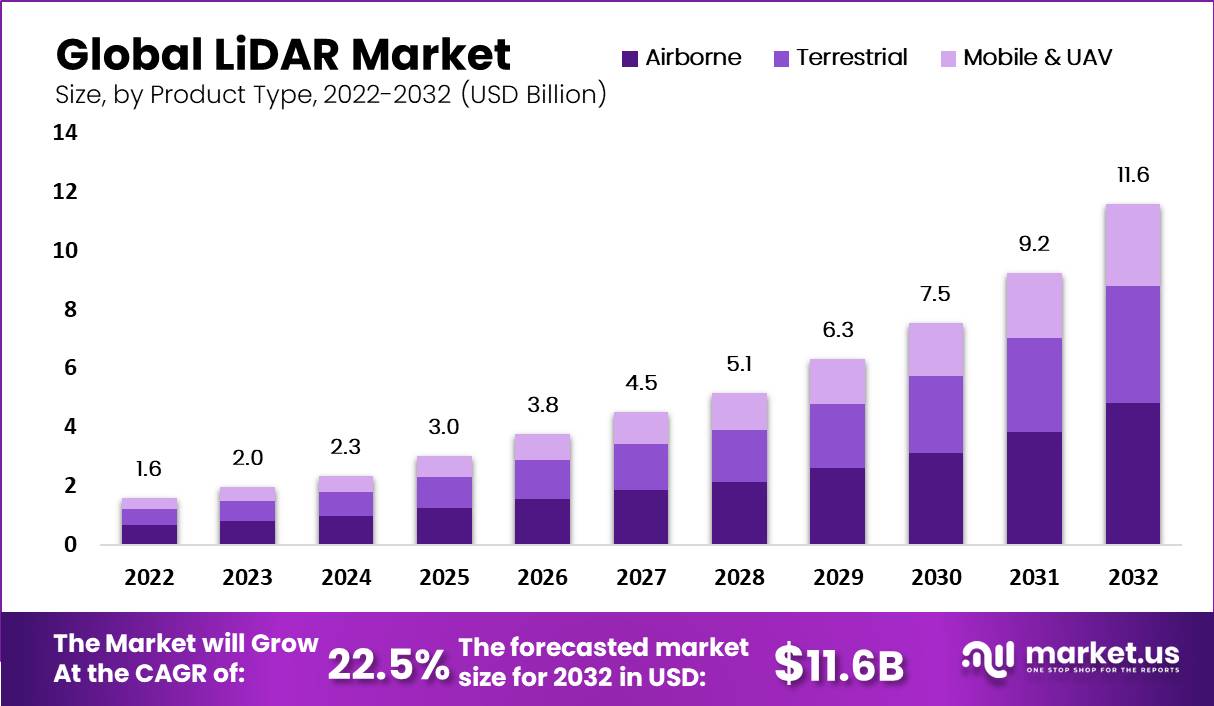

The global LiDAR market is witnessing rapid expansion, increasing from USD 2.0 billion in 2023 to an estimated USD 11.6 billion by 2032. This progression represents a strong compound annual growth rate of 22.5% during the forecast period from 2023 to 2032. Growth is being supported by the rising adoption of LiDAR in autonomous vehicles, advanced mapping applications, environmental monitoring, and infrastructure development, as industries continue to rely on precise spatial data and high-resolution imaging technologies.

LiDAR (Light Detection and Ranging) refers to sensing technology that emits laser pulses and measures reflection times to generate precise distance and spatial information. It is used for mapping terrain, enabling autonomous vehicles, infrastructure inspection, forestry, agriculture, environmental monitoring, and robotics. Products include airborne LiDAR, ground-based LiDAR, mobile LiDAR, and solid-state vs mechanical LiDAR variants. Components include laser scanners, inertial navigation systems, scanning mechanisms, optics, and software for processing point clouds and mapping.

The LiDAR market is being driven by the demand for safer, automated transportation (for example Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles) that require accurate depth perception. Cost reduction in LiDAR hardware, especially solid-state LiDAR, is making widespread deployment more viable.

