Cybersecurity companies help protect computers, phones, networks, and data from online attacks. They monitor systems for unusual activity, fix weak points, and block hackers, viruses, and scams. These companies install security tools, give advice on safe online habits and respond quickly if something goes wrong. They work with banks, schools, hospitals, governments and small businesses to keep information private and services running. In simple terms, a cybersecurity company acts like an online bodyguard, always checking doors and windows so your digital world stays safe, trusted, and open for everyday use by people and organisations.

Cybersecurity Market Size

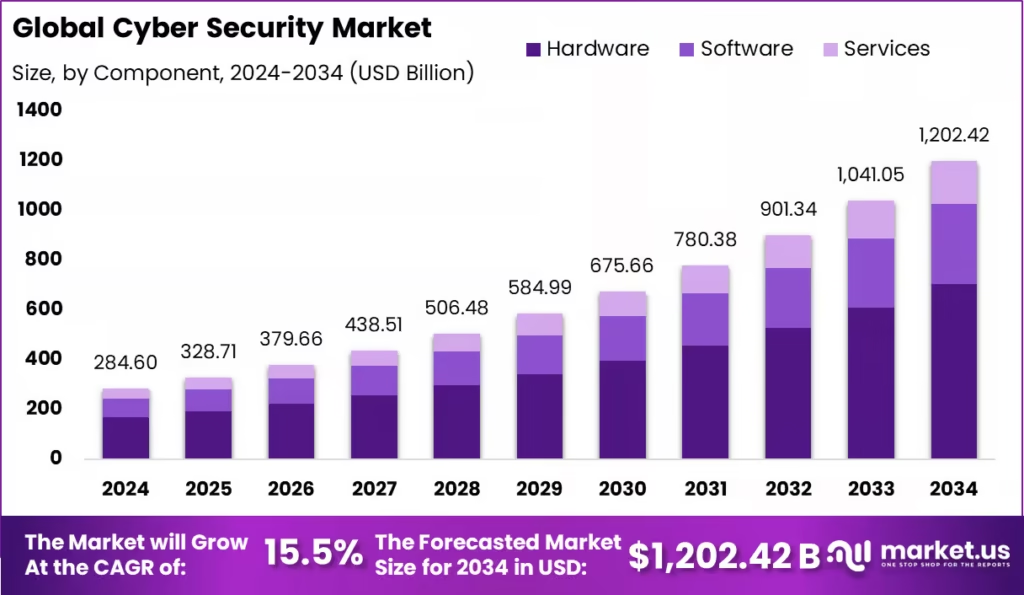

- The global cybersecurity market was valued at about USD 284.60 billion in 2024 and is expected to grow from around USD 1,126.36 billion in 2025 to about USD 7,473.05 billion by 2034, with an average annual growth rate of 15.50%.

- In 2024, North America generated about USD 108.15 billion in cybersecurity revenue and held more than 39.5% of the worldwide market.

- The hardware segment of the cybersecurity market is the largest, with a 58.7% share, indicating that most spending still goes to physical security devices and equipment.

- Endpoint security accounts for 33.7% of the security solutions market, underscoring the importance of protecting laptops, phones, and other end-user devices.

- On-premises cyber security solutions make up 62.5% of deployments, which shows that many organizations still prefer to keep sensitive security systems inside their own buildings.

- Large enterprises account for 70.3% of the market because they usually have bigger budgets and invest more in advanced security tools and services.

- The IT and telecom industry accounts for 28.6% of cybersecurity spending, as these companies run critical networks that require strong protection.

- North America accounts for 39.5% of the cybersecurity market, and the United States alone is worth about USD 306.46 billion, with a strong annual growth rate of 20.2%.

- In 2023, there were 2,365 recorded cyberattacks worldwide affecting about 343,338,964 people, and in 2024, the average cost of a single data breach reached USD 4.88 million.

- Around 35% of malware in 2023 was sent by email, and 94% of organizations said they faced some kind of email security problem.

- About 76% of organizations that got Cyber Essentials certification said it was useful, and 87% said they would recommend it to others.

- Cyber Essentials is especially important for companies that work on UK government contracts, because it shows they follow basic security standards.

- Organisations with Cyber Essentials certification were 60% less likely to make cyber insurance claims, suggesting that this certification helps reduce risk.

- More than half of small businesses reported no major difficulties in putting the Cyber Essentials technical controls in place, which shows that it is manageable even for smaller firms.

- The total global cost of cybercrime in 2023 was about USD 8 trillion, and it is expected to reach around USD 10.5 trillion by 2025.

- On average, companies lost about USD 1.3 million each to cybercrime in 2023.

- According to Norton’s report, 77% of people in the United States have taken some action to protect their personal information online.

- Phishing is still a major danger, and more than 75% of targeted cyberattacks in 2024 started from emails.

- About 17% of cyberattacks focus on weaknesses in web applications, and 98% of web apps have issues that could allow malware or redirect users to harmful websites.

- Around 50% of companies now outsource their cybersecurity work to specialist security centres or external providers.

Palo Alto Networks

| Title | Details |

| Company Type | Public company (American multinational cybersecurity and network security firm; listed on Nasdaq as PANW). |

| Parent Organization | None – operates as an independent, publicly traded company (no parent organization listed in filings or profiles). |

| CEO | Nikesh Arora, Chairman and Chief Executive Officer (since 2018). |

| Number of Employees | About 16,068 employees worldwide as of fiscal year ending 31 July 2025. |

| Established (Date & Year) | Founded in 2005 by Nir Zuk (exact day/month not publicly highlighted; commonly cited as founded in 2005). |

| Subsidiaries | Numerous international subsidiaries, including entities such as Palo Alto Networks (Australia) Pty Ltd, Palo Alto Networks (Brasil) Ltda., Palo Alto Networks (Canada) Inc., Palo Alto Networks (Germany) GmbH, Palo Alto Networks (Mexico) S. de R.L. de C.V., Palo Alto Networks (UK) Limited, Palo Alto Networks Godo Kaisha (Japan) and Palo Alto Networks International Inc. |

| Products | Next-generation firewalls (PA-Series hardware and VM/CN virtual firewalls), Prisma SASE, Prisma Cloud, and the Cortex portfolio (Cortex XDR, Xpanse, XSOAR, XSIAM), providing network, cloud and security operations capabilities. |

| Headquarters | Santa Clara, California, United States. |

| Geographical Presence | Global presence, serving 70,000+ organizations in over 150 countries, including a large share of Fortune 100 companies and major banks, utilities and hospitals. |

| Website | https://www.paloaltonetworks.com |

- Palo Alto Networks is widely recognized as the world’s largest pure-play cybersecurity company, with a market value of around USD 120 billion and a broad platform covering network, cloud and security operations.

