Introduction

Real Time Payments (RTP) Adoption Statistics: Instead of waiting hours or even days, individuals and businesses can move money in seconds with real-time payments (RTP). As RTP provides 24/7 services and confirms transactions instantly, customers now expect more from transfers than ACH or card payments typically provide. Many companies already use RTP to disburse salaries, issue refunds, process claims, and pay gig workers without delay.

It also helps firms to pay suppliers more quickly and match invoices with payments more easily. However, rolling out RTP is more than a quick system change as it demands strong operational readiness and careful risk management. To adopt RTP, banks must establish appropriate network connections, operate 24/7, manage fraud risk, and set fees. At the same time, businesses must determine when RTP is a better option than ACH, wire transfers, or card payments.

In this article, we explain what is driving RTP growth, what challenges remain, and how organisations can launch RTP smoothly and measure results.

Editor’s Choice

- As of 2025, the global real-time payments market was worth USD 39.5 billion, up from USD 29.9 billion in 2024.

- In 2024, the real-time payments (RTP) market stood at USD 25.92 billion.

- Global real-time transaction volumes increased by 42.2%, and in India, 84% of electronic payments are real-time.

- Today, 84% of electronic payments in India are instant, and India accounts for about half of global real-time transaction volume.

- Regionally, the Asia-Pacific region was the top performer, with over 38% global share and USD 11.3 billion in revenue.

- At the low end of RTP adoption, the United States ranks 33rd globally for RTP transactions per month.

- Gpaymentsindustryintelligence.com further states that the real-time transactions are expected to reach 575.1 billion by 2028.

- The galileo-ft.com report further stated that, over the past year, The Clearing House RTP and the FedNow Service have often exceeded 1 million transactions per day.

- According to the FedPayments Improvement data, overall instant real-time payment adoption among all users is 5%.

- In a survey of 56 banks, only 11% reported that real-time business payments are currently live.

General Statistics On Real-Time Payments (RTP) Adoption

- A report published by thunes.com stated that in 2024, the real-time payments (RTP) market stood at USD 25.92 billion.

- Meanwhile, the market is expected to reach around USD 116.23 billion by 2029, growing at a 35% CAGR from 2024 to 2029.

(Source: thunes.com)

- Global real-time transaction volumes increased by 42.2%, and in India, 84% of electronic payments are real-time.

- Brazil is forecast to exceed 115 billion RTP transactions by 2028 (25.4% CAGR).

- Additionally, Indonesia is growing at an 81.9% CAGR (from 2022 to 2027).

- Malaysia’s RTPs were worth USD 1.9 billion in 2023, and the Netherlands saw 32% YoY growth (2022 to 2023).

- The market is also projected to increase by USD 112.32 billion by 2028.

- These instant payments can be made anytime, 24/7, unlike traditional payment methods.

- Paystand reports that 24% of companies cite improved cash flow as the biggest benefit.

- PYMNTS found RTP strengthened supplier ties for 89% of large retailers, 91% of manufacturers, and 80% of insurers.

Highest RTP Transactions Statistics By Country

- In India, real-time payments started with IMPS in 2010, while UPI was launched in April 2016.

- India’s RTP market is expected to grow at a 13.9% CAGR from 2023 to 2028.

- It also shows strong year-over-year growth, with transactions up 45% from 2022 to 2023.

- In 2023, India recorded 129.3 billion real-time transactions.

- Today, 84% of electronic payments in India are instant, and India accounts for about half of global real-time transaction volume.

| Market | Key Year/Launch | Growth Rates | Volumes/Values/Shares |

| Brazil | Pix 2020 | CAGR 25.4% (by 2028); YoY 77.9% (2022–2023) | 36.5% of all transactions; 115,000 million RTP transactions (2028); 77% consumers use Pix. |

| Indonesia | BI-FAST Dec 2021 | CAGR 81.9% (2022-2027); YoY 267% (2022-2023) | 55% consumers use RTPs; RTP value USD 1.9 billion (2023), |

| Malaysia | PayNet was formed in 2017; DuitNow was formed in 2018 | YoY 26% (2022-2023); CAGR 16.9% (2023-2028) | PayNet value USD 1.9 billion (2023); market size USD 4.1 billion (2028); 5 years (by 2022). |

| Netherlands | iDEAL 2005; Dutch PSPs 2019 | YoY 32% (2022-2023); CAGR 25.8% (2023-2028) | Fees +5%; instant payments 10.9% of volume; RTP value USD 1.3 billion (2023); USD 10.109 trillion (2028). |

