Market Overview

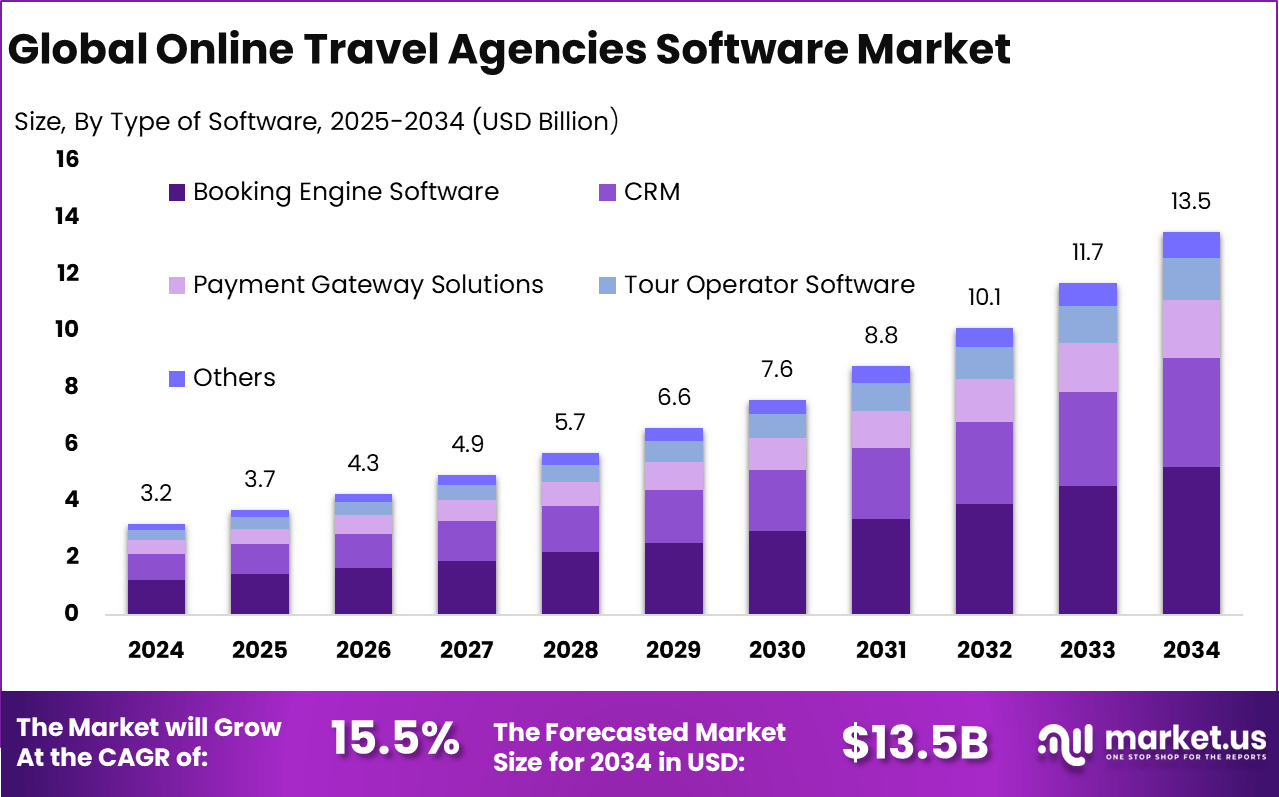

The Global Online Travel Agencies Software Market is poised for strong growth, expanding from USD 3.2 billion in 2024 to nearly USD 13.5 billion by 2034, at a robust CAGR of 15.5% during 2025 to 2034. This acceleration is being fueled by the rapid adoption of digital booking platforms, increasing mobile penetration, and rising demand for seamless travel planning solutions that integrate payments, reservations, and personalized recommendations.

Key Takeaways

- The segment led with a 38.7% share in 2024, reflecting rising demand for integrated platforms that simplify reservations, enhance user experience, and improve conversion rates for travel service providers.

- On-premises solutions captured 64.4% share, as operators prioritized control over sensitive data, customization capabilities, and security, especially in high-volume booking environments.

