Introduction

Mobile Browser Usage Statistics: By 2025, there will be a definitive shift in how people access the internet toward mobile devices. Mobile has gradually transformed from a mere companion to desktop browsing to the primary means of web access for billions worldwide. Mobile phones are ubiquitous, and the rapid spread of high-speed internet makes it impossible to consider mobile internet browsing merely one option; rather, it is the only means by which people access the entire digital world of communication, entertainment, trade, and information.

In this in-depth article, we present the latest 2025 mobile browser usage statistics, including numeric data, revenue projections, market share breakdowns, user trends, and evidence-based insights from recent research.

Editor’s Choice

- Mobile devices already monopolize internet access worldwide, with more than 62% of the global web traffic attributed to smartphones in 2025, thus confirming the primary position of mobile as the internet’s entry point.

- In the mobile browser market, Google Chrome remains the dominant browser, with nearly 71% of the global market share, largely due to its default status on Android phones.

- Apple Safari accounts for nearly 20% of the mobile browser market, with its growth closely linked to iPhone adoption rather than competition.

- The mobile browser field is still very much monopolized, with the likes of Samsung Internet and Opera being able to attract only specific groups of users, not being considered competitors to the market leaders.

- Video remains the dominant driver of mobile data usage, accounting for nearly 76% of total mobile traffic and consistently diverting users from the traditional web to streaming platforms.

- Mobile browsing now accounts for only 1.4% of mobile data consumption, indicating that a shift from mobile browsers to apps has begun and is supported by market trends.

- The younger generation has been the primary driver of increased mobile browser usage, and nearly all adults aged 18–49 have smartphones.

- The conversion rates of mobile browsers remain substantially lower than those of desktop browsers: 2.2% for mobile and 4.3% for desktop, indicating that browsers are primarily used for discovery.

- The conversion efficiency of mobile apps exceeds 150% compared with mobile browsers, and they capture nearly all transactional intent.

- Android’s global operating system market share of 72.7% confirms Chrome’s dominance.

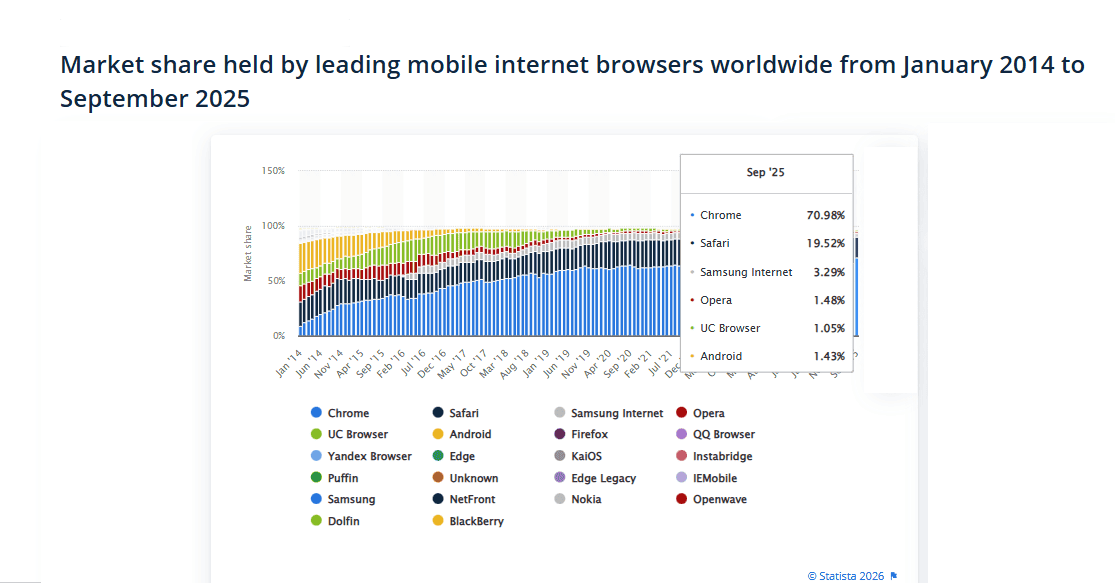

Global Mobile Internet Browser Market Share

(Source: statista.com)

- The global mobile internet browser market in 2025 is characterized by a very concentrated and highly competitive scenario, where the platforms and ecosystems have taken over.

