Dassault Systèmes posted Q4 2025 revenue of €1.68 billion (up 1% YoY) and full-year revenue of €6.24 billion (up 4%), with non-IFRS diluted EPS rising 9% to €0.40 in Q4 and 7% to €1.31 annually. Shares plunged nearly 20% post-earnings amid a revenue growth miss and cautious 2026 guidance of 3-5%.

About Dassault Systèmes

Dassault Systèmes (Euronext Paris: DSY.PA) is a leading provider of 3D design, simulation, and collaborative software solutions, powering the “3DEXPERIENCE” platform for virtual twin technology across industries like aerospace, automotive, life sciences, and manufacturing. Founded in 1981 and headquartered in Vélizy-Villacoublay, France, the company serves clients in over 140 countries, enabling innovation through AI-driven digital twins and cloud-based tools.

With a market capitalization of approximately €36-42 billion (around $39-45 billion), DSY trades at a trailing P/E ratio of about 35x and offers a dividend yield near 0.8-1.5%, reflecting its high-growth software profile with recurring revenue now at 82% of software sales. The firm employs roughly 26,000 people globally and generated €6.24 billion in 2025 revenue, with strong momentum in cloud (up 8%) and subscriptions (up 11%).

Top Financial Highlights

- Total revenue reached €1.68 billion, up 1% YoY in constant currencies against a tough base.

- Annual revenue grew 4% to €6.24 billion (~$7.44 billion), driven by 6% recurring revenue growth.

- Non-IFRS operating profit hit €622 million in Q4 (margin 37.0%) and €1.99 billion full-year (margin 32.0%).

- Q4 non-IFRS diluted EPS rose 9% (constant currency) to €0.40; full-year up 7% to €1.31.

- Non-IFRS operating margin expanded 90 bps to 37.0% in Q4 and 40 bps to 32.0% full-year.

- Full-year cash flow from operations was €1.63 billion, slightly below prior year due to investments and working capital.

- Industrial innovation (core) up 6%; 3DEXPERIENCE platform up 10%; cloud revenue up 8%; life sciences down 2% amid pharma slowdowns.

- Full-year recurring software revenue up 6%, representing 82% of total software; subscriptions surged 11%.

- Strong balance sheet supports €340 million share repurchases, €343 million dividends, and acquisitions like Contentserv (€189 million).

- Revenue growth 3-5%; non-IFRS operating margin 32.2-32.6%; diluted EPS €1.30-1.34.

- New Annual Run Rate (ARR) reporting starts 2026 for subscription/cloud visibility.

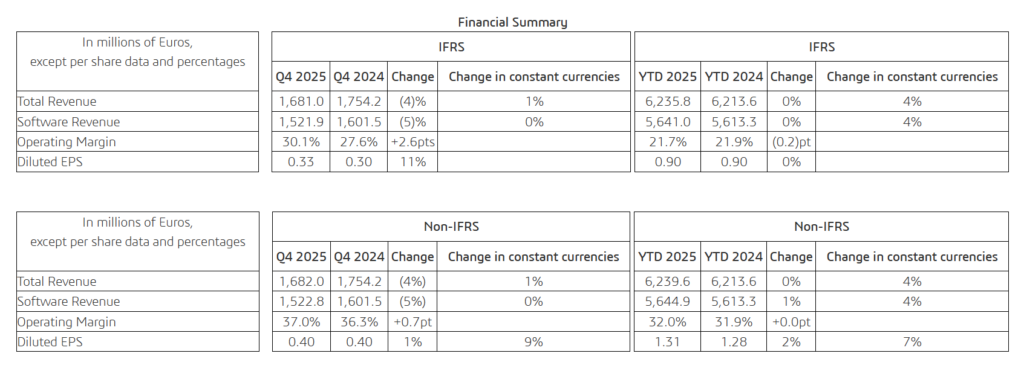

Financial Summary

Financial Comparisons

Fourth Quarter 2025 Versus 2024

In the fourth quarter of 2025, total revenue increased by 1% year over year to €1.68 billion. Software revenue remained stable at €1.52 billion. Subscription and support revenue rose by 3%, with recurring revenue accounting for 76% of total software revenue, up one percentage point from the prior year. License and other software revenue declined by 7% to €358 million. Services revenue recorded strong growth of 11%, reaching €159 million during the quarter.

Software Revenue by Geography

Software revenue in the Americas grew by 3%, supported by solid performance in High-Tech, Transportation and Mobility, and Home and Lifestyle sectors. The region represented 37% of total software revenue.

Europe, which accounted for 42% of software revenue, declined by 5% compared to a strong prior-year base, particularly in France, Germany, and Southern Europe. However, Northern Europe showed positive momentum.

Asia delivered a 6% increase in software revenue and represented 21% of total software revenue. Growth was driven by Transportation and Mobility and High-Tech industries, with strong performance in Korea and stable demand in Japan. China experienced softer conditions during the quarter.