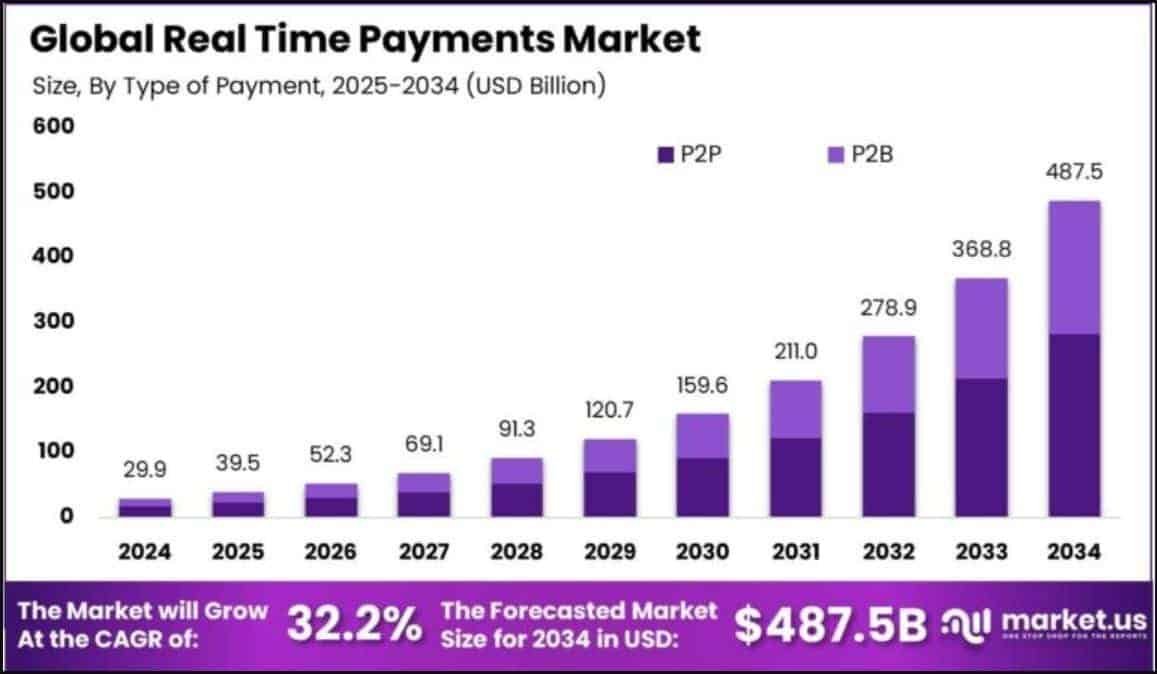

Real-Time Payments Market Size

(Source: market.us)

- As of 2025, the global real-time payments market was worth USD 39.5 billion, up from USD 29.9 billion in 2024.

- It is expected to grow sharply to USD 487.5 billion by 2034, showing a 32.2% CAGR from 2025 to 2032.

- In 2024, P2P payments accounted for over 58% of the global market.

- The Solutions category was the largest, accounting for more than 72% of the market.

- Cloud-based deployments also ranked first, capturing over 64% of the market.

- Large enterprises accounted for more than 70.1% of the market.

- The BFSI dominated with over 38% share.

- The Asia-Pacific region was the top performer, with over 38% global share and USD 11.3 billion in revenue.

- In China, the RTP market was valued at approximately USD 3.7 billion in 2024.

| Year | USD in Billion |

| 2024 | 29.9 |

| 2025 | 39.5 |

| 2026 | 52.3 |

| 2027 | 69.1 |

| 2028 | 91.3 |

| 2029 | 120.7 |

| 2030 | 159.6 |

| 2031 | 211 |

| 2032 | 278.9 |

| 2033 | 368.8 |

| 2034 | 487.5 |

Real-Time Payments Statistics In The United States

- At the low end of RTP adoption, the United States ranks 33rd globally for RTP transactions per month.

