Introduction

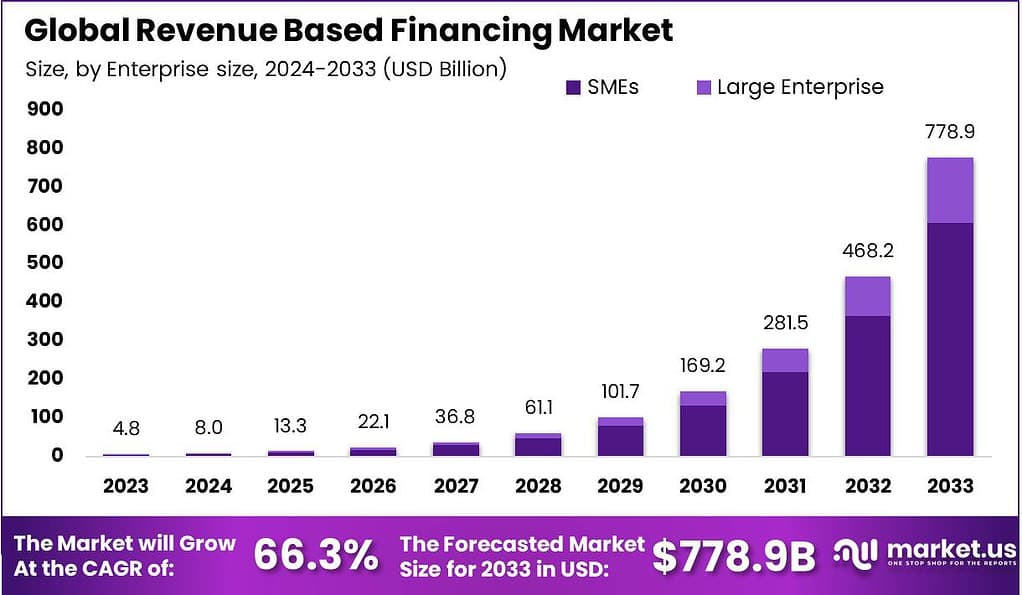

The Global Revenue Based Financing (RBF) Market is projected to expand rapidly, reaching about USD 778.9 Billion by 2033, rising from USD 4.8 Billion in 2023. This reflects an exceptional CAGR of 66.35% from 2024 to 2033. In 2023, North America held a leading position, capturing over 40% of the global share and generating USD 1.9 Billion in revenue, driven by strong adoption among startups and growth-stage enterprises.

Revenue Based Financing (RBF) is an alternative funding method where businesses receive capital in exchange for a fixed percentage of their future revenues. This method helps companies, especially startups and small to medium enterprises (SMEs), to secure funds without giving up equity or taking on the rigid repayment schedules typical of traditional loans. RBF aligns repayments directly with business performance, so payments are higher when revenue is strong and lower when revenue dips, providing flexibility during fluctuating income periods.

According to Forbes, RBF providers generally target businesses with annual sales between $4 million and $10 million. These firms often maintain reliable cash flows but face challenges in securing traditional loans or equity financing. Repayment structures in RBF are tied directly to monthly revenues, with total repayment obligations typically ranging from 1.5x to 3x the initial borrowed amount. This model offers flexibility for businesses while ensuring sustainable returns for investors.

Key Takeaways

- The Global RBF Market is expected to rise from USD 4.8 Billion in 2023 to nearly USD 778.9 Billion by 2033, at a remarkable 66.35% CAGR.

- In 2023, SMEs dominated the market, accounting for over 78% share.

- The Retail & E-commerce segment held a strong position, contributing more than 27% share in 2023.

- North America led the global market, capturing over 40% share and generating USD 1.9 Billion in 2023.

Analysts’ Viewpoint

The key driving factors fueling the adoption of revenue-based financing include the increasing demand for faster, more flexible capital access among startups and SMEs. Many businesses face challenges with traditional bank loans due to rigid credit requirements, collateral needs, and long approval times. RBF offers a flexible approach where repayment terms adjust with real-time revenue, lowering financial stress during slower periods. Additionally, the rise of digital platforms facilitating quick financing decisions based on data analytics enhances market accessibility.

Investment opportunities in the RBF market lie in expanding services to startups, SMEs, and new sectors such as e-commerce, SaaS, and healthcare. The increasing participation of digital platforms and fintech companies is broadening market reach and driving innovation. Geographic expansion into high-growth regions like Asia-Pacific and Latin America offers substantial potential.