- Statista reports that Google Chrome has never lost its lead in the mobile browser market and, as of September 2025, captured 70.98% of the market share.

- This position of Chrome is indicative not only of Google’s extensive presence across Android devices but also of the vast digital services ecosystem in which it operates.

- Safari from Apple ranks second on the list, with a significant gap and a 19.52% market share, reflecting Apple’s iPhone worldwide sales rather than competition directly displacing it.

- Safari’s buoyancy is based on an ecosystem strategy, in which mobile browser usage is effectively bundled with iOS adoption, leaving users with no option but to use it because the OS is more robust and the browser is integrated into it.

- Safari has a very loyal customer base; its growth ceiling is inherently tied to Apple’s hardware expansion rather than open-market competition.

- Taking a step back to examine the entire browser market provides further support for this story. Because approximately half of the world’s population actively uses the internet, browsers have become the primary gateway to digital services.

- Chrome’s supremacy is not limited to mobile browsers; it also extends to the desktop environment, where it held nearly 67% of the global desktop browser market in 2024, thereby eclipsing all competitors by a large margin.

- In December 2024, the two most used browsers worldwide were Chrome for Android and Chrome on desktop, indicating a steady cross-platform dominance.

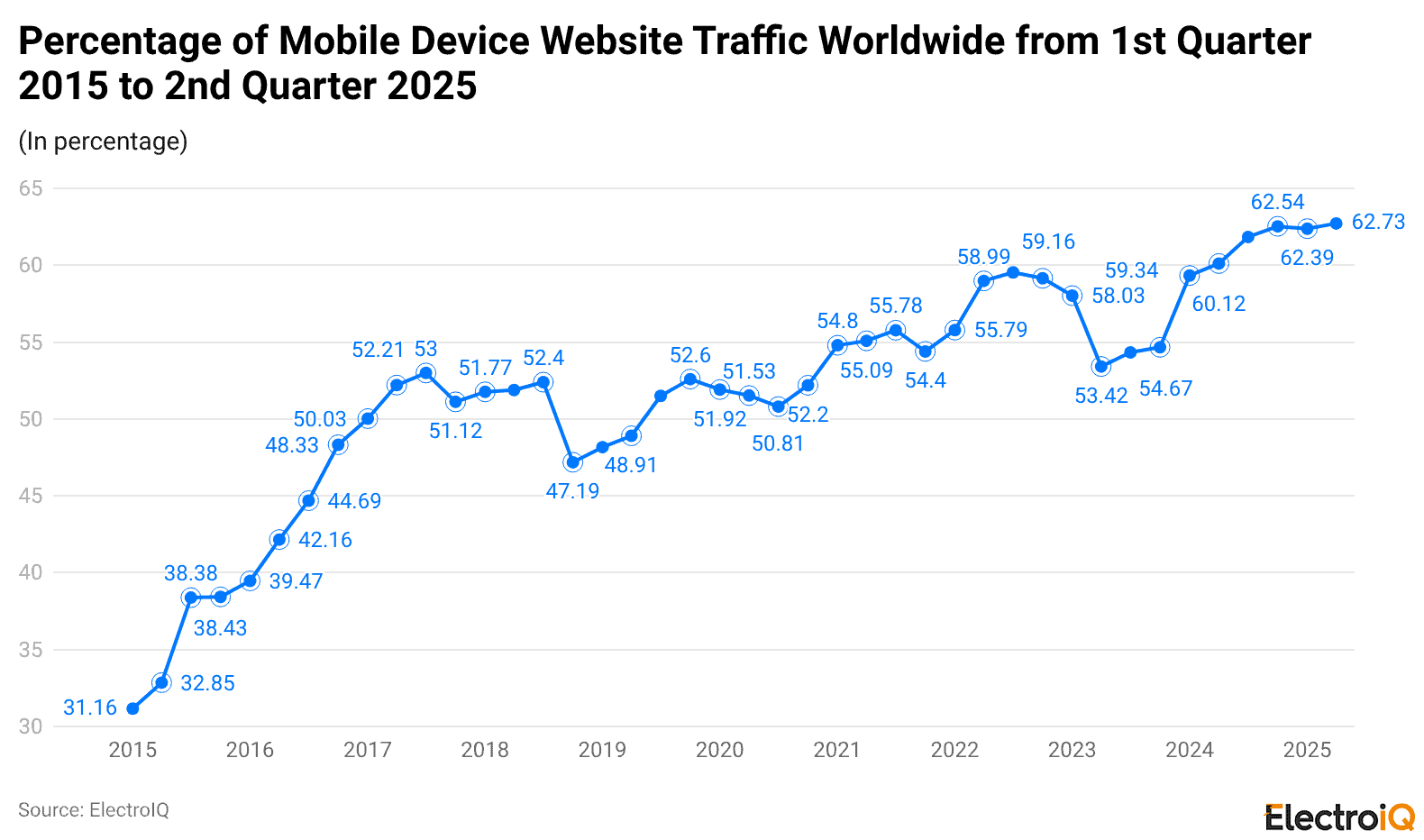

Share of Global Mobile Website Traffic

(Reference: statista.com)

- According to a Statista report, the data indicate a clear and persistent shift toward mobile browsers as the primary means of accessing the internet, surpassing traditional desktop computers.

- Especially after the second quarter of 2025, 62.54% of global website visitors used only smartphones, firmly establishing the supremacy of mobile over other digital devices for internet access.

- The gradual growth to 50% around 2017 accelerated in 2020, when mobile usage crossed the midpoint, and has continued to climb since. This is not a short-term change in users’ habits; the world has changed how it views the web with respect to accessibility.

Mobile-First Economies And The Global Digital Behaviour Transformation

- In many economies that are just beginning to use the internet, the desktop internet era has been largely displaced by limited fixed-broadband infrastructure that is also unaffordable.