- The company generated about USD 8.0 billion in revenue in fiscal year 2024, growing 16% year over year, showing strong demand for its cybersecurity platforms.

- Subscription and support now account for roughly 80% of total revenue in fiscal 2025, highlighting Palo Alto Networks’ shift toward recurring, platform-based security services.

- Palo Alto Networks protects more than 70,000 organizations in over 150 countries, including the vast majority of Fortune 100 companies, which shows its global scale and trust among large enterprises.

- The company employs about 16,000 people worldwide as of 2025, under the leadership of CEO Nikesh Arora, who has been Chairman and CEO since 2018.

- In December 2024, Palo Alto Networks achieved FedRAMP High authorization across all three of its main platforms (network, cloud and SOC), giving it one of the most comprehensive suites of AI-powered security services approved for use in U.S. federal networks.

- In 2025, Palo Alto Networks introduced Cortex XSIAM 3.0, an AI-driven SecOps platform that helps security teams cut vulnerability “noise” and stop attacks at scale using automated, data-driven defences.

- Also in October 2025, the company launched Prisma AIRS 2.0 and Cortex Cloud 2.0, new AI-powered offerings designed to protect AI applications and cloud environments, using AI agents trained on more than 1.2 billion security incident responses.

- Palo Alto Networks is expanding heavily into AI and identity security, agreeing to acquire CyberArk in a cash-and-stock deal valued at about USD 25 billion, which will strengthen its privileged access and identity-security capabilities.

- To further automate security operations, Palo Alto Networks recently unveiled Cortex AgentiX, a platform for building and governing AI agents that investigate and remediate threats automatically, positioning it at the forefront of AI-driven cybersecurity.

- Analysts continue to view Palo Alto Networks as a top cybersecurity stock, with Wedbush adding it to its “Best Ideas” list in September 2025, citing its strong AI strategy and the strategic value of the CyberArk acquisition.

CrowdStrike

| Title | Details |

| Company Type | Public company (CrowdStrike Holdings, Inc.; listed on Nasdaq under ticker CRWD) |

| Parent Organization | None – operates as an independent, publicly traded company (no parent organization listed in filings). |

| CEO | George Kurtz, co-founder and Chief Executive Officer. |

| Number of Employees | About 10,118 employees as of fiscal year ended January 31, 2025 (latest reported), before accounting for announced layoffs of ~5%. |

| Established (Date & Year) | Founded in 2011 by George Kurtz, Dmitri Alperovitch and Gregg Marston. |

| Subsidiaries | Includes entities such as CrowdStrike, Inc. (US), CrowdStrike Services, Inc., CrowdStrike UK Limited, CrowdStrike Australia Pty LTD, CrowdStrike GmbH (Germany), CrowdStrike India Private Limited, CrowdStrike Israel R&D Ltd., Flow Security Ltd., Bionic Stork Ltd., CrowdStrike Singapore PTE. LTD, CrowdStrike Ireland Limited, CrowdStrike (Netherlands) B.V., among others. |

| Products | CrowdStrike Falcon® platform provides cloud-native endpoint security, extended detection and response (XDR), threat intelligence, identity protection and cloud security; includes modules for endpoint protection, threat hunting, incident response and more. |

| Headquarters | Headquartered in Austin, Texas, United States (company also historically associated with Sunnyvale, California offices). |

| Geographical Presence | Global operations protecting organizations worldwide, including hundreds of Fortune 500 and Global 2000 companies and customers across North America, Europe, Asia-Pacific, Middle East and Latin America. |

| Website | https://www.crowdstrike.com |

- CrowdStrike is one of the leading cybersecurity companies in the world, with over 10,000 employees and headquarters in Austin, Texas, focusing on cloud-native endpoint security, XDR and incident response.

- In fiscal year 2025, CrowdStrike generated about USD 3.95 billion in revenue, representing 29% year-over-year growth, which shows very strong demand for its Falcon security platform.

- By the second quarter of fiscal 2026, CrowdStrike’s annual recurring revenue (ARR) reached roughly USD 4.66 billion, with quarterly revenue of USD 1.17 billion, up 21% compared with the same quarter a year earlier.

- CrowdStrike has been recognized as the #1 vendor in worldwide corporate endpoint security by market share, holding about 12.6% of the global corporate endpoint security market in an IDC report.

- Many enterprises adopt multiple modules of the Falcon platform, and nearly half of CrowdStrike’s subscription customers now use 6 or more cloud modules, indicating deep platform adoption rather than single-product use.

- In February 2025, CrowdStrike became the first cloud-native cybersecurity ISV to exceed USD 1 billion in revenue through AWS Marketplace, underscoring the widespread adoption of Falcon in cloud environments.

- In September 2025, CrowdStrike announced a deal to acquire AI security startup Pangea for around USD 260 million, aiming to deliver the industry’s first full AI Detection and Response (AIDR) solution that secures data, models, agents, and infrastructure across the AI lifecycle.

- Also in August 2025, CrowdStrike announced plans to acquire Onum, a real-time telemetry pipeline company, to strengthen Falcon Next-Gen SIEM with better data ingestion and autonomous detection across security and IT operations.

- CrowdStrike has recently expanded important AI-focused partnerships, including a deeper collaboration with NVIDIA around AI agents and an expanded partnership with Zscaler to modernize legacy endpoint detection and response and strengthen AI-driven security operations.

- In September 2025, CrowdStrike and Wipro launched CyberShield MDR, an AI-powered managed detection and response service built on Falcon Next-Gen SIEM, which helps enterprises simplify and unify their security operations.