Business benefits of revenue-based financing include improved cash flow management and reduced financial stress due to repayments being proportional to revenue. It supports growth initiatives without sacrificing equity, allowing founders to maintain control and participate fully in future gains. The flexibility in terms reduces the risk of default and fosters better lender-borrower relationships. Additionally, the speed of funding helps businesses capitalize quickly on growth opportunities, essential in competitive markets.

The regulatory environment for revenue-based financing is currently evolving, with some U.S. states like Virginia, New York, Utah, and California implementing or preparing regulations requiring disclosure of financing terms. These rules aim to enhance transparency for businesses regarding repayment amounts, fees, and terms. Because RBF repayments are linked to revenues rather than fixed schedules, standard loan definitions and disclosures don’t always fit perfectly, leading to regulatory adaptations.

Key Market Segments

By Enterprise Size

- SMEs

- Large Enterprises

By End-User

- BFSI

- IT & Telecom

- Healthcare

- Retail & E-commerce

- Media & Entertainment

- Others

Top Key Players in the Market

- Clearco

- Wayflyer

- Outfund

- 8fig

- Yardline

- Viceversa

- Booste

- Ritmo

- Karmen

- Silvr

- Liberis

- Unlimitd

- Paperstack

- Shopify Capital

- Amazon Lending

- Other Key Players

Driver Analysis

Increased Focus on Cash Flow Management

Revenue Based Financing (RBF) is gaining momentum primarily because it suits businesses that need flexible cash flow management. Unlike traditional loans with fixed monthly payments, RBF ties repayments directly to a company’s revenue, making it easier for startups and small businesses with fluctuating income to manage payments without financial strain.

This alignment with actual earnings lets companies pay less during slower periods and more when revenues increase, reducing stress on cash reserves and improving financial stability. Industries with recurring revenue models, like subscription services, find RBF especially useful as it matches their ongoing income streams, encouraging the growth of this financing method.

This flexibility also attracts investors who prefer returns linked to business performance rather than fixed interest payments, creating a win-win environment for both fundraisers and lenders. The growing demand for such adaptable funding amid uncertain economic conditions positions RBF as a preferred alternative to traditional financing, fueling its expanding market presence.

Restraint Analysis

Limited Appeal for Pre-Revenue Companies

A notable challenge for Revenue Based Financing is that it mainly serves companies with existing revenue streams. Early-stage startups not yet generating income remain ineligible for RBF since repayments are a portion of future sales. These pre-revenue businesses must look elsewhere, often facing equity dilution or stringent loan conditions through alternative funding routes.

This limitation means RBF cannot support all startup phases equally, restricting its adoption. Additionally, the need for consistent revenue to qualify restricts the pool of potential borrowers, slowing broader market growth. Entrepreneurs new to financing may also lack awareness of this constraint, causing them to overlook RBF as an option too early in their lifecycle.

Opportunity Analysis

Rise in Digital Platform Adoption

The increasing use of digital platforms presents a significant growth opportunity for Revenue Based Financing. Digital businesses produce detailed, real-time revenue data that can improve transparency and trust between borrowers and lenders. This data enables faster and more accurate evaluations for RBF providers, easing access to funding for many startups and SMEs.

As more companies move to online sales, subscription models, and digital services, they generate reliable revenue metrics that align well with RBF’s repayment model. Furthermore, fintech advancements are making RBF transactions quicker and more user-friendly, encouraging wider adoption. This digital integration is expected to fuel further expansion of the RBF market by enhancing accessibility and simplifying investment decisions.

Challenge Analysis

Unpredictable Revenue and Risk for Lenders

Despite its flexibility, revenue-based financing faces challenges due to the inherent unpredictability of some companies’ revenues. Businesses with volatile or fluctuating incomes may struggle to maintain steady repayments, posing risks to RBF investors. This uncertainty can deter some investors wary of potential losses, especially in sectors subject to seasonal demand or economic shifts.

Additionally, smaller or less profitable companies might have difficulty meeting repayment obligations, leading to defaults or extended repayment periods that increase overall costs. Regulatory complexities across different regions also add difficulty for RBF providers, affecting market scalability. Managing these risks remains critical for the continued healthy growth of the revenue-based financing sector.

Source of Information – https://market.us/report/revenue-based-financing-market/