- Around 81% of Americans have sent a real-time payment, and 77% have received one.

- The bigger issue is the U.S. payment infrastructure.

- Before FedNow® and The Clearing House (TCH), the closest option was Zelle, which is the second-most common way businesses send instant payments (after push-to-card).

- Launching a new system also requires interoperability with banks and other financial institutions, as well as additional technology costs.

- B2B is a major driver, given the inefficiencies of paper and cross-border payments.

- RTPs could replace USD 18.9 trillion in U.S. ACH and check-based B2B payments by 2028.

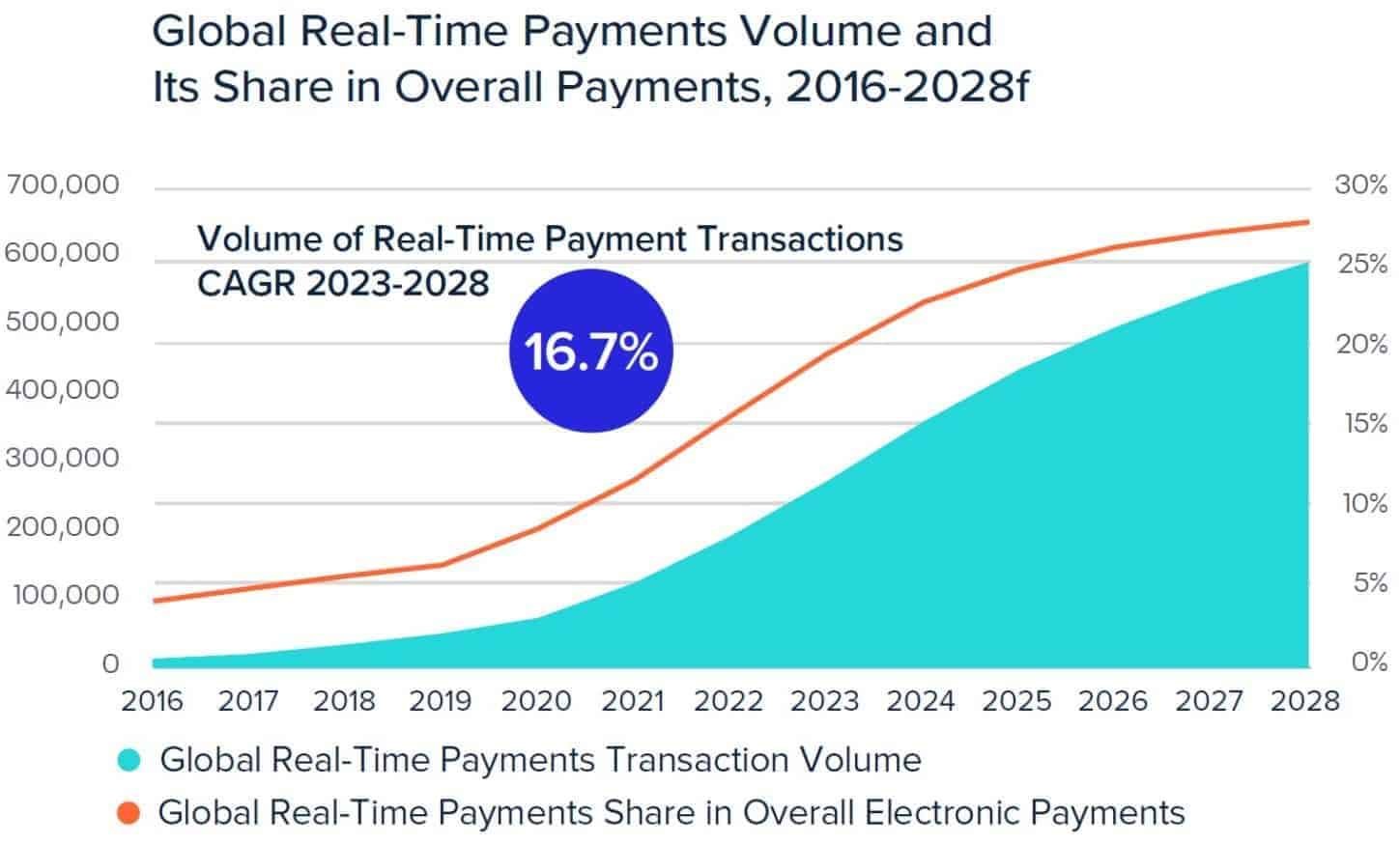

Real Time Payments (RTP) Statistics By Volumes And Overall Share

(Source: paymentsindustryintelligence.com)

- The real-time transactions are expected to reach 575.1 billion by 2028.