- In July/November 2025, a faulty Falcon sensor update triggered a major global Windows outage, temporarily crashing systems for tens of thousands of organizations; although it was not a cyberattack, it drew attention to operational risk and the importance of rigorous testing for security updates.

Microsoft Security

| Title | Details |

| Company Type | Security business unit of Microsoft Corporation, a publicly traded American multinational technology company (Nasdaq: MSFT); not a separate legal company. |

| Parent Organization | Microsoft Corporation. |

| CEO | Satya Nadella, Chairman and CEO of Microsoft. The Microsoft Security organization is led by Charlie Bell (Executive Vice President, Microsoft Security) and Vasu Jakkal (Corporate Vice President, Microsoft Security business). |

| Number of Employees | Microsoft overall has about 228,000 employees globally as of FY 2024/25. The dedicated Security/Compliance/Identity/Management cybersecurity group is reported as a ~10,000-person organization, but Microsoft does not publish an exact current headcount just for Microsoft Security. |

| Established Date and Year | June 2020 – Microsoft formally established Security as a distinct business/solution area; Vasu Jakkal was brought in to lead this security business. |

| Subsidiaries / Key Internal Units | Not a separate company with legal subsidiaries; instead it comprises major security organizations and programs inside Microsoft such as Microsoft Defender, Microsoft Sentinel, Microsoft Entra, Microsoft Purview, Microsoft Priva, Security Copilot, Microsoft Security Response Center (MSRC) and Microsoft Threat Intelligence. |

| Products | End-to-end security platform including: Microsoft Defender (endpoint, email, IoT, cloud), Microsoft Sentinel (cloud-native SIEM/SOAR), Microsoft Entra (identity and access), Microsoft Purview (data security & governance), Microsoft Priva (privacy management), Intune (endpoint/device management), Security Copilot (AI security assistant) and the Microsoft Security Store for security SaaS and AI agents. |

| Headquarters | Operates globally but is part of Microsoft’s corporate HQ at Redmond, Washington, United States. |

| Geographical Presence | Microsoft Security serves customers worldwide as part of Microsoft’s global cloud and security footprint, with Azure regions in 60+ regions across 140+ countries and security customers in 120+ countries. |

| Website | Main corporate site: https://www.microsoft.com; security portfolio: https://www.microsoft.com/security. |

- Microsoft Security is widely regarded as the world’s largest cybersecurity business, with Microsoft disclosing that its security revenue roughly doubled in two years to about 20 billion USD annually, placing it at the top of global cybersecurity vendors by revenue.

- Microsoft reports that more than 860,000 organizations were using Microsoft Security solutions by early 2023 and that this has grown to around 1.2 million security customers globally by 2024–2025.

- According to Microsoft’s Digital Defence reports, its platforms processed about 65 trillion security signals per day in 2023 and around 78 trillion signals per day in 2024, giving Microsoft Security an unusually broad view of global cyber threats.

- Microsoft has been ranked number one in the worldwide modern endpoint security market share in IDC’s “Worldwide Modern Endpoint Security Market Shares, 2023” report, confirming its leading position in endpoint protection among cybersecurity companies.

- The 2025 Microsoft Digital Defence Report finds that more than half of the cyberattacks observed against Microsoft customers are financially motivated, with ransomware and data-theft extortion driving a large share of the incidents that Microsoft Security tools defend against.

- In 2025, Microsoft launched Microsoft Security Copilot agents, a family of generative-AI security assistants embedded across Defender, Sentinel, Entra and other products, which are designed to automate tasks such as phishing triage, incident investigation and access-policy optimization for security teams.

- Microsoft also introduced the new Microsoft Security Store in October 2025 as a central marketplace where customers can find and deploy security SaaS solutions and AI-powered agents, many built on Security Copilot, to extend their security capabilities.

- Recent updates to Microsoft Sentinel add preview features that enable Security Copilot to automatically generate incident summaries in the Sentinel portal, helping analysts quickly understand and triage security alerts.

- Microsoft’s security teams have recently documented and disrupted campaigns that abuse Microsoft Teams and tech-support scams, including threats that use remote-monitoring tools and phishing to steal credentials and deploy malware, demonstrating how attackers increasingly exploit trust in Microsoft brands.

- In June 2025, Microsoft’s Digital Crimes Unit worked with international law-enforcement agencies to dismantle a transnational scam network targeting older adults, demonstrating how Microsoft Security combines technology, legal action and cross-border partnerships to reduce cybercrime.

- Microsoft continues to investigate and publish details of focused attacks, such as the “payroll pirate” phishing campaigns targeting U.S. universities in 2025, using insights from its massive telemetry to help organisations harden their defences and improve incident response.

Fortinet, Inc

| Title | Details |

| Company Type | Public company (American cybersecurity and network security corporation; listed on Nasdaq as FTNT). |

| Parent Organization | None – Fortinet, Inc. operates as an independent, publicly traded company (no parent company listed in filings or profiles). |

| CEO | Ken Xie, Founder, Chairman and Chief Executive Officer. |

| Number of Employees | Around 14,138 employees as of the end of 2024, according to company filings and summaries. |

| Established Date and Year | Founded in 2000 in the San Francisco Bay Area by brothers Ken Xie and Michael Xie. |

| Subsidiaries (examples) | Includes Fortinet International, Inc. (Cayman Islands), Fortinet UK Ltd. (UK), Fortinet Technologies (Canada), Inc. (Canada), Fortinet Japan K.K. (Japan), Fortinet Information Technology (Beijing) Co., Ltd. and Fortinet Information Technology (Tianjin) Co., Ltd. (China), Fortinet Malaysia SDN. BHD. (Malaysia), and Fortinet Federal, Inc. (US federal-focused subsidiary). |

| Products | Broad cybersecurity portfolio including Fortinet Security Fabric, FortiGate next-generation firewalls and SD-WAN, FortiSwitch (switching), FortiAP (wireless access), FortiWeb, FortiSIEM, FortiAnalyzer, FortiClient, FortiEDR, FortiNAC, and many other enterprise-grade security products for network, cloud, endpoint and OT security. |

| Headquarters | Sunnyvale, California, United States (909 Kifer Road, Sunnyvale, CA 94086 – US headquarters). |

| Geographical Presence | Global operations with offices and business presence across the Americas, Europe, Middle East, Africa and Asia-Pacific, securing hundreds of thousands of enterprises, service providers and government organizations worldwide. |

| Website | https://www.fortinet.com |

- Fortinet is a top global cybersecurity vendor with about 14,138 employees worldwide as of 2024, reflecting its large scale in the security industry.