Infrastructure development, mapping, smart city planning, and environmental monitoring are increasing demand for precise spatial data. The rising use of unmanned aerial vehicles (drones) for surveying and inspections also supports LiDAR adoption since aerial LiDAR mounted on drones allows access to difficult terrain cheaply and efficiently. Regulatory requirements in certain jurisdictions (for example rules mandating sensors for vehicle safety) further push adoption. Reports show rapid adoption especially in Asia-Pacific where infrastructure expansion and mapping needs are strong.

Key Takeaway

- The market is projected to expand from USD 2.0 billion in 2023 to about USD 11.6 billion by 2032, registering a strong CAGR of 22.5%.

- In 2022, the Airborne LiDAR segment held a leading position, securing a dominant share in overall deployments.

- The Laser Scanners segment also captured a significant portion of the market, reinforcing its importance within LiDAR hardware solutions.

- Corridor Mapping applications accounted for more than 34% of the market in 2022, showing strong demand in infrastructure and transportation-related projects.

- In the automotive sector, LiDAR was critical in advancing autonomous driving technologies, leading the automotive application segment to secure a notable market share.

- Regionally, North America dominated in 2022 with over 40% share, generating revenues of around USD 0.6 billion, reflecting high adoption across both commercial and industrial applications.

Analysts’ Viewpoint

Demand is growing across several segments. Automotive is one of the strongest: manufacturers of passenger vehicles, trucks, EVs and autonomous systems need LiDAR for perception, obstacle detection, and navigation. Mapping and surveying applications (including corridor mapping, topographic mapping, forestry, watersheds, agriculture) generate substantial demand for airborne and mobile LiDAR systems.

Industries such as mining, oil & gas, utilities, and construction require ground-based LiDAR for site inspections, volume measurements, and infrastructure integrity monitoring. Governments and city planners also demand LiDAR data for smart city and climate risk projects (flood mapping, urban planning). Regions with heavy infrastructure growth and environmental conservation priorities are showing strong uptake.

Solid-state LiDAR is gaining traction, as it offers fewer moving parts, lower cost, smaller size, and better durability compared with mechanical LiDAR. Other technology trends include FMCW (Frequency Modulated Continuous Wave) LiDAR, which adds velocity measurement and improved interference resistance. Advances in optics, scanning mechanisms (MEMS, flash LiDAR), integration with inertial measurement units, and software for better point-cloud processing are also important.

Recent Developments

- In September 2024, Teledyne Geospatial introduced new solutions at INTERGEO 2024, including the Galaxy Edge airborne LiDAR system and the Network Surveyor. These technologies are designed to deliver advanced real-time data processing, improving mapping accuracy and analysis efficiency.

- In August 2024, YellowScan partnered with Nokia in Finland to integrate the YellowScan Surveyor Ultra LiDAR scanner into Nokia’s Drone Networks. This integration enables automated 5G-based LiDAR scanning, with applications in inspecting telecommunications towers and utility infrastructure, marking a step forward in industrial automation.

- In June 2024, Innoviz Technologies collaborated with a global automotive OEM to strengthen Level 4 autonomous vehicle capabilities. By incorporating Innoviz’s new short-range LiDAR sensors from the InnovizTwo platform into light commercial vehicles, the partnership seeks to enhance safety and performance in autonomous driving.

- In April 2024, Hesai Group partnered with Marelli Holdings of Japan to combine next-generation ATX LiDAR technology with advanced headlamp designs. The collaboration achieved reduced sensor size and seamless headlamp integration, supporting both affordability and improved detection for mainstream and luxury vehicles.

Driver

Growing Demand for Autonomous Vehicles

One key driver for the LiDAR market is the rapid increase in demand for autonomous vehicles. LiDAR technology provides accurate real-time 3D mapping and obstacle detection, making it crucial for the safe navigation of self-driving cars. As automotive companies invest heavily in autonomous driving technologies, the need for reliable LiDAR systems that can detect pedestrians, vehicles, and road conditions is rising. This demand is expected to grow as more vehicles with Level 2+ or Level 3 autonomy features enter the market globally, fueling LiDAR adoption in safety and navigation systems.