Software Revenue by Product Line

Industrial Innovation software revenue increased by 1% to €880 million and represented 58% of total software revenue. Growth was supported by strong demand for SIMULIA and ENOVIA solutions, while CATIA demonstrated resilience.

Performance was moderated by a strong comparison base from the prior year. Life Sciences software revenue declined by 4% to €264 million, representing 17% of software revenue. MEDIDATA continued to face challenges due to lower clinical study volumes.

Mainstream Innovation software revenue rose by 1% to €380 million on a non-IFRS basis and €379 million under IFRS. This segment accounted for 25% of total software revenue. SOLIDWORKS maintained steady growth, while CENTRIC PLM was affected by a strong prior-year comparison, although cloud adoption continued to expand.

Strategic Drivers

3DEXPERIENCE software revenue declined by 3% and represented 44% of eligible software revenue. Despite several strategic transactions, performance was affected by a strong prior-year base and weaker conditions in the European automotive sector.

Cloud software revenue increased by 9% and represented 24% of total software revenue. Within this segment, 3DEXPERIENCE Cloud revenue rose by 38%, reflecting continued customer adoption of cloud-based solutions.

Operating Income and Margins

IFRS operating income increased by 5% to €506 million. Non-IFRS operating income declined by 2% to €622 million. The IFRS operating margin improved to 30.1%, compared to 27.6% in the fourth quarter of 2024. The non-IFRS operating margin increased to 37.0%, up from 36.3% in the prior-year period. IFRS diluted earnings per share increased by 11% to €0.33. Non-IFRS diluted earnings per share reached €0.40, reflecting a 1% increase as reported and a 9% increase on a constant currency basis.

Beat or Miss?

| Metric | Reported | Difference/Analysis |

| Q4 Revenue | €1.68B | Missed consensus (~3% growth expected); came in at low end of company objectives. |

| Full-Year Revenue | €6.24B | Below some expectations; 4% growth vs. hoped-for higher amid macro pressures. |

| Q4 Non-IFRS EPS | € 0.40 | Beat via margin expansion (+90 bps); up 9% constant currency. |

| FY Non-IFRS EPS | € 1.31 | Solid +7% growth despite top-line softness. |

What Leadership Is Saying?

“At Dassault Systèmes, our ambition is clear: we will lead the Industrial AI transformation through 3D UNIV+RSES… True transformation takes time… We anticipate 2026 total revenue growth between 3% and 5%, operating margin expansion of 40-80 basis points and EPS up 3% to 6%.”by Pascal Daloz, CEO

“We are delivering outcomes, not just software… Operating margin came in at 30.9% and our EPS for the quarter was €0.32… We have been able to deliver the EPS as initially planned.” by Rouven Bergmann, CFO

Historical Performance

| Category | Q4 2025 | Q4 2024 | Change (%) |

| Revenue | €1.68B | €1.67B | 1% |

| Net Income (implied, non-IFRS op. profit) | €622M | €606M | 3% |

| Operating Expenses | N/A (margin focus) | N/A | Margin +90 bps |

Competitor YoY Comparison

| Category | Q4 FY2025 | Q4 FY2024 | Change (%) |

| Revenue | $1.47B | $1.37B | 7% |

| Net Income | $290M | $218M | 33% |

| Operating Expenses | $1.01B | $950M | 6% |

Financial Objectives for 2026

| Q1 2026 | FY 2026 | |

|---|---|---|

| Total Revenue (billion) | €1.481 – €1.541 | €6.290 – €6.410 |

| Growth | (6) – (2)% | 1 – 3% |

| Growth ex FX | 1 – 5% | 3 – 5% |

| Software revenue growth * | 1 – 5% | 3 – 5% |

| – Of which licenses and other software revenue growth * | 0 – 8% | (1)% – 2% |

| – Of which recurring revenue growth * | 1 – 4% | 5 – 6% |

| Services revenue growth * | 4 – 10% | 2 – 6% |

| Operating Margin | 29.2% – 30.7% | 32.2% – 32.6% |

| Diluted EPS | €0.28 – €0.31 | €1.30 – €1.34 |

| Growth | (11) – (3)% | (1) – 2% |

| Growth ex FX | (2) – 6% | 3 – 6% |

| US dollar | $1.18 per Euro | $1.18 per Euro |

| Japanese yen (before hedging) | JPY 170.0 per Euro | JPY 170.0 per Euro |

How the Market Reacted?

Dassault Systèmes shares cratered nearly 20% in early trading following the Q4 release, marking one of its worst days ever, as Q4 revenue growth of just 1% undershot consensus (~3%) and even bearish estimates (~2%).

The 3-5% 2026 revenue outlook disappointed hopes for 4-6%+, raising doubts on execution amid software sector pressures and macro headwinds like European auto weakness. Sentiment turned sharply bearish, with analysts noting an “unforgiving software tape” punishing the growth shortfall despite margin resilience.