- In 2024, Fortinet generated approximately USD 5.96 billion in total revenue and about USD 1.75 billion in net income, demonstrating strong profitability relative to many peers.

- Fortinet reports that more than 890,000 customers use its solutions globally, making its security products among the most widely deployed in the market.

- In the second quarter of 2025, Fortinet’s revenue grew 14% year over year to USD 1.63 billion, with billings up 15% to USD 1.78 billion, driven by secure networking and security operations demand.

- Fortinet’s Unified SASE annual recurring revenue (ARR) increased 22% year over year, and Security Operations ARR increased 35% year over year in Q2 2025, highlighting rapid growth in these next-generation security services.

- Industry analysis shows Fortinet holding around 36.8% unit market share across the combined firewall, UTM, and VPN markets, underscoring its dominance in security appliances.

- In November 2025, Fortinet launched its Secure AI Data Centre solution and the new FortiGate 3800G data centre firewall, providing an end-to-end security framework specifically designed to protect AI data centres, models and GPU clusters at scale.

- Recent earnings news in late 2025 shows Fortinet reporting Q3 revenue of about USD 1.72 billion, up 14% year over year, although the stock fell on softer guidance, reflecting investor focus on future growth beyond the current firewall refresh cycle.

- Fortinet’s Fabric-Ready Technology Alliance Partner Program passed 400 technology partners and 3,000+ integrations in 2025, strengthening its Security Fabric ecosystem and making it easier for customers to integrate Fortinet with other IT and security tools.

- The company positions itself as a convergence leader of networking and security, with its Security Fabric spanning more than 50 enterprise products that cover SD-WAN, cloud security, endpoint security, OT security and more, helping organizations consolidate point solutions.

Cisco Systems, Inc.

| Title | Details |

| Company Type | Public company – American multinational digital communications and networking technology company (Nasdaq: CSCO). |

| Parent Organization | None – Cisco Systems, Inc. is an independent, publicly traded corporation (no parent company). |

| CEO | Chuck Robbins, Chair and Chief Executive Officer (CEO since 2015). |

| Number of Employees | About 86,200 employees worldwide as of July 26, 2025. |

| Established Date & Year | Founded on December 10, 1984 in San Francisco, California, USA by Leonard Bosack and Sandy Lerner. |

| Subsidiaries (examples) | Cisco has 259 subsidiaries worldwide across many countries and sectors. Examples include Cisco Systems (India) Private Limited, Cisco Systems Capital Corporation, Cisco Meraki (cloud-managed networking division), Splunk Inc. (security & observability software), Webex entities, and various regional Cisco Systems companies. |

| Products | Broad portfolio covering networking (routers, switches, Meraki cloud networking, UCS servers), security (Cisco Secure, Duo, Firewalls, Umbrella, XDR, Hypershield), collaboration (Webex), and observability/analytics (AppDynamics, ThousandEyes, Splunk integrations). |

| Headquarters | San Jose, California, United States (corporate campus at Santana Row / Tasman Drive). |

| Geographical Presence | Operates worldwide, with 200+ corporate offices in more than 80 countries, serving global enterprise, service provider, government and SMB customers. |

| Website | https://www.cisco.com |

- Cisco reported USD 56.7 billion in total revenue in fiscal year 2025, up 5% year over year, underscoring its scale as one of the largest infrastructure and cybersecurity vendors worldwide.

- Cisco’s Security product revenue reached about USD 8.1 billion in FY 2025, up 59% from 2024, driven mainly by threat-detection and response offerings from Splunk, along with growth in SASE and network security products.

- Security now accounts for around 14% of Cisco’s overall revenue mix, making it the second-largest product category in Cisco’s portfolio, behind networking.

- In the fourth quarter of fiscal 2025, security revenues were about USD 1.95 billion, up 9% year over year, and new offerings such as Secure Access, XDR, Hypershield and AI Defence collectively added 750 new customers in that quarter alone.

- Following completion of its USD 28 billion acquisition of Splunk in March 2024, Cisco’s quarterly security revenue roughly doubled to around USD 2 billion in late 2024, highlighting how strongly Splunk has accelerated its security business.

- Industry analyses now describe Cisco, combining networking, security and observability with Splunk, as one of the largest software and cybersecurity platforms globally, reshaping the market for integrated security and AI operations.

- In January 2025, Cisco launched Cisco AI Defence, a new platform specifically designed to help enterprises develop, deploy and secure AI applications against emerging AI-driven threats.

- Cisco has introduced Cisco Hypershield, an AI-native distributed security system that embeds protection into switches, routers and servers so that the network behaves like “millions of tiny firewalls” across data centres and applications.

- At RSA Conference 2025, Cisco announced multiple AI-enhanced security innovations, including upgraded XDR 2.0, deeper integrations with Secure Access, Hypershield and AI Defence, and centralised policy management through Security Cloud Control to simplify security operations.

- In September 2025, Cisco introduced its Sovereign Critical Infrastructure portfolio, an air-gapped, configurable stack aimed at European customers that need on-premises sovereign infrastructure aligned with EU and country certifications.

- Cisco’s security products have also been in the news because of zero-day vulnerabilities in IOS/IOS XE software and certain firewall devices, which were actively exploited in 2024–2025 and led Cisco and U.S. authorities to issue urgent guidance for patching, hardware checks and, in some cases, device replacement.