- The Subscription-based Pricing model dominated with 72.5%, highlighting the industry’s shift toward predictable, scalable cost structures that help OTAs and travel businesses manage operational expenses effectively.

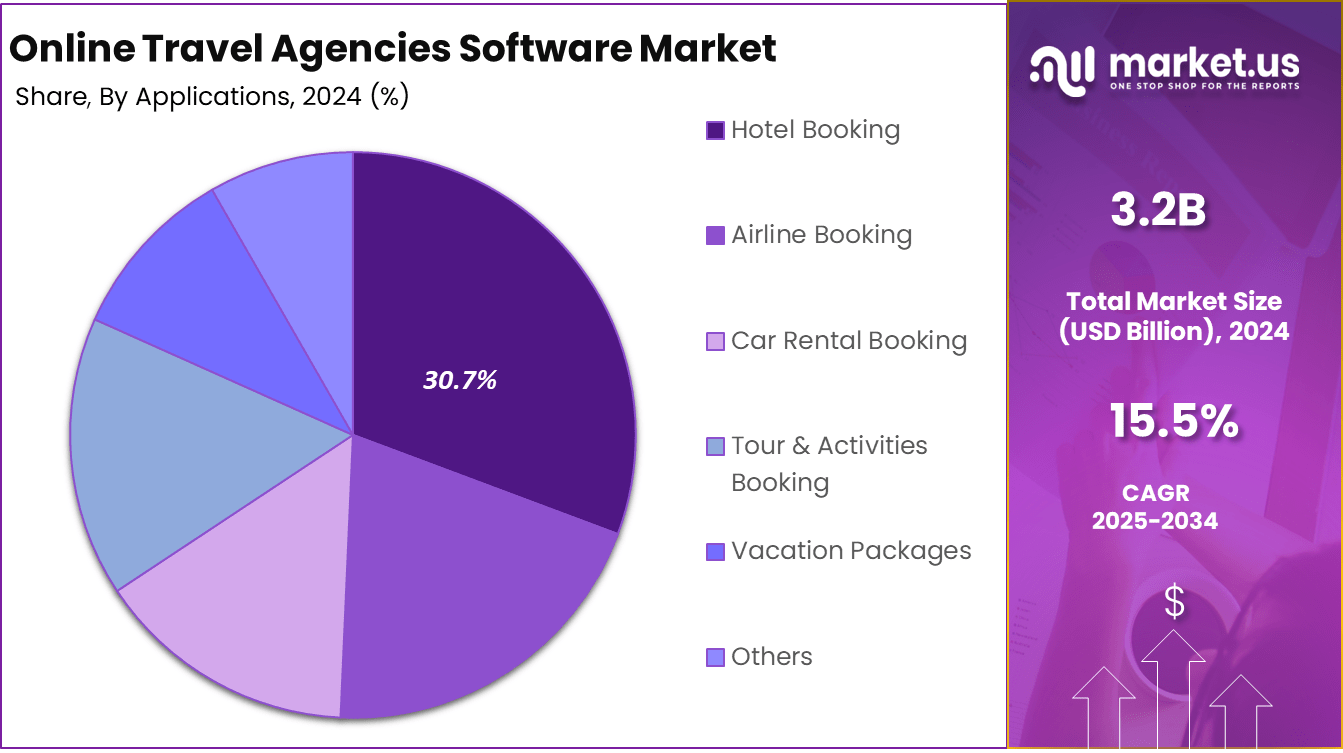

- Hotel Booking accounted for 30.7% share, supported by strong demand for online accommodation services and consumer preference for bundled travel packages.