- This equates to a 16.7% CAGR from 2023 to 2028, and by 2028, RTPs are forecast to account for 27.1% of all electronic payments worldwide.

| Region/Market | Key numbers | Growth/share |

| India | 129.3 billion transactions (2023) | 84% of India’s e-payments are real-time; more than the top 10 combined |

| Brazil & LatAm | 77.9% YoY (2023); 37.4 billion transactions (2023) | 75% of LatAm RTP; Peru 51.2% CAGR (2023-2028); Colombia 42.6% |

| APAC | 185.8 billion transactions (2023); 351.5B by 2028 | 24.0% share (2023); 13.6% CAGR (2023-2028); 4/5 top markets |

| Middle East | 855 million to 3.0 billion transactions by 2028 | 28.8% CAGR (2023-2028); schemes launched 2023 |

| Europe | Instant payments 13% by 2028 | Up from 8% (2023); EU rule passed Feb 2024; 27 EU states |

| North America | FedNow launched in 2023 | 27.1% CAGR (2023-2028) |

| Nigeria (Africa) | 7.9 billion transactions (2023) | 82.1% share of e-payments (2023) |

United States’ Real-Time Payments (RTP) Adoption Statistics by User Demographics

| Category | Demographic group | Adoption / Preference |

| Consumer adoption (FedPayments Improvement) | Total (all users) | 5% |

| Gen Z (18-27) | 10% | |

| Millennials (28-43) | 9% | |

| Gen X (44-59) | 4% | |

| Baby Boomers (60-78) | 1% | |

| By income (FedPayments Improvement) | Under USD 35K | 5% |

| USD 35K-99K | 4% | |

| USD 100K+ | 7% | |

| (FedPayments Improvement) | Primarily nonbank | 3% |

| One FI | 3% | |

| 2+ FIs | 6% | |

| Likelihood to choose instant (PYMNTS, 2025) | Highly likely (2025) | 56% |

| Highly likely (2023) | 47% | |

| Parents vs. non-parents (PYMNTS, 2025) | Have children | 67% |

| No children | 48% | |

| By generation (PYMNTS, Jan 2025) | Gen Z | 70.3% |

| Millennials | 68.1% | |

| Bridge millennials | 67.3% | |

| Gen X | 55.5% | |

| Baby boomers | 36.7% | |

| By income (PYMNTS, Jan 2025) | >USD 100K | 58.9% |

| USD 50K-100K | 54.4% | |

| <USD 50K | 51.8% | |

| Urgency for payouts (PYMNTS, 2025) | Want payouts in <30 minutes | 24% |

| Millennials (<30 minutes) | 29% | |

| People with children (<30 minutes) | 29% |

A Key Turning Point For Banks To Enable Real-Time Payments

- The galileo-ft.com report further stated that, over the past year, The Clearing House RTP and the FedNow Service have often exceeded 1 million transactions per day.

- RTP participation by financial institutions rose 67% in 2024.

- In Q4, RTP processed 98 million transactions totalling $80 billion, up 12% in volume and 16% in value compared with the prior quarter.

- Moreover, instant payments will form 16% of global payments by 2027 and 22% by 2028.

- About 70% to 80% of financial institutions may support the receipt of RTPs.

- Also, 52% of retail banks plan to prioritise consumer instant payments in 2025.