Zscaler, Inc.

| Title | Details |

| Company Type | Public company – American cloud security and cybersecurity vendor, listed on Nasdaq under ticker ZS and a Nasdaq-100 component. |

| Parent organization | None – Zscaler, Inc. operates as an independent, publicly traded company (no parent company listed in filings). |

| CEO | Jay Chaudhry – Founder, Chairman and Chief Executive Officer. |

| Number of Employees | Around 7,348 employees globally in 2024 (latest reported figure). |

| Established date and year | Founded in 2007 by Jay Chaudhry and Kailash Kailash; incorporated September 28, 2007. |

| Subsidiaries (examples) | Includes Zscaler Softech India Private Limited, Zscaler Spain S.L., Zscaler Switzerland GmbH, Zscaler UK Ltd., Zscaler US Government Solutions, LLC, Zscaler Israel Ltd., Zscaler K.K. (Japan) and Zscaler Netherlands B.V., among other global entities. |

| Products | Cloud-delivered Zero Trust Exchange™ platform including Zscaler Internet Access (ZIA), Zscaler Private Access (ZPA), Zscaler Digital Experience (ZDX), and related zero-trust, SSE/SASE and cloud security services. |

| Headquarters | San Jose, California, USA – worldwide HQ at 120 Holger Way, San Jose, CA 95134. |

| Geographical Presence | Serves customers worldwide, operating a large cloud platform with data centers in 150+ locations and users in 180–185+ countries. |

| Website | https://www.zscaler.com |

- Zscaler is a leading cloud security and SASE company whose Zero Trust Exchange platform now processes over half a trillion security transactions every day for 8,600+ customers and 47+ million users across 160+ cloud data centre edges worldwide.

- In fiscal year 2025, Zscaler generated about USD 2.67 billion in revenue, growing roughly 23% year over year, which underlines its strong position among fast-growing cybersecurity vendors.

- In the fourth quarter of fiscal 2025, Zscaler reported USD 719.2 million in revenue, up 21% year over year, and achieved a non-GAAP operating margin of 22% with free cash flow of USD 171.9 million (24% of revenue).

- Zscaler’s Annual Recurring Revenue (ARR) surpassed USD 3.02 billion in Q4 2025, growing 22% year over year, while calculated billings reached USD 1.20 billion, up 32% year over year, and deferred revenue rose 30% to USD 2.47 billion.

- Management reports that Zscaler’s platform now secures nearly 40% of the Global 2000 and over 45% of the Fortune 500, showing deep penetration into large enterprises.

- Zscaler has grown its large-account base so that 664 customers each generate more than USD 1 million in ARR, and commentary around recent earnings notes that the total is 9,400+ enterprise customers.

- For fiscal 2026, Zscaler is guiding to revenue of USD 3.27–USD 3.28 billion and ARR of about USD 3.68–USD 3.70 billion, implying expected annual growth of roughly 22–23% while maintaining an operating margin around 22% and a free-cash-flow margin in the mid-20s.

- In August 2025, Zscaler closed its USD 675 million acquisition of Red Canary, adding managed detection and response (MDR) capabilities and strengthening its AI-driven endpoint and cloud workload detection.

- In November 2025, Zscaler announced the acquisition of AI security startup SPLX, adding AI asset discovery, automated red-teaming and AI governance features to the Zero Trust Exchange to better secure enterprise AI models and applications.

- Recent Zscaler product updates include new AI Guardrails and AI security capabilities for public and private apps and enhancements to Zscaler Digital Experience (ZDX) to provide better real-time monitoring and protection for AI-driven traffic.

- Zscaler’s ThreatLabz research team recently reported a 67% jump in Android malware and that 40% of IoT attacks now target critical industries and hybrid-work environments, highlighting the need for its mobile, IoT and OT security solutions.

- Earlier in fiscal 2025, Zscaler’s stock pulled back after billings growth and revenue guidance came in below some investor expectations and long-time CFO Remo Canessa announced plans to retire, even though revenue and earnings at that time were still beating Wall Street forecasts.

Cloudflare, Inc.

| Title | Details |

| Company Type | Public company – American cloud services and cybersecurity provider; listed on NYSE under ticker NET. |

| Parent organization | None – Cloudflare, Inc. is an independent, publicly traded corporation (no parent company). |

| CEO | Matthew Prince, Co-founder, Chair and Chief Executive Officer. |

| Number of Employees | About 4,263 employees worldwide as of December 31, 2024. |

| Established date and year | Founded on July 26, 2009 by Matthew Prince, Lee Holloway and Michelle Zatlyn. |

| Subsidiaries (examples) | Cloudflare has multiple subsidiaries worldwide (full list in SEC filings), and has acquired companies such as Area 1 Security, Neumob, Zaraz, Vectrix, Nefeli Networks, BastionZero and Kivera, which operate as part of its broader group. |

| Products | Global cloud platform and security services including content delivery network (CDN), DDoS protection, web application firewall (WAF), Zero Trust security, DNS, secure connectivity cloud, application services, network services and a developer platform (Workers, R2, KV, AI tools, etc.). |

| Headquarters | San Francisco, California, United States – primary HQ at 101 Townsend St, San Francisco, CA 94107. |

| Geographical Presence | Operates a large global network with data centers in hundreds of cities worldwide, delivering services to customers in many countries and across all major regions (Americas, EMEA, and Asia-Pacific). |

| Website | https://www.cloudflare.com |

- Cloudflare operates one of the largest security-focused networks in the world, with data centers in about 330 cities across 120+ countries, handling on average 63 million HTTPS requests per second and 42 million DNS requests per second for millions of websites.

- In the second quarter of 2025, Cloudflare reported revenue of USD 512.3 million, up 28% year over year, and guided to full-year 2025 revenue of roughly USD 2.11 billion, reflecting around 27% annual growth.

- In the third quarter of 2025, Cloudflare’s revenue rose further to USD 562 million, up 31% year over year, and earnings beat Wall Street expectations, helping push the stock up more than 10% after the announcement.

- Cloudflare plays a major role in DDoS protection; in Q1 2025, it mitigated about 20.5 million DDoS attacks, and in Q2 2025, it still blocked 7.3 million attacks, underscoring its role as a security shield for online services.

- Cloudflare’s DDoS reports show that in Q4 2024 alone, it mitigated 6.9 million DDoS attacks, which was an 83% increase year over year, highlighting the growing volume of cyberattacks hitting its network.

- As part of its push into AI security, Cloudflare has launched an AI Security Suite and Firewall for AI, which can automatically discover AI apps, filter unsafe prompts and protect large language model endpoints from prompt injection and data abuse.