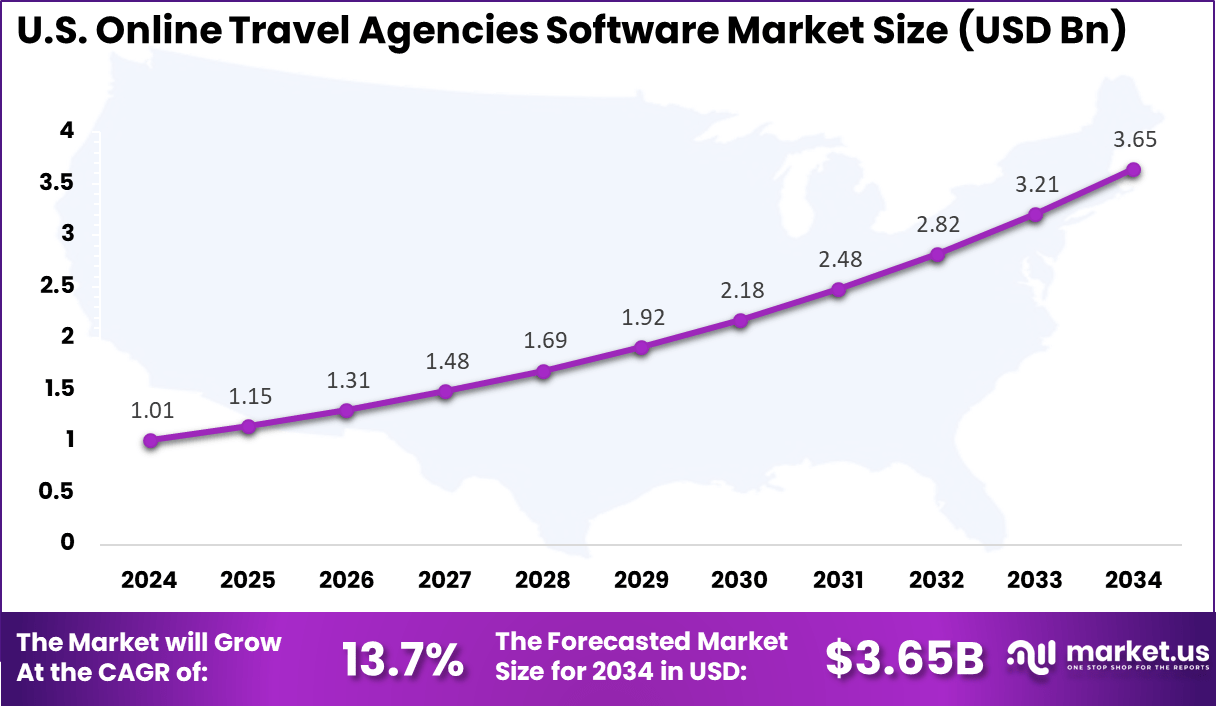

- The U.S. market was valued at USD 1.01 billion in 2024, with a projected CAGR of 13.7%, fueled by rapid digital adoption, recovery in the travel sector, and increased reliance on mobile-based bookings.