- Countries such as India, Nigeria, Ghana, and Kenya have adopted mobile-first or mobile-only digital strategies, with smartphones as the primary computing device for millions of users.

- In much of Africa, smartphone users have gone so far as to associate the positive economic impact of their mobile devices with communication, and total web traffic via these means of access has now exceeded 50%.

- On the other hand, in the US, desktop computers are more commonly used in professional and project environments; thus, it is understandable that the mobile share of 45.49% is relatively high, reflecting the continued use of desktops.

Mobile Browser Usage By Regional Distribution

| Region | Chrome (%) | Safari (%) | Other (%) | Key Factor |

| South America | 78.5 | 7.9 | 13.6 | Android affordability |

| Africa | 75.4 | 8.5 | 16.1 | Budget smartphones |

| Asia | 71.5 | 13.5 | 15.0 | Android dominance |

| Europe | 60.9 | 19.8 | 19.3 | Diverse market |

| Oceania | 56.0 | 28.3 | 15.7 | Balanced ecosystem |

| North America | 50.4 | 31.8 | 17.8 | iOS penetration |

(Source: aboutchromebooks.com)

- The use of mobile browsers shows the influence of regional economies and different device ecosystems on digital behaviour globally.

- South America leads as the most Chrome-dominated region, with 78.5% of users, primarily due to the low cost of Android and its wide availability, which makes Chrome the default entry point to the mobile internet for most users.

- A similar structural dynamic is observed in Africa and Asia, where Chrome is the leading mobile browser, with market shares of 75.4% and 71.5%, respectively.

- In these areas, Android is not only a choice but also a necessity, which has made Chrome the primary gateway for the mobile-first population entering the digital economy in large numbers.

- North America is a good example of such a balanced ecosystem, where Chrome accounts for 50.4% and Safari 31.8%, very close behind. This indicates high iPhone penetration and Apple’s integrated software environment.

- Europe, in the same manner, but leaning more towards Chrome, where mobile browser usage has reached 60.9% for Chrome and 19.8% for Safari, this indicates mixed device adoption across countries.

- Oceania furthered the dual-ecosystem trend, recording 56% for Chrome and 28.3% for Safari, thereby highlighting the presence of strong iOS alongside Android’s growth.

- Overall, the differences across regions indicate that mobile browser use is more closely related to underlying device economics, platform defaults, and regional purchasing power than to users’ choice of browser, making browser market share a clear reflection of global smartphone adoption trends.