- In August 2025, Cloudflare released new Zero Trust tools for secure AI adoption, giving security teams a single console to monitor AI usage, control “shadow AI” tools and prevent sensitive data from leaking through AI applications.

- Cloudflare recently introduced a Content Signals Policy that updates how robots.txt works, giving millions of websites on its platform more control over whether AI bots can use their content for training, search answers or other AI purposes.

- The company is also moving into AI-driven e-commerce by planning a USD-backed stablecoin called “NET Dollar”, aimed at enabling autonomous AI agents to make secure micro-payments over Cloudflare’s network.

- Cloudflare has said it aims to reach a USD3 billion annual revenue run rate by Q4 2026 and USD5 billion by Q4 2028, positioning itself as a long-term growth leader in connectivity, performance and cybersecurity.

Check Point Software Technologies Ltd.

| Title | Details |

| Company Type | Public company – multinational cybersecurity and security software vendor, listed on Nasdaq under ticker CHKP. |

| Parent Organization | None – Check Point Software Technologies Ltd. operates as an independent, publicly traded company (no parent company). |

| CEO | Nadav Zafrir, Chief Executive Officer since December 2024. |

| Number of Employees | 6,669 employees as of December 31, 2024. |

| Established Date and Year | Founded in 1993 in Ramat Gan, Israel by Gil Shwed, Marius Nacht and Shlomo Kramer. |

| Subsidiaries (examples) | Global group including entities such as Check Point Software Technologies (Netherlands) B.V. (holding company), Check Point Software Technologies S.A. (Argentina), Check Point Software Technologies (Australia) PTY Limited, Check Point Software Technologies (Brazil) LTDA, Check Point Software Technologies (Hong Kong) Ltd., Check Point Software Technologies (Sweden) AB, Check Point Software (Kenya) Limited, and Cyberint Technologies Ltd., among others. |

| Products | Broad cybersecurity portfolio including Quantum network security firewalls and VPN, CloudGuard cloud security, Harmony email, endpoint and mobile protection, Infinity unified security architecture, plus threat prevention, endpoint security, mobile security, cloud and web application security, and security management solutions. |

| Headquarters | Headquartered in Tel Aviv-Yafo, Israel, with major U.S. offices/headquarters in the San Carlos / Redwood City, California area. |

| Geographical Presence | Multinational company operating in 60+ countries, protecting 100,000+ organizations worldwide, including governments and enterprises across the Americas, EMEA and Asia-Pacific. |

| Website | https://www.checkpoint.com |

- Check Point Software Technologies is a multinational cybersecurity company active in 60+ countries and protecting over 100,000 organizations globally, positioning it among the major players in enterprise cyber defense.

- The company employed 6,669 people as of December 31, 2024, an increase of about 3.4% year over year, demonstrating steady workforce growth.

- For the full year 2024, Check Point reported USD 2.565 billion in total revenue (up 6% year over year) and USD 2.658 billion in calculated billings (up 9%), with security subscription revenue of USD 1.104 billion (up 13%), underlining its shift toward recurring subscription-based security services.

- In the third quarter of 2025, Check Point delivered USD 678 million in revenue (up 7% year over year), USD 672 million in billings (up 20%), and USD 305 million in security subscription revenue (up 10%), while GAAP EPS jumped 79% to USD 3.28 and non-GAAP EPS rose 75% to USD 3.94, beating Wall Street expectations.

- Independent testing firm Miercom named Check Point’s Infinity Platform the top-ranked AI-powered cybersecurity platform in its 2025 assessment, and separate testing reported 99.9% block rate on new malware, 99.7% phishing prevention, and 98% blocking of high- and critical-severity intrusions, highlighting strong prevention efficacy.

- Check Point has introduced Infinity AI Copilot, a generative AI assistant trained on decades of cyber data that automates routine security tasks, acts as both an administrative and analytical assistant, and can cut the time needed for common admin tasks by up to 90%, helping overworked security teams.

- In February 2025, the company unveiled new AI-powered innovations and Infinity AI bundles that add six capabilities to the Infinity Platform to simplify security operations, accelerate zero-trust adoption, and move toward more autonomous unified security management.

- In its Q2 2025 results, Check Point highlighted growth in emerging technologies such as email security, SASE, and enterprise risk management, and announced the acquisition of Veriti to strengthen the Infinity platform’s “open-garden” architecture and risk-based security approach.

- In September 2025, Check Point announced and has now completed the acquisition of Lakera, an AI-native security platform, to build a full end-to-end AI security stack and create a Global Center of Excellence for AI Security, securing the full lifecycle of AI models, agents, and data.

- The Infinity Platform has also earned a “Certified Secure 2025” designation from Miercom as a leading Zero Trust platform with top security efficacy, reinforcing Check Point’s positioning as a prevention-first security vendor.

- In September 2025, TIME and Statista included Check Point on their World’s Best Companies 2025 list for the second year in a row, recognizing its employee satisfaction, revenue growth, and sustainability transparency, which supports its reputation not only as a top cybersecurity company but also as a strong employer.

BM Security (QRadar SIEM)

| Title | Details |

| Company Type | Security software and services business unit within IBM Corporation; not a separate legal company. IBM itself is a public company listed on NYSE (ticker IBM). |

| Parent organization | IBM Corporation (International Business Machines Corporation). |

| CEO | IBM’s overall CEO is Arvind Krishna (Chairman and Chief Executive Officer). IBM Security, including QRadar SIEM, sits under IBM’s Software and Security leadership but does not have a separate CEO. |

| Number of Employees | IBM overall has about 270,300 employees worldwide as of December 31, 2024 (IBM does not publish a separate headcount just for IBM Security or QRadar). |

| Established date and year (IBM / security) | IBM was founded on 16 June 1911 (as Computing-Tabulating-Recording Company) and became IBM in 1924. IBM’s security portfolio has grown over decades and now includes QRadar SIEM as one of its flagship security products. |

| Subsidiaries (security-related examples) | IBM Security is part of IBM and not a separate holding, but IBM delivers security through many IBM subsidiaries and acquired entities (for example, earlier IBM Internet Security Systems and multiple regional IBM companies) that provide security services and QRadar deployments. |

| Products (SIEM focus) | Key SIEM product is IBM QRadar® SIEM, a threat detection and security analytics platform that centralizes log and event data, correlates security events, and helps with compliance; closely related offerings include IBM QRadar threat detection and response (SIEM, SOAR, EDR) and integrations with the broader IBM Security portfolio. |

| Headquarters | IBM Security is headquartered with IBM at Armonk, New York, United States. |

| Geographical Presence | IBM operates in 175+ countries, and IBM Security / QRadar SIEM is offered globally through IBM’s worldwide sales, cloud regions and partner network, serving organizations in most major regions. |

| Website | Main IBM site: https://www.ibm.com; QRadar SIEM product page: https://www.ibm.com/products/qradar-siem. |

- IBM Security’s QRadar SIEM holds about 9.5% of the global SIEM market share with more than 3,600 customers, placing it among the top SIEM platforms worldwide.