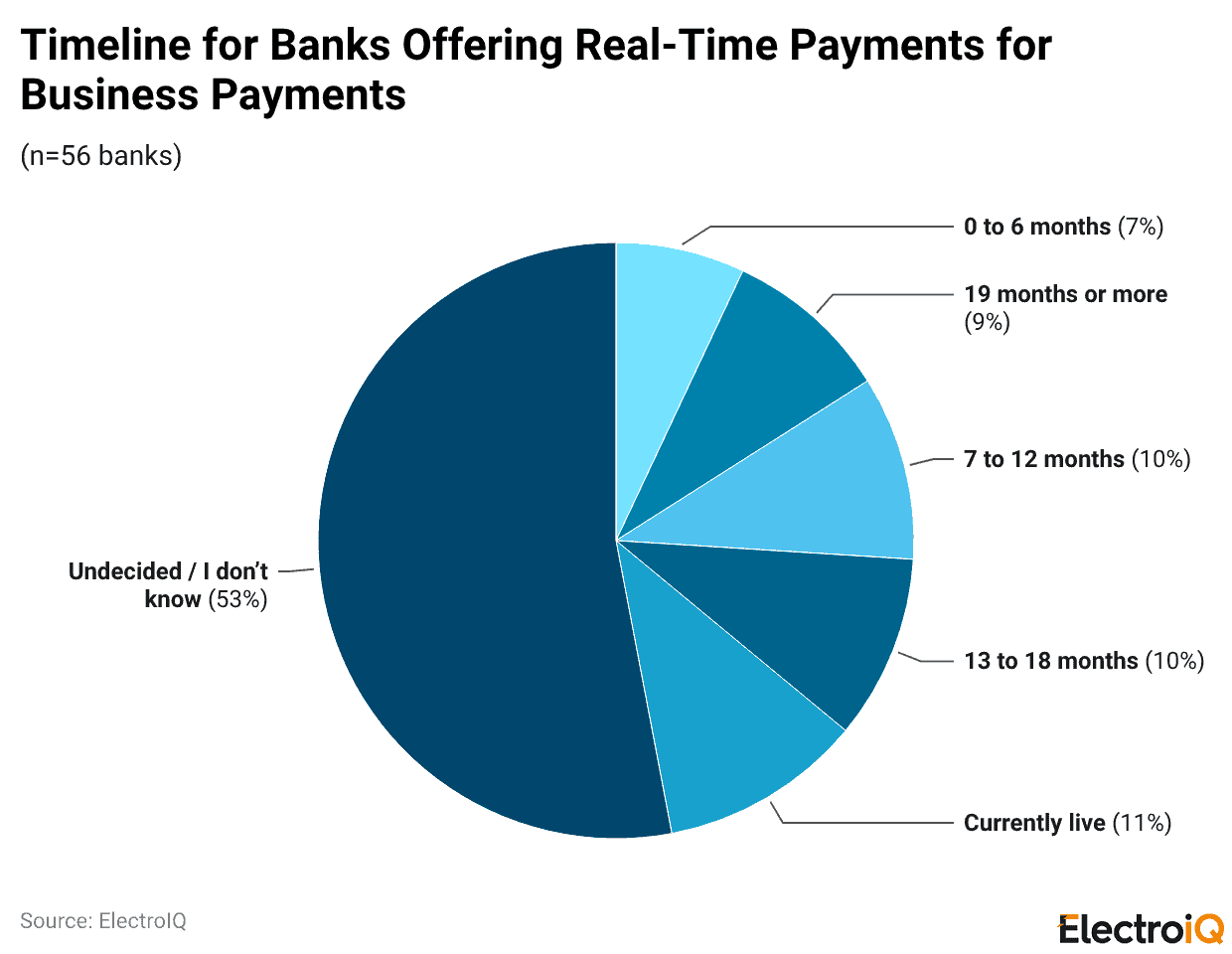

Timeline For Banks Offering Real-Time Payments For Business Payments

(Reference: datos-insights.com)

- In a survey of 56 banks, only 11% reported that real-time business payments are currently live.

- Another 7% expect to offer them in 0 to 6 months, 10% in 7 to 12 months, and 10% in 13 to 18 months.

- About 9% think it will take 19 months or more, and the largest group 53%, said they are undecided or don’t know.

Conclusion

Real-time payments are now mandatory, as they have become integral to today’s banking system. As more banks, fintech firms, and merchants adopt RTP, its benefits extend beyond speed and security. Money can move and settle immediately, day or night, with clearer payment information and better cash-flow control for individuals and businesses.

Even so, RTP will grow faster only if issues such as fraud, complaint handling, fair pricing, and seamless system integrations are resolved. In the future, services such as request-to-pay, instant salary payments, and quick business payouts will increase the use of RTP.