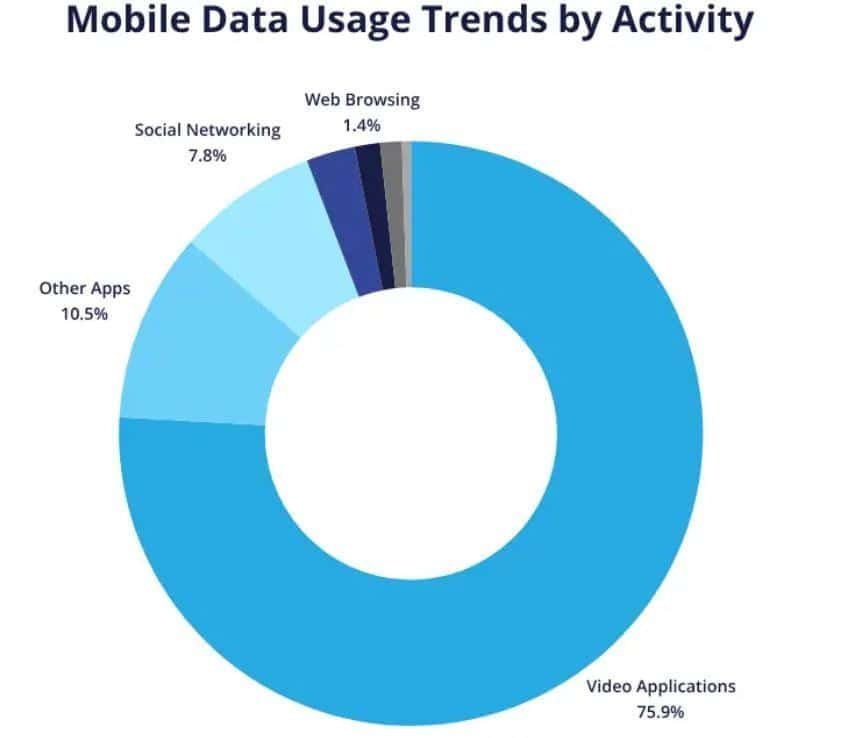

Mobile Data Usage By Activity

(Source: sqmagazine.co.uk)

- According to the SQmagzine report, the distribution of mobile data consumption provides a clear indication of future user interests and network demands.

- Video applications are the biggest contributors to mobile data usage, accounting for 75.9% of total traffic. This indicates customers’ demand for high-bandwidth, immersive video experiences, including streaming, short-form, and live content.

- The pattern of mobile data consumption has a direct negative effect on mobile browsers, which are losing market share as users choose app-based environments that are better suited to rich media delivery.

- Mobile non-video applications are gradually emerging as a major category, accounting for 10.5% of mobile data traffic, and their popularity stems from the sustained use of facilities, productivity tools, and background app services that primarily operate outside regular mobile browsing.

- Social networking sites account for an additional 7.8%. Here, user engagement is mediated by media-rich feeds, real-time messaging, and embedded videos, thereby again confirming the superiority of app ecosystems over mobile web interactions.

- On the other hand, web surfing takes up only 1.4% of the total mobile data usage, suggesting that there is a drop in mobile browser usage caused by users switching over to very quick, personalized, and immersive in-app experiences.

- From a strategic perspective, these data confirm that mobile browser usage is increasingly limited to simple transactions and information retrieval, whereas apps continue to account for the majority of users’ time, engagement, and data consumption.

Mobile Browser Usage By Demographics

- In the U.S., the number of smartphone users is very high: 97% of adults aged 18-49 and 76% of adults aged 65+; thus, indicating a pronounced generational gap.

- Younger users are quicker to adopt new browser features and ecosystems, as Chrome usage among the 35-44 age group is already above 98%.

- This dominance of mobile usage gradually declines with age: only 46% of people in the 55-64 age group use Chrome, and the figure drops to 5% in the 65+ age group.

- Worldwide, internet penetration reached 67.9% in early 2025, a favourable figure but still uneven across age groups.

- The youngest group (15-24) comes closest to achieving 75% internet usage, whereas the oldest group (65+) has only 65%.

- It has also been observed that lower-income and older users are somewhat more vulnerable to browser fingerprinting.

- Gender dynamics also come into play where the privacy behavior of male versus female users is concerned, as female users are usually less willing to share browser data.

- These trends are reinforcing the notion that mobile browser usage is not purely a matter of technology but also involves issues such as trust, literacy, and perceived risk.

Conversion Rates – Mobile Vs. Desktop Browsers

- The difference in conversion performance remains a key indicator of structural differences between mobile and desktop browsing habits.

- The global average desktop conversion rate is approximately 4.3% in 2025, nearly twice the 2.2% recorded for mobile browsers.

- In high-value e-commerce categories, desktop outperforms mobile by 2.5x or more, indicating stronger purchase intent and easier navigation.