- Market research lists IBM QRadar as one of the leading SIEM vendors alongside Microsoft Sentinel, Splunk, Exabeam and Securonix in the global security information and event management market.

- IBM reports that its Security segment revenue grew about 0.8% year over year in 2024 (1.5% in constant currency), showing steady but modest growth of its security portfolio, including QRadar products.

- QRadar SIEM is designed to analyze millions of security events in near real time using thousands of prebuilt use cases, user and network behavior analytics, vulnerability data and IBM X-Force threat intelligence to generate high-fidelity alerts.

- The broader IBM QRadar Suite integrates SIEM, SOAR, EDR/XDR and log management into a unified analyst experience with a common UI and embedded AI and automation to speed threat detection, investigation and response.

- In November 2023, IBM launched a cloud-native QRadar SIEM built to maximise security teams’ time by using AI to automate repetitive tasks and help analysts focus on the highest-priority incidents.

- In September 2024, IBM divested its cloud-native QRadar SIEM SaaS offering to Palo Alto Networks, a deal that brought IBM about USD 0.4 billion in proceeds, while IBM continued to develop its remaining QRadar on-prem and hybrid offerings.

- IBM continues to update the rest of the QRadar portfolio, and in August 2025, it released a new version of IBM Security QRadar SOAR (V51.0.7) and a new App Host version to enhance orchestration, automation and SOC efficiency.

- A September 2025 integration between Contrast Application Detection and Response (ADR) and IBM QRadar SIEM embeds real-time application and API threat intelligence directly into QRadar workflows, improving detection of application-layer attacks.

- QRadar EDR, part of the portfolio, uses continuously learning AI and low-level NanoOS technology to autonomously detect previously unseen endpoint threats and provide deep visibility across processes and applications.

- IBM regularly issues security bulletins for QRadar SIEM, such as a recent notice about multiple vulnerabilities in underlying components, along with patches, which shows active maintenance and vulnerability management for the platform.

- Documentation for QRadar SIEM Cloud-Native SaaS emphasises that it correlates alerts with machine-learning-based severity rankings and dynamic Sigma community rules to help reduce investigation time and focus analysts on the most critical threats.

Trend Micro Incorporated

| Title | Details |

| Company Type | Public company – Japanese/American multinational cybersecurity software vendor, listed on the Tokyo Stock Exchange as 4704 (public K.K.). |

| Parent Organization | None – Trend Micro Inc. operates as an independent, publicly traded corporation (no parent company listed in filings). |

| CEO | Eva Chen – Co-founder and Chief Executive Officer since 2005 (Steve Chang is founder and Chairman). |

| Number of Employees | About 6,869 employees as of 31 Dec 2024 (often rounded to “~7,000 employees across 70 countries” in recent company communications). |

| Established Date & Year | Founded on 24 October 1988 in Los Angeles, California, USA by Steve Chang, Jenny Chang, and Eva Chen. |

| Subsidiaries (examples) | Examples include Trend Micro Inc. (USA), Trend Micro Korea Inc., Trend Micro Italy S.r.l., Trend Micro Deutschland GmbH, Trend Micro Australia Pty. Ltd., Trend Micro do Brasil Ltda., Trend Micro Hong Kong Ltd., plus newer specialist entities such as TXOne Networks (IoT/OT security JV), VicOne (vehicle security), and CTOne (5G network security subsidiary). |

| Products | Broad cybersecurity portfolio including the Trend Vision One™ AI-powered enterprise cybersecurity / XDR platform, Trend Micro One risk and exposure management, Cloud One (cloud workload & container security), Apex One endpoint security, email and network security, and many other enterprise and consumer security solutions across cloud, network, endpoint, and OT. |

| Headquarters | Global headquarters split between Tokyo, Japan and Irving, Texas, USA, with global R&D headquarters in Taipei, Taiwan. |

| Geographical Presence | Global cybersecurity leader with ~7,000 employees across 70 countries, protecting 500,000+ organizations and 250+ million individuals across clouds, networks, devices, and endpoints; R&D in 16 locations on every continent except Antarctica. |

| Website | https://www.trendmicro.com |

- Trend Micro is a global cybersecurity leader with about 7,000 employees in 70 countries, helping to protect more than 500,000 organizations and 250+ million individuals across clouds, networks, devices and endpoints.

- The company reports that its platform protects over 82 million assets in 175+ countries and blocked around 147 billion threats in 2024, demonstrating very large-scale threat visibility.

- In 2023, Trend Micro blocked 161 billion threats, almost double the 82 billion blocked five years earlier, showing how quickly the global threat volume has grown.

- Trend Micro’s Trend Vision One™ cybersecurity platform now serves more than 10,000 enterprise customers worldwide, and has been extended to help small and mid-sized businesses manage cyber risk as well.

- For the full year 2024, Trend Micro grew global net sales by 10% year over year, increased enterprise annual recurring revenue by 7% to over USD 1.3 billion, and improved operating income by 48%, reaching an 18% operating margin.

- In Q1 2025, Trend Micro reported 22% operating margin, a 24% increase in operating income, and total company ARR surpassing USD 1.7 billion, driven by a 14% ARR increase in Trend Vision. One large-enterprise customer.

- Recent company profiles estimate Trend Micro’s trailing 12-month revenue at roughly US USD 1.8 billion–1.9 billion, confirming its place among the larger global cybersecurity vendors.