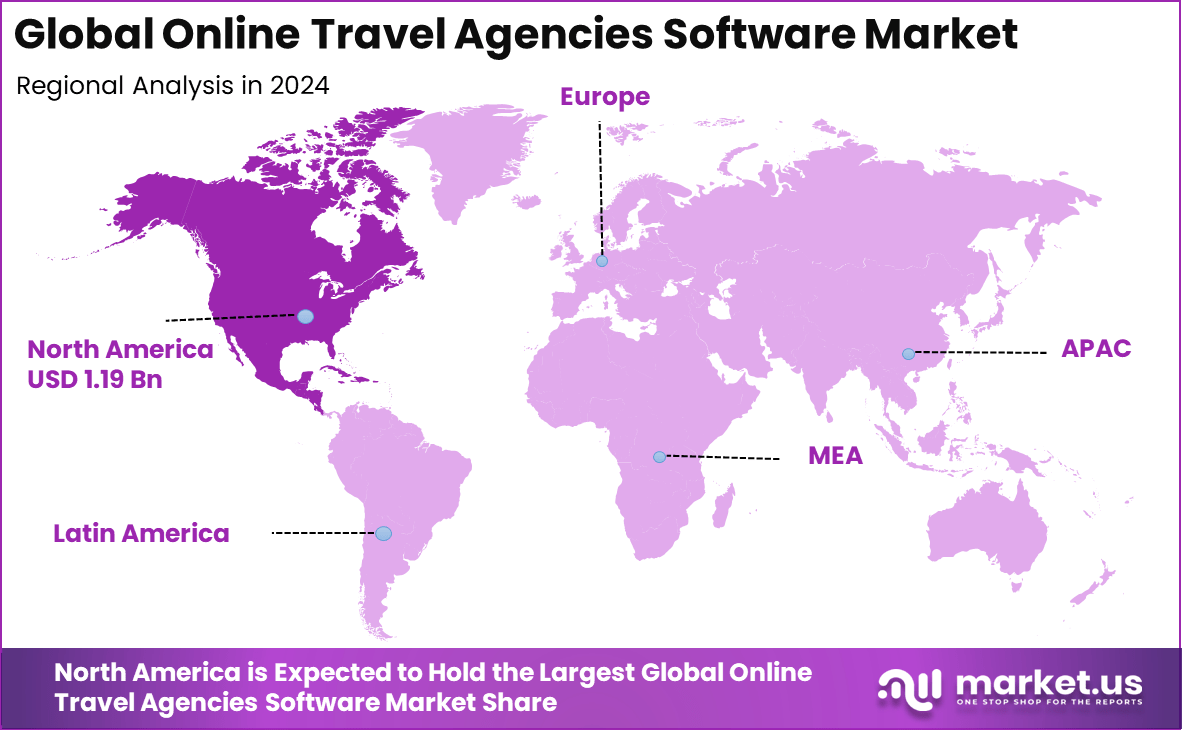

- North America contributed 32.7% share in 2024, driven by mature travel infrastructure, early adoption of advanced booking technologies, and rising use of digital reservation platforms.

Based on data from llcbuddy, most travel agency software solutions are priced between USD 49 and USD 99 per month, with advanced platforms such as Tourplan and Softrip catering to large tour operators and destination management companies. Traveler behavior continues to evolve, with 72% of mobile bookings occurring within just 48 hours of travel, highlighting the growing preference for last-minute arrangements.

In 2025, Booking.com’s app dominated the OTA market with 80 million downloads, while Delta Air Lines stood out as the most punctual carrier of the year, achieving an on-time performance rate of over 80%. According to ET TravelWorld, India’s Travel and Tourism sector made a total GDP contribution of ₹20.9 trillion (USD 249.3 billion) in 2024, marking a 20% increase over 2019 levels and representing 6.6% of the national economy.

The WTTC projects further expansion to ₹22.5 trillion (USD 268.7 billion) in 2025, with long-term forecasts indicating a near doubling to ₹41.9 trillion (USD 501.1 billion) by 2035, where the sector is expected to contribute 10.9% to India’s GDP. Supporting this growth, investments in digital transformation are reshaping the industry. For example, in May 2024, Collett’s Travel collaborated with Dolphin Dynamics to integrate a new reservation module, enabling real-time availability, dynamic pricing, and streamlined booking management, ultimately enhancing customer experience and operational efficiency.

Regional Analysis

The market for Online Travel Agencies Software within the U.S. is growing tremendously and is currently valued at USD 1.01 billion, the market has a projected CAGR of 13.7%. Rapid growth in travel bookings is due to the increasing use of online platforms as travelers are seeking simplicity, flexibility, and affordable prices.

In 2024, North America maintained a dominant market position, accounting for more than 37.2% of the global share with revenue of USD 1.19 billion. The region’s leadership is supported by strong digital infrastructure, high consumer reliance on online booking channels, and the presence of established travel technology providers. North America’s early adoption of cloud-based solutions and AI-driven personalization continues to set the benchmark for global growth in online travel agency software.

Emerging Trend

AI-Powered Personalization

A key emerging trend in online travel agencies software is the rapid integration of artificial intelligence for personalizing the travel booking experience. Companies are leveraging AI to analyze vast amounts of user data and deliver tailored recommendations, dynamic pricing, and smart itinerary planning.

This shift not only improves user satisfaction but also helps agencies stand out in a crowded marketplace by offering travelers faster, more precise, and more relevant options, whether on desktop or mobile devices. The industry is also witnessing a strong focus on making mobile bookings seamless and efficient, reflecting travelers’ demand for convenience and immediacy.