- The food delivery sector enjoys mobile conversion rates of up to 6.1% due to the nature of the product and its habitual use.

- The case of travel bookings is different, with mobile conversions of around 1.4% as compared to the 3.9% of desktop.

- According to independent studies conducted by WordStream and SpeedCommerce, the same pattern was observed: desktop conversion rates are consistently higher than mobile ones.

- It is worth noting that mobile apps are 157% more successful than mobile web, further supporting the perception that browsers are primarily used for exploration and comparison rather than as final transaction platforms.

Mobile Browser Adoption By Device Type

- The core of mobile browser usage is definitely the device ecosystems. As the end of May 2025 approaches, Android is the dominant global mobile operating system, with a substantial 72.7% share, leaving iOS with 26.9%.

- Not surprisingly, the vast majority of Android users choose Chrome, thereby increasing Google’s influence over access to the mobile web, whereas iOS users still prefer Safari due to the platform’s limitations.

- It is not impossible that an AI-powered browser, such as Comet, pre-installed on the device, will alter current usage patterns.

- On the other hand, global web traffic from tablet PC browsing accounts for only 5.1%, underscoring the smartphone’s dominance.

- The use of browsers is not as significant as one might think; in fact, apps account for almost all time spent on a mobile device, and browsers account for less than 6%, which is about 300 MB of mobile data per month.

Factors Driving Mobile Browser Growth

- There is no doubt about the long-term growth of mobile browsing; mobile traffic has increased from just 6.1% of total web traffic in 2011 to over 64.35% by May 2025.

- The mobile browser transformation has been driven by factors such as low prices and availability, rapid smartphone adoption, and a global population of internet users, which reached USD 4.88 billion and is expected to reach USD 5.83 billion by 2028.

- In the U.S. market, for example, people spend an average of nearly four hours per day on their smartphones, indicating that mobile accessibility has become deeply rooted in daily life.

- Nonetheless, social, entertainment, and utility apps are at the forefront, so browsers play a lesser role most of the time.

- It has identified AI browser projects, assistant integrations, and pre-install strategies as the primary drivers of the market’s future growth.

- Regulatory scrutiny—especially in the UK—questions whether the dominance of Safari and Chrome hinders competition.

- Growing concern about privacy is also affecting mobile browsers, leading to the adoption of privacy-oriented alternatives such as Brave and DuckDuckGo in small numbers.

Recent Developments

- Recent trends indicate that there is a clear structural rebalancing of mobile browser usage rather than disruption.

- Chrome’s dominant position has somewhat been weakened in July 2025, with its mobile market share falling to 67% from 70% in June.

- Although Chrome remains the dominant browser, this decline indicates a gradual diversification of mobile browser usage, particularly among iOS users and privacy-conscious users.

- Safari was the largest beneficiary of this trend, increasing from 20.9% in June to 22.4% in July. This increase points to the continued strength of Apple’s ecosystem and confirms Safari’s expanding role in the premium device segments’ mobile browser market.

- Samsung Internet also saw a small increase in market share, rising to 3.5%, primarily due to tighter integration with Samsung devices and enhanced performance features.

- At the opposite end of the market, there were small but positive changes for Opera and UC Browser, which increased to 1.68% and 1.36%, respectively.

- Firefox and Edge remained nearly unchanged, with market shares of approximately 0.55% and 0.53%, respectively, suggesting that their presence on mobile is stable relative to desktop.

- From a market-sizing perspective, the browser industry’s fundamentals remain sound.

- The global browser market was valued at USD 236.6 billion in 2024 and is projected to reach USD 994.8 billion by 2033, reflecting a compound annual growth rate of 17.3%.

- The growth trajectory of mobile browser usage indicates that, despite short-term fluctuations in market share, mobile browsers will remain a major component of the digital economy.

Conclusion

In 2025, mobile browser usage is at a crucial crossroads, shaped by the widespread adoption of smartphones, the rise of ecosystems as primary drivers, and changing user habits. Although mobile devices have become the main way people access the internet, and the browsers function as gateways rather than destinations, the applications monopolize the engagement and data consumption. Chrome and Safari are still reflecting the power of the underlying OS rather than the competition.

At the same time, regional, age-group, and device-type preferences indicate strong structural patterns. In the future, AI browsing, privacy-first alternatives, and regulatory pressure may prompt the ecosystem to shift and redefine the role of mobile browsers in the app-centric digital world.