- In February 2025, Trend Micro announced what it calls the industry’s first “proactive cybersecurity AI”, combining telemetry from 250+ million sensors with AI to help organizations stay ahead of attacks rather than just reacting to incidents.

- In August 2025, Trend Micro launched an “Agentic SIEM” – an AI-based SIEM designed to drastically cut alert overload for security operations teams by using autonomous agents for correlation and response.

- Trend Micro’s State of AI Security and 2025 Cyber Risk reports highlight how AI is reshaping both defences and attacks, and use telemetry from the prior year to map exposures and attacker behaviour for 2025 planning.

- In February 2025, Reuters reported that several major private-equity firms, including Bain Capital, Advent, EQT and KKR, were competing to potentially take Trend Micro private in a deal valuing the company at about 1.32 trillion yen (around USD 8.5 billion), although no transaction has been finalised.

- Trend Micro researchers recently revealed new attacker techniques, such as ransomware operators using Windows Subsystem for Linux (WSL) to run Linux encryptors on Windows systems, which can evade traditional Windows-focused defences.

- In mid-2025, Trend Micro also issued an urgent advisory about a critical zero-day vulnerability in its Apex One Management Console (CVEs with scores around 9.4/10), urging customers to patch or apply mitigations immediately after evidence of active exploitation.

Comparing the Top 10 Companies in Cybersecurity

| Company | Primary cyber-security role | Main security strengths & focus areas | Primary cybersecurity role |

| Palo Alto Networks | Broad platform security vendor across network, cloud and SecOps. | Next-gen firewalls and secure networking (Strata), cloud security (Prisma), and AI-driven SecOps (Cortex XDR/XSIAM); strong in Zero Trust architectures and large, integrated platforms. | Large enterprises and governments wanting to consolidate many point products into one AI-powered security platform for network, cloud and SOC. |

| CrowdStrike | Endpoint/XDR specialist with strong incident response and threat intel. | Falcon platform for EDR/XDR, cloud workload and identity protection; very strong in stopping ransomware and advanced threats on endpoints and servers. | Organizations prioritising endpoint, server and cloud-workload protection with fast detection/response and managed threat hunting. |

| Microsoft Security | Huge, integrated cloud and identity security stack bundled with Microsoft 365 and Azure. | Defender (endpoint, email, cloud), Sentinel (SIEM/SOAR), Entra (identity/Zero Trust), Purview (data security), all fed by tens of trillions of daily signals; excels at integrated protection for Microsoft environments. | Organizations heavily using Windows, Azure and Microsoft 365 that want “built-in” security, plus cloud-scale SIEM and identity protection. |

| Fortinet, Inc. | Secure networking & firewall leader with broad “Security Fabric.” | FortiGate firewalls/SD-WAN, OT and branch security, plus SOC tools; strong hardware appliances and convergence of networking + security, now extending to AI data-center security. | Enterprises, telcos and public sector needing high-performance firewalls/SD-WAN and campus/branch protection with one vendor. |

| Cisco (Security + Splunk) | Large network & security platform with strong SIEM/observability via Splunk. | Network security (firewalls, Secure Access), SASE, XDR, and Splunk SIEM/observability; new AI-native tools like Hypershield embed security into routers, switches and servers. | Organizations standardizing on Cisco networking that want integrated network, cloud and SIEM/XDR security with deep observability. |

| Zscaler, Inc. | Zero Trust / SASE cloud security specialist. | Zero Trust Exchange platform, ZIA (secure internet access) and ZPA (private app access); replaces VPNs and legacy web gateways with cloud-native SSE/SASE. | Companies moving to remote work and cloud apps that want to retire VPNs and MPLS and adopt Zero Trust for users, devices and workloads. |

| Cloudflare, Inc. | Edge security and web/app protection provider. | Massive global edge network for DDoS mitigation, WAF, bot management, Zero Trust access and secure DNS; secures websites, APIs, and SaaS at Internet scale. | Any org running public-facing websites, APIs or SaaS that needs high-capacity DDoS protection, WAF and Zero Trust access without heavy hardware. |

| Check Point Software | Prevention-focused firewall and platform vendor (Infinity). | Quantum network security, CloudGuard cloud security, Harmony endpoint/email/mobile; strong emphasis on threat prevention and unified AI-powered management via Infinity. | Enterprises wanting very high prevention efficacy on perimeter, cloud and endpoints, plus unified management and AI copilot tools for SOC. |

| IBM Security (QRadar Suite) | SIEM/SOAR/XDR and services specialist within IBM. | QRadar SIEM, SOAR and EDR/XDR plus IBM consulting and X-Force threat intel; strong in compliant log management, incident response workflows and complex enterprises. | Large, often regulated organizations needing enterprise SIEM, SOAR and services integrated with existing IBM/mainframe/cloud environments. |

| Trend Micro Inc. | Endpoint, server and cloud-workload security focused vendor. | Trend Vision One XDR platform, Cloud One for cloud workloads/containers, and strong server/virtualization security; also active in OT/IoT and email security. | Enterprises and mid-market customers needing server, cloud, email and endpoint protection, especially in hybrid and multi-cloud environments. |

Sources

- Microsoft Blog

- DeepStrike.io

- Wikipedia

- Wikipedia

- Wikipedia

- Wikipedia

- Wikipedia

- Wikipedia

- Wikipedia

- Wikipedia

- Wikipedia

- yahoo! Finance

- CISCO

- CISCO

- Fortinet

- CrowdStrike

- Zscaler

- Microsoft Learn

- Microsoft Learn

- Microsoft Learn

- Miercom

- Microsoft News

- Microsoft News

- Cisco

- Cisco

- Cisco

- IBM

- Trendmicro

- Trendmicro

- Securitymea

- StockAnalysis

- Techaisle

- VPNCentral

- 6sense

- Ainvest

- Bloomberg

- Business Insider

- Checkpoint

- Checkpoint

- Cloudflare

- Cloudflare

- Contrast Security

- CRN

- CRN

- Crowdstrike

- Fortinet

- Fortinet

- IBM

- IBM

- Investing

- Reuters

- Techradar

- Zscaler