Report Segmentations

Component Segment: Solution Leads with 67.2% Share in 2023

In 2023, the Solution segment dominated the component category with a commanding market share of 67.2%. AI-powered fraud detection solutions encompassing software tools and platforms are critical in identifying and mitigating fraudulent behaviors efficiently. These solutions leverage advanced machine learning, data analysis, and real-time anomaly detection to provide accurate and timely fraud alerts. The dominance of the solutions segment highlights the critical need for integrated and comprehensive fraud prevention systems rather than stand-alone services.

Application Segment: Payment Fraud Leads with 49.4%

Payment Fraud stood as the leading application segment in 2023, holding 49.4% of the market. The surge in digital and contactless payment methods has increased vulnerabilities and fraud risks, which AI-driven technologies address by detecting suspicious transactions instantly and with high accuracy. The need to secure payment channels against fraudsters fuels investments in AI-powered tools tailored to payment fraud detection.

Organization Size: Large Enterprises Dominate with 68.0%

In 2023, Large Enterprises accounted for 68.0% of the market share in terms of organization size. These entities lead the adoption of AI in fraud detection due to their extensive data ecosystems and the substantial financial risks associated with fraud losses. Large enterprises have the resources and urgency to invest in advanced AI-powered detection systems to safeguard their operations, customer trust, and regulatory compliance.

Industry Vertical: BFSI Sector Accounts for 26.5%

The Banking, Financial Services, and Insurance (BFSI) sector was the highest adopter within the industry vertical segment, capturing 26.5% of the market in 2023. BFSI institutions face significant exposure to fraud risks, driving aggressive deployment of AI-powered fraud detection systems to enhance security, reduce fraud losses, and comply with regulatory frameworks.

Market Driver

Digital Transformation and Consumer Convenience

The most powerful driver for the adoption of online travel agencies software is the broad digital transformation occurring in the travel sector. More travelers are booking journeys online because it saves time, compares more options easily, and provides instant confirmation. Agencies, in response, implement advanced booking engines, CRM, and data analytics tools that streamline operations and enhance customer support. This digital evolution addresses both consumer demand for simplicity and agency need for operational efficiency, fueling robust market growth.

Market Restraint

Cost and Integration Complexity

Despite its growth, the software market faces a significant restraint linked to the high costs and integration challenges, especially for small and mid-sized travel agencies. Implementing comprehensive solutions often requires large investments and specialized technical knowledge. Aligning new platforms with existing processes and legacy systems can be complex and may cause interruptions or inefficiencies, putting small agencies at a disadvantage compared to larger competitors that have more resources at their disposal.

Market Opportunity

Expansion of Data Analytics and Niche Segments

An exciting opportunity lies in the expanding use of advanced data analytics, allowing agencies to better understand client behavior, forecast demand, and create targeted marketing campaigns. OTAs are branching into niche segments such as eco-tourism and adventure travel, which demand software capable of handling bespoke itineraries and dynamic bookings. By leveraging these technologies, agencies can boost loyalty, uncover new revenue streams, and serve emerging traveler expectations with greater accuracy.

Market Challenge

Price Competition and Data Security

A persistent challenge in the online travel agencies software space is the intense price competition, alongside growing concerns over customer trust and data security. As many OTAs compete for visibility and bookings, margins are often squeezed, making it tough to offer both low prices and high service levels. At the same time, agencies handle sensitive customer data, so any breach can quickly erode trust and impact business viability. Balancing affordability, innovation, and robust cybersecurity is a mounting challenge for all players.

Key Market Segments

By Type of Software

- Booking Engine Software

- Customer Relationship Management (CRM) Software

- Payment Gateway Solutions

- Tour Operator Software

- Others

By Deployment Type

- Cloud-based

- On-premises

By Pricing Model

- Subscription-based Pricing

- Transaction-based Pricing

By Application

- Airline Booking

- Hotel Booking

- Car Rental Booking

- Tour & Activities Booking

- Vacation Packages

- Others

Top Key Players in the Market

- Lemax

- Technoheaven

- Rezdy

- Traveltek

- PHPTRAVELS

- Dolphin Dynamics

- Toogonet

- Travel Connection Technology

- Tenet Enterprises Solutions

- teenyoffice

- Trawex Technologies

- WebBookingExpert

- TravelCarma

- SutiSoft

- Inc Tramada

- Axis Softech Pvt Ltd

- eTravos

- Sabre

- Others