Introduction

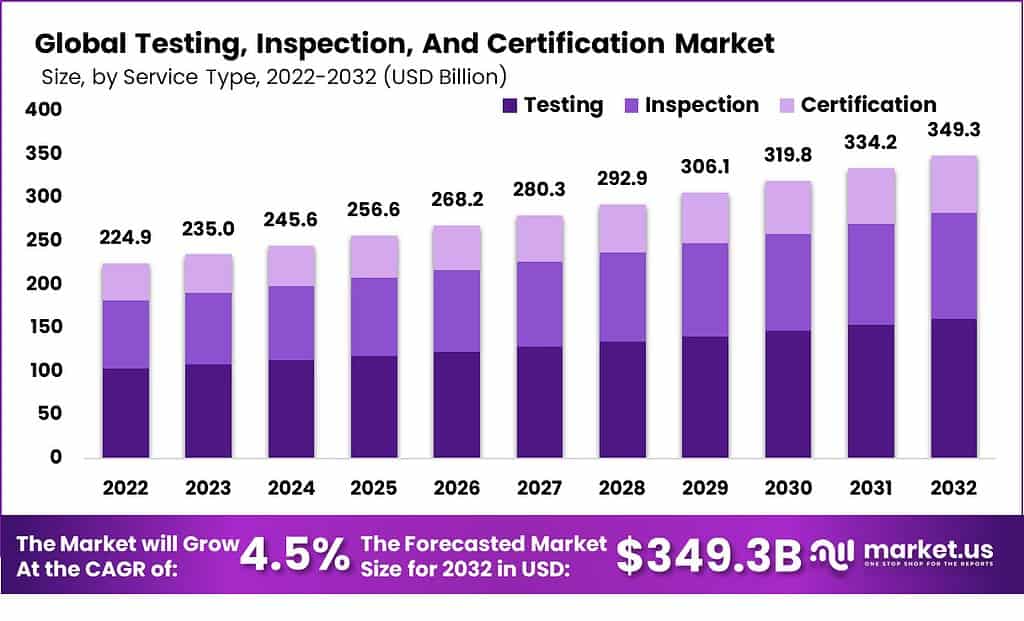

The Global Testing, Inspection, and Certification Market is valued at USD 235.0 billion in 2023 and projected to reach USD 349.3 billion by 2033, growing at a CAGR of 4.5% as industries prioritize quality, safety, compliance, and sustainability amid complex regulations and global trade.

The Testing, Inspection and Certification market refers to services that assess the quality, safety, performance and compliance of products, systems and processes against regulatory standards. These services are provided by independent organizations that perform evaluations, audits, laboratory testing and certification issuance. Industries such as automotive, healthcare, manufacturing, food and energy rely on these services to ensure products meet safety and quality expectations. The market plays a central role in enabling regulatory compliance, reducing risk and building stakeholder confidence in products and services.

Growth in this market has been supported by increasing regulatory requirements and heightened quality expectations among consumers and businesses. As global supply chains expand, organizations face complex standards that differ across regions and sectors. Testing, inspection and certification services help firms demonstrate conformity with these requirements, facilitating market access. Continued technological innovation and global trade expansion have reinforced the importance of these assurance services.

Top Key Takeaways

Top Key Takeaways

- Testing leads service types with 68.4% share, essential for verifying product performance in manufacturing, automotive, and healthcare.

- In-house sourcing holds 53.8% of sourcing type share, preferred for control, customization, and confidentiality in large firms.

- Medical and life sciences dominate applications with 22.6% share, driven by strict regulations and rising healthcare demands.

- Asia Pacific commands 31.8% regional share, fueled by rapid industrialization, trade growth, and tech adoption in China and India.

Top Driving Factors

One major driver of the market is the rising emphasis on product safety and quality across regulated industries. Governments and standard bodies have introduced stringent regulations to protect consumers from hazardous or substandard products. This has increased demand for independent testing and certification to verify compliance. As regulations evolve, organizations increasingly depend on external expertise to navigate complex conformity requirements.

Another key driver is the globalization of supply chains. Companies that operate across multiple regions must ensure that products and processes comply with varied local and international standards. Testing and inspection services reduce the risk of non compliance, market recalls and reputational damage. These services also support cross border trade by providing recognized certifications that facilitate acceptance in target markets.

Demand Analysis

Demand for testing, inspection and certification services is influenced by technological advancements that introduce new product categories and safety considerations. Innovations such as connected devices, electric vehicles and advanced materials require updated evaluation methods and expertise. Service providers are adapting to these shifts by investing in specialized testing capabilities. This has expanded demand across sectors that are undergoing rapid technological change.

Demand is also shaped by corporate risk management strategies. Organizations are adopting proactive compliance practices to reduce legal liabilities and enhance brand credibility. Testing and certification serve as independent validation of product claims, strengthening market trust. This alignment between risk mitigation and quality assurance continues to support sustained demand for these services.

Increasing Adoption Technologies

Digital technologies such as automation and data analytics are being adopted to improve the speed and accuracy of testing and inspection processes. Automated inspection systems and sensor-based monitoring enable real time evaluation of product attributes and manufacturing conditions. Data analytics supports pattern recognition and predictive quality insights that reduce defects and improve operational performance. These technology integrations have enhanced service efficiency and reliability.

Cloud computing and digital reporting platforms have also transformed how certification results are tracked and shared. Digital certificates and online dashboards provide secure, accessible records for clients and regulators. Remote auditing tools and virtual inspections have emerged as practical solutions where on-site access is constrained. Technology adoption has thus increased scalability and responsiveness of service delivery.