For instance, the rise of Advanced Driver Assistance Systems (ADAS) that use LiDAR to improve vehicle safety drives sales of these sensors in the automotive sector. LiDAR’s ability to deliver a 360-degree environmental view with high precision makes it irreplaceable for precise automated driving functions. The increasing regulatory focus on safety along with consumer demand for smarter vehicles further accelerates this growth. Hence, the automotive sector remains a vital engine pushing the LiDAR market forward.

Restraint

High Cost of LiDAR Technology

A significant restraint limiting broader LiDAR adoption is its relatively high cost. LiDAR sensors, especially those with advanced features like solid-state or MEMS technology, involve complex manufacturing and expensive components. This cost factor increases the overall price of products, particularly in automotive applications where cost sensitivity is high, limiting adoption in lower-priced vehicle segments. The expensive LiDAR modules slow down widespread inclusion in mass-market vehicles and other industries.

For example, despite advances reducing unit costs, LiDAR remains pricier than alternative sensing technologies like radar and cameras. This prevents some manufacturers from adopting it fully or forces compromises in sensor quality or quantity. Smaller companies and those with limited budgets in agriculture or construction may also find LiDAR adoption less feasible due to upfront investment. Until costs come down further, price will remain a key barrier to faster market growth.

Opportunity

Expansion in Non-Automotive Sectors

While automotive drives demand, one important opportunity lies in expanding LiDAR use beyond vehicles. Industries such as urban planning, environmental monitoring, agriculture, and infrastructure development increasingly adopt LiDAR for precise 3D mapping and data collection. LiDAR helps create detailed topographic maps, monitor forests, manage resources, and support smart city projects. Growing investment in digital twin models and construction digitization further opens new business cases.

For instance, LiDAR technology enables accurate elevation data collection in forestry and agriculture for better resource management. Smart cities use LiDAR for infrastructure monitoring and environmental mapping, which enhances urban planning efficiency. This diversification of applications reduces dependency on automotive alone and helps the market tap into rising global investments in urbanization and environmental management. Expanding geographically in developing regions with high urban growth also boosts this opportunity.

Challenge

Technological and Integration Complexity

A key challenge facing the LiDAR market is the technological complexity and integration issues. Developing LiDAR systems that deliver high accuracy, reliability, and long-range detection while fitting size and power constraints is difficult. Integrating LiDAR with other sensors such as cameras and radar to provide seamless perception in autonomous systems requires advanced algorithms and sensor fusion, raising development costs and timelines. This technical complexity slows innovation and increases risk for manufacturers.

For example, achieving stable performance in adverse weather or lighting conditions remains problematic for some LiDAR models. Additionally, ensuring software compatibility and real-time data processing with other vehicle or industrial systems demands ongoing R&D investment. These hurdles can deter smaller players or limit rapid product deployment. Therefore, minimizing technological challenges through better design and partnerships is crucial for future growth.

Key Market Segments

By Product Type

- Airborne

- Terrestrial

- Mobile & UAV

By Component

- GPS

- Navigation (IMU)

- Laser Scanners

- Other Components

By Application

- Corridor Mapping

- Engineering

- Environment

- Exploration and Detection

- Advanced Driver Assistance Systems (ADAS)

- Other Applications

By End-user

- Automotive

- Aerospace & Defense

- Healthcare

- IT & Telecom

- Oil & Gas

- Other End-users

Top Key Players in the Market

- Leica Geosystems Holdings AG

- Faro Technologies Inc.

- Beijing SureStar Technology Co. Ltd

- Velodyne LiDAR, Inc.

- Trimble Navigation Limited

- Sick AG

- GeoDigital

- RIEGL USA Inc.

- Quanergy Systems Inc.

- Topcon Corp

- Other Key Players

Read More – https://market.us/report/lidar-market/