One key reason organizations adopt testing, inspection and certification services is to ensure compliance with mandatory regulatory standards. Many jurisdictions require independent verification of safety, performance and environmental criteria before products can be marketed. External assurance reduces the risk of legal penalties, product seizures and costly rework. Compliance driven adoption protects both business continuity and consumer interests.

Another reason is the need to build customer confidence and brand integrity. Certifications and quality reports signal that products have been evaluated by reputable third parties. This independent validation can influence purchasing decisions and strengthen competitive positioning. As markets become more informed and discerning, such assurances increasingly affect buyer trust and loyalty.

Investment and Business Benefits

Investment opportunities in the testing, inspection and certification market exist in specialized segments such as cybersecurity testing and sustainability verification. As digital products proliferate, demand for secure and resilient system evaluations is rising. Similarly, environmental and social governance criteria have created opportunities for certification related to sustainability claims. Investing in expertise and infrastructure for these niche services can differentiate providers and capture emerging demand.

Another opportunity lies in expanding service delivery through digital platforms that support remote testing and virtual inspections. Investments in advanced laboratories, simulation environments and digital marketplaces can attract global clients. Strategic collaborations with technology innovators can enhance service portfolios and improve market reach. These approaches align with evolving customer needs and emerging industry trends.

Adoption of testing, inspection and certification services can improve operational performance by identifying defects and compliance gaps before products reach the market. Early detection of issues reduces waste, recalls and warranty costs. This supports cost-effective quality management and strengthens supply chain reliability. Enhanced operational clarity also supports continuous improvement initiatives.

These services also enable better market access and reduced time to market. Certifications recognized by regulatory bodies and industry stakeholders facilitate acceptance in diverse markets. This can accelerate product launches and expand geographic reach. Organizations that leverage independent validation can achieve strategic advantage and expanded business opportunities.

Regulatory Environment

The regulatory environment for the testing, inspection and certification market is shaped by national and international standards that govern product safety, quality and performance. Standards bodies such as ISO develop frameworks that guide conformity assessments across industries. Compliance with these standards ensures mutual recognition of test results and certifications across borders. Regulatory harmonization improves cross-border trade and reduces duplication of evaluation efforts.

Regulations related to accreditation and competency also influence how services are delivered. Certification bodies and laboratories must meet defined criteria to maintain accreditation and operate lawfully. Oversight by conformity assessment authorities ensures that services adhere to rigorous quality benchmarks. This regulatory framework supports credibility, consistency and trust in the assurance ecosystem.

Key Market Segment

Service Type

- Testing

- Inspection

- Certification

Sourcing Type

- In-House Sourcing

- Outsourced Sourcing

Application

- Consumer Goods and Retail

- Medical and Life Science

- Agriculture and Food

- Chemicals

- Construction and Infrastructure

- Energy and Power

- Other Applications

Top Key Players

- Intertek Group plc

- Applus+

- Bureau Veritas SA

- DEKRA SE

- DNV GL

- Element Materials Technology

- Eurofins Scientific

- ALS Limited

- MISTRAS Group Inc.

- SGS SA

- TÜV NORD GROUP

- UL LLC

- DNV GL

- Socotec Group

- BSI Group

- Other Key Players

Use Cases

- Product Quality Assurance: Testing and inspection services are used to verify that products meet defined quality and performance standards before reaching the market. This is widely applied in consumer goods, electronics, and industrial equipment to reduce defects and returns. Certification builds buyer confidence and supports brand reputation.

- Regulatory Compliance Verification: TIC services are used to ensure compliance with national and international regulations across industries. This is critical in sectors such as pharmaceuticals, food and beverages, chemicals, and medical devices. Compliance testing helps companies avoid legal penalties and market access restrictions.

- Supply Chain and Vendor Audits: Inspection and certification are applied to audit suppliers and manufacturing partners. This use case helps companies ensure consistent quality, ethical sourcing, and safety practices across global supply chains. It is commonly used in manufacturing, automotive, and retail industries.

- Safety and Risk Assessment: Testing and inspection are used to identify safety risks in products, infrastructure, and operations. This includes fire safety testing, electrical safety checks, and workplace inspections. The use case supports risk reduction and protects workers, consumers, and assets.

- Environmental and Sustainability Assessment: TIC services are used to test emissions, waste, energy efficiency, and environmental impact. Certification supports sustainability claims and environmental reporting. This use case is increasingly important for construction, energy, and industrial companies.Construction and Infrastructure Validation

- Market Access and Trade Enablement: Certification is used to meet import and export requirements in global trade. Products often require specific certifications to enter certain countries or regions. This use case supports smooth cross-border trade and faster market entry.

Recent Development

- November, 2025 – Intertek acquired Professional Testing Laboratory, a leading US flooring testing firm, to expand its North American building materials certification capabilities.

- August, 2025 – Bureau Veritas featured prominently in management system certification evaluations for global reach and strategic partnerships in TIC services.

Conclusion

The testing, inspection, and certification market grows steadily as businesses focus on quality, safety, and rules in global trade.

Testing, in-house sourcing, and medical-life sciences lead the main areas, with Asia Pacific taking the top spot regionally.

Tough rules and costs create hurdles, but green tech and digital tools open new chances for better services ahead.

Read More – https://market.us/report/testing-inspection-and